Click image to open full size in new tab

Article Text

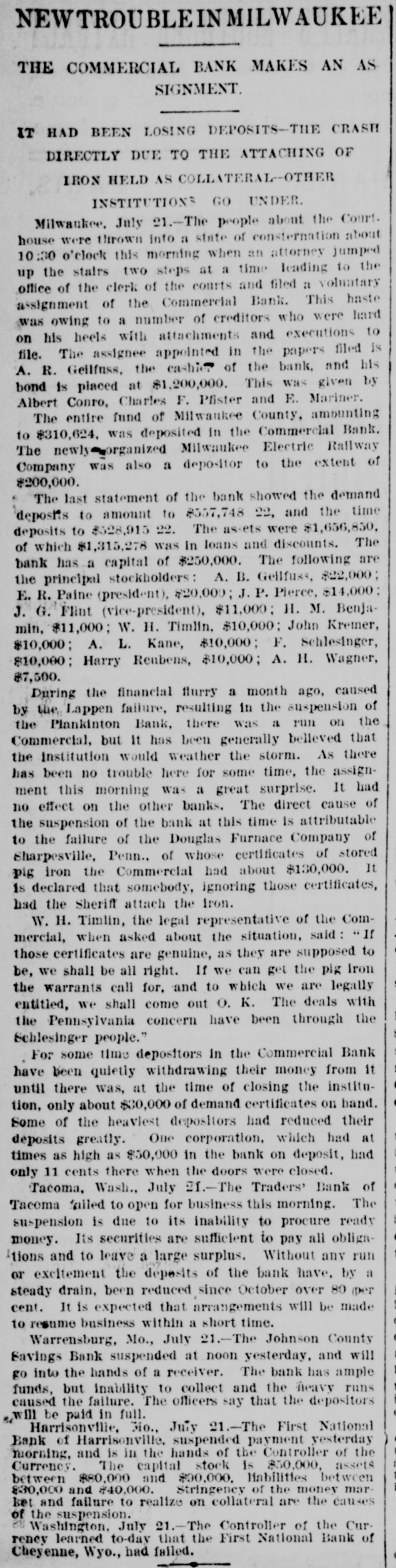

NEWTROUBLEIN MILWAUKEE THE COMMERCIAL BANK MAKES AN AS SIGNMENT. IT HAD BEEN LOSING DEPOSITS-THE CRASH DIRECTLY DUE TO THE ATTACHING OF IRON HELD AS COLLATERAL--OTHER INSTITUTIONS GO UNDER. Milwaukee, July 21.-The people about the Court. house were thrown into a state of consternation about 10:30 o'clock this morning when an attorney jumped up the stairs two steps at a time leading to the office of the clerk of the courts and filed a voluntary assignment of the Commercial Bank. This haste was owing to a number of creditors who were hard on his heels with attachments and executions to file. The assignee appointed in the papers filed is A. R. Gellfuss, the cashier of the bank, and his bond is placed at $1,200,000. This was given by Albert Conro, Charles F. Pfister and E. Mariner. The entire fund of Milwaukee County, amounting to $310,624. was deposited in the Commercial Bank. The newly organized Milwaukee Electric Railway Company was also a depositor to the extent of $200,000. The last statement of the bank showed the demand deposits to amount to $557,748 22, and the time deposits to $528,915 22. The assets were $1,656,850, of which $1,315,278 was in loans and discounts. The bank has a capital of $250,000. The following are the principal stockholders: A. B. Gellfuss, $22,000; E. R. Paine (president), $20,000; J. P. Pierce, $14,000; J. G. Flint (vice-president), $11,000; H. M. Benjamin, $11,000; W. H. Timlin, $10,000; John Kremer, $10,000; A. L. Kane, $10,000; F. Schlesinger, $10,000; Harry Reubens, $10,000; A. H. Wagner, $7,500. During the financial flurry a month ago, caused by the Lappen failure, resulting in the suspension of the Plankinton Bank, there was a run on the Commercial, but It has been generally believed that the Institution would weather the storm. As there has been no trouble here for some time, the assignment this morning was a great surprise. It had no effect on the other banks. The direct cause of the suspension of the bank at this time is attributable to the failure of the Douglas Furnace Company of Sharpesville, Penn., of whose certificates of stored pig iron the Commercial had about $130,000. It 1s declared that somebody, ignoring those certificates, had the Sheriff attach the iron. W. H. Timlin, the legal representative of the Commercial, when asked about the situation, said If those certificates are genuine, as they are supposed to be, we shall be all right. If we can get the pig iron the warrants call for, and to which we are legally entitled, we shall come out O. K. The deals with the Pennsylvania concern have been through the Schlesinger people." For some time depositors in the Commercial Bank have been quietly withdrawing their money from it until there was, at the time of closing the institution, only about $30,000 of demand certificates on hand. Some of the heavlest depositors had reduced their deposits greatly. One corporation, which had at times as high as $50,000 in the bank on deposit, had only 11 cents there when the doors were closed. Tacoma, Wash., July 21.-The Traders' Bank of Tacoma failed to open for business this morning. The suspension is due to its inability to procure ready money. Its securities are sufficient to pay all obliga¹tions and to leave a large surplus. Without any run or excitement the deposits of the bank have, by a steady drain, been reduced since October over 80 (per cent. It is expected that arrangements will be made to resume business within a short time. . Warrensburg, Mo., July 21.-The Johnson County Savings Bank suspended at noon yesterday, and will go into the hands of a receiver. The bank has ample funds, but inability to collect and the heavy runs caused the failure. The officers say that the depositors will be paid in full. Harrisonville, Mo., July 21.-The First National Bank of Harrisonville, suspended payment yesterday morning, and is in the hands of the Controller of the Currency. The capital stock is $50,000, assets between $80,000 and $90,000. liabilities between $30,000 and $40,000. Stringency of the money market and failure to realize on collateral are the causes of the suspension. 88 Washington, July 21.-The Controller of the Currency learned to-day that the First National Bank of Cheyenne, Wyo., had failed. .