Click image to open full size in new tab

Article Text

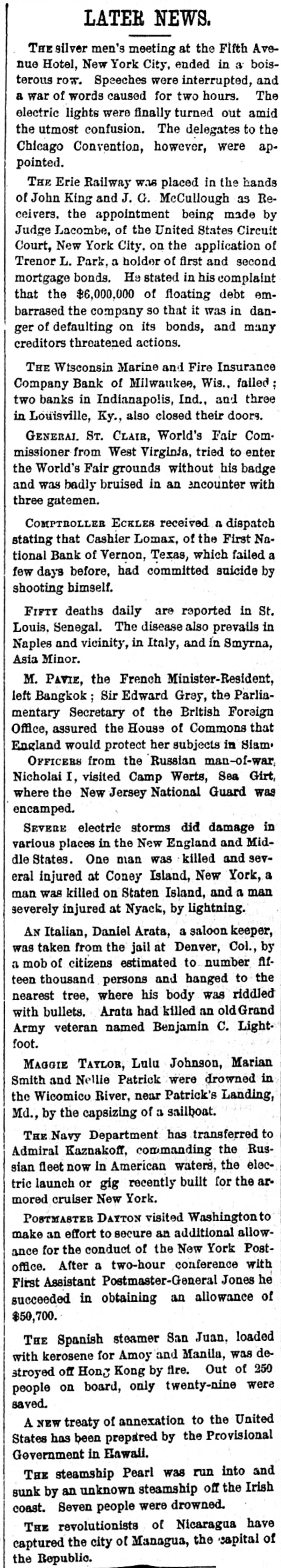

LATER NEWS. THE silver men's meeting at the Fifth Avenue Hotel, New York City, ended in 3 boisterous row. Speeches were interrupted, and a war of words caused for two hours. The electric lights were finally turned out amid the utmost confusion. The delegates to the Chicago Convention, however, were appointed. THE Erie Railway Was placed in the hands of John King and J. G. McCullough as Receivers. the appointment being made by Judge Lacombe, of the United States Circuit Court, New York City. on the application of Trenor L. Park, a holder of first and second mortgage bonds. He stated in his complaint that the $6,000,000 of floating debt embarrased the company so that it was in danger of defaulting on its bonds, and many creditors threatened actions. THE Wisconsin Marine and Fire Insurance Company Bank of Milwaukee, Wis., failed ; two banks in Indianapolis, Ind., and three in Louisville, Ky., also closed their doors. GENERAL ST. CLAIR, World's Fair Commissioner from West Virginia, tried to enter the World's Fair grounds without his badge and was badly bruised in an encounter with three gatemen. COMPTROLLER ECKLES received a dispatch stating that Cashier Lomax, of the First National Bank of Vernon, Texas, which failed a few days before, had committed suicide by shooting bimself. FIFTY deaths daily are reported in St. Louis, Senegal. The disease also prevails in Naples and vicinity, in Italy, and in Smyrna, Asia Minor. M. PAVIE, the French Minister-Resident, left Bangkok; Sir Edward Grey, the Parliamentary Secretary of the British Foreign Office, assured the House of Commons that England would protect her subjects in Siam. OFFICERS from the Russian man-of-war Nicholai I, visited Camp Werts, Sea Girt, where the New Jersey National Guard was encamped. SEVERE electric storms did damage in various places in the New England and Middle States. One man was killed and several injured at Coney Island, New York, a man was killed on Staten Island, and a man severely injured at Nyack, by lightning. AN Italian, Daniel Arata, a saloon keeper, was taken from the jail at Denver, Col., by a mob of citizens estimated to number flfteen thousand persons and hanged to the nearest tree, where his body was riddled with bullets. Arata had killed an old Grand Army veteran named Benjamin C. Lightfoot. MAGGIE TAYLOR, Lulu Johnson, Marian Smith and Nellie Patrick were drowned in the Wicomico River, near Patrick's Landing, Md., by the capsizing of a sailboat. THE Navy Department has transferred to Admiral Kaznakoff, commanding the Russian fleet now in American waters, the electric launch or gig recently built for the armored cruiser New York. POSTMASTER DAYTON visited Washington to make an effort to secure an additional allowance for the conduct of the New York Postoffice. After a two-hour conference with First Assistant Postmaster-General Jones he succeeded in obtaining an allowance of $50,700. THE Spanish steamer San Juan, loaded with kerosene for Amoy and Manila, was destroyed off Hony Kong by fire. Out of 250 people on board, only twenty-nine were saved. A NEW treaty of annexation to the United States has been prepared by the Provisional Government in Hawaii. THE steamship Pearl was run into and sunk by an unknown steamship off the Irish coast. Seven people were drowned. THE revolutionists of Nicaragua have captured the city of Managua, the capital of the Republic.