Click image to open full size in new tab

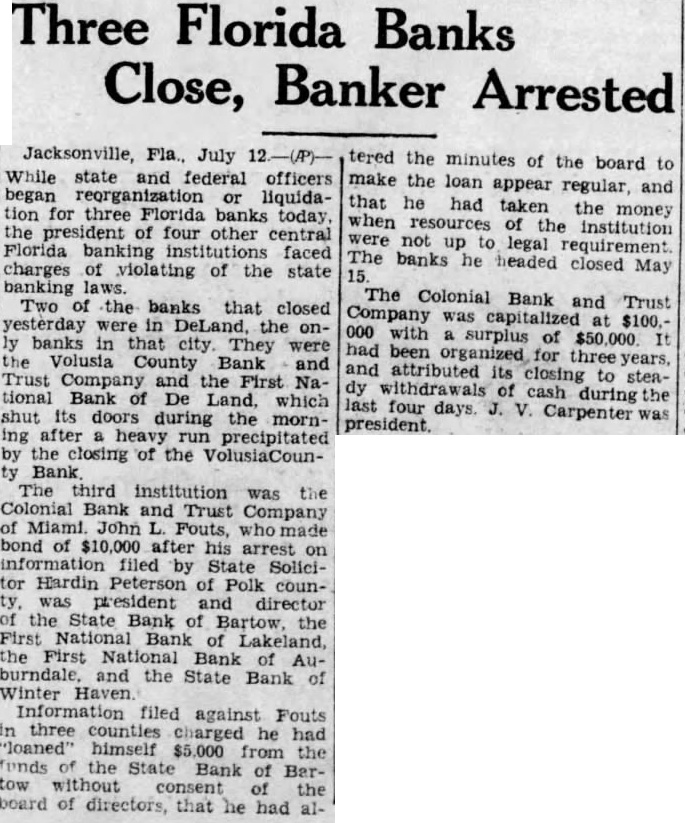

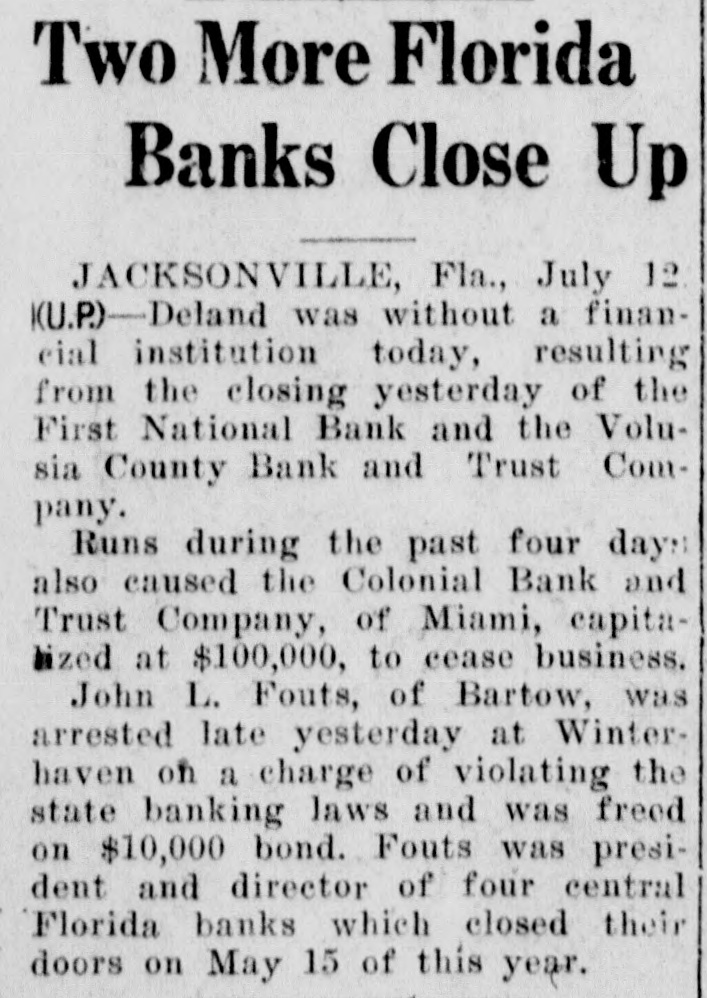

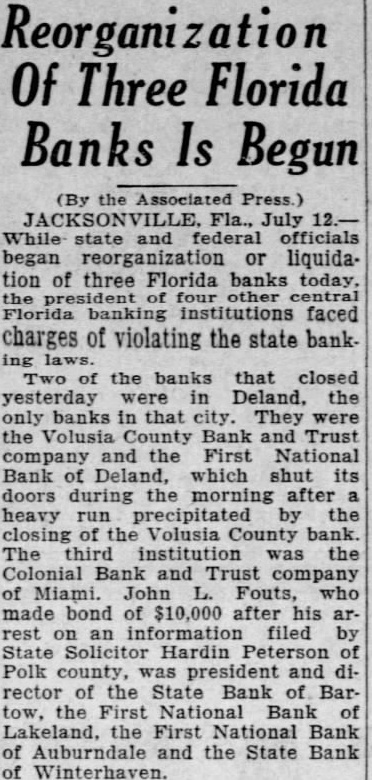

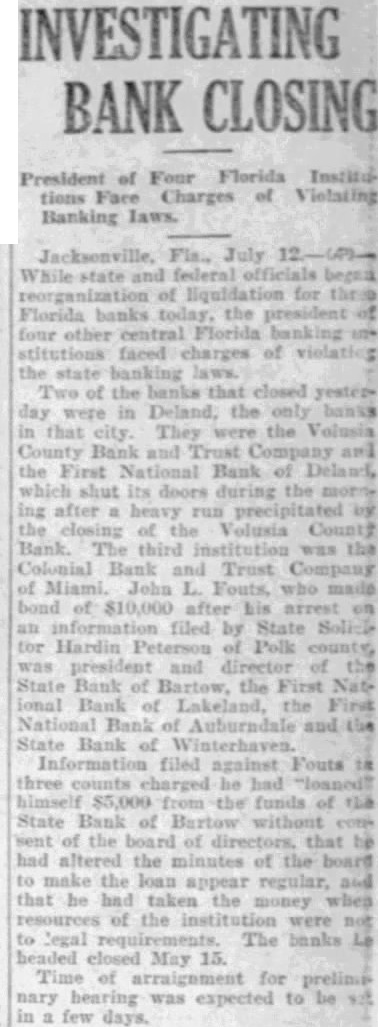

Article Text

SCANDAL MILL

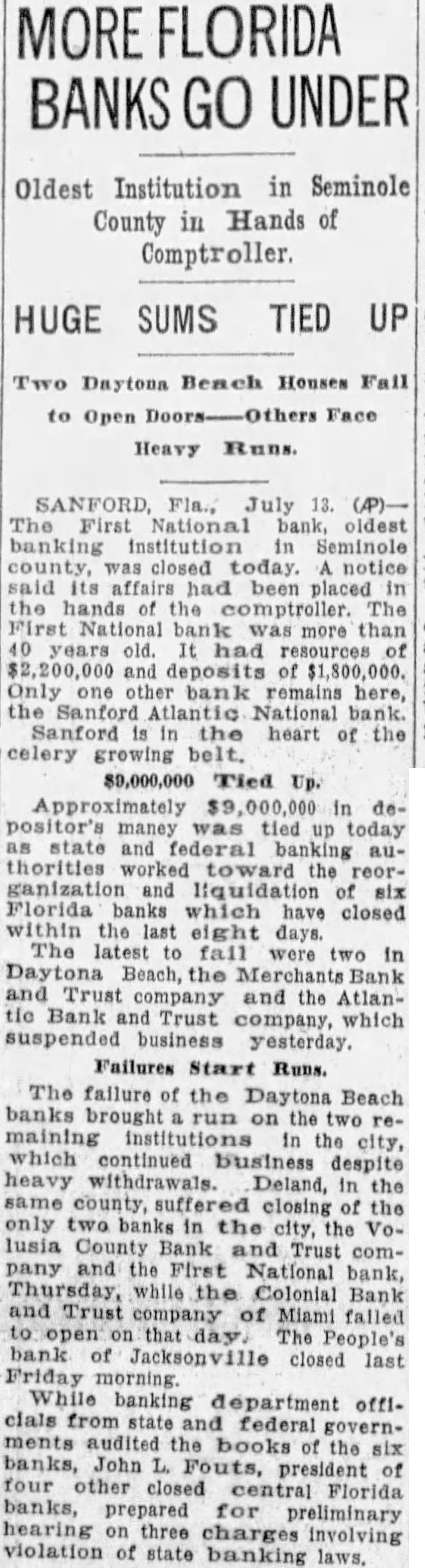

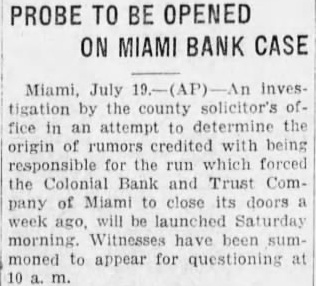

Continued from Page barrassing M. Lehman, sheriff: N. Vernon Hawthorne. state's attorney: George McCaskill, county solicitor, and Chappell, member of the legislature from Dade county. It charged that 5,000 pamphiets bearing extracts from an published ing the Dade headed "How Should Have Been Written." charging that officials named sanctioned the of gambling houses, were printed and circulated by the group. were indicted for conspiracy in the alleged kidnaping of Lally 1930, subsequent refusal the grand jury Later, of his Gautier, before grand jury, after he had been charged with contempt and said have admitted that alleged kidnaping hoax about the indictment Sheriff M. Lehman, on that the sheriff had part the alleged kidnaping The against Lally and charges alleged naping the dego before the grand jury Lehman kidnaped Lally to prevent him from appearing and certain testimony claimed to have had touching on the question of alleged malpractice of under "the color of his office sheriff. The charges that Lally the grand that the charges of and for indicting the sheriff. The two men specifically charged with delaying and embarrassing and hindering Mr. Hawthorne and the grand jury its vestigation and that the acts of Lally Sheneman others the grand jury agreed be falsely and maliciously and committed to injure the morals and prevent the of the state and to prevent or Morgan Sheneman placed under bail bond of $1,000 and Lally under bond $2,000. The grand jury's final report attacked Sheriff Lehman, charging that the "neglects and omissions of Sheriff M. P. Lehman chief executive law enforcement officer of this county has seriously reflected upon all governmental and has been largely for bringing nity into disrepute one having for the obedience to its The report also that "Sheriff Lehman take into account his oath of office, resign or be reThe method of operations of the county the report, which forth that separate, and expensive are being by the county make tax burdens for the taxpayers. The grand jury when empaneled charged specifically to into the matter of taxation in its investigations. The report criticized W. Cecil Watchairman county commissioners, for private secretary not maintain offices the and did report the though he is county fund Ernest state criticized for allowing the Colonial Bank Trust Company to operate after he had notified the officials banking institution in November, 1928, of its condition, and on the part for in assessing property grand jury's report follows: empanelled sworn, the Hon. Atkinson charged with reference to matters taxation and the expenditures of tax money. of the court we have kept in mind; its and the welfare of this been realized the point of inquiries some of the of find the established practice has for the county sioners inclined themreference their separate districts ruler kingdom all his own, exercising and authority programs and make expenditures public suit his individual whims, and to many instances to be offended if such program and expenditures were questioned the of the board of comfind that result of this practice, the taxpayers burdened with additional expense five complete, distinct, independent expensive ganizations, with attendant and additional expense of maintaining the various and deheads each. "The taxpayers under this system Five seperate road departments. separate sets of road machinery Five separate road supervisors or foremen. "(d) Five separate machine shops. Five separate machine shop foremen. Five of trucks, tracroad road shovels, drag and the implements used in doing the county's work. has been the common practice for individual to purchase expensive machinery, equipment, tools, material whenever fit, in small quantities. use in district, when similar equipment not available in all the districts, but ing be stored exposed the elements wasted. The recent attempt to adopt resolution thwarted by the agent to advertise for "Competitive Bids" for road material already purchased and delivered, indicative the manner which the county's be administered find in desolate and sections the county been for, and within their respective and independent districts, involving immense amounts public funds, without seeking the counsel of the board, and without its "We find that the efforts of the county agent the duties his office in purchasing and for county purposes met and meeting So autocratic have been of the commissioners exercise their districts without or molestation, that determined efforts have been threatened and made have the office of purchasing agent abolished. spite the maintenance by the ters in the in which the are furnished public expense, and equipment they necessary needful, appears that the present chairman of the board of coundoes now and has for period in excess of four years, maintained on county pay roll private quartered the fice in with the dollars day. The duties this according his testimony. mostly running errands, making up pay rolls, writing letters. and answering inquiries that come the office commissioners' office in the maintained for the county's business has complete force, including help all The prito in the office in the never ports services being either not available any the sioners, or not taken advantage of by them. "The cost of maintaining the county has been subject of complaint, and make thorough Their copied indicates that this respect the county commissioners are deserving of commendation. committee found, contrary to adverse that the building is being operated cared for efficiently by apparently employed good operating this other buildings vastly methods required that no very evident program retrenchment appears. Comparison this building other public buildings of similar nature, specifically Los Angeles, maintenance rather below than above the average. report should not be Interpreted to mean that has been found but the personnel in charge appears aware adand made time and allow. "Colonial Bank and Trust Company. We have the fnto the of be one great The closing bank, their directly hundred (900) depositors. The had on posit, according to their records, approximately hundred thirty thousand dollars ($330,000), and in actual cash at the time its closing less than dollars though there no run on the bank, almost belief. appears from the records of the that state condition the number and had called its condition to the of the president directors far back November, 1928. The bank remained open, conditions going from the tenth day 1929. In addition heard stock appears from their published and