Article Text

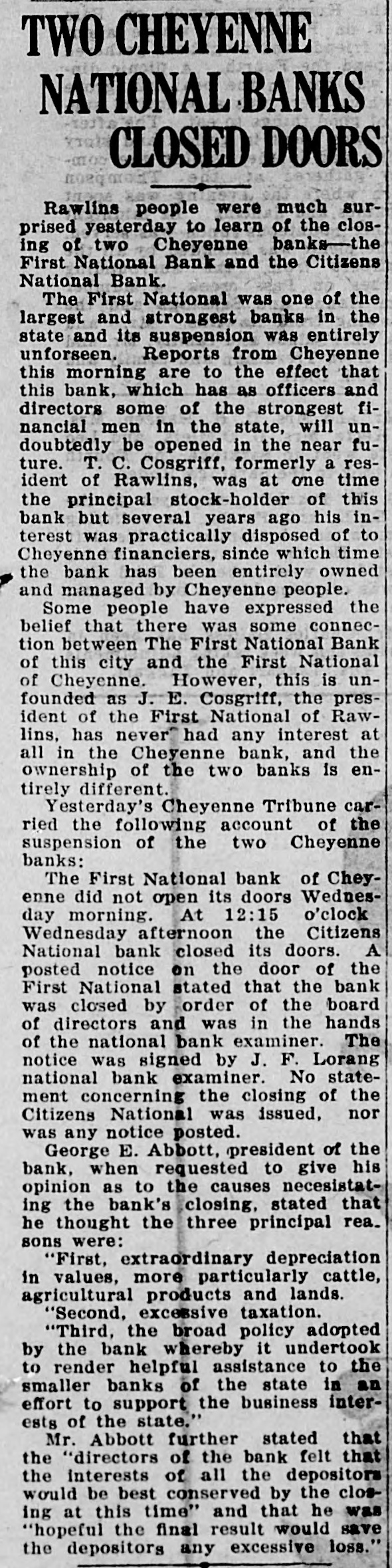

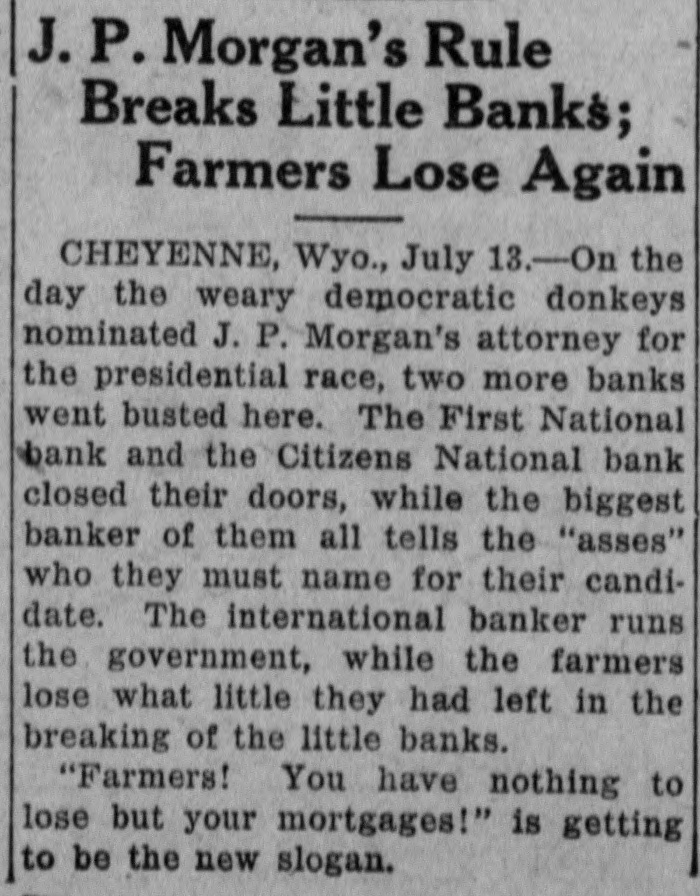

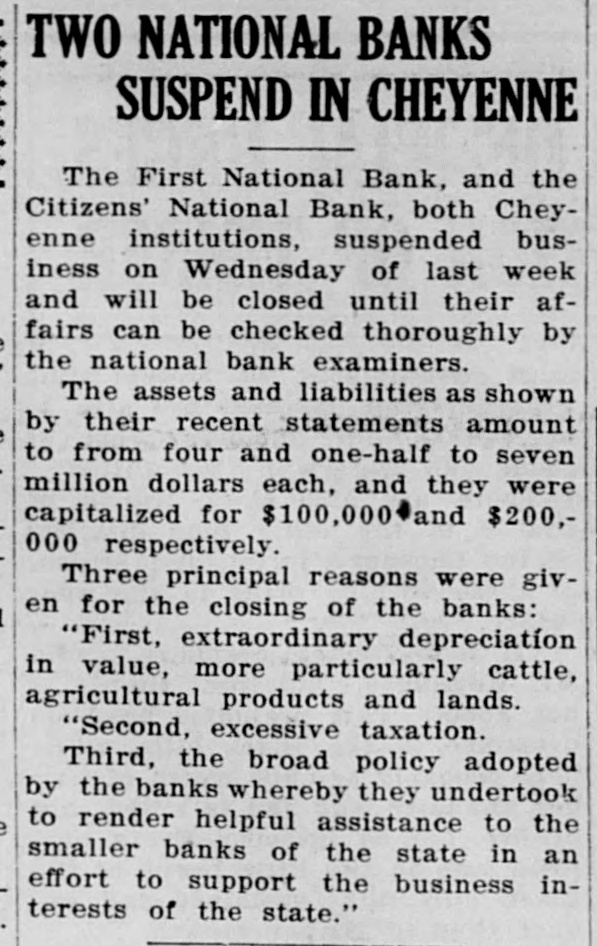

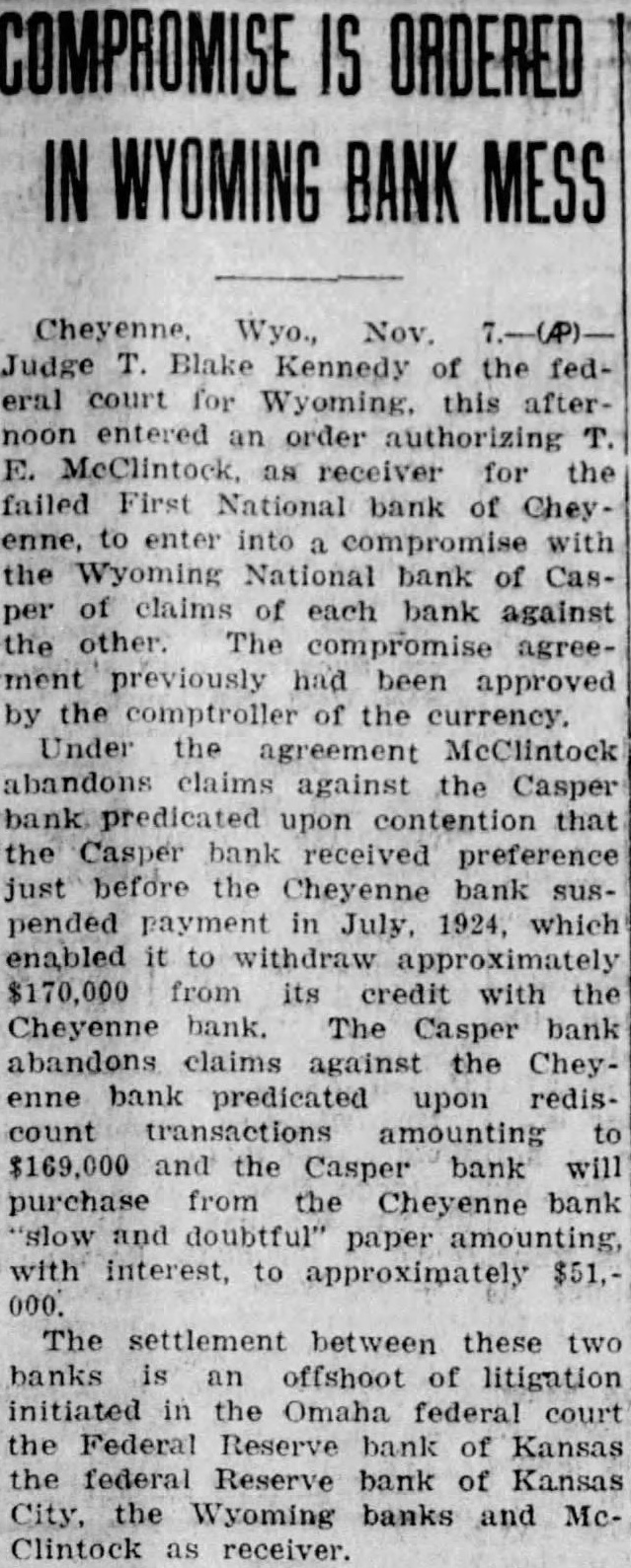

TWO CHEYENNE NATIONAL BANKS CLOSED DOORS Rawlins people were much surprised yesterday to learn of the closing of two Cheyenne banks-the First National Bank and the Citizens National Bank. The First National was one of the largest and strongest banks in the state and its suspension was entirely unforseen. Reports from Cheyenne this morning are to the effect that this bank, which has as officers and directors some of the strongest financial men in the state, will undoubtedly be opened in the near future. T. C. Cosgriff, formerly a resident of Rawlins, was at one time the principal stock-holder of this bank but several years ago his interest was practically disposed of to Cheyenne financiers, since which time the bank has been entirely owned and managed by Cheyenne people. Some people have expressed the belief that there was some connection between The First National Bank of this city and the First National of Cheyenne. However, this is unfounded as J. E. Cosgriff, the president of the First National of Rawlins, has never had any interest at all in the Cheyenne bank, and the ownership of the two banks is entirely different. Yesterday's Cheyenne Tribune carried the following account of the suspension of the two Cheyenne banks: The First National bank of Cheyenne did not open its doors Wednesday morning. At 12:15 o'clock Wednesday afternoon the Citizens National bank closed its doors. A posted notice on the door of the First National stated that the bank was closed by order of the board of directors and was in the hands of the national bank examiner. The notice was signed by J. F. Lorang national bank examiner. No statement concerning the closing of the Citizens National was issued, nor was any notice posted. George E. Abbott, president of the bank, when requested to give his opinion as to the causes necesistating the bank's closing, stated that he thought the three principal rea. sons were: "First, extraordinary depreciation in values, more particularly cattle, agricultural products and lands. "Second, excessive taxation. "Third, the broad policy adopted by the bank whereby it undertook to render helpful assistance to the smaller banks of the state in an effort to support the business interests of the state." Mr. Abbott further stated that the "directors of the bank felt that the interests of all the depositors would be best conserved by the closing at this time" and that he was "hopeful the final result would save the depositors any excessive loss."