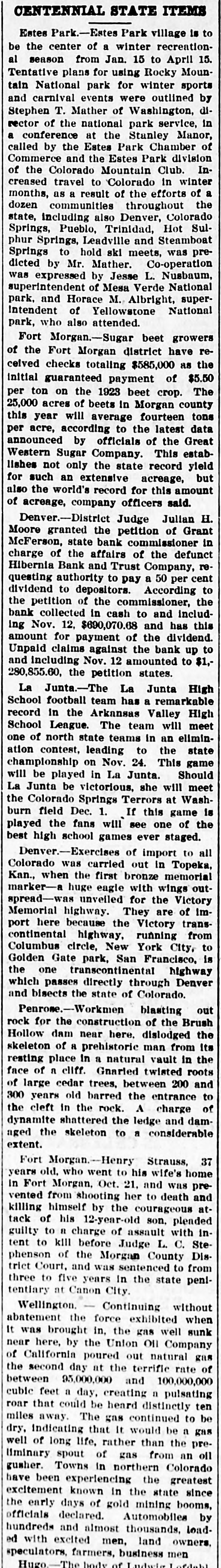

Article Text

WOMAN IS SOUGHT IN BANK'S FAILURE Three Arrested in Shortage of Near Half Million in Denver Institution. By the Associated Press. DENVER, Colo., July 28.-Doors of the Hibernia Bank and Trust Company are closed and three young men prominent in Denver financial circles spent last night in jail, following the discovery of a shortage in the bank's funds estimated to be between $400,000 and $500,000. Those taken to the county jail last night were Leo P. Floyd, secretary of the company; John Harrington, teller, son of M. C. Harrington, vice president of the bank, and R. M. Mandell, head of Mandell & Co., investment brokers. District Attorney Philip Van Cise stated last night that charges against the trio would be filed today. More arrests loom in the case, according to the bank examiners and officials of the District Attorney's office. Detectives who have been called in to help unravel the financial tangle intimated that "the woman in the case" is being sought. Her name was not revealed. Leonard De Lue, head of the De Lue Detective Agency, who arrested Floyd and Harrington, predicted additional arrests soon. There will be an investigation also, he declared. into what he termed a "tipoff" which enabled favored depositors to withdraw thousands of dollars from the bank before notice was posted that it was in the hands of the state banking examiner. De Lue estimated that possibly $40,000 or $50,000 had been withdrawn by these depositors, Floyd, according to his alleged confession, told how money and bonds had been manipulated over a period of three years in such manner that bank examiners did not detect the reported defalcations. Harrington was quoted as saying that he had knowledge of what was going on, but that he sought to protect his friend, Floyd. "I did not receive a cent," he declared. Floyd was quoted as saying: "I was not in this alone." Three Years' Activities. Vice President Harrington said that Floyd had revealed the shortages to the bank directors, that they had begun three years ago. when, he said, Mandell put through some short checks which the bank's secretary had covered because of friendship for the broker. E. P. Ryan of Spokane, Wash., president of the bank, is en route to Denver with securities, and Mrs. Josephine Leonard, a large stockholder, is coming from Washington, D. C., with additional securities to be used in an effort to meet the Hibernia's losses. Although the alleged peculations cover a period of three years, bank examiners last Tuesday pronounced the bank's records satisfactory. According to the last statement the Hibernia had deposits of $1,373,729.