Click image to open full size in new tab

Article Text

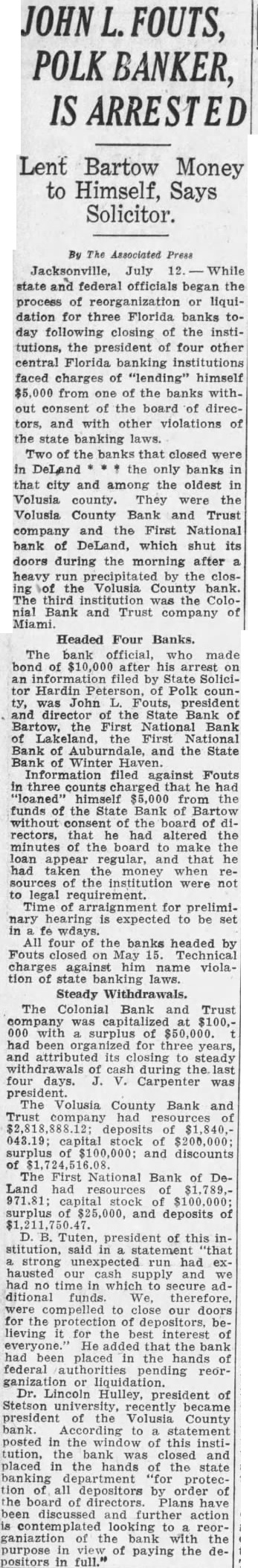

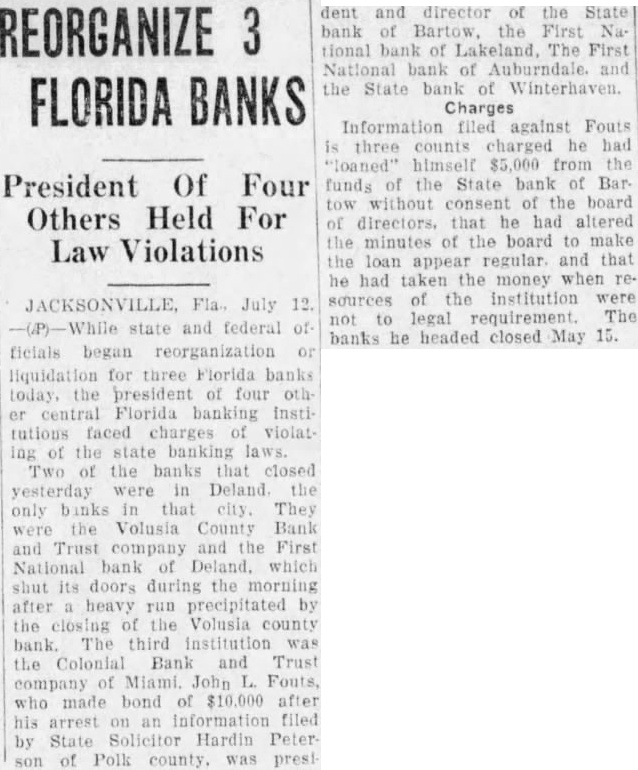

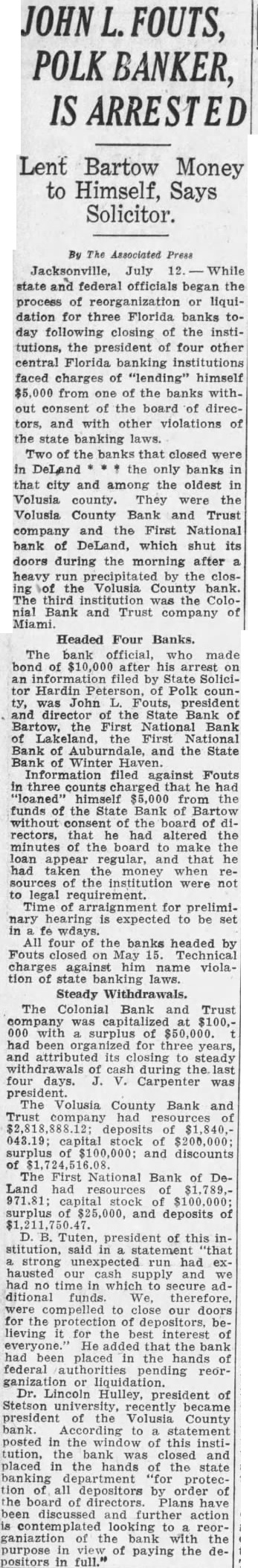

JOHN L. FOUTS, POLK BANKER, IS ARRESTED

Lent Bartow Money to Himself, Says Solicitor.

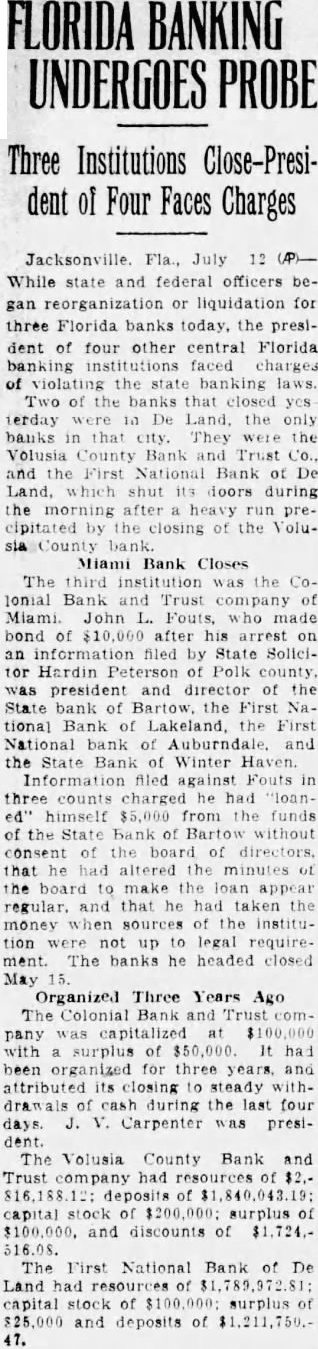

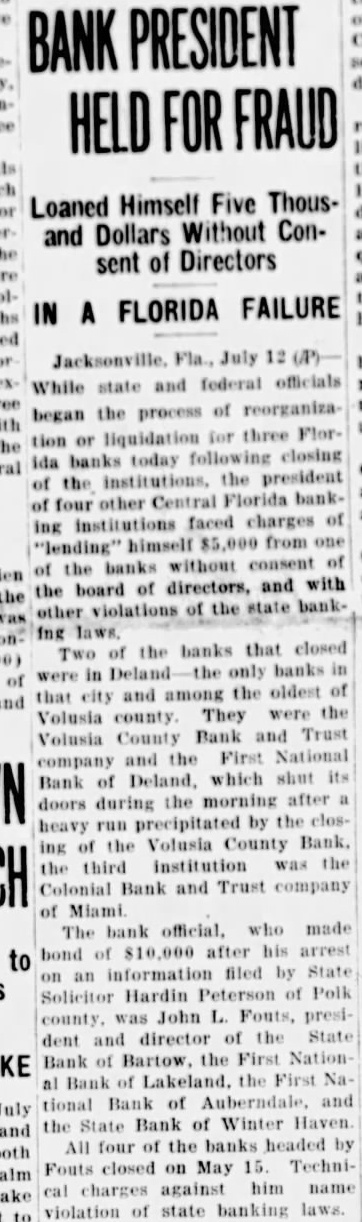

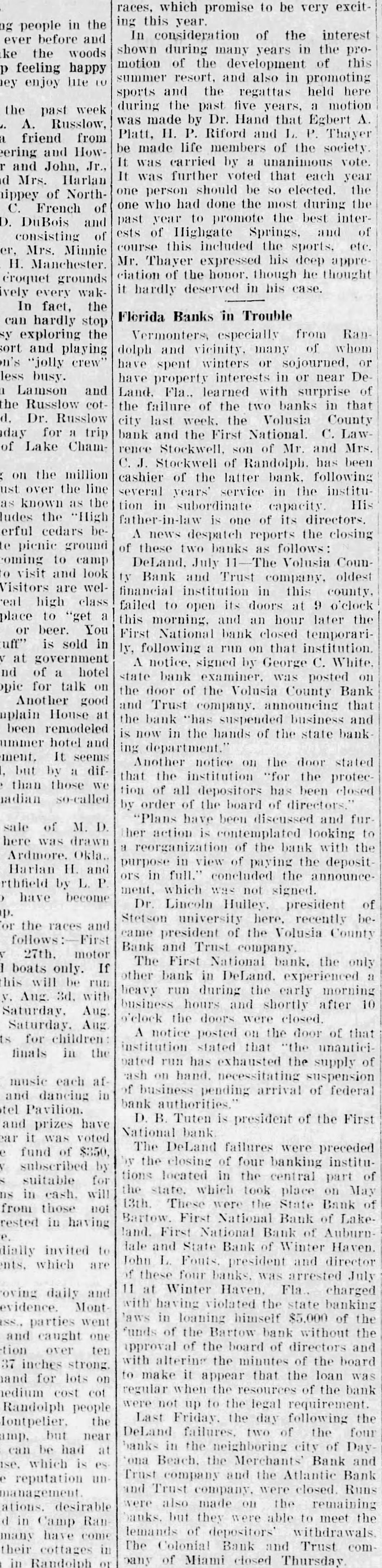

By The Associated Jacksonville, July 12. While state and federal officials began the process of reorganization or liquidation for three Florida banks today following closing of the institutions, the president of four other central Florida banking institutions faced charges of "lending" himself $5,000 from one of the banks without consent of the board of directors, and with other violations of the state banking laws. Two of the banks that closed were in DeLand the only banks in that city and among the oldest in Volusia county. They were the Volusia County Bank and Trust company and the First National bank of DeLand, which shut its doors during the morning after heavy run precipitated by the closing of the Volusia County bank. The third institution was the Colonial Bank and Trust company of Miami.

Headed Four Banks. The bank official, who made bond of $10,000 after his arrest on an information filed by State Solicitor Hardin Peterson. of Polk county, was John L. Fouts, president and director of the State Bank of Bartow, the First National Bank of Lakeland, the First National Bank of Auburndale, and the State Bank of Winter Haven. Information filed against Fouts in three counts charged that he had "loaned" himself $5,000 from the funds of the State Bank of Bartow without consent of the board of rectors, that he had altered the minutes of the board to make the loan appear regular, and that he had taken the money when resources of the institution were not to legal requirement. Time of arraignment for preliminary hearing is expected to be set in fe wdays. All four of the banks headed by Fouts closed on May 15. Technical charges against him name violation of state banking laws. Steady Withdrawals. The Colonial Bank and Trust company was capitalized at $100,000 with a surplus of $50,000. had been organized for three years, and attributed its closing to steady withdrawals of cash during the last four days. J. V. Carpenter was president. The Volusia County Bank and Trust company had resources of $2,818,888.12; deposits of $1,840,048.19; capital stock of $200,000; surplus of $100,000: and discounts The First National Bank of DeLand had resources of $1,789,971.81; capital stock of $100,000; surplus of $25,000, and deposits of D. B. Tuten, president of this institution, said in statement 'that a strong unexpected run had exhausted our cash supply and we had no time in which to secure additional funds We, therefore. were compelled to close our doors for the protection of depositors, believing it for the best interest of everyone." He added that the bank had been placed in the hands of federal authorities pending reorganization or liquidation. Dr. Lincoln Hulley, president of Stetson university, recently became president of the Volusia County bank. According to statement posted in the window of this institution, the bank was closed and placed in the hands of the state banking department "for protection of all depositors by order of the board of directors. Plans have been discussed and further action is contemplated looking to reorganiaztion of the bank with the purpose in view of paying the depositors in full."