Article Text

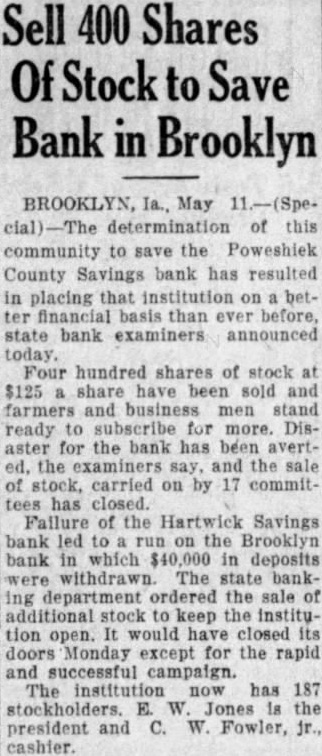

Sell 400 Shares Of Stock to Save Bank in Brooklyn BROOKLYN, Ia., May 11.-(Special) determination of this community to save the Poweshiek County Savings bank has resulted in placing that institution on better financial basis than ever before, state bank examiners announced today. Four hundred shares of stock at $125 a share have been sold and farmers and business men stand ready to subscribe for more. Disaster for the bank has been averted. the examiners say, and the sale of stock, carried on by 17 committees has closed. Failure of the Hartwick Savings bank led to run on the Brooklyn bank in which $40,000 in deposits were withdrawn. The state banking department ordered the sale of additional stock to keep the institution open. It would have closed its doors Monday except for the rapid and successful campaign. The institution now has 187 stockholders. E. W Jones is the president and C. W. Fowler, jr., cashier.