Click image to open full size in new tab

Article Text

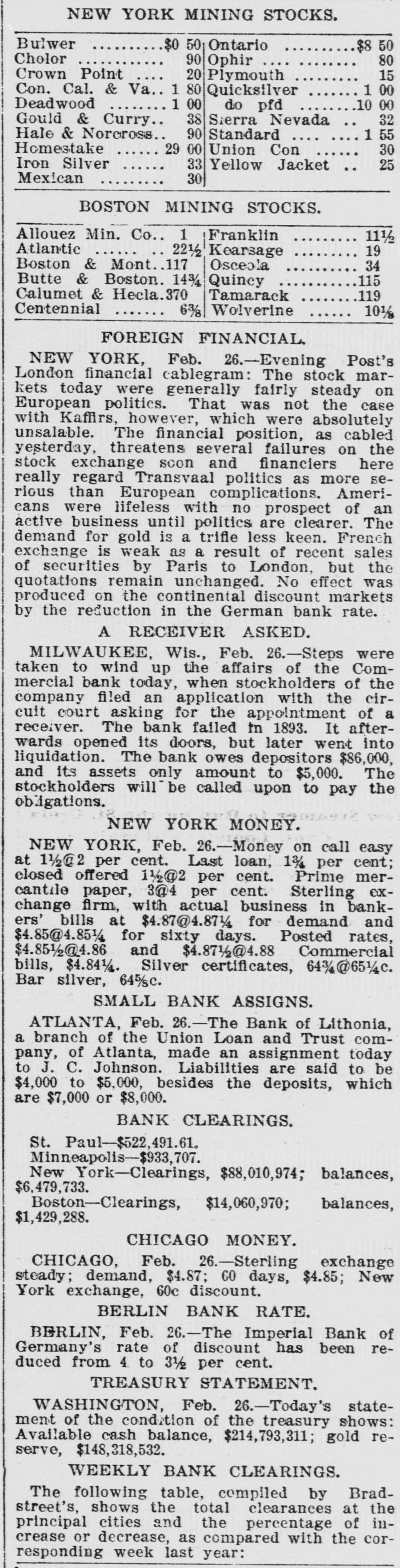

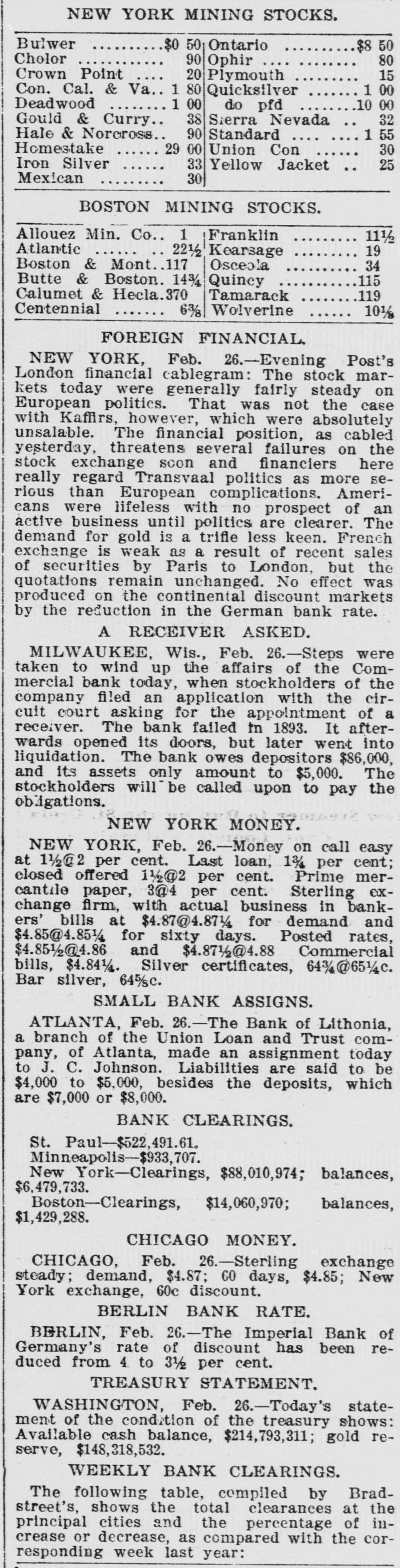

NEW YORK MINING STOCKS. Bulwer $0 50 Ontario $8 50 Cholor 80 90 Ophir Crown Point 20 15 Plymouth 1 80 Con. Cal. & Va. 1 00 Quicksilver Deadwood 1 00 10 00 do pfd 38 32 Sierra Nevada Gould & Curry 90 Hale & Noreross 1 55 Standard Homestake 29 00 30 Union Con Iron Silver 33 25 Yellow Jacket Mexican 30 BOSTON MINING STOCKS. Allouez Min. Co.. 1 Franklin 11½ Atlantic 221/2 19 Kearsage Boston & Mont 117 Osceola 34 115 Butte & Boston 143/4 Quincy Calumet & Hecla 370 119 Tamarack Centennial Wolverine 63/8 10½ FOREIGN FINANCIAL. NEW YORK, Feb. 26.-Evening Post's London financial cablegram: The stock markets today were generally fairly steady on European politics. That was not the case with Kaffirs, however, which were absolutely unsalable. The financial position, as cabled yesterday, threatens several failures on the stock exchange soon and financiers here really regard Transvaal politics as more serious than European complications. Americans were lifeless with no prospect of an active business until politics are clearer. The demand for gold is a trifle less keen. French exchange is weak as a result of recent sales of securities by Paris to London, but the quotations remain unchanged. No effect was produced on the continental discount markets by the reduction in the German bank rate. A RECEIVER ASKED. MILWAUKEE, Wis., Feb. 26.-Steps were taken to wind up the affairs of the Commercial bank today, when stockholders of the company filed an application with the circuit court asking for the appointment of a receiver. The bank failed tn 1893. It afterwards opened its doors, but later went into liquidation. The bank owes depositors $86,000, and its assets only amount to $5,000. The stockholders will be called upon to pay the obligations. NEW YORK MONEY. NEW YORK, Feb. 26.-Money on call easy at 1½2 per cent. Last loan, 13/4 per cent; closed offered 1½2 per cent. Prime mercantile paper, 3@4 per cent. Sterling exchange firm, with actual business in bankers' bills at $4.87@4.87% for demand and $4.85@4.851/4 for sixty days. Posted rates, $4.851/2@4.86 and $4.871/2@4.88 Commercial bills, $4.841/4. Silver certificates, 64%@651/4c. Bar silver, 645/sc. SMALL BANK ASSIGNS. ATLANTA, Feb. 26.-The Bank of Lithonia, a branch of the Union Loan and Trust company, of Atlanta, made an assignment today to J. C. Johnson. Liabilities are said to be $4,000 to $5,000, besides the deposits, which are $7,000 or $8,000. BANK CLEARINGS. St. Paul-$522,491.61. Minneapolis-$933,707. New York-Clearings, $88,010,974; balances, $6,479,733. Boston-Clearings, $14,060,970; balances, $1,429,288. CHICAGO MONEY. CHICAGO, Feb. 26.-Sterling exchange steady; demand, $4.87; 60 days, $4.85; New York exchange, 60c discount. BERLIN BANK RATE. BERLIN, Feb. 26.-The Imperial Bank of Germany's rate of discount has been reduced from 4 to 3½ per cent. TREASURY STATEMENT. WASHINGTON, Feb. 26.-Today's statement of the condition of the treasury shows: Available cash balance, $214,793,311; gold reserve, $148,318,532. WEEKLY BANK CLEARINGS. The following table, compiled by Bradstreet's, shows the total clearances at the principal cities and the percentage of increase or decrease, as compared with the corresponding week last year: