Click image to open full size in new tab

Article Text

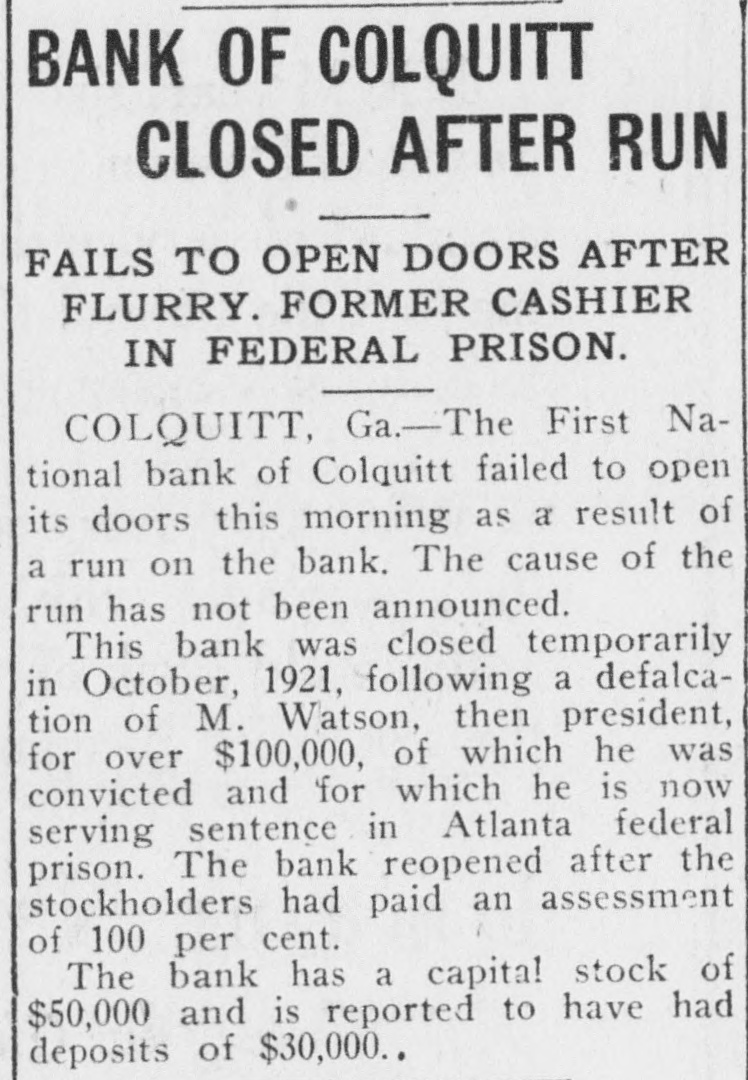

BANK OF COLQUITT CLOSED AFTER RUN FAILS TO OPEN DOORS AFTER FLURRY. FORMER CASHIER IN FEDERAL PRISON. COLQUITT, Ga.-The First National bank of Colquitt failed to open its doors this morning as a result of a run on the bank. The cause of the run has not been announced. This bank was closed temporarily in October, 1921, following a defalcation of M. Watson, then president, for over $100,000, of which he was convicted and for which he is now serving sentence in Atlanta federal prison. The bank reopened after the stockholders had paid an assessment of 100 per cent. The bank has a capital stock of $50,000 and is reported to have had deposits of $30,000..