Article Text

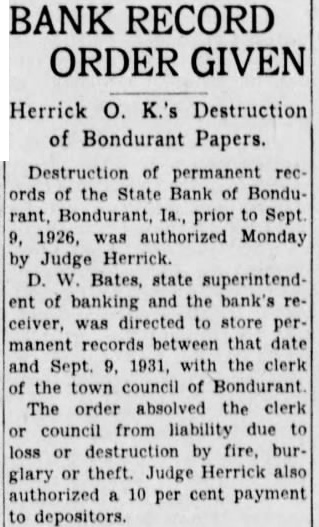

BANK RECORD ORDER GIVEN Herrick O. K.'s Destruction of Bondurant Papers. Destruction of permanent rec ords of the State Bank of Bondurant, Bondurant, Ia., prior to Sept 1926, was authorized Monday by Judge Herrick. D. W. Bates, state superintendent of banking and the bank's receiver, was directed to store permanent records between that date and Sept. 9. 1931, with the clerk the town council of Bondurant The order absolved the clerk or council from liability due to loss or destruction by fire, burglary or theft. Judge Herrick also authorized 10 per cent payment to depositors.