Article Text

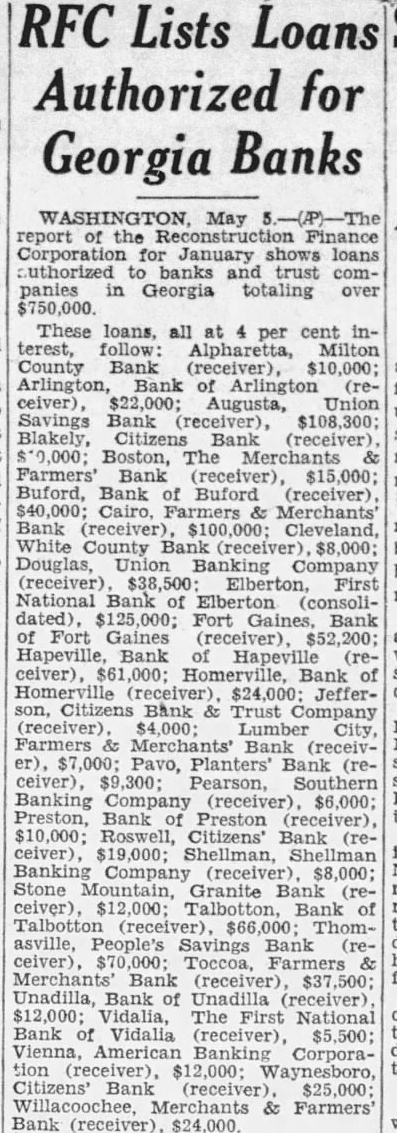

RFC Lists Loans Authorized for Georgia Banks WASHINGTON, May report the Finance Corporation for January shows loans outhorized companies in Georgia totaling over $750,000. These loans, all at per cent interest, follow: Alpharetta, Milton County Bank (receiver), $10,000; Arlington, Bank of Arlington (re$22,000; Augusta, Union Savings Bank (receiver), $108,300; Citizens Bank (receiver) 0,000; Boston, Merchants Farmers' Bank (receiver), $15,000; Bank Buford (receiver), Merchants' $100,000; Cleveland, White County $8,000; Douglas, Banking Company (receiver) Elberton, First National Bank Elberton $125,000; Fort Gaines, Bank Fort Gaines $52,200; Hapeville, Bank Hapeville (reBank of JefferBank Trust (receiver) $4,000; Lumber Farmers & Merchants' Bank Pavo, Planters' (re$9,300; Southern Banking Company (receiver) $6,000; Preston, Bank Preston (receiver), Roswell, Citizens' $19,000; Shellman, Banking Company (receiver) $8,000; Stone Granite Bank (receiver), Talbotton, Bank Talbotton ThomPeople's Savings Bank Toccoa, Farmers Merchants' Bank (receiver), $37,500; Unadilla, Bank of (receiver), $12,000; Vidalia, The First National Bank Vidalia $5,500; Vienna, American Banking Corporation (receiver), $12,000; Waynesboro, Citizens' Bank (receiver), $25,000; Willacoochee, Merchants & Farmers' Bank (receiver), $24,000.