Click image to open full size in new tab

Article Text

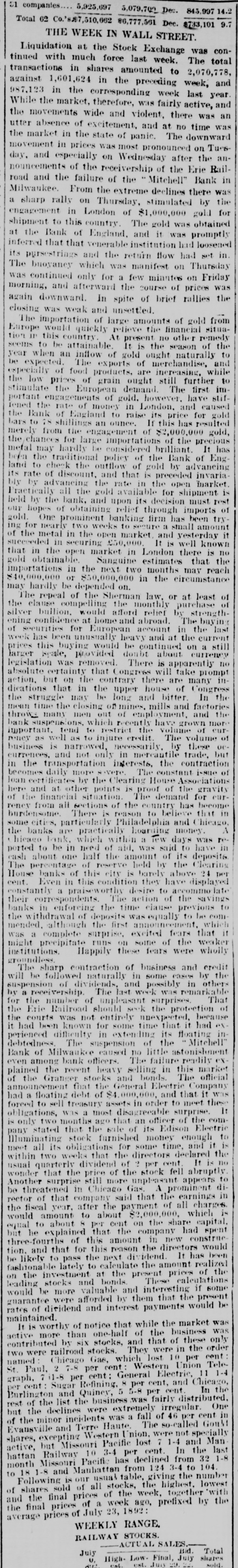

THE WEEK IN WALL STREET.

Liquidation at the Stock Exchange was con-

tinued with much force last week. The total

transactions in shares amounted to 2,070,778,

against 1,601,624 in the preceding week, and

987.123 in the corresponding week last year.

While the market, therefore, was fairly active, and

the movements wide and violent, there was an

utter absence of excitement, and at no time was

the market in the state of panic. The downward

movement in prices was most pronounced on Tues-

day, and especially on Wednesday after the an-

nouncements of the receivership of the Erie Rail-

road and the failure of the "Mitchell" Bank in

Milwaukee. From the extreme declines there was

a sharp rally on Thursday, stimulated by the

engagement in London of $1,000,000 gold for

shipment to this country. The gold was obtained

at the Bank of England, and it was promptly

inferred that that venerable institution had loosened

its pursestrings and the return flow had set in.

The buoyancy which was manifest on Thursday

was continued only for a few minutes on Friday

morning, and afterward the course of prices was

again downward. In spite of brief rallies the

closing was weak and unsettled.

The importation of large amounts of gold from

Europe would quickly relieve the financial situa-

tion in this country. At present no other remedy

seems to be attainable. It is the season of the

year when an inflow of gold ought naturally to

be expected. The exports of merchandise, and

especially of food products, are increasing, while

the low prices of grain ought still further to

stimulate the European demand. The first im-

portant engagements of gold, however, have stif-

fened the rate of money in London, and caused

the Bank of England to raise its price for gold

bars to 18 shillings an ounce. If this has resulted

merely from the engagement of $2,000,000 gold,

the chances for large importations of the precious

metal may hardly be considered brilliant. It has

been the traditional policy of the Bank of Eng-

land to check the outflow of gold by advancing

its rate of discount, and that is preceded invaria-

bly by advancing the rate in the open market.

Practically all the gold available for shipment is

held by the bank, and upon its decision must rest

our hopes of obtaining relief through imports of

gold. One prominent banking firm has been try-

ing for nearly two weeks to secure a small amount

of the metal in the open market, and yesterday it

succeeded in securing £50,000. It is well known

that in the open market in London there is no

gold obtainable. Sanguine estimates that the

importations in the next two months may reach

$40,000,000 or $50,000,000 in the circumstance

may hardly be depended on.

The repeal of the Sherman law, or at least of

the clause compelling the monthly purchase of

silver bullion, would afford relief by strength-

ening confidence at home and abroad. The buying

of securities for European account in the last

week has been unusually heavy and at the current

prices this buying would be continued on a still

larger scale, provided doubt about currency

legislation was removed. There is apparently no

absolute certainty that Congress will take prompt

action, but on the contrary there are many in-

dications that in the upper house of Congress

the struggle may be long and bitter. In the

mean time the closing of mines, mills and factories

throw many men out of employment, and the

bank suspensions, which recently have grown more

important, tend to restrict the volume of cur-

rency as well as to injure credit. The volume of

business is narrowed, necessarily, by these oc-

currences, and not only in mercantile trade, but

in the transportation interests, the contraction

becomes daily more severe. The constant issue of

loan certificates by the Clearing House Associations

here and at other points is proof of the gravity

of the financial situation. The demand for cur-

rency from all sections of the country has become

burdensome. There is reason to believe that in

some cities, particularly Philadelphia and Chicago,

the banks are practically hoarding money. A

Chicago bank, which within a few days was re-

ported to be in need of aid, was said to have in

cash about one half the amount of its deposits.

The percentage of reserve held by the Clearing

House banks of this city is barely above 24 per

cent. Even in this condition they have displayed

constantly a praiseworthy desire to accommodate

their correspondents. The action of the savings

banks in enforcing the time clause previous to

the withdrawal of deposits was equally to be com-

mended, although the first announcement, which

was a complete surprise, excited fears that it

might precipitate runs on some of the weaker

institutions. Happily these fears were wholly

groundless.

The sharp contraction of business and credit

will be followed naturally in some cases by the

suspension of dividends, and possibly in others

by a receivership. The last week was remarkable

for the number of unpleasant surprises. That

the Erie Railroad should seek the protection of

the courts was not entirely unexpected, because

it had been known for some time that it had ex-

perienced difficulty in extending its floating in-

debtedness. The suspension of the "Mitchell"

Bank of Milwaukee caused no little astonishment

even among bank officers. The failure readily ex-

plained the recent heavy selling in this market

of the Granger stocks and bonds. The official

announcement that the General Electric Company

had a floating debt of $4,000,000, and that it was

forced to sell treasury assets in order to meet these

obligations, was a most disagreeable surprise. It

is only two months ago that an officer of the com-

pany stated that the sale of its Edison Electric

Illuminating stock furnished money enough to

meet all its obligations for some time, and it is

within two weeks that the directors declared the

usual quarterly dividend of 2 per cent. It is no

wonder that the price of the stock fell abruptly.

Another surprise still more unpleasant appears to

be threatened in Chicago Gas. A prominent di-

rector of that company said that the earnings in

the fiscal year, after the payment of all charges,

would amount to about $2,000,000, which is

equal to about 8 per cent on the share capital,

but he explained that the company had spent

three-fourths of this amount in new construc-

tion, and that for this reason the directors would

be likely to pass the next dividend. It has been

fashionable lately to calculate the amount realized

on the investment at the present prices of the

leading stocks and bonds. These calculations

would be more valuable and interesting if some

guarantee were afforded by them that the present

rates of dividend and interest payments would be

maintained.

It is worthy of notice that while the market was

active more than one-half of the business was

contributed by six stocks, and that of these only

two were railroad stocks. They were in the order

named: Chicago Gas, which lost 10 per cent:

St. Paul, 2 7-8 per cent: Western Union Tele-

graph, 7 1-8 per cent: General Electric, 11 1-4

per cent: Sugar Refining, 8 per cent, and Chicago,

Burlington and Quincy, 5 5-8 per cent. In the

rest of the list the business was fairly distributed,

but the declines were extremely irregular. One

of the minor incidents was a fall of 46 per cent in

Evansville and Terre Haute. The so-called Goul

shares, excepting Western Union, were not specially

active, but Missouri Pacific lost 7 1-4 and Man-

hattan Railway 10 3-4 per cent. In the last

month Missouri Pacific has declined from 32 1-8

to 18 1-8 and Manhattan from 124 3-4 to 104.

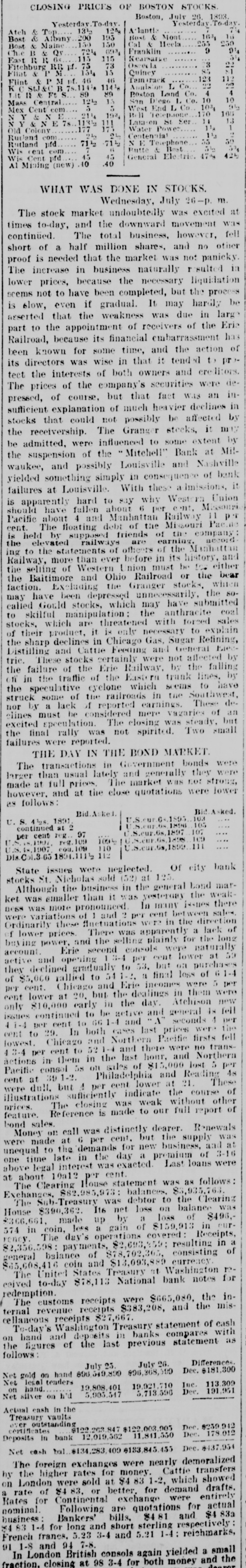

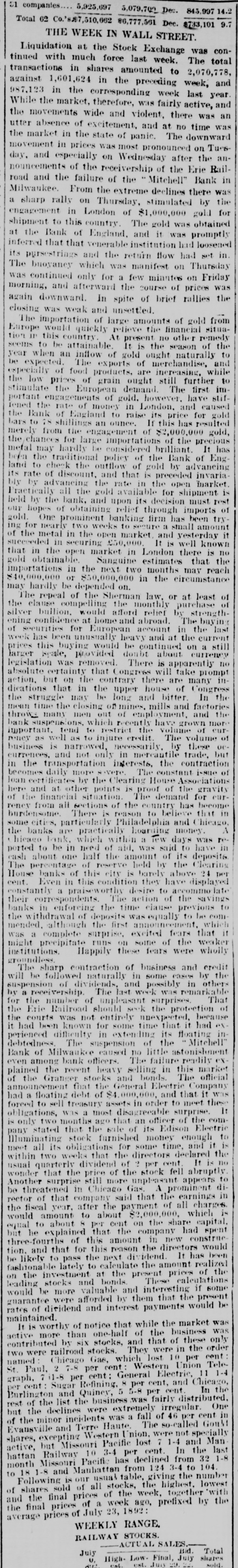

Following is our usual table, giving the number

of shares sold of all stocks, the highest, lowest

and the final prices of the week, together with

the final prices of a week ago, prefixed by the

average prices of July 23, 1892:

WEEKLY RANGE,

RAILWAY STOCKS.