Article Text

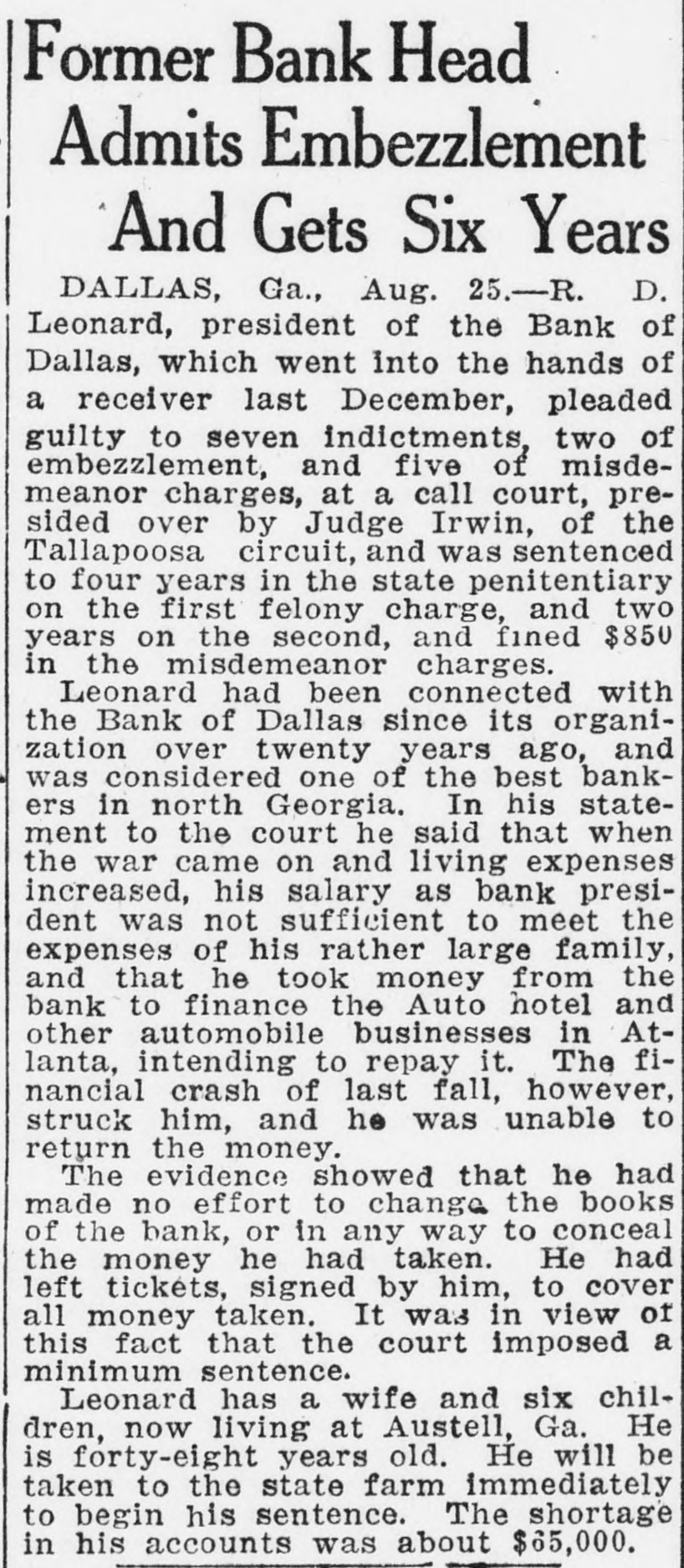

Former Bank Head Admits Embezzlement And Gets Six Years DALLAS, Ga., Aug. 25.-R. D. Leonard, president of the Bank of Dallas, which went into the hands of a receiver last December, pleaded guilty to seven indictments, two of embezzlement, and five of misdemeanor charges, at a call court, presided over by Judge Irwin, of the Tallapoosa circuit, and was sentenced to four years in the state penitentiary on the first felony charge, and two years on the second, and fined $850 in the misdemeanor charges. Leonard had been connected with the Bank of Dallas since its organization over twenty years ago, and was considered one of the best bankers in north Georgia. In his statement to the court he said that when the war came on and living expenses increased, his salary as bank president was not sufficient to meet the expenses of his rather large family, and that he took money from the bank to finance the Auto hotel and other automobile businesses in Atlanta, intending to repay it. The financial crash of last fall, however, struck him, and he was unable to return the money. The evidence showed that he had made no effort to change the books of the bank, or in any way to conceal the money he had taken. He had left tickets, signed by him, to cover all money taken. It was in view of this fact that the court imposed a minimum sentence. Leonard has a wife and six children, now living at Austell, Ga. He is forty-eight years old. He will be taken to the state farm immediately to begin his sentence. The shortage in his accounts was about $65,000.