Click image to open full size in new tab

Article Text

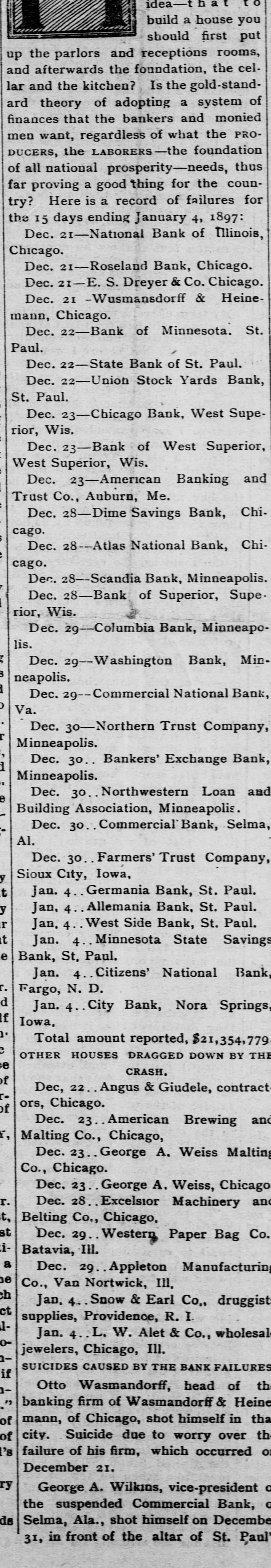

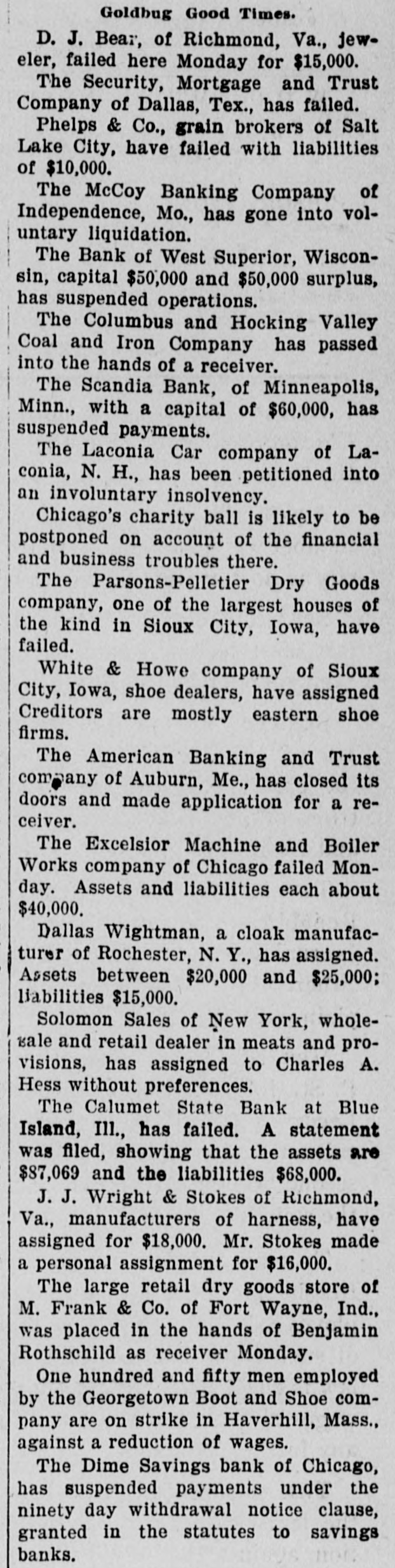

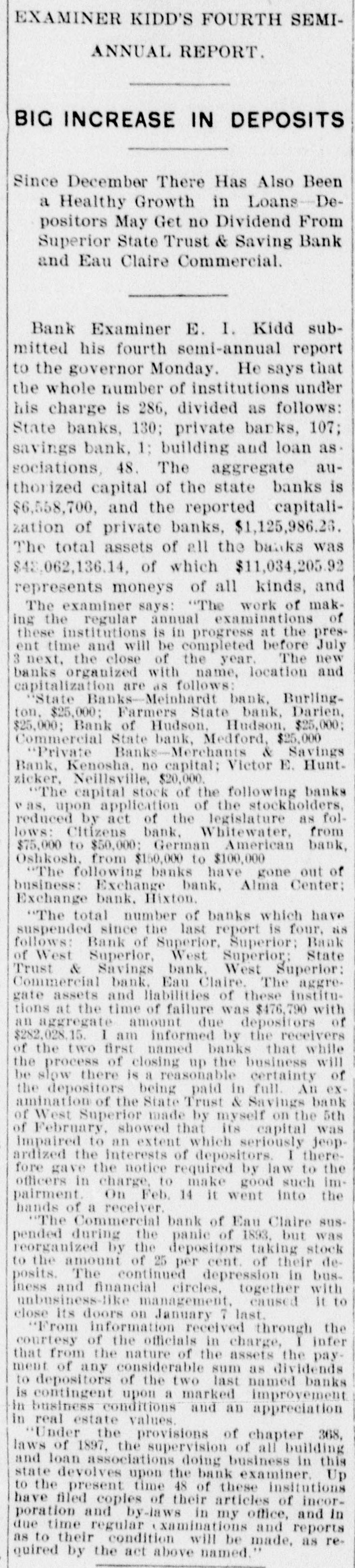

BANK FAILURES. Bank of West Superior Forced to Suspend. The National Bank of Illinois, one of the oldest and best known banking institutions III Chicago, closed its doors on Monday morning last. At the last report of this bank, which was November 30, the bank had a capital of $1,000,000, a surplus of $1,000,000. undivided profits of $450,000, and total assets, including bonds, $1,046,992. Its liabilities will be about $11,600,000. The last statement of the bank showed: Deposits, $1,175,766; loans, $,199,642; cash resources, $4,983, 202. The Bank of Minnesota, St. Paul's oldest bank, closed its doors on Tuesday. The last published statement was on Oct. 5, 1896, showed: Total resources, $3,320,369.49 Liabilities-Capital stock paid in $600,000; undivided profits, $102,783.11; individual deposits. $1,071,050,95; time certificates of deposits, $1,041,793.82: due to banks, $303'218.71; demand certificates of deposits, $101,522.90; total $3,320,369.49. The Union Stock Yards Bank, which IS closely connected with the Bank of Minnesota, closed the same day. Owing to the failure of National Bank of Illinois and the Bank of Minnesota, the Bank of West Superior was forced to close its doors on Wednesday morning. The last statement of this bank showed as follows: Loans and discounts, $106,971.98; overdrafts. $412.63; real estate assets, $53,419.40; furniture, $1,746; bonds and securities, $5,391.09; cash on hand and in banks, $22,259.90; expenses, $252; total, $180,452. Capital stock. $50,000; surplus, $50,000; deposits, $78,947; rediscounts, $1,505; total, $180.452. Of the banks assets 271 per cent. were cash. Of the cash on hand which the bank had for doing business, $22,000, $20,000 as near as can be estimated was in outside institutions. The city had $10,706.67, of which $8.557.6t was in the street bond sinking fund and $2,139.06 was in the sewer bond sinking fund. The workhouse committee has a balance of $2,000 in the bank. L. A. Nichols has been named as the assignee.