Article Text

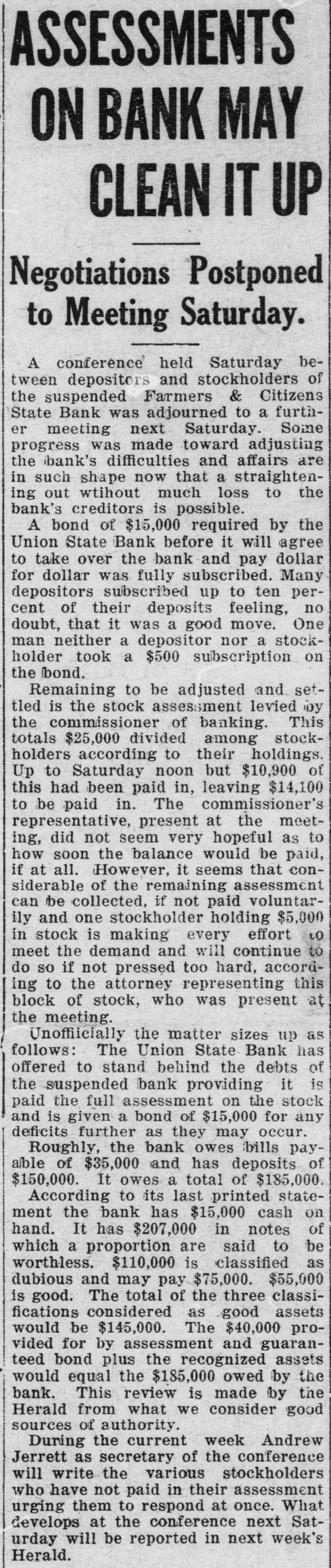

ASSESSMENTS ON BANK MAY CLEAN IT UP Negotiations Postponed to Meeting Saturday. A conference held Saturday between depositors and stockholders of the suspended Farmers & Citizens State Bank was adjourned to a further meeting next Saturday. Some progress was made toward adjusting the bank's difficulties and affairs are in such shape now that a straightening out wtihout much loss to the bank's creditors is possible. A bond of $15,000 required by the Union State Bank before it will agree to take over the bank and pay dollar for dollar was fully subscribed. Many depositors subscribed up to ten percent of their deposits feeling, no doubt, that it was a good move. One man neither a depositor nor a stockholder took a $500 subscription on the bond. Remaining to be adjusted and settled is the stock assessment levied by the commissioner of banking. This totals $25,000 divided among stockholders according to their holdings. Up to Saturday noon but $10,900 of this had been paid in, leaving $14,100 to be paid in. The commissioner's representative, present at the meeting, did not seem very hopeful as to how soon the balance would be paid, if at all. However, it seems that considerable of the remaining assessment can be collected, if not paid voluntarily and one stockholder holding $5,000 in stock is making every effort to meet the demand and will continue to do SO if not pressed too hard, according to the attorney representing this block of stock, who was present at the meeting. Unoffiicially the matter sizes up as follows: The Union State Bank has offered to stand behind the debts of the suspended bank providing it is paid the full assessment on the stock and is given a bond of $15,000 for any deficits further as they may occur. Roughly, the bank owes bills paya/ble of $35,000 and has deposits of $150,000. It owes a total of $185,000. According to its last printed statement the bank has $15,000 cash on hand. It has $207,000 in notes of which a proportion are said to be worthless. $110,000 is classified as dubious and may pay $75,000. $55,000 is good. The total of the three classifications considered as good assets would be $145,000. The $40,000 provided for by assessment and guaranteed bond plus the recognized assets would equal the $185,000 owed by the bank. This review is made by the Herald from what we consider good sources of authority. During the current week Andrew Jerrett as secretary of the conference will write the various stockholders who have not paid in their assessment urging them to respond at once. What develops at the conference next Saturday will be reported in next week's Herald.