Article Text

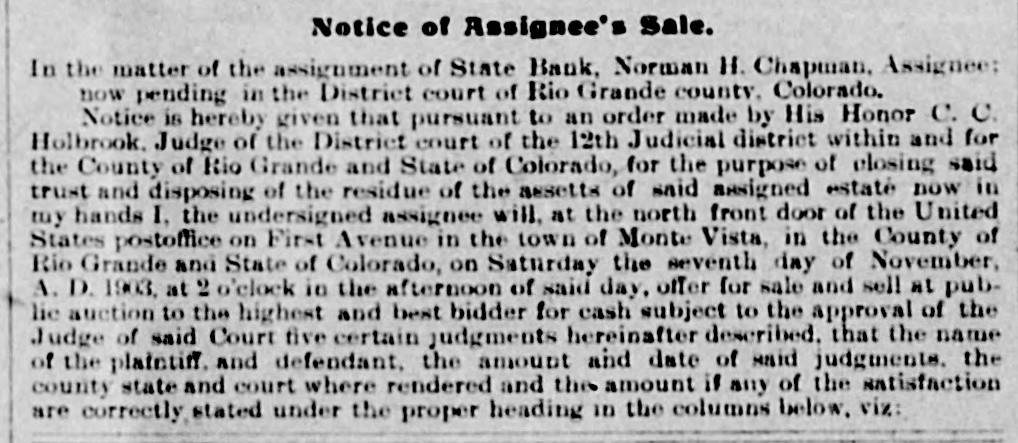

Notice of Assignee's Sale. In the matter of the assignment of State Bank, Norman H. Chapman, Assignee: now pending in the District court of Rio Grande county. Colorado. Notice is hereby given that pursuant to an order made by His Honor C. C. Holbrook. Judge of the District court of the 12th Judicial district within and for the County of Rio Grande and State of Colorado, for the purpose of closing said trust and disposing of the residue of the assetts of said assigned estaté now in my hands I, the undersigned assignee will, at the north front door of the United States postoffice on First Avenue in the town of Monte Vista, in the County of Rio Grande and State of Colorado, on Saturday the seventh day of November, A. D. 1903, at 2 o'clock in the afternoon of said day, offer for sale and sell at public auction to the highest and best bidder for cash subject to the approval of the Judge of said Court five certain judgments hereinafter described, that the name of the platetiff, and defendant, the amount and date of said judgments. the county state and court where rendered and the amount if any of the satisfaction are correctly stated under the proper heading in the columns below, viz: