Article Text

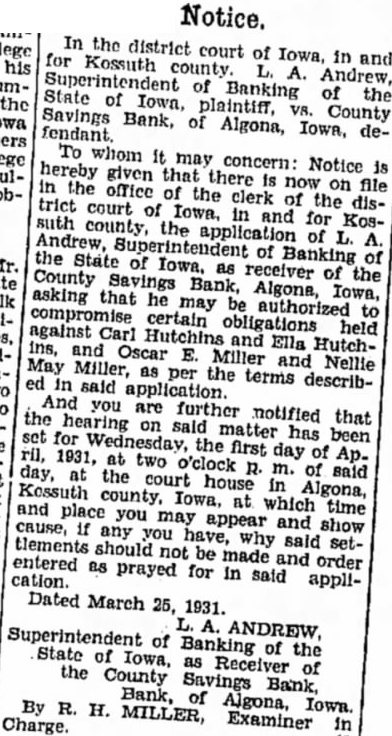

Plan Purchase of Pavilion and More Land From Nearby Farm. ALGONA, Sept. of proposed court sale of the former Lloyd Wellendorf farm just east of the fairgrounds to the county fair association and Mr. Wellendorf by the County Savings bank receiver appears in today sale. A hearing on the application will be held next Tuesday. If the sale goes thru as planned the fair will get the east 212 feet of the Wellendorf farm, which parallels the fairgrounds fence on the west side of the race track. The sale includes all land east of the road in front of the house, and the fair society will own the big sale pavilion erected 10 or more years ago by Mr. Wellendorf. The rest of the land is to be sold to Mr. Wellendorf. With this additional land the fair can build new grandstand on the west side of the race track, where the afternoon sun will not drive spectators out of seats. Much of the space in the present grandstand kept vacant by hot sun. The Wellendorf will also be notable addition to the fairgrounds buildings, excellent for calf and other club work and for demonstration talks by judges.