Article Text

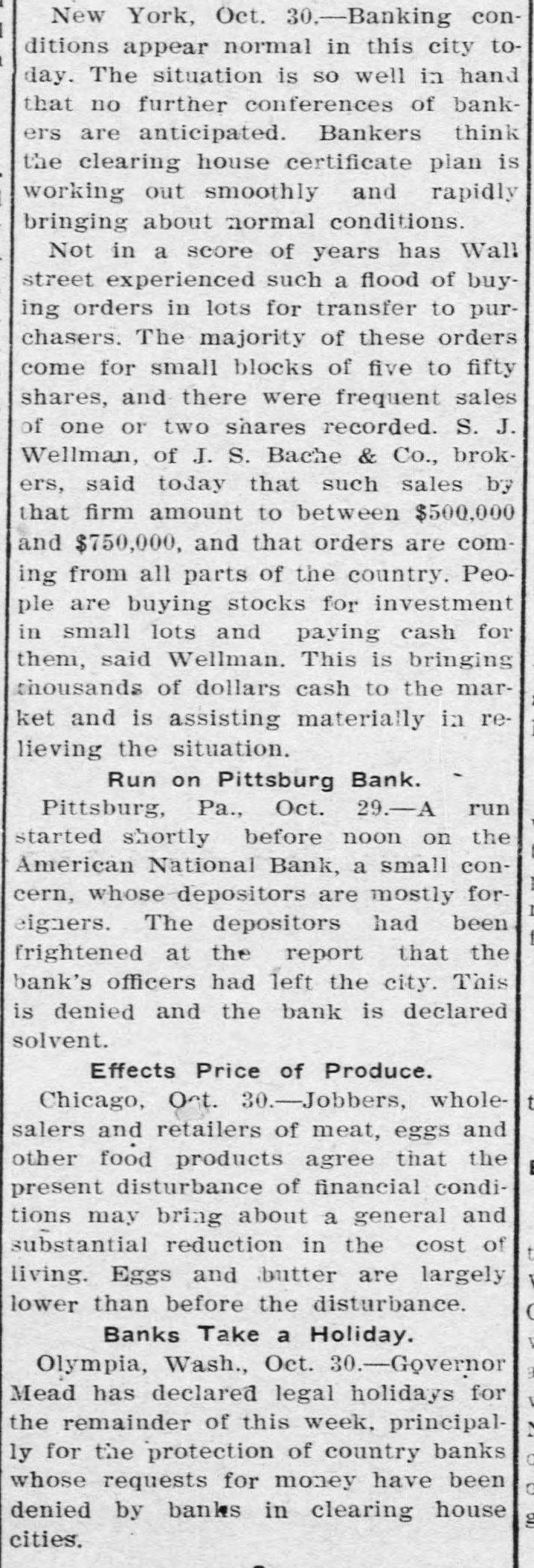

New York, Oct. 30.-Banking conditions appear normal in this city today. The situation is so well in hand that no further conferences of bankers are anticipated. Bankers think the clearing house certificate plan is working out smoothly and rapidly bringing about normal conditions. Not in a score of years has Wall street experienced such a flood of buying orders in lots for transfer to purchasers. The majority of these orders come for small blocks of five to fifty shares, and there were frequent sales of one or two shares recorded. S. J. Wellman, of J. S. Bache & Co., brokers, said today that such sales by that firm amount to between $500,000 and $750,000, and that orders are coming from all parts of the country. People are buying stocks for investment in small lots and paying cash for them, said Wellman. This is bringing thousands of dollars cash to the market and is assisting materially in relieving the situation. Run on Pittsburg Bank. Pittsburg, Pa., Oct. 29.-A run started shortly before noon on the American National Bank, a small concern, whose-depositors are mostly foreigners. The depositors had been frightened at the report that the bank's officers had left the city. This is denied and the bank is declared solvent. Effects Price of Produce. t Chicago, Oct. 30.-Jobbers, wholesalers and retailers of meat, eggs and other food products agree that the present disturbance of financial conditions may bring about a general and substantial reduction in the cost of living. Eggs and butter are largely lower than before the disturbance. ( Banks Take a Holiday. Olympia, Wash., Oct. 30.-Governor Mead has declared legal holidays for the remainder of this week, principally for the protection of country banks whose requests for money have been denied by banks in clearing house g cities.