Article Text

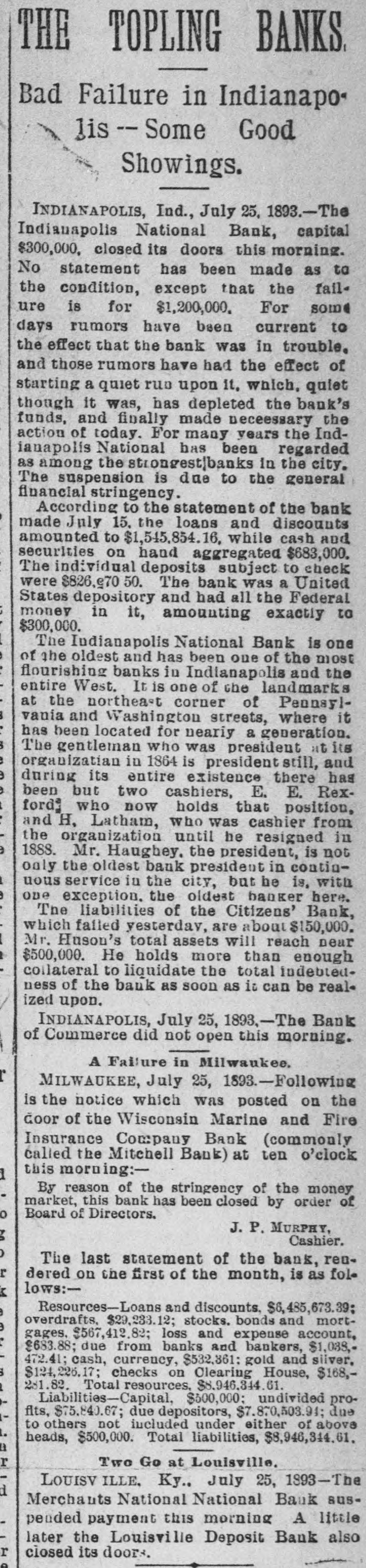

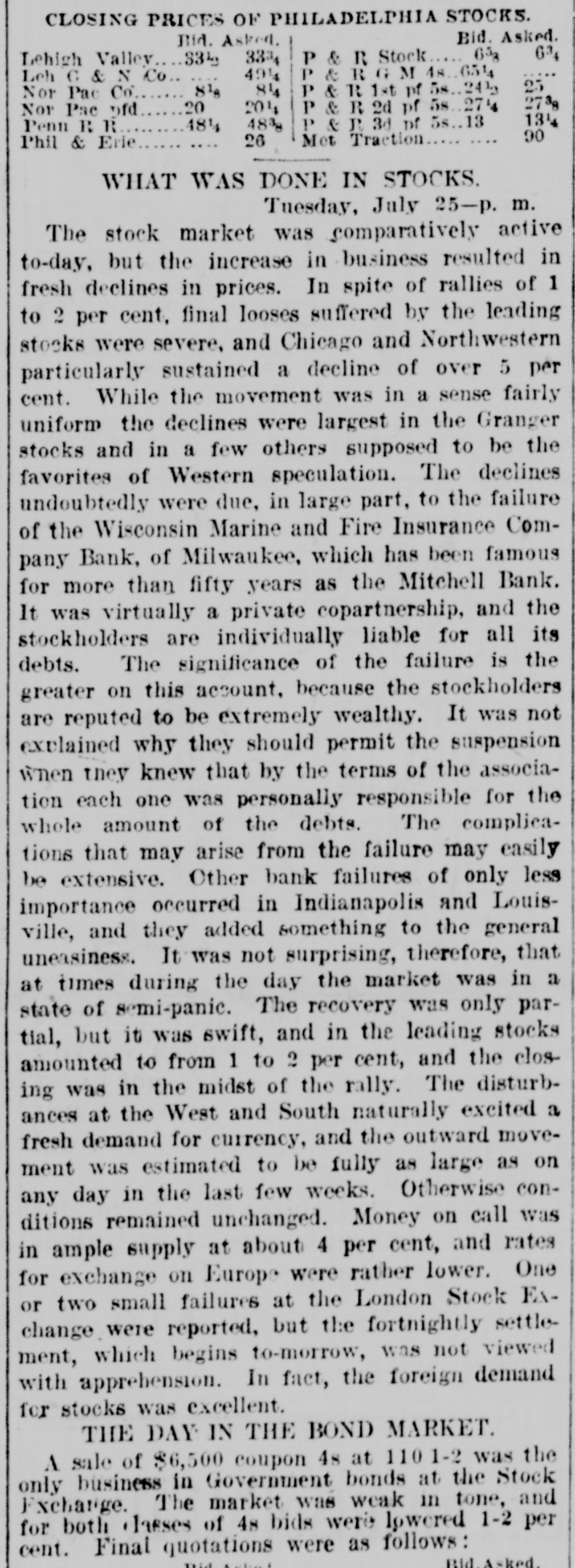

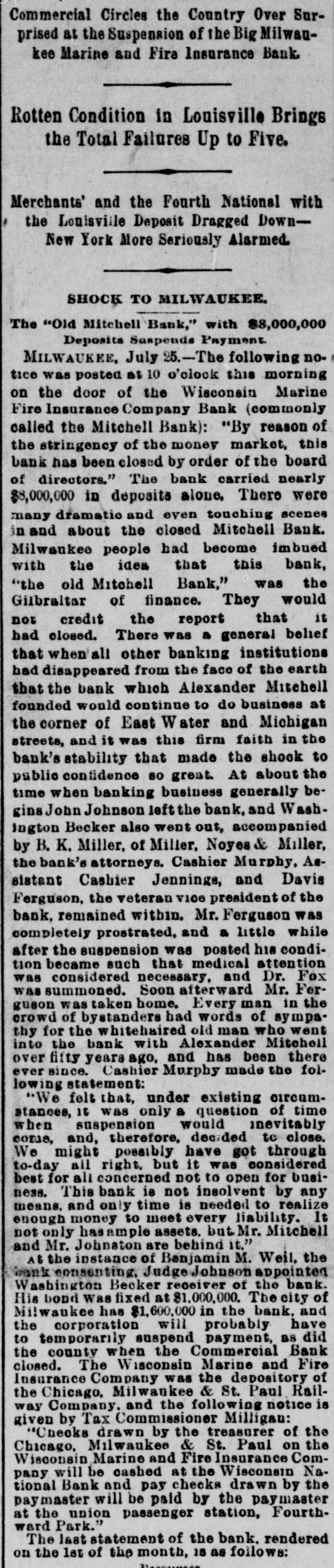

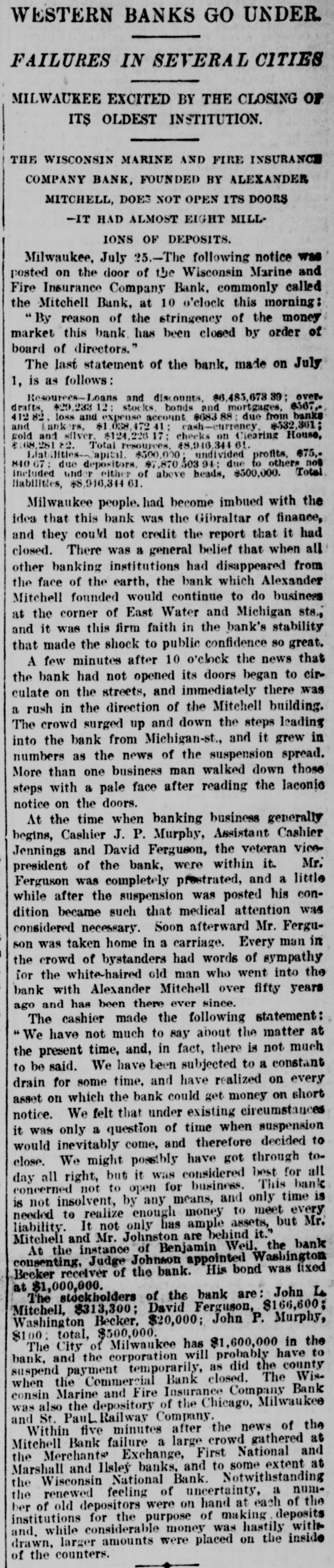

THE TOPLING BANKS Bad Failure in Indianapo lis -- Some Good Showings. INDIANAPOLIS, Ind., July 25. 1893.-The Indianapolis National Bank, capital $300,000. closed its doors this morning. No statement has been made as to the condition, except that the fail ure is for $1,200,000. For some days rumors have been current to the effect that the bank was in trouble. and those rumors have had the effect of starting a quiet run upon 11, which, quiet though it was, has depleted the bank's funds, and finally made neceessary the action of today. For many years the Indiauapolis National has been regarded as among the strongest|banks in the city. The suspension is due to the general financial stringency. According to the statement of the bank made July 15, the loans and discounts amounted to $1,545,854.16, while cash and securities on hand aggregated $683,000. The individual deposits subject to check were $826,e70 The bank was a United States depository and had all the Federal ; money in it, amounting exactly to $300,000. The Indianapolis National Bank is one of the oldest and has been one of the most : flourishing banks in Indianapolis and the entire West. It is one of the landmarks at the northeast corner of Pennsyl3 vania and Washington streets, where it : has been located for nearly a generation. 3 The gentleman who was president at its e organizatian in 1864 is president still, and 9 during its entire existence there has ) been but two cashiers, E. E. Rex1 ford who now holds that position, : and H, Latham, who was cashier from the organization until he resigned in e 1888. Mr. Haughey. the president, is not only the oldest bank president in contin1 uous service in the city, but be is, with 9 one exception. the oldest banker here. The liabilities of the Citizens' Bank, which falled yesterday, are about $150,000. I Mr. Huson's total assets will reach near I $500,000. He holds more than enough collateral to liquidate the total indebtedness of the bank as soon as it can be realized upon. INDIANAPOLIS, July 25, 1893,-The Bank of Commerce did not open this morning. A Failure in Milwaukee. r MILWAUKEE, July 25, 1893.-Following is the notice which was posted on the Goor of the Wisconsin Marine and Fire Insurance Company Bank (commonly called the Mitchell Bank) at ten o'clock this morning:1 By reason of the stringency of the money market, this bank has been closed by order of Board of Directors. o J. P. MURPHY, No Cashier. ) The last statement of the bank, renr dered on the first of the month, is as fol lows:K Resources-Loans and discounts. $6,485,673.39; ) overdrafts, $29,233.12; stocks. bonds and mort9 gages, $567,412.82; loss and expense account, : $683.88; due from banks and bankers, $1,083,472.41; cash, currency, $532,361: gold and silver, 3 $124,226.17; checks on Clearing House, $168,i 231.82. Total resources, $8,946,344.61. Liabilities-Capital, $500,000; undivided profits, $75,840.67; due depositors, $7.870.503.94; due to others not included under either of above 1. heads, $500,000. Total liabilities, $8,946,344.61. a r Two Go at Louisville, LOUISV ILLE, Ky.. July 25, 1893-The d Merchants National National Bank suspended payment this morning A little later the Louisville Deposit Bank also r closed its doors. e