Click image to open full size in new tab

Article Text

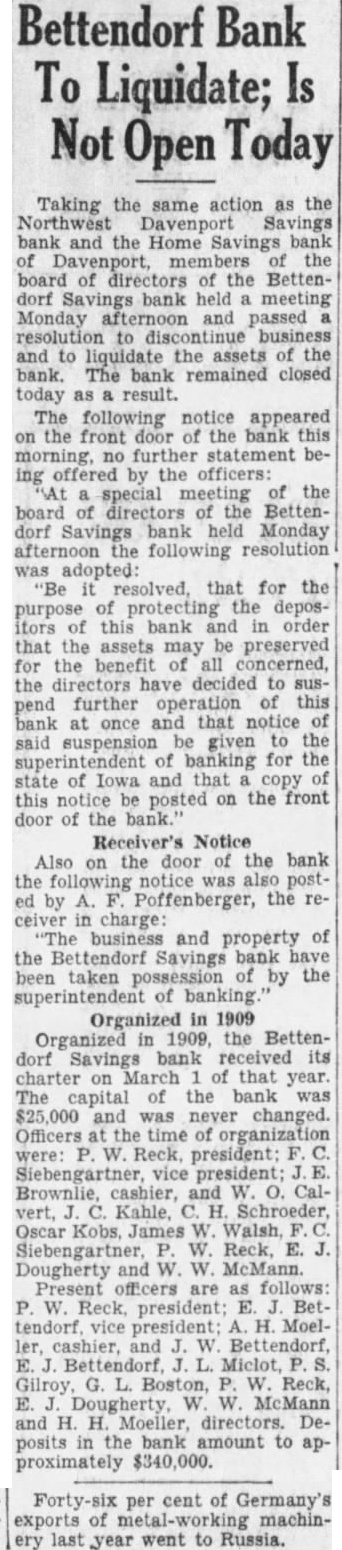

Bettendorf Bank To Liquidate; Is Not Open Today

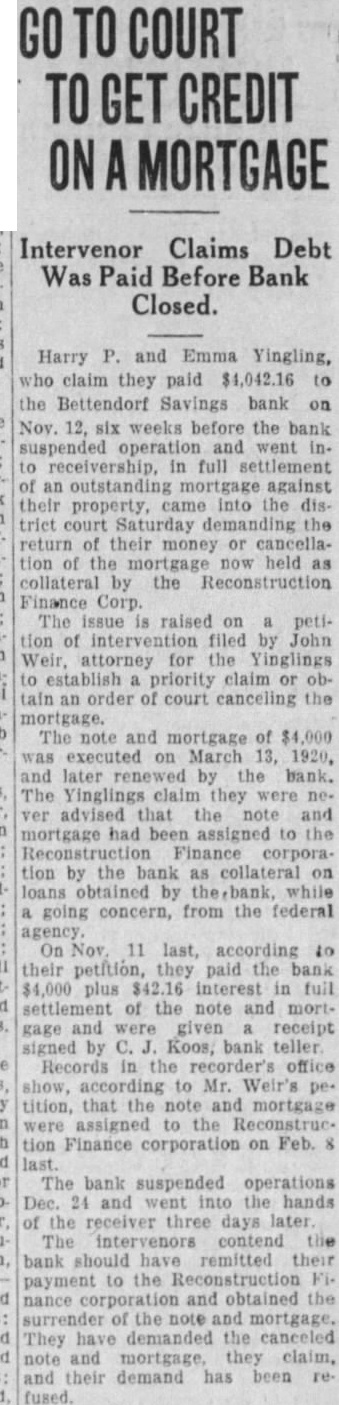

Taking the same action as the Northwest Davenport Savings bank and the Home Savings bank of Davenport, members of the board of directors of the Bettendorf Savings bank held a meeting Monday afternoon and passed resolution to discontinue business and to liquidate the assets of the bank. The bank remained closed today as a result. The following notice appeared on the front door of the bank this morning, no further statement being offered by the officers: At a special meeting of the board of directors of the Bettendorf Savings bank held Monday afternoon the following resolution was adopted: "Be it resolved, that for the purpose of protecting the depositors of this bank and in order that the assets may be preserved for the benefit of all concerned, the directors have decided to suspend further operation of this bank at once and that notice of said suspension be given to the superintendent of banking for the state of Iowa and that a copy of this notice be posted on the front door of the bank." Receiver's Notice Also on the door of the bank the following notice was also posted by A. F. Poffenberger, the receiver in charge: "The business and property of the Bettendorf Savings bank have been taken possession of by the superintendent of banking. Organized in 1909 Organized in 1909, the Bettendorf Savings bank received its charter on March 1 of that year. The capital of the bank was $25,000 and was never changed. Officers at the time of organization were: P. W. Reck, president: F. Siebengartner, vice president; J. Brownlie, cashier, and W. O. Calvert, J. C. Kahle, C. H. Schroeder, Oscar Kobs. James W. Walsh, F. Siebengartner, P. W. Reck. E. J. Dougherty and W. W. McMann. Present officers are as follows: P. W. Reck, president; E. J. Bettendorf, vice president; A. H. Moeller, cashier, and J. W. Bettendorf, E. Bettendorf, J. L. Miclot, P. S. Gilroy, G. L. Boston, P. W. Reck, E. J. Dougherty, W. W. McMann and H. H. Moeller, directors. Deposits in the bank amount to approximately $340,000.

Forty-six per cent of Germany's exports of metal-working machinery last year went to Russia.