1.

July 11, 1929

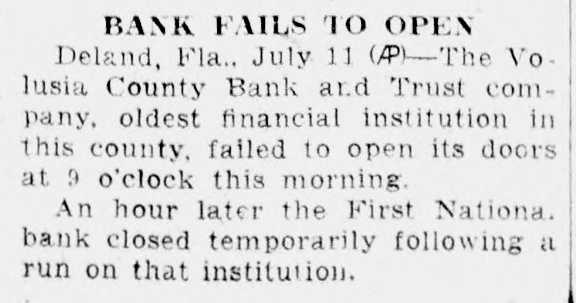

New Britain Herald

New Britain, CT

Click image to open full size in new tab

Article Text

BANK FAILS TO OPEN Deland, Fla.. July 11 (AP)-The Vo. lusia County Bank and Trust company, oldest financial institution in this county, failed to open its doors at 9 o'clock this morning An hour later the First Nationa. bank closed temporarily following a run on that institution.

2.

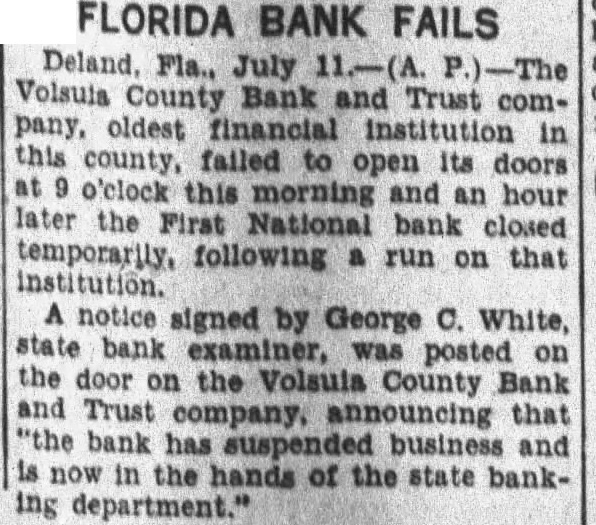

July 11, 1929

The Chattanooga News

Chattanooga, TN

Click image to open full size in new tab

Article Text

FLORIDA BANK FAILS

Deland, Fla., July 11.-(A. P.)-The Volsuis County Bank and Trust company, oldest financial institution in this county, failed to open its doors o'clock this morning and an hour later the First National bank closed temporarily, following a run on that institution. notice signed by George C. White, state bank examiner, was posted on the door on the Volsula County Bank and Trust company, announcing that "the bank has suspended business and is now in the hands of the state banking department."

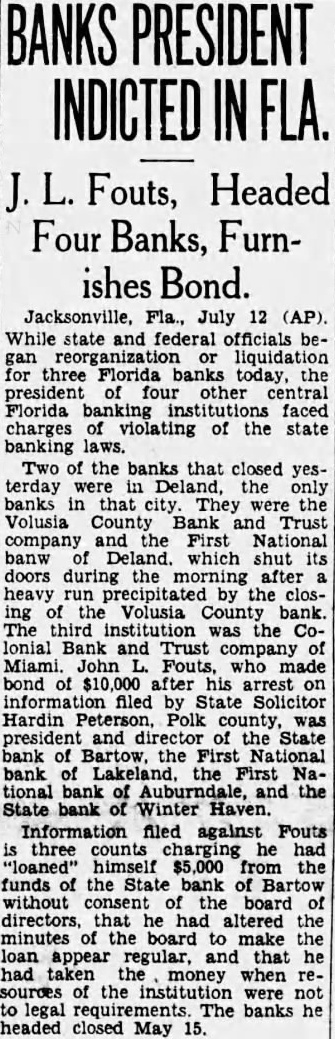

3.

July 12, 1929

The Salisbury Post

Salisbury, NC

Click image to open full size in new tab

Article Text

Fouts, Headed Four Banks, FurnBond.

Jacksonville, July 12 While state and federal officials or liquidation three Florida banks today, the president four other Florida faced charges of violating of the state banking Two of the banks that closed yesterday were Deland, banks that city. They were the Volusia County Bank Trust company and the First National banw Deland. which shut its doors during the after heavy by ing Volusia bank. The third was the Colonial Bank and Trust company of Miami. John made bond of $10,000 after his arrest filed by State Solicitor Hardin Polk county, president director the State bank of the First bank First National bank and the State bank Winter Haven. Information filed against Fouts three counts charging had "loaned" himself $5,000 from funds the State bank of Bartow without consent board of directors, that had altered the minutes of the board make the loan appear and that had taken money when sources of the institution were not legal The banks headed closed May 15.

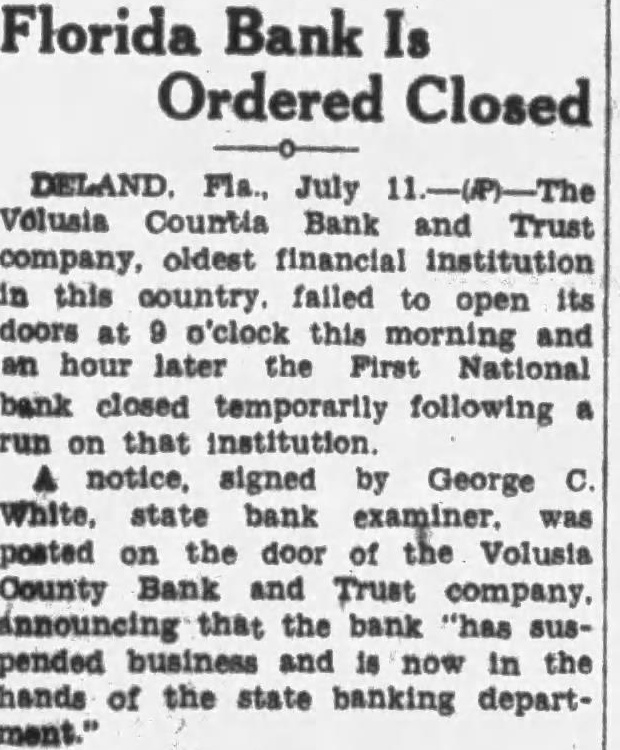

4.

July 12, 1929

Danville Register and Bee

Danville, VA

Click image to open full size in new tab

Article Text

Florida Bank Is Ordered Closed

DELAND Fla., July 11.-(P)-The Volusia Countila Bank and Trust company, oldest financial institution in this country. failed to open its doors at 9 o'clock this morning and an hour later the First National bank closed temporarily following a run on that institution. notice, signed by George C. White, state bank examiner. was posted on the door of the Volusta County Bank and Trust company. announcing that the bank "has suspended business and now in the hands of the state banking department."

5.

July 12, 1929

Springfield Evening Union

Springfield, MA

Click image to open full size in new tab

Article Text

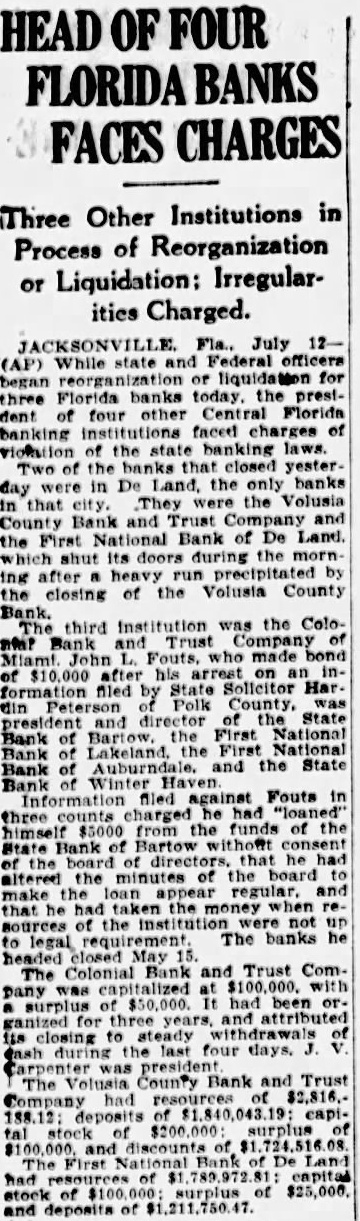

HEAD OF FOUR FLORIDA BANKS FACES CHARGES

Three Other Institutions in Process of Reorganization or Liquidation: Irregularities Charged.

JACKSONVILLE. Fla., July 12(AP) While state and Federal officers began reorganization or liquidation for three Florida banks today. the prestof four other Central Florida dent banking institutions faced charges of violation of the state banking laws. Two of the banks that closed yesterday were in De Land, the only banks in that city. They were the Volusia County Bank and Trust Company and the First National Bank of De Land. which shut its doors during the morning after a heavy run precipitated by the closing of the Volusta County Bank. The third Institution was the Colonon? Bank and Trust Company of Miami John L. Fouts, who made bond of $10,000 after his arrest on an information filed by State Solicitor Har. din Peterson of Polk County, president and director of the State Bank of Bartow, the First National Bank of Lakeland. the First National Bank Auburndale. and the State Bank Winter Information filed against Fouts in three counts charged he had "loaned" himself $5000 from the funds of the State Bank of Bartow without consent of the board of directors. that he had altered the minutes of the board and make the loan appear that he had taken the money when resources of the institution were not up The banks he to legal headed closed May The Colonial Bank and Trust Company was capitalized at $100,000. with surplus of $50,000. It had been ganized for three years, and attributed 118 closing to steady withdrawals cash during the four days. J. Carpenter president County Bank and Trust The Volusia Company had resources of $2,816.188.12: deposits of capital stock of $200,000 surplus and discounts of The First National Bank De Land had resources of capital stock of surplus of and deposits of $1,211,750.47.

6.

July 12, 1929

The Times

Trenton, NJ

Click image to open full size in new tab

Article Text

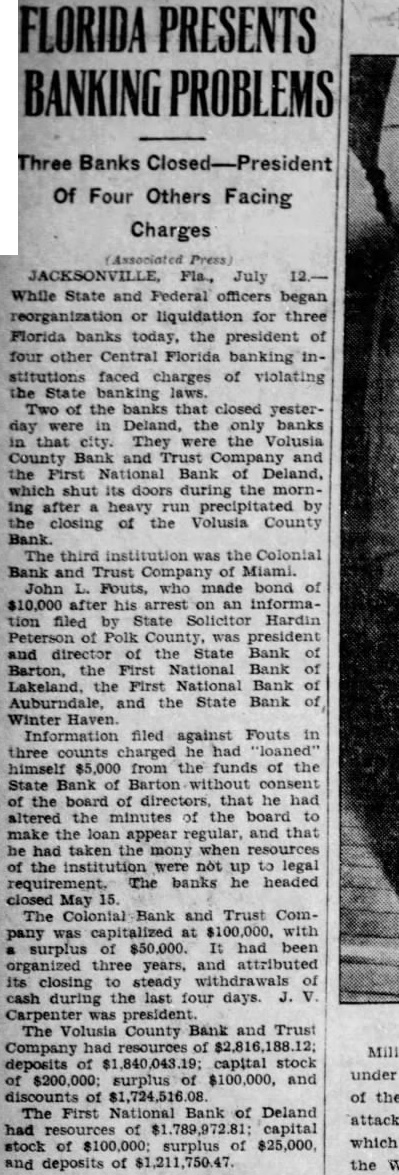

FLORIDA PRESENTS BANKING PROBLEMS

Three Banks Closed-President Of Four Others Facing

Charges

JACKSONVILLE, Fla, July While State and Federal officers began reorganization or liquidation for three Florida banks today, the president of four other Central Florida banking stitutions faced charges of violating the State banking laws. Two of the banks that closed yesterday were in Deland, the only banks in that city. They were the Volusia County Bank and Trust Company and the First National Bank of Deland, which shut its doors during the morning after heavy run precipitated by closing of the Volusia County Bank. The third institution was the Colonial Bank and Trust Company of Miami. John L. Fouts, who made bond of $10,000 after his arrest on an information filed by State Solicitor Hardin Peterson of Polk County, was president and director of the State Bank Barton, the First National Bank of Lakeland, the First National Bank Auburndale, and the State Bank of Winter Haven. Information filed against Fouts in three counts charged he had "loaned" himself $5,000 from the funds of the State Bank of Barton without consent of the board of directors, that he had altered the minutes of the board to make the loan appear regular, and that he had taken the mony when of the institution were not up to legal requirement. The banks he headed closed May 15. The Colonial Bank and Trust Company was capitalized at $100,000. with surplus of $50,000. It had been organized three years, and attributed its closing to steady withdrawals cash during the last four days. J. was president The Volusia County Bank and Trust Company had resources of deposits of capital stock of $200,000; surplus of $100,000, and discounts of $1,724,516.08. The First National Bank of Deland had resources of capital stock of $100,000; surplus of $25,000, and deposits of $1,211,750.47.

7.

July 12, 1929

The News Journal

Wilmington, DE

Click image to open full size in new tab

Article Text

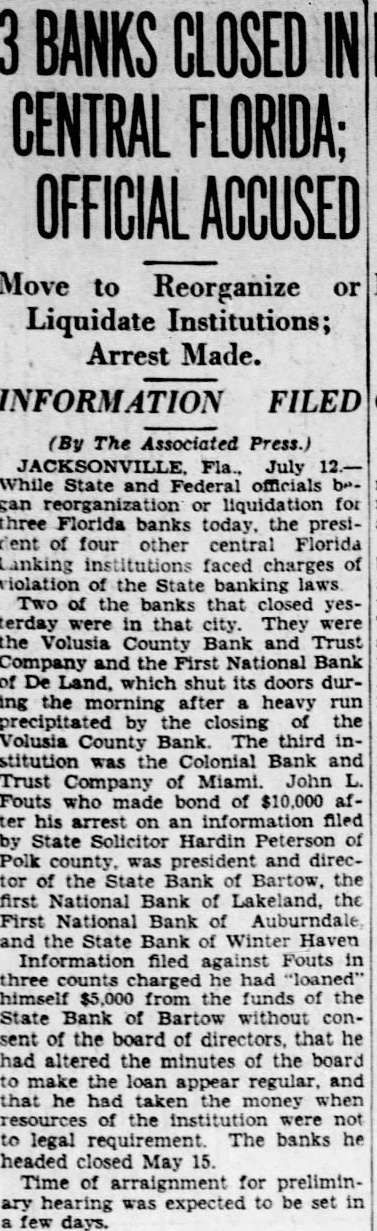

3 BANKS CLOSED IN CENTRAL FLORIDA; OFFICIAL ACCUSED

Move to Reorganize or Liquidate Institutions; Arrest Made.

INFORMATION FILED

(By The Associated Press.) JACKSONVILLE Fla., July 12.While State and Federal officials be. gan reorganization or liquidation for three Florida banks today, the president of four other central Florida Lanking institutions faced charges of violation of the State banking laws Two of the banks that closed yesterday were in that city. They were the Volusia County Bank and Trust Company and the First National Bank of De Land. which shut its doors during the morning after a heavy run precipitated by the closing of the Volusia County Bank. The third institution was the Colonial Bank and Trust Company of Miami. John L. Fouts who made bond of $10,000 after his arrest on an information filed by State Solicitor Hardin Peterson of Polk county, was president and director of the State Bank of Bartow, the first National Bank of Lakeland, the First National Bank of Auburndale and the State Bank of Winter Haven Information filed against Fouts in three counts charged he had "loaned" himself $5,000 from the funds of the State Bank of Bartow without consent of the board of directors, that he had altered the minutes of the board to make the loan appear regular, and that he had taken the money when resources of the institution were not to legal requirement. The banks he headed closed May 15. Time of arraignment for preliminary hearing was expected to be set in a few days.

8.

July 12, 1929

The Philadelphia Inquirer

Philadelphia, PA

Click image to open full size in new tab

Article Text

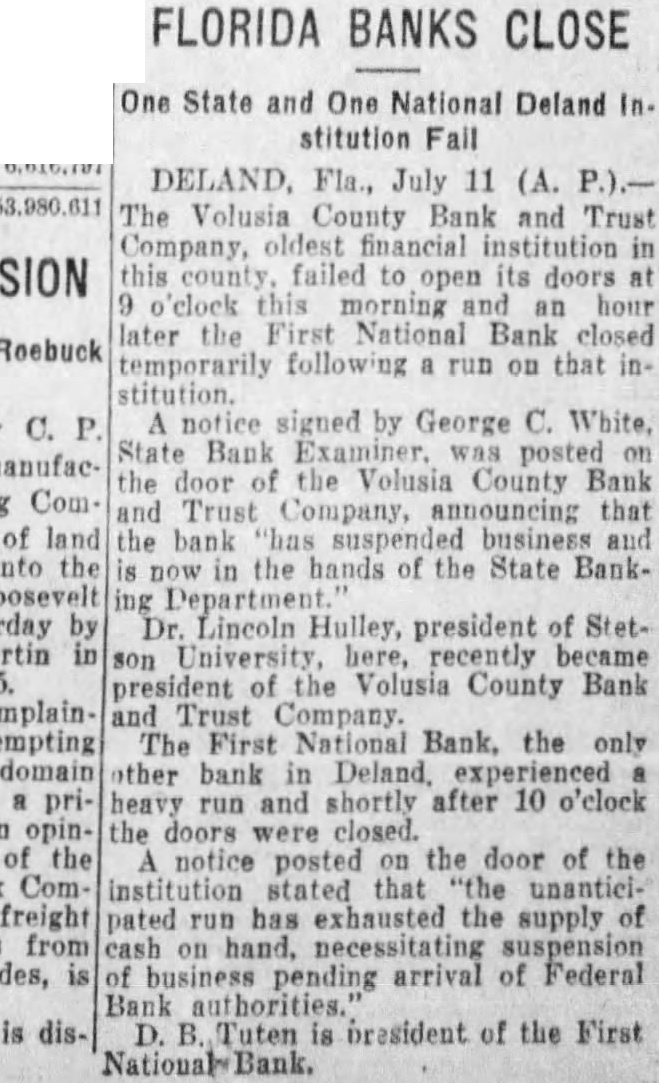

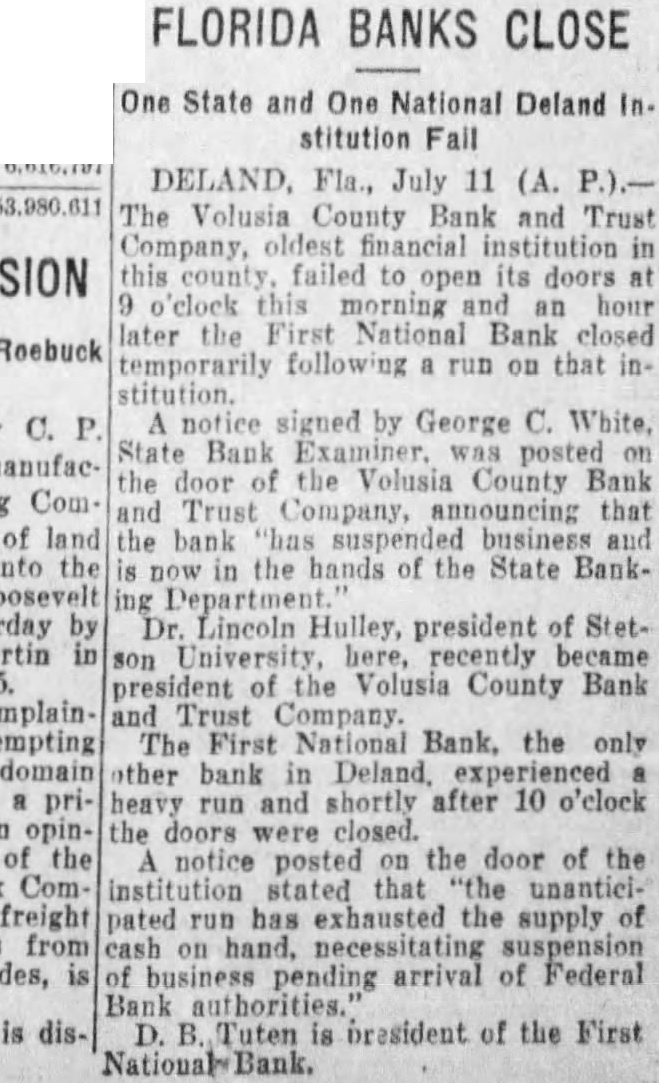

FLORIDA BANKS CLOSE

One State and One National Deland In. stitution

DELAND. Fla., July (A. The Volusia County Bank and Trust Company, financial this its an later Bank temporarily run on that institution. signed by George C. White, Bank the the Volusia County Bank and Trust that the bank business the hands the State Banknow Lincoln president of Stetpresident the Volusia County Bank Trust Company. First National Bank, the only other bank Deland run shortly after 10 o'clock the door of the stated that unanticirun has exhausted supply necessitating arrival of Federal pending Bank Tuten oresident of the First

9.

July 12, 1929

Imperial Valley Press

El Centro, CA

Click image to open full size in new tab

Article Text

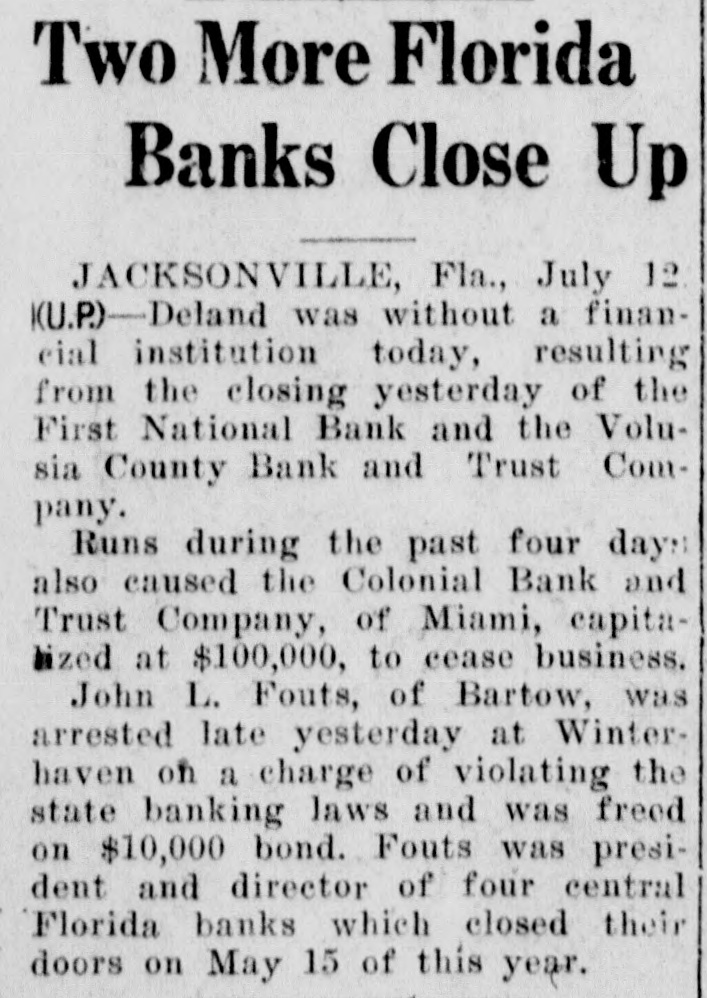

Two More Florida Banks Close Up JACKSONVILLE, Fla., July 12 (U.P)-Deland was without a financial institution today, resulting from the closing yesterday of the First National Bank and the Volusia County Bank and Trust Company. Runs during the past four days also caused the Colonial Bank and Trust Company, of Miami, capitalized at $100,000, to cease business. John L. Fouts, of Bartow, was arrested late yesterday at Winterhaven on a charge of violating the state banking laws and was freed on $10,000 bond. Fouts was president and director of four central Florida banks which closed their doors on May 15 of this year.

10.

July 12, 1929

The Tampa Times

Tampa, FL

Click image to open full size in new tab

Article Text

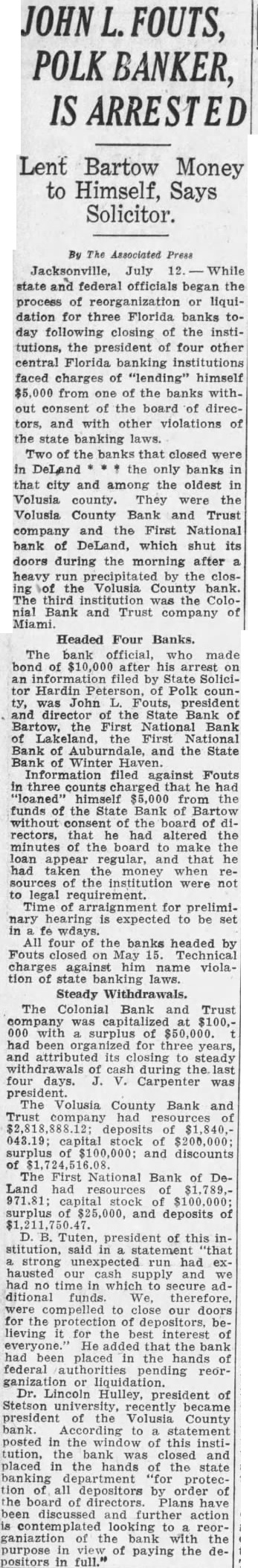

JOHN L. FOUTS, POLK BANKER, IS ARRESTED

Lent Bartow Money to Himself, Says Solicitor.

By The Associated Jacksonville, July 12. While state and federal officials began the process of reorganization or liquidation for three Florida banks today following closing of the institutions, the president of four other central Florida banking institutions faced charges of "lending" himself $5,000 from one of the banks without consent of the board of directors, and with other violations of the state banking laws. Two of the banks that closed were in DeLand the only banks in that city and among the oldest in Volusia county. They were the Volusia County Bank and Trust company and the First National bank of DeLand, which shut its doors during the morning after heavy run precipitated by the closing of the Volusia County bank. The third institution was the Colonial Bank and Trust company of Miami.

Headed Four Banks. The bank official, who made bond of $10,000 after his arrest on an information filed by State Solicitor Hardin Peterson. of Polk county, was John L. Fouts, president and director of the State Bank of Bartow, the First National Bank of Lakeland, the First National Bank of Auburndale, and the State Bank of Winter Haven. Information filed against Fouts in three counts charged that he had "loaned" himself $5,000 from the funds of the State Bank of Bartow without consent of the board of rectors, that he had altered the minutes of the board to make the loan appear regular, and that he had taken the money when resources of the institution were not to legal requirement. Time of arraignment for preliminary hearing is expected to be set in fe wdays. All four of the banks headed by Fouts closed on May 15. Technical charges against him name violation of state banking laws. Steady Withdrawals. The Colonial Bank and Trust company was capitalized at $100,000 with a surplus of $50,000. had been organized for three years, and attributed its closing to steady withdrawals of cash during the last four days. J. V. Carpenter was president. The Volusia County Bank and Trust company had resources of $2,818,888.12; deposits of $1,840,048.19; capital stock of $200,000; surplus of $100,000: and discounts The First National Bank of DeLand had resources of $1,789,971.81; capital stock of $100,000; surplus of $25,000, and deposits of D. B. Tuten, president of this institution, said in statement 'that a strong unexpected run had exhausted our cash supply and we had no time in which to secure additional funds We, therefore. were compelled to close our doors for the protection of depositors, believing it for the best interest of everyone." He added that the bank had been placed in the hands of federal authorities pending reorganization or liquidation. Dr. Lincoln Hulley, president of Stetson university, recently became president of the Volusia County bank. According to statement posted in the window of this institution, the bank was closed and placed in the hands of the state banking department "for protection of all depositors by order of the board of directors. Plans have been discussed and further action is contemplated looking to reorganiaztion of the bank with the purpose in view of paying the depositors in full."

11.

July 12, 1929

The Crowley Post-Signal

Crowley, LA

Click image to open full size in new tab

Article Text

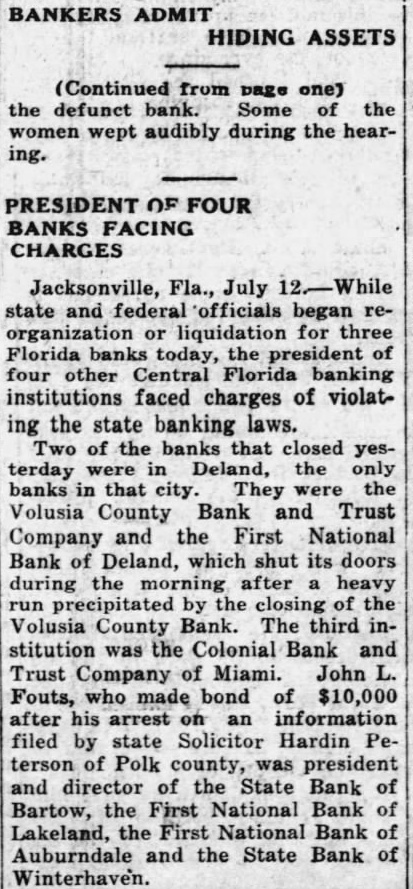

BANKERS ADMIT HIDING ASSETS

(Continued from page one) the defunct bank. Some of the women wept audibly during the hearing.

PRESIDENT OF FOUR BANKS FACING CHARGES

Jacksonville, Fla., July While state and federal officials began reorganization or liquidation for three Florida banks today, the president of four other Central Florida banking institutions faced charges of violating the state banking laws. Two of the banks that closed yesterday were in Deland, the only banks in that city. They were the Volusia County Bank and Trust Company and the First National Bank of Deland, which shut its doors during the morning after a heavy run precipitated by the closing of the Volusia County Bank. The third institution was the Colonial Bank and Trust Company of Miami. John L. Fouts, who made bond of $10,000 after his arrest on an information filed by state Solicitor Hardin Peterson of Polk county, was president and director of the State Bank of Bartow, the First National Bank of Lakeland, the First National Bank of Auburndale and the State Bank of Winterhaven.

12.

July 12, 1929

The Huntsville Times

Huntsville, AL

Click image to open full size in new tab

Article Text

COMELY YOUNG FOR REUNION IN BANKS WOMAN HELD MONTMARTRE FACE CHARGES

Topeka Woman Confesses She Robbed Two Men In Daylight Holdup year and she mitted the holdup Benefit June The Mrs. Vivian and Cecil in an they Marie Rainey, who with them as "nlece" and was Scraper's confidante after the crime, was held for investigation. Officers found $13,690 hidden in an chair behind in the Mrs. said, that her Streit that the holdup after A. salesman, drive her to scene the in front of Security build- Louis Streit brother of Streit, one the employes she robbed. Sheriff Horning said Mrs. Scraphad refused implicate Streit in her confession. Scraper according sheriff, planned the holdup but delayed It because she "lost nerve.' She also said revolver used was There cartridges gun when was found shortly after robbery. arrest the three was said to have resulted given to the authorities by the Rainmother. Rainey Mrs. Scraper and Cecil her home within an hour after the robbery carrying blankets. Officers were inclined to believe the money was hidden in them. Two days later she the returned and took away shoe which, officers said, apparently contained the

Fliers of Pathfinder Expect To Join French Ocean Fliers Soon

July tary shortly for the Orchard Club." The Americans want to their to the French Fevre that both crews succeeded in crossing safely. During the latter part next the will plane crated and will then sail for home. The fliers also drop visit Major Italian flier who is hospital there resting The government has called convene at 6:30 p.m. today Collona render homage to Roger Captain Lewis Yancey, Atlantic aviators. The meeting will mark the of Rome's the two fliers, arrived from Old Orchard, with but one stop enroute, at SanSpain. There will music speeches by ItalThe Aviators will be given a high by the Italian government, Maurice, orders Saints they King Victor Emanuel next Monday.

Four Central Florida Financiers Accused of Violating Bank Laws July and cials liquidation for three Florida banks today, the four other central Florida faced of violating the state Two of the banks closed terday Deland, the banks Volusia Company First National Deland, which during after run the Volusia The Bank and Trust of John Fouts, who $10,000 information Hardin the National Lakeland, the National State Bank Winterhaven Information filed Fouts in counts "loanhimself $5,000 funds the State Bank Bartow out consent directhat had altered the regular that he the institution were not up to legal reThe he headed closed May

Time of for preliminary to be set few The Colonial Bank and Trust Company was capitalized at $100,000 $50,000. closing attributed withdrawa during last few J. The Volusia County Bank and Trust Company had resources capital of surplus $100,000 and discounts of $1,724,The First National Bank of Deland had resources of capital stock of surplus $2,500 and deposits of $1,211,750.47.

13.

July 12, 1929

The Selma Times-Journal

Selma, AL

Click image to open full size in new tab

Article Text

THREE BANKS CLOSE RESULT RUNS

Head Of Four Other Institutions Faces Charges

July 12. state and federal offictals began reorganization or liquidation for three Florida banking institutions faced charges of violating the state laws. Two of the banks that closed yesterday were in Deland, the only banks in that They were the Volusia County Bank and Trust Company the First National Bank Deland, which shut doors during the morning after heavy run precipitated by the closVolusia County Bank. ing the third institution the Coloriial Bank and Trust Company of Miami. John made bond of $10,000 his arrest on information filed by State Solicitor Hardin county, was president and the State Pank of Bartow, the First National Bank Lakeland, the First NationBank of and the Bank of Winterhaven filed against Fouts in he had "loancounts himselg $5,000 the funds of the State Bank of Bartow withboard of direcout tors, that altered the utes of the board make the loan that had appear regular and the when of the institution not up to legal The banks he headed closed May

Time of arraignment for preliminary hearing expected to be set few days. The Colonial Bank and Trust Company surplus of $50,000. Its closing was attributed to steady withdrawals during the last few days. J. Carpenter was president. The Volusia County Bank and Trust Company had resources of deposits of 082.19; capital stock surplus of $100,000 and discounts The First National Bank of Deland had stock of

14.

July 12, 1929

Morristown Gazette Mail

Morristown, TN

Click image to open full size in new tab

Article Text

Florida Bank Closed

Press) De Land, Fla., July 12.-The Volusia County Bank and Trust Company, oldest financial institution in this county, failed to open its doors at 9:00 o'clock Thursday morning and an hour later the First National Bank closed temporarily, following a run on that institution. A notice, signed by George C. White, state bank examiner, was posted on the door of the Volusia County Bank and Trust Company, announcing that the bank "has suspended business and is now in the hands of the state banking department."

15.

July 12, 1929

The Buffalo News

Buffalo, NY

Click image to open full size in new tab

Article Text

HEAD OF FARM BANKS IN FLORIDA ACCUSED

John L. Fouts Faces Arrest as Finance Scandal Spreads.

JACKSONVILLE Fla. July 12 (P)While and officers began reorganization liquidation three Florida today the president of four Florida banking institutions faced charges of violating the state banking Two the banks that closed vesterday were in De Land, the only banks in that city They were the Volusia County Bank and Trust company and the First National bank De Land. shut its during the morn ing after heavy run by the closing of the County bank The third institution was the Colonial Bank and Trust company of Miami John Fouts. who made bond of $10,000 after on an information Hardin Peterson of Polk was president and director of the State bank of Barton. the First National bank of Lake land the First National bank of Auburndale and the State bank of Winter Information filed against Fouts in three he had "loaned" himself $5000 from the funds of the State bank of Barton without consent the board of directors, that he had altered the minutes of the board to make the loan appear regular and that he had taken the when reof the were not legal requirement The banks he headed closed May 15

16.

July 12, 1929

The Buffalo News

Buffalo, NY

Click image to open full size in new tab

Article Text

HEAD OF FARM BANKS IN FLORIDA ACCUSED

July 12 While and federal officers began liquidation for three Florida banks today the president of central Florida stitutions faced charges of violating the state banking the that closed De Land banks They the Volusia County Bank and Trust company and the First National bank of De Land which shut doors during the morn heavy run by closing bank The Colonial Bank and Trust company of Miami

17.

July 12, 1929

News and Record

Greensboro, NC

Click image to open full size in new tab

Article Text

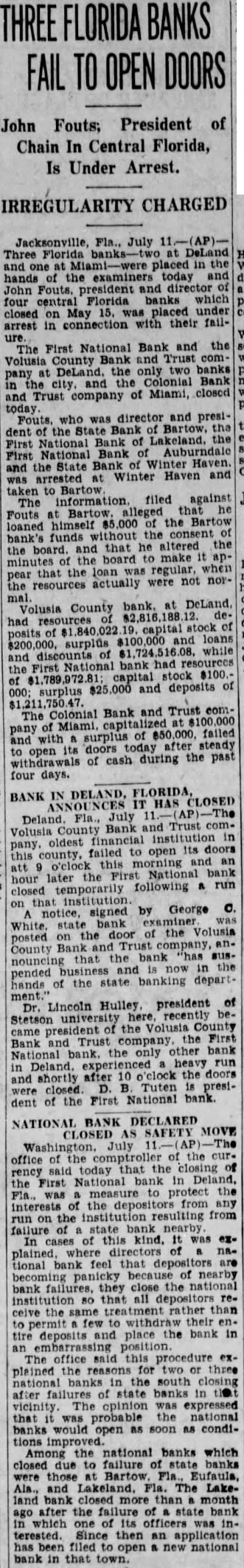

FLORIDA BANKS FAIL TO OPEN DOORS

John Fouts; President of Chain In Central Florida, Is Under Arrest.

IRREGULARITY CHARGED

Jacksonville, Fla., July Three Florida at DeLand and one Miami-were placed in the the examiners today and John Fouts. president and director Florida banks which four central closed on May 15. was placed under arrest in connection with their failThe First National Bank and the Volusia County Bank and Trust comthe only two banks pany at Colonial Bank the and and Trust company of Miami, closed Fouts. who was director and president the State Bank of Bartow, First National Bank of Lakeland. the First National Bank Auburndale and the State Bank of Haven. was arrested at Winter Haven and to Bartow The information filed against Fouts at Bartow, alleged that loaned himself 85 000 of the Bartow bank's funds without the consent the board. and that he altered the minutes of the board to make appear that the loan was regular when the resources actually were not norCounty bank. at had Volusia resources deposits of 19. stock $200,000, surplus $100,000 and loans and of $1,724,516.08, while the First National bank had resources $100.capital stock of surplus $25 000 and deposits of The Colonial Bank and Trust comand pany with of Miami, surplus of $50,000, failed to open its doors after steady withdrawals of cash during the past four days.

BANK IN DELAND, FLORIDA, ANNOUNCES HAS CLOSED Deland. Fla., July Volusia County Bank and Trust company, oldest financial institution in this county, failed to open its and doors an morning att hour later o'clock the National bank closed temporarily following a run on that notice, institution. signed by George C. bank examiner White, posted on state the door of the Volusia County Bank and announcing the bank "has suspended and in the hands of the state banking department." Dr. Lincoln Hulley, president of Stetson university here recently became president of the Volusia County Bank and Trust company, the First National only other bank in Deland. heavy run and shortly after 10 o'clock the doors were closed. D. Tuten is president of the First National bank.

NATIONAL BANK DECLARED AS SAFETY MOVE Washington, July office of comptroller of the currency said today that the closing of the First National bank in Deland, Fla., was measure to protect the interests of the depositors from any run on the institution resulting from failure of state bank nearby. In cases of this kind, it was explained, national bank feel that depositors are of nearby bank they close the national institution so that all depositors recelve the same treatment rather than permit few to withdraw their entire deposits and place the bank in an embarrassing The office said this procedure explained the reasons for two or three national banks in the south closing after failures of state banks in the vicinity. The opinion was expressed was probable the national banks would open as as condiAmong the national banks which closed due to failure of state banks those at Bartow Eufaula, and Lakeland, Fla. The Lakeland bank more than month ago after the failure of state bank which of Its officers was interested. Since then an application has been filed to open new national in that town.

18.

July 13, 1929

New Britain Herald

New Britain, CT

Click image to open full size in new tab

Article Text

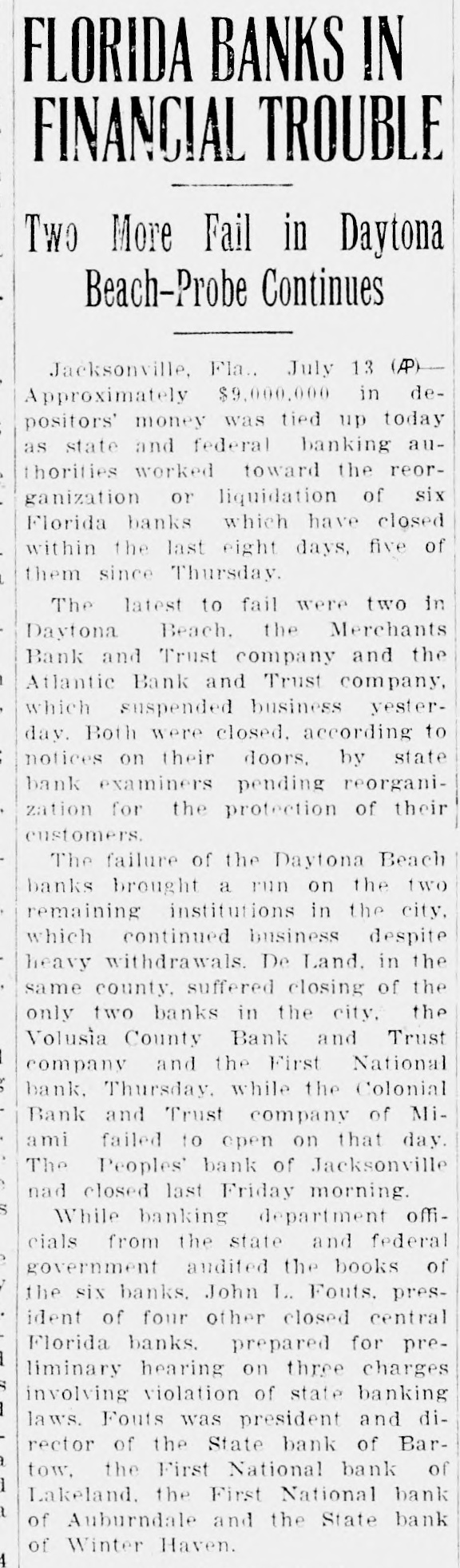

FLORIDA BANKS IN FINANCIAL TROUBLE TWO More Fail in Daytona Beach-Probe Continues Jacksonville, Fla.. July 13 (AP) Approximately $9,000,000 in depositors' money was tied up today as state and federal banking authorities worked toward the reorganization or liquidation of six Florida banks which have closed within the last eight days, five of them since Thursday, The latest to fail were two in Daytona Beach. the Merchants Bank and Trust company and the Atlantic Bank and Trust company, which suspended business vesterday. Both were closed. according to notices on their doors, by state bank examiners pending reorganization for the protection of their customers. The failure of the Daytona Beach banks brought a run on the two remaining institutions in the city, which continued business despite heavy withdrawals. De Land. in the same county, suffered closing of the only two banks in the city, the Volusia County Bank and Trust company and the First National bank. Thursday, while the Colonial Bank and Trust company of Miami failed to open on that day. The Peoples' bank of Jacksonville nad closed last Friday morning. While banking department officials from the state and federal government audited the books of the six banks. John 1.. Fouts. president of four other closed central Florida banks. prepared for preliminary hearing on three charges involving violation of state banking laws. Fouts was president and director of the State bank of Bartow, the First National bank of Lakeland, the First National bank of Auburndale and the State bank of Winter Haven.

19.

July 13, 1929

The Watchman and Southron

Sumter, SC

Click image to open full size in new tab

Article Text

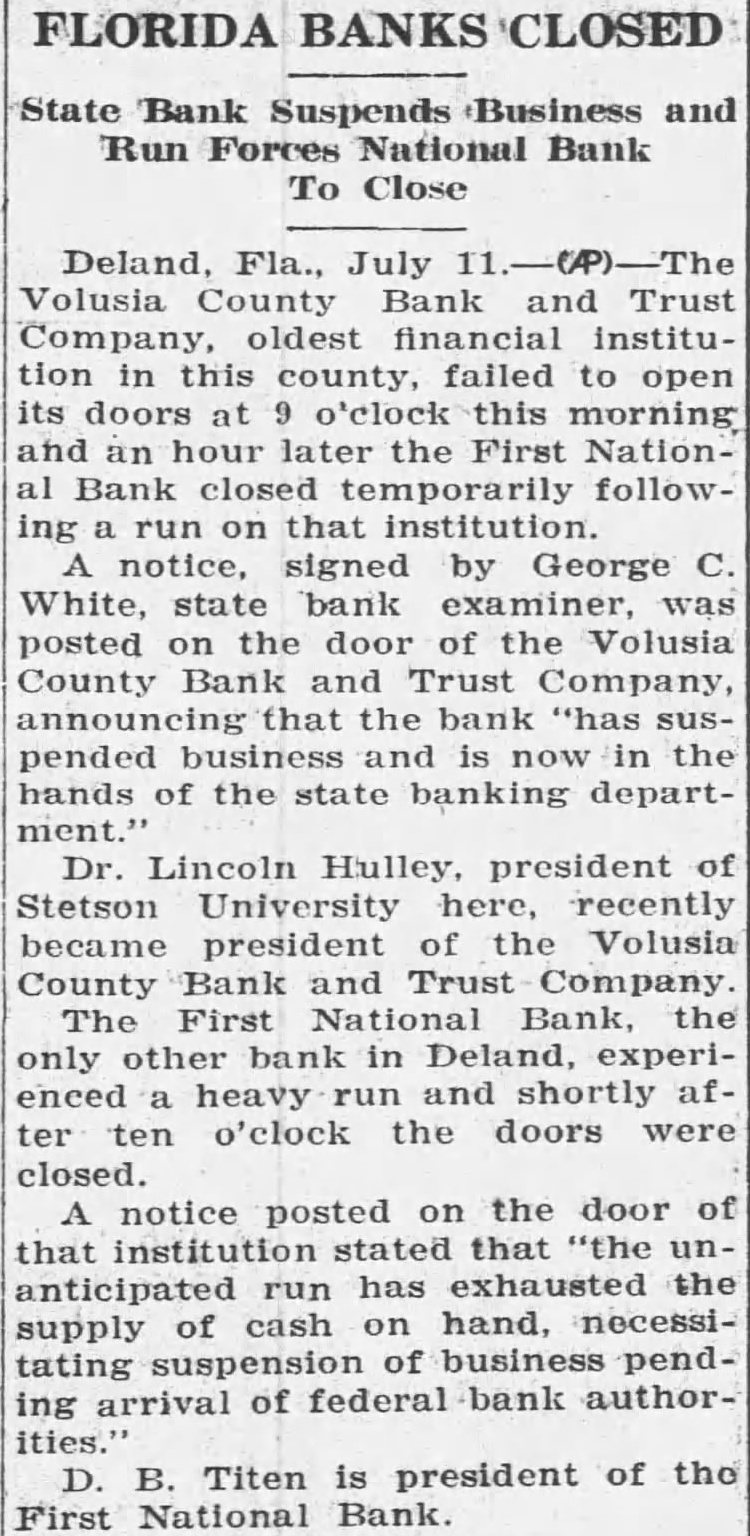

State Bank and Run Forces National Bank Close

Deland, Fla., July Volusia Bank and Trust Company, oldest financial institution in county, failed to open its doors o'clock this morning an hour later the First Bank closed followrun that institution notice, signed George White, state bank examiner, posted door Volusia County Bank Trust Company, announcing that the bank "has pended business and is now hands of the departDr. Hulley, president Stetson University here, recently became president the Volusia County Bank and Trust Company The First National Bank, only other Deland, experienced heavy and ten o'clock the doors were closed. notice posted on the door that that anticipated run has exhausted of cash on hand, supply tating of business pending arrival of authorTiten president of the First National Bank.

20.

July 13, 1929

Record-Journal

Meriden, CT

Click image to open full size in new tab

Article Text

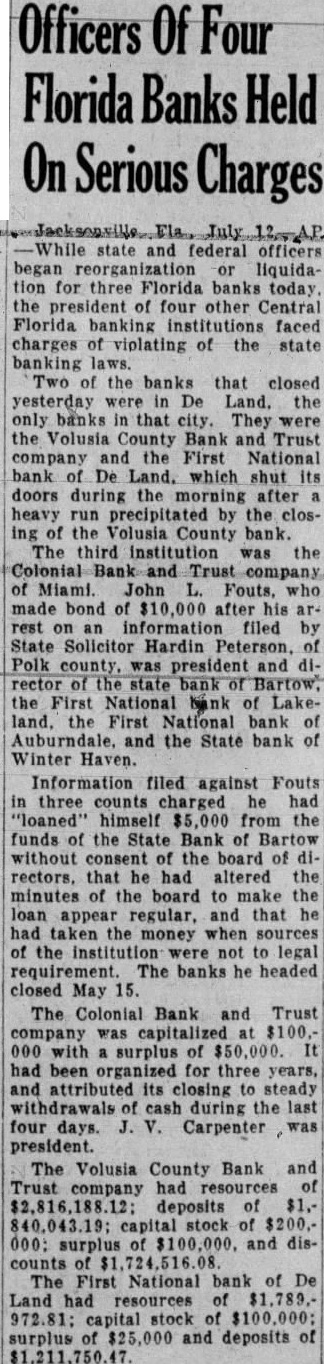

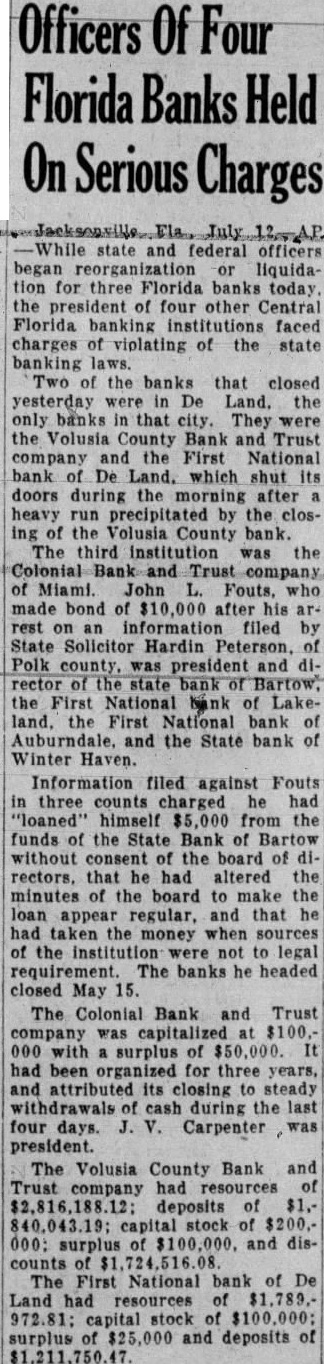

Officers Of Four Florida Banks Held Serious Charges

July While state and federal officers began reorganization liquidation for three Florida banks today. the president of four other Central Florida banking institutions faced charges of violating of the state Two of the banks that closed were De Land. the only banks that They were the Volusia County Bank Trust the First National which shut its doors during the after precipitated by the ing the Volusia County bank. The third was the Trust Fouts, who after his rest information filed by State Solicitor Hardin of Polk county. was president and rector state bank Bartow, the First National bank of Lakeland. the First bank of Auburndale, and the State bank Haven. Information filed against Fouts in three counts charged he had "loaned" himself $5,000 from the funds the State Bank of Bartow without consent of the board of he had altered the minutes the board to make the loan appear regular, and that he had taken the money when sources of the not to legal The banks he headed 15. The Colonial Bank and Trust company capitalized $100.000 with surplus of It organized for three years, and attributed its closing steady withdrawals cash during the last Carpenter was The Volusia County Bank and Trust company resources deposits of capital stock of $200,000: surplus of and discounts $1,724,516.08 The First National bank of De Land had resources $1,789.972.81: capital stock surplus and deposits of $1,211,750.47.

21.

July 17, 1929

The Watchman and Southron

Sumter, SC

Click image to open full size in new tab

Article Text

the precedent will be followed on FLORIDA BANKER other ships of the same line, and ARRESTED perhaps other lines. The official President of Four Banks Charged responsible for the innovation With Misuse of Funds he believes travelers prefer to be served by young women than July (AP) men. This is probably true, pro- While state and federal officials began liquidavided the young women are comely tion three Florida today, to look upon, and know their busthe president of four other central iness. faced result may be new boom charges violation of the state ocean travel. woman's banking Two the banks that closed face was once potent enough were in Deland, only "launch thousand ships," banks that city They the may not other women's faces help Volusia County Bank and Trust shipping business? Company the First