Article Text

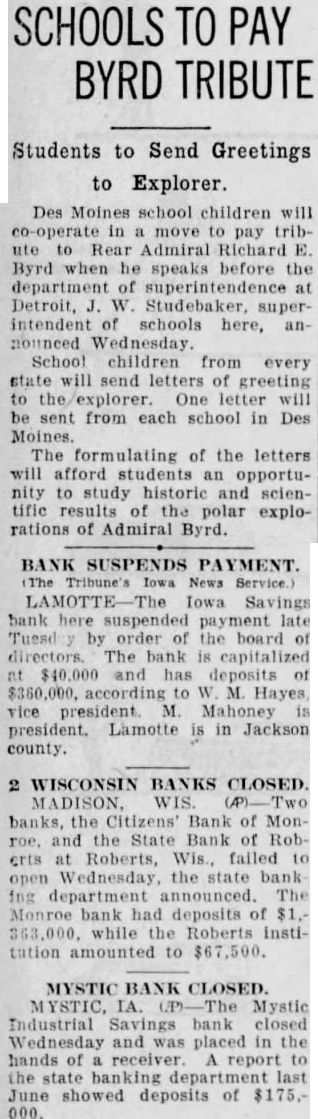

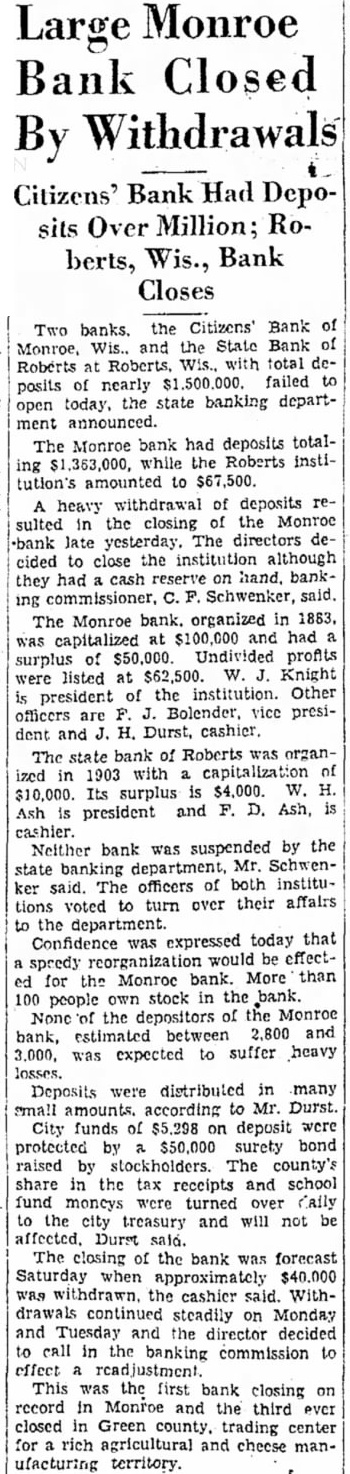

SCHOOLS TO PAY BYRD TRIBUTE Students to Send Greetings to Explorer. Des Moines school children will co-operate in a move to pay tribute to Rear Admiral Richard E. Byrd when he speaks before the department of superintendence at Detroit, J. W. Studebaker, superintendent of schools here, announced Wednesday. School children from every state will send letters of greeting to the/explorer. One letter will be sent from each school in Des Moines. The formulating of the letters will afford students an opportunity to study historic and scientific results of the polar explorations of Admiral Byrd. BANK SUSPENDS PAYMENT. The Tribune's Iowa News Service.) LAMOTTE-The Iowa Savings bank here suspended payment late Tuesd by order of the board of directors The bank is capitalized nt $40.000 and has deposits of $360,000. according to W M. Hayes vice president M Mahoney is president. Lamotte is in Jackson county. 2 WISCONSIN BANKS CLOSED. banks, the Citizens' Bank of Monroe. and the State Bank of Robcrts at Roberts, Wis. failed to open Wednesday, the state bank ing department announced. The Monroe bank had deposits of $1.363,000. while the Roberts institation amounted to $67,500. MYSTIC BANK CLOSED. MYSTIC. IA. (P)-The Mystic Industrial Savings bank closed Wednesday and was placed in the hands of receiver report to the state banking department last June showed deposits of $175,000.