Click image to open full size in new tab

Article Text

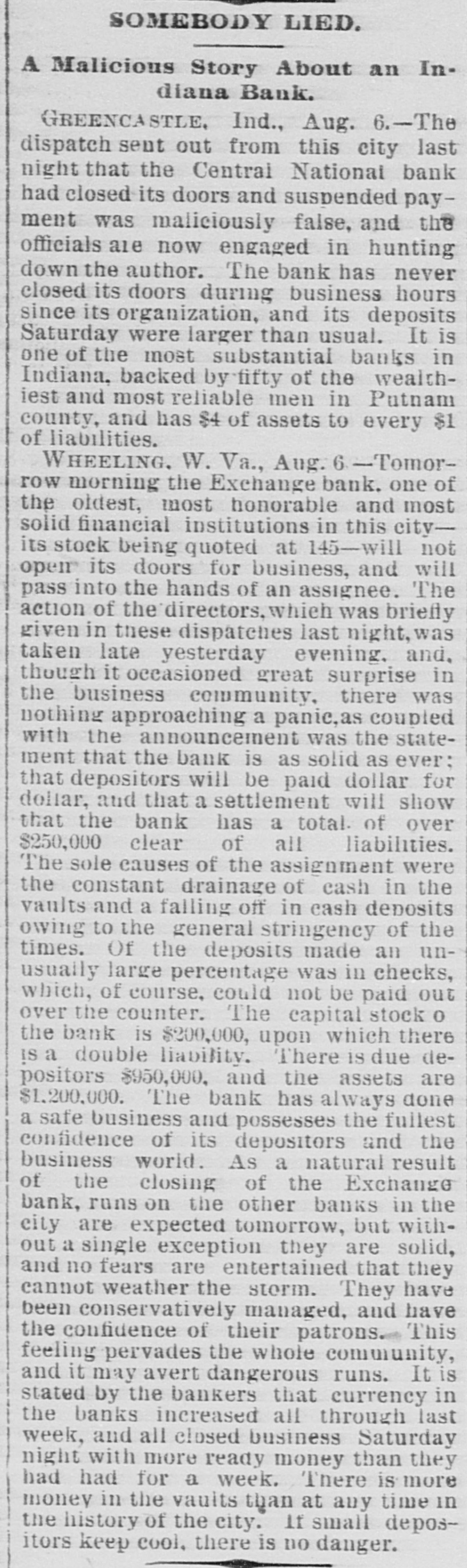

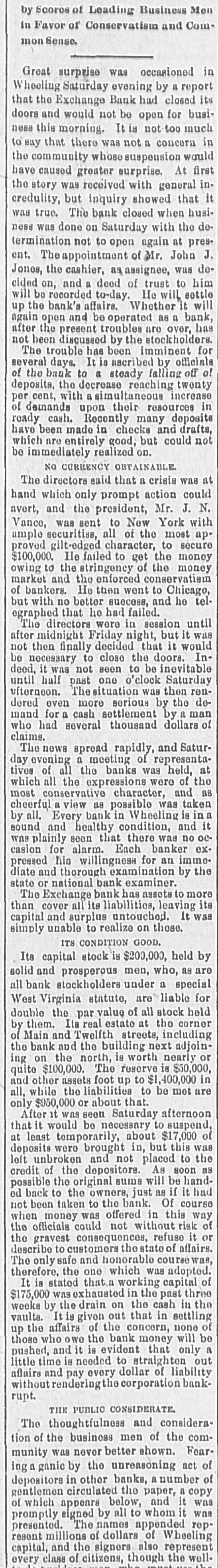

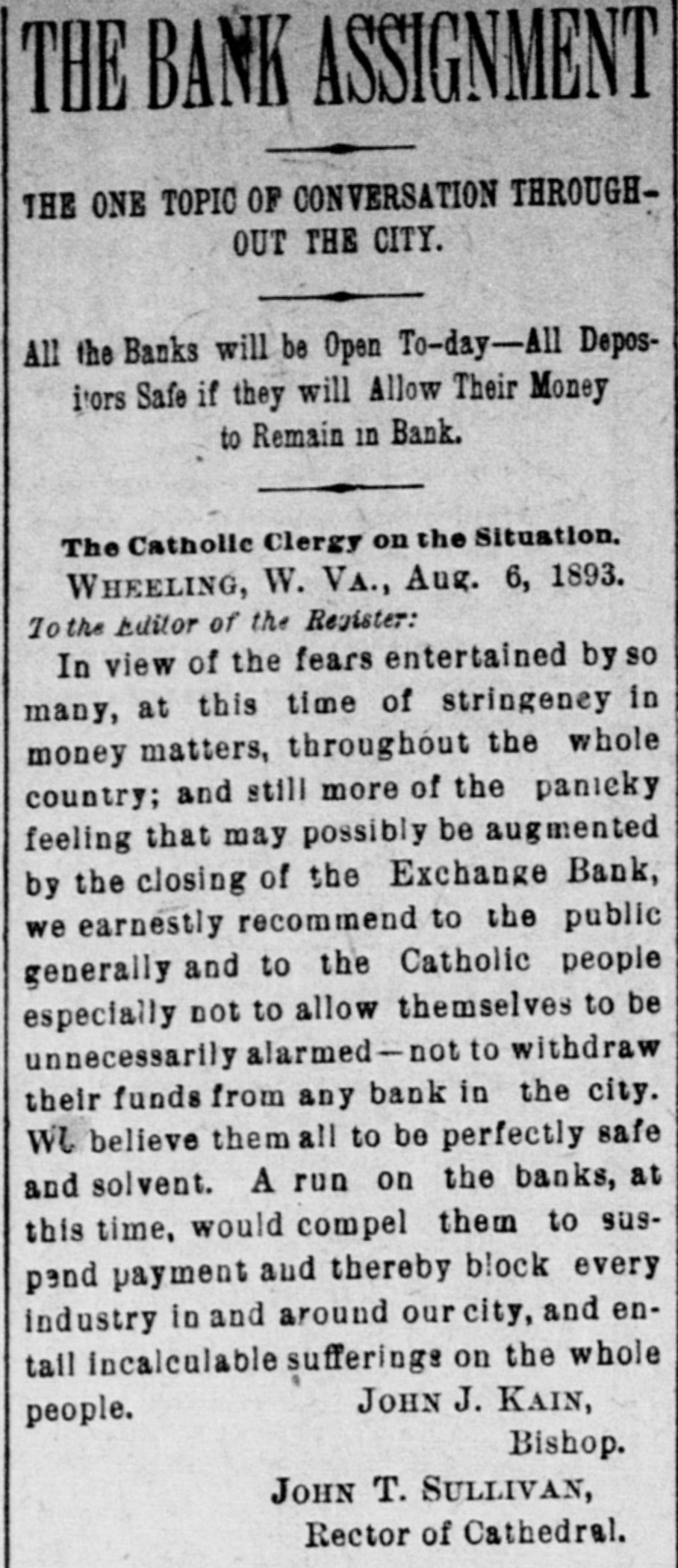

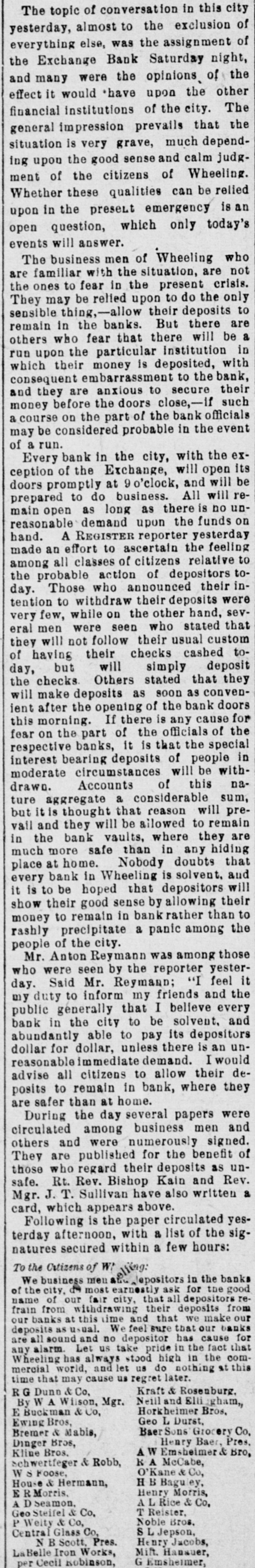

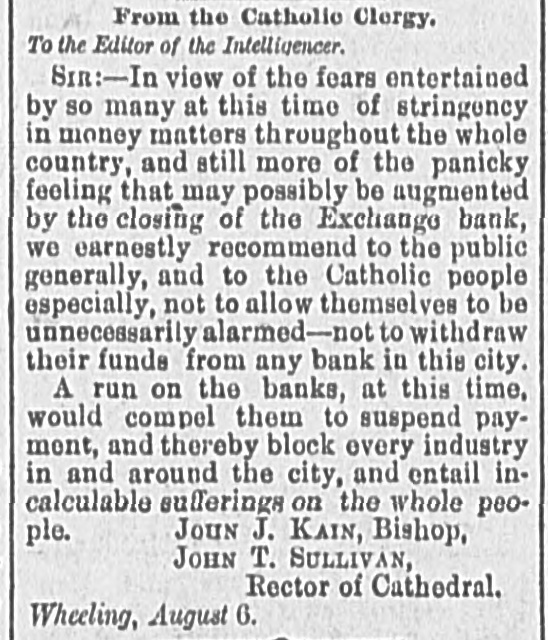

The topic of conversation in this city yesterday, almost to the exclusion of everything else, was the assignment of the Exchange Bank Saturday night, and many were the opinions of the effect it would have upon the other financial institutions of the city. The general impression prevails that the situation is very grave, much depending upon the good sense and calm judgment of the citizens of Wheeling. Whether these qualities can be relied upon in the present emergency is an open question, which only today's events will answer. The business men of Wheeling who are familiar with the situation, are not the ones to fear in the present crisis. They may be relied upon to do the only sensible thing,-allow their deposits to remain in the banks. But there are others who fear that there will be a run upon the particular institution in which their money is deposited, with consequent embarrassment to the bank, and they are anxious to secure their money before the doors close,-if such a course on the part of the bank officials may be considered probable in the event of a run. Every bank in the city, with the exception of the Exchange, will open its doors promptly at o'clock, and will be prepared to do business. All will remain open as long as there is no unreasonable demand upon the funds on hand. A REGISTER reporter yesterday made an effort to ascertain the feeling among all classes of citizens relative to the probable action of depositors today. Those who announced their intention to withdraw their deposits were very few, while on the other hand, several men were seen who stated that they will not follow their usual custom of having their checks cashed today, but will simply deposit the checks. Others stated that they will make deposits as soon as convenient after the opening of the bank doors this morning. If there is any cause for fear on the part of the officials of the respective banks, it is that the special interest bearing deposits of people in moderate circumstances will be withdrawn. Accounts of this nature aggregate a considerable sum, but it is thought that reason will prevail and they will be allowed to remain in the bank vaults, where they are much more safe than in any hiding place at home. Nobody doubts that every bank in Wheeling is solvent, and it is to be hoped that depositors will show their good sense by allowing their money to remain in bank rather than to rashly precipitate a panic among the people of the city. Mr. Anton Reymann was among those who were seen by the reporter yesterday. Said Mr. Reymann; "I feel it my duty to inform my friends and the public génerally that I believe every bank in the city to be solvent, and abundantly able to pay its depositors dollar for dollar, unless there is an unreasonable immediate demand. I would advise all citizens to allow their deposits to remain in bank, where they are safer than at home. During the day several papers were circulated among business men and others and were numerously signed. They are published for the benefit of those who regard their deposits as unsafe. Rt. Rev. Bishop Kain and Rev. Mgr. J. T. Sullivan have also written a card, which appears above. Following is the paper circulated yesterday afternoon, with a list of the signatures secured within a few hours: To the Crtizens of W/ King: We business men and Jepositors in the banks of the city, de most earnestly ask for the good name of our fair city, that all depositors refrain from withdrawing their deposits from our banks at this time and that we make our deposits as usual. We feel sure that our banks are all sound and no depositor has cause for any alarm. Let us take pride in the fact that Wheeling has always stood high in the commercial world, and let us do nothing at this time that may cause us regret later. Kraft & Rosenburg. R G Dunn & Co, By W A Wilson, Mgr. Neill and Elli gham, Horkheimer Bros. E Buckman & Co, Geo L Durst, Ewing Bros, BaerSons Grocery Co, Bremer & Mabis, Henry Baer, Pres, Dinger Bros, Kline Bros. AW Emsheimer & Bro, RA McCabe, schwertfeger & Robb, O'Kane & Co, W S Foose, H B Baguley, House & Hermann, Henry Morris, E R Morris, AL Rice & Co, A D Seamon. T Reister, Geo Steifel & Co, Noble Bros, P Welty & Co, S L Jepson, Central Glass Co, N B Scott, Pres. Henry Jacobs, Milt. Hanauer, LaBelle Iron Works, per Cecil Robinson, G Emsheimer,