Click image to open full size in new tab

Article Text

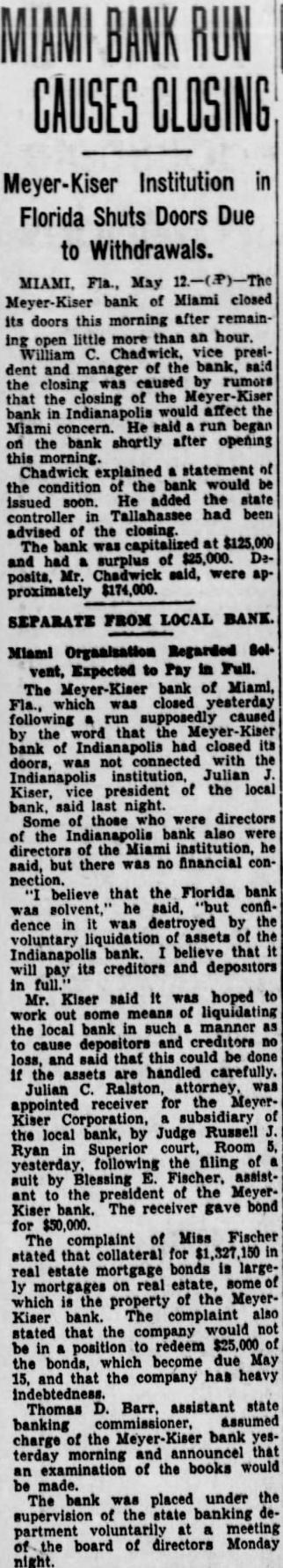

MEYER-KISER RECEIVER SUES FOR MILLIONS Six-Paragraph Action Is Filed by Garvin, He Announces. SUM TOTAL $3,025,000 Conversion of Funds to Own Uses Is Charged to Sol Meyer. Filing of a suit to recover sums totaling more than three million dollars in assets of the Meyer-Kiser bank, alleged to have been converted to personal use of Sol Meyer, former president, featured today's activity in probe of the bank affairs in circuit court. The suit against Mr. Meyer was filed by Thomas E. Garvin, receiver, alleging in six paragraphs, various conversions of funds belonging to the bank and subsidiaries. Largest amount of damages asked is $975,000. Other paragraphs ask for $750,000, two for $500,000, one for $175,000 and one for $125,000, all amounts alleged to have been funds taken from the bank assets. Totaled, this amounts to $3,025,000. Filing Is Announced Mr. Garvin announced filing of the suit in circiut court, shortly before adjournment at noon for an indefinite period. The hearing will be resumed at a later date. with Anthony Wichmann, cashier of the defunct bank, as a witness. His presence was ordered by Circuit Judge Earl R. Cox. Howard Painter, auditor, was instructed to make a record of depositors who withdrew large sums on the closing day, although Mr. Meyer denied from the witness stand that he had advised any friends to withdraw their money. J. J. Kiser Testifies After Mr. Meyer had testified, J J. Kiser, former vice-president of the bank, stated that the closing was caused by unwillingness of other bankers in the city to loan additional money to the Meyer-Kiser. "They felt that to pledge any more of our collateral to secure additional funds to meet withdrawals by some depositors would not be fair to other depositors," Mr. Kiser said. Although considerable time was devoted to the subject, no additional information was obtained regarding the purported shipment of $150,000 in bonds to Miami from the bank here, December, 1930 Karl Steinecker, former bond clerk at the bank, whose information regarding the bond shipments precipitated the probe along this line, testified this morning that he had "disobeyed insurance company orders at the direction of Sol Meyer Given Packages, He Says Mr. Steinecker said that the insurance rules demand that at least two employes check outgoing bond shipments, but that Mr. Meyer gave him sealed packages of bonds and told him to mail them "without saying anything.' He also told the court that Mr. Meyer had talked to him yesterday. advising him to "tell the truth.' Judge Cox questioned Mr. Meyer regarding his conversation with Mr. Stienecker and alleged threats to accuse the latter of perjury Mr. Meyer was questioned at length by Walter Myers, attorney for Mr. Garvin, regarding a long list of bond shipments, but answered each query "he did not remember. Gambling in the casino of the Gloridian hotel, a bank property, was disclosed when Mr. Meyer was questioned regarding correspondence with Arthur Childers, hotel manager, Mert Wertheimer. manager of the casino, and Ferd S. Meyer, Mr. Meyer's son. According to Mr. Meyer, the bank received annual revenue of $10,000 from lease of the casino. Participation of Mr. Childers in Miami Beach politics was revealed in excerpts from letters, read by Mr. Myers to the witness. Fisher Action Cited A letter to Ferd Meyer from Childers. written on Floridian hotel stationery, said "After several attempts, I have succeeded in recovering Mert's gambling devices that were taken from his room last winter. I asked Mert approximately $6,000, since the court already had issued a destroy order on all his stuff. This favor alone should force them to forever hold their peace about the money they spent on their new rooms in the hotel. I appreciate your friendly interest in my race for city council, and I assure you that I have no intention of entering the race for mayor, although it has been suggested to me by several of the leading business men here on Miami Beach 'I have almost positive proof that Fisher Carl Fisher, former Indianapolis capitalist and Indianapolis Motor Speedway promoter) approached one of the candidates for mayor, with an offer to support him, if he would vote to close all gambling on the beach this winter "It is the general belief that his reason for doing this is the fact that Capone's lawyer made a monkey out of Fisher on the stand in the recent padlock case against Capone.