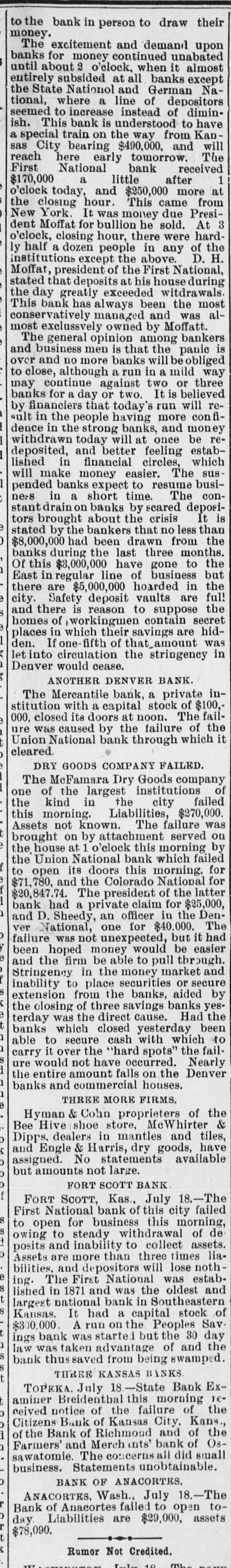

Article Text

to the bank in person to draw their money. The excitement and demand upon for money continued unabated almost until banks about 2 o'clock, when it subsided at all Nationol and entirely the State German banks depositors except National, where a line of diminseemed to increase instead of have This bank is understood to Kanish. special train on the way from will a City bearing $490,000, and The sas reach here early tomorrow. received First National a little bank after o'clock $170,000 today, and $250,000 more from at the closing hour. This came PresiYork. It was money due At 3 New Moffat for bullion he sold. hour, there were a dozen people in any o'clock, ly dent half closing above. of D. hard- the H. institutions except the Moffat, president of the First National, stated that deposits at his witdrawals useduring the greatly exceeded bank has always been managed conservatively This day and Moffatt. the was most almost exclussvely owned by The general opinion among bankers is men is that the panic and no more banks will to over although a run in a and close, business mild be obliged or three way continue against two believed banks may for a day or two. It is will refinanciers that today's run confiby the people having more in the strong banks, today will at once dence sult withdrawn in and money be estab- redeposited, and better feeling which lished in financial circles, The suswill make money easier. busipended banks expect to resume The conin a short time. deposine-s on banks by scared is about the 0 by the bankers that no the stated tors stantdrain brought crisis from less It than $8,000,000 had been drawn months. banks during the last three to the Of this $3,000,000 have gone but in regular line of business in the East are $5,000,000 hoarded ful! there Safety deposit vaults are the city. is reason to suppose and of ;workingmen contain hidin which their savings are places homes there secret was If one-fifth of that_amount in den. letinto circulation the stringency Denver would cease. ANOTHER DENVER BANK. Mercantile bank, a private of $100,- institution The with a capital stock The failclosed its doors at noon. of the 000, caused by the failure which it Union ure was National bank through cleared. DRY GOODS COMPANY FAILED. McFamara Dry Goods company of The of the largest institutions failed one the morning. kind in Liabilities, the city $270,000. this not known. The failure served was on brought Assets on by attachment by house at 1 o'clock this morning failed the National bank which for its doors this to open and the Colorado latter $71,780, the Union morning. National the for $20,847.74. The president of bank had a private claim for the $25,000, Denand D. Sheedy, an one officer for $40,000. in The ver National, was not unexpected, but easier it had failure hoped money would be been the firm be able to pull through. and Stringency and in the money market secure to place securities or from the of three savings extension inability closing banks, banks aided Had yes- the by the was the direct cause. been terday banks which closed yesterday which to able to secure cash with the failit over the "hard spots" Nearly carry would not have occurred. ure entire amount falls on the Denver the banks and commercial houses. e THREE MORE FIRMS. & Cohn proprieters of the & Hyman Hive shoe store, McWhirter Bee dealers in mantles and have tiles, Dipps. Engle & Harris, dry goods, available assigned. and No statements but amounts not large. FORT SCOTT BANK FORT SCOTT, Kas., July 18.-The failed National bank of this city First for business this morning, of de to open to steady withdrawal and inability to more than three owing posits Assets are collect lose times assets. noth- liaand depositors will e First National was and in 1871 and was the bilities. lished ing. The Southeastern oldest estabnational bank in S It had a Kansas. run on the Peoples $300,000 largest A capital stock 30 Sav- day of bank was started but the and the ings was taken advantage of swamped. bank law thus saved from being THREE KANSAS BANKS July 18.-State Bank Ex- reTOPEKA. Breidentbal this morning the ceived aminer notice of the failure of Kans., Bank of Kansas City, of the Citizens Bank of Richmond and of Osof Farmers' the and Merch ints' bank did small sawatomie. The concerns all business. Statements unobtainable. 0 BANK OF ANACORTES. ANACORTES. Wash. July 18.-The to of Anacortes failed to open assets day. Bank Liabilities are $29,000, $78,090. Rumor Not Credited. Lula 10 The