Article Text

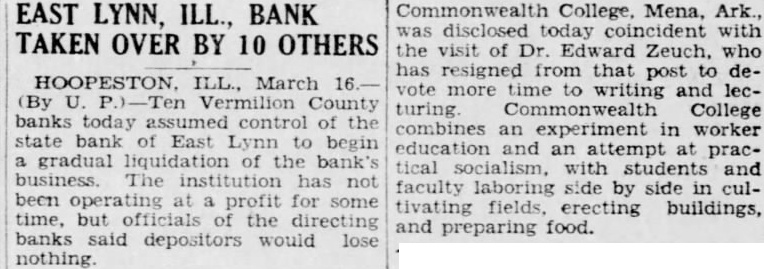

EAST LYNN, ILL., BANK TAKEN OVER BY 10 OTHERS (By U. P.)-Ten Vermilion County banks today assumed control of the state bank of East Lynn to begin a gradual liquidation of the bank's business The institution has not been operating at a profit for some time, but officials of the directing banks said depositors would lose nothing. Commonwealth College, Mena, Ark. was disclosed today coincident with the visit of Dr. Edward Zeuch, who has resigned from that post to devote more time to writing and lecturing Commonwealth College combines an experiment in worker education and an attempt at practical socialism, with students and faculty laboring side by side in cultivating fields, erecting buildings, and preparing food.