1.

June 3, 1931

Beaver Dam Daily Citizen

Beaver Dam, WI

Click image to open full size in new tab

Article Text

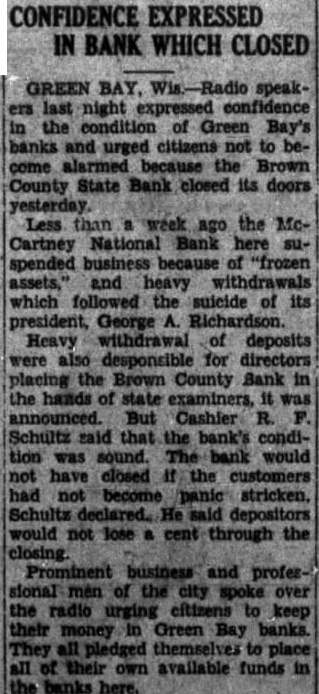

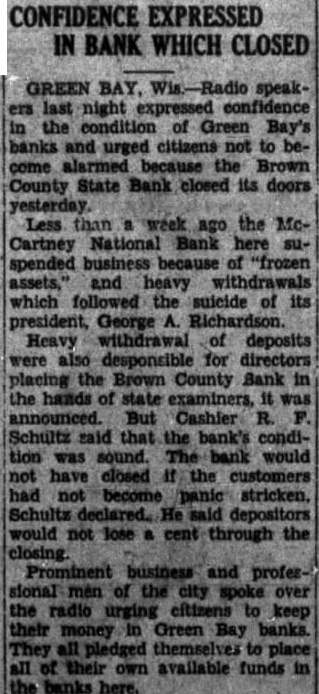

CONFIDENCE EXPRESSED IN BANK WHICH CLOSED

GREEN BAY, speaklast night in the of Green Bay's and urged not bebecause the Brown County State Bank closed its doors yesterday Less than week ago the McCartney National here suspended business because of "frozen assets," and which followed suicide of its president, George Heavy deposits also for directors placing the Brown County Bank in the hands of it announced. Cashier Schultz said the bank's condiwas would not the customers said depositors would not cent through the Prominent and profesmen of the city spoke over the radio citizens in Green Bay banks. They all pledged themselves to place all of available funds the banks here.

2.

June 3, 1931

The Sheboygan Press

Sheboygan, WI

Click image to open full size in new tab

Article Text

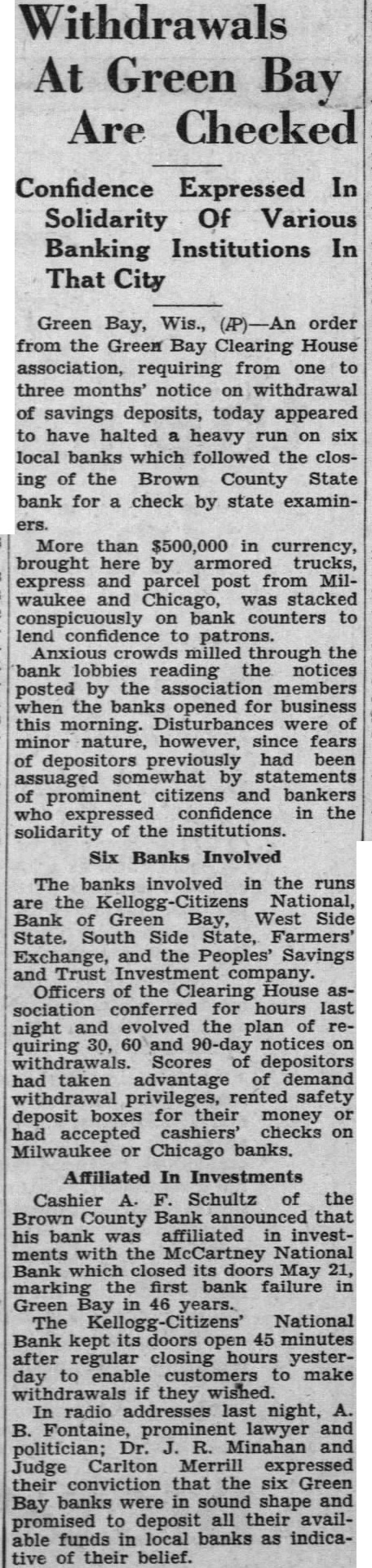

Withdrawals Green Bay Are Checked

Confidence Expressed In Solidarity Of Various Banking Institutions In That City

Green Bay, Wis., order from the Green Bay Clearing House association, requiring from one to three months' notice on withdrawal of savings deposits, today appeared to have halted heavy run on six local banks which followed the closing of the Brown County State bank for check by state examiners.

More than in currency, brought here armored trucks, express and parcel post from Milwaukee Chicago, was stacked conspicuously on bank counters to lend confidence to patrons. Anxious crowds milled through the bank reading the notices posted by the members when the banks opened for business this morning. Disturbances were minor nature, however, since fears of depositors previously had been assuaged by statements of prominent citizens and bankers expressed confidence in the solidarity of the institutions.

Six Banks Involved

The banks involved in the runs the National, Bank Green Bay, West Side State, South Side State, Farmers' Exchange, and the Peoples' Savings and Trust Officers of the House sociation for hours last night evolved the plan quiring 30, 90-day notices Scores depositors had taken advantage of demand privileges, safety deposit boxes for their money had cashiers' checks on Milwaukee Chicago banks.

Affiliated In Investments

Cashier Schultz the Brown County Bank that his bank affiliated in investments with the McCartney National Bank which closed its doors May 21, marking the first bank failure Green in years. The National Bank kept its doors open 45 minutes after regular closing hours yesterday to enable customers to make withdrawals they wished. In radio addresses last night, Fontaine, prominent lawyer and politician; R. Minahan Judge Carlton Merrill expressed their conviction that six Green Bay banks were sound shape and to deposit all their availpromised able funds local banks as indicative of their belief.

3.

June 3, 1931

The Oshkosh Northwestern

Oshkosh, WI

Click image to open full size in new tab

Article Text

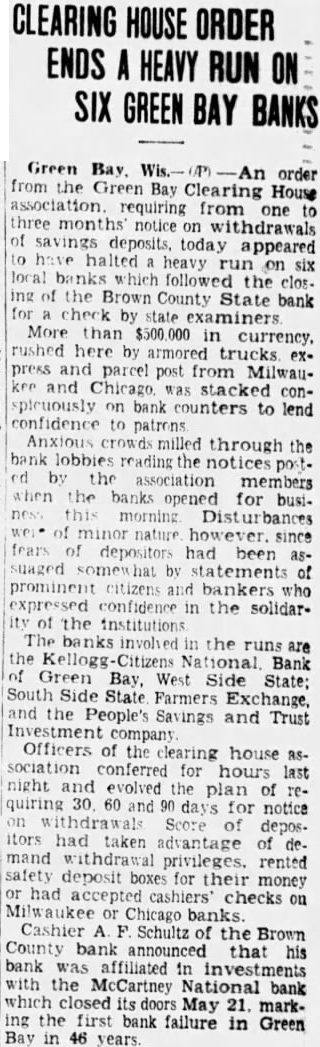

CLEARING HOUSE ORDER ENDS HEAVY RUN GREEN BAY BANKS

Green Bay. order from the Bay Clearing House requiring from to months withdrawals savings deposits. today appeared have halted heavy six banks the clos. the Brown County State bank check examiners More than $500,000 in rushed here by armored trucks press parcel post from Milwauand Chicago stacked conspicuously bank counters to lend confidence Anxious through the lobbies association members the opened for morning since depositors been assuaged statements prominent bankers who expressed confidence the solidarthe The banks involved the runs are Bank Green West Side State: South Side State Farmers Exchange, People's and Trust Investment Officers the clearing house sociation conferred for hours last night and evolved plan quiring 30 60 and for notice itors had taken advantage of mand rented safety deposit their money cashiers checks on or Chicago banks. Cashier Schultz the Brown County bank announced that bank was affiliated in investments with the McCartney National bank which closed its doors 21 markthe first bank failure in Green Bay in 46

4.

June 3, 1931

Wausau Daily Herald

Wausau, WI

Click image to open full size in new tab

Article Text

Today

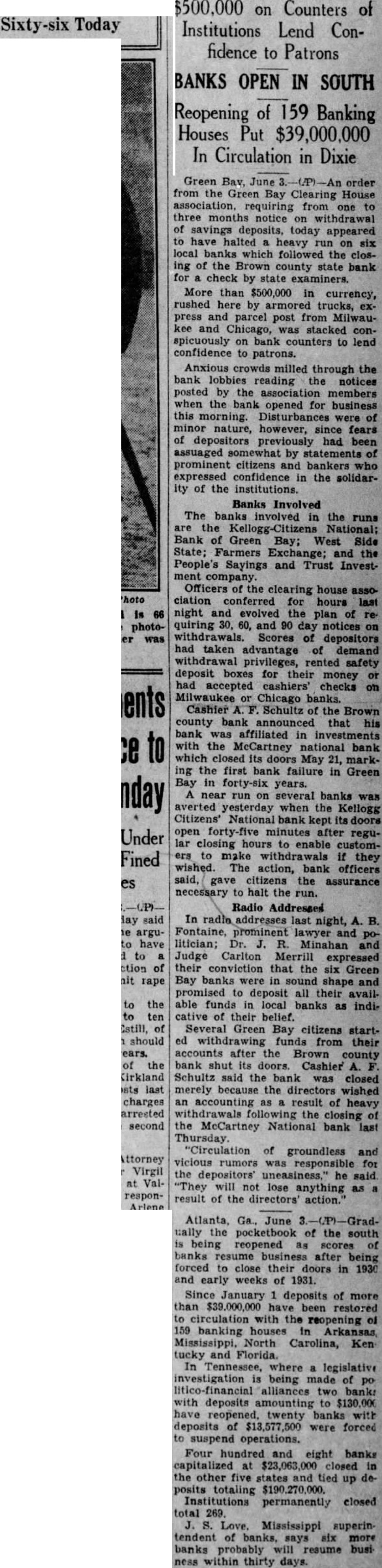

$500,000 Counters of on Institutions Lend Confidence to Patrons

BANKS OPEN IN SOUTH Reopening of 159 Banking Houses Put $39,000,000 In Circulation in Dixie

Green Bav, order the Green Bay Clearing House association. requiring from to three months notice withdrawal of deposits, appeared halted heavy the closthe Brown county state bank for check by state More than $500,000 in currency, rushed here armored trucks, press parcel post from Milwauand Chicago, stacked spicuously on bank counters to lend confidence to patrons. Anxious crowds milled through the bank lobbies reading notices posted by association members when the bank opened for business this morning. Disturbances were nature, however, since fears depositors previously had been assuaged somewhat statements prominent citizens and bankers expressed confidence the solidarity of the institutions. Banks Involved The banks involved the runs the National: Bank Green Bay; West Side State: Farmers Exchange; the People's Sayings and Trust Investment Officers the clearing house association conferred for hours night evolved the plan of quiring and day notices Scores of depositors taken advantage demand withdrawal privileges, rented safety deposit boxes their money had accepted cashiers' checks Milwaukee Chicago banks. Cashier Schultz the Brown county bank announced that his bank affiliated investments with the McCartney national bank which closed its doors marking the first bank failure in Green Bay forty-six years. near several banks averted yesterday when the Kellogg Citizens' National bank doors open minutes after reguclosing enable custommake withdrawals they wished. The action, bank officers gave citizens the assurance necessary to halt the Radio Addressed In last night, Fontaine, prominent lawyer and litician; Minahan and Judge Carlton Merrill expressed their conviction that the Green Bay banks shape deposit all their available funds local banks indicative of their belief. Several Green Bay citizens startwithdrawing funds from their accounts after the Brown county bank shut doors. Cashier Schultz said the bank was closed merely because an accounting result of heavy withdrawals the closing the McCartney National bank last Thursday. "Circulation of groundless and vicious rumors the depositors' uneasiness." he said "They will not lose anything result of the directors' action.'

Atlanta, Ga., June ually pocketbook the south is being reopened scores banks resume after being forced close their doors in 1930 and early weeks of 1931. Since January deposits of more $39,000,000 been restored circulation with the reopening 159 banking houses Arkansas, Mississippi, North Carolina, Ken tucky and Florida. Tennessee, where legislative investigation being made alliances two bank: with deposits amounting have twenty banks with deposits $13,577,500 were forced suspend operations. Four hundred and eight banks capitalized closed the other five states and tied up totaling $190,270,000. Institutions permanently closed total Love. Mississippi superintendent of banks, says banks probably resume within thirty days.

5.

June 3, 1931

Kenosha News

Kenosha, WI

Click image to open full size in new tab

Article Text

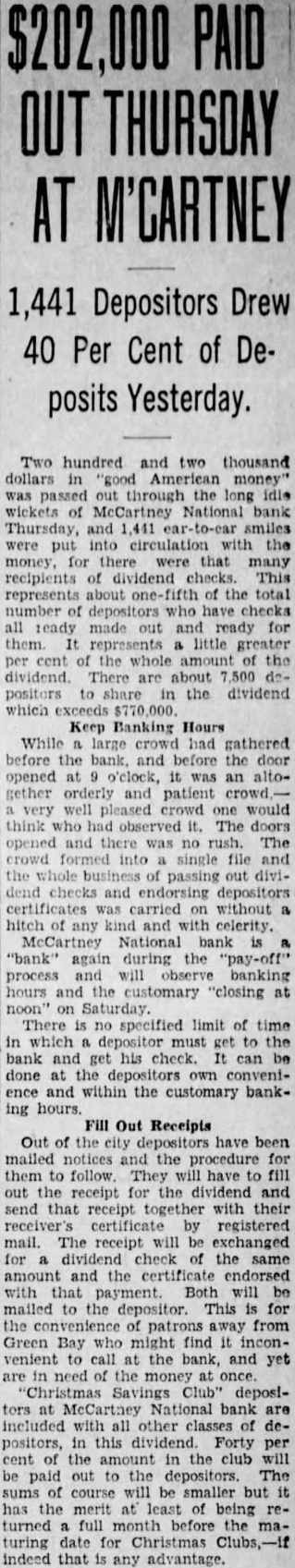

Can Withdraw Cash Only on Given Notice

Green Bay Clearing House Takes Steps to Save Six Banks

Green Bay, Wis.-(P)-An order from the Green Bay Clearing House association, requiring from one to three months notice on withdrawal of savings deposits, today appeared to have halted a heavy run on six local banks which followed the closing of the Brown County State bank for a check by state examiners. More than $500,000 in currency, rushed here by armored trucks, express and parcel post from Milwaukee and Chicago, was stacked conspicuously on bank counters to lend confidence to patrons. Anxious crowds milled through the bank lobbies reading the notices posted by the association members when the banks opened for business this morning. Disturbances were of minor nature, however, since fears of depositors previously had been assuaged somewhat by statements of prominent citizens and bankers who expressed confidence in the solidarity of the institution. The banks involved in the runs are the Kellogg Citizens National; Bank of Green Bay; West Side State; South Side State; Farmers Exchange; and the Peoples' Savings and Trust Investment company. Evolve Plan at Meet association conferred for hours last night and evolved the plan of requiring 30, 60, and 90 day notices on withdrawals. Scores of depositors had taken advantage of demand withdrawal privileges, rented safety deposit boxes for their money or had accepted cashiers' checks on Milwaukee or Chicago banks. Cashier A. FV Schultz of the Brown County bank announced that his bank was affiliated in investments with the McCartney National bank which closed its doors May 21, marking the first bank failure in Green Bay in 46 years. A near run on several banks was averted yesterday when the Kellogg Citizens' National bank kept its doors open 45 minutes after regular closing hours to enable to make withdrawals if they wished. The action, bank officials said, gave citizens the assurance necessary to halt the run.

Vow Faith in Banks In radio addresses last night, A. B. Fontaine, prominent lawyer and politician; Dr. J. R. Minahan and Judge Carlton Merrill expressed their conviction that the six Green Bay banks were in sound shape and promised to deposit all their available funds in local banks as indicative of their belief. Several Green Bay citizens started withdrawing funds from their accounts after the Brown County bank shut its doors. Cashier A. F. Schultz said the bank was closed merely because the directors wished an accounting as result of heavy withdrawals following the closing of the McCartney National bank last Thursday. "Circulation of groundless and vicious rumors was responsible for the depositors' uneasiness," he said. "They will not lose anything as a result of the directors' action."

There is one dentist for every 1700

6.

June 3, 1931

Kenosha News

Kenosha, WI

Click image to open full size in new tab

Article Text

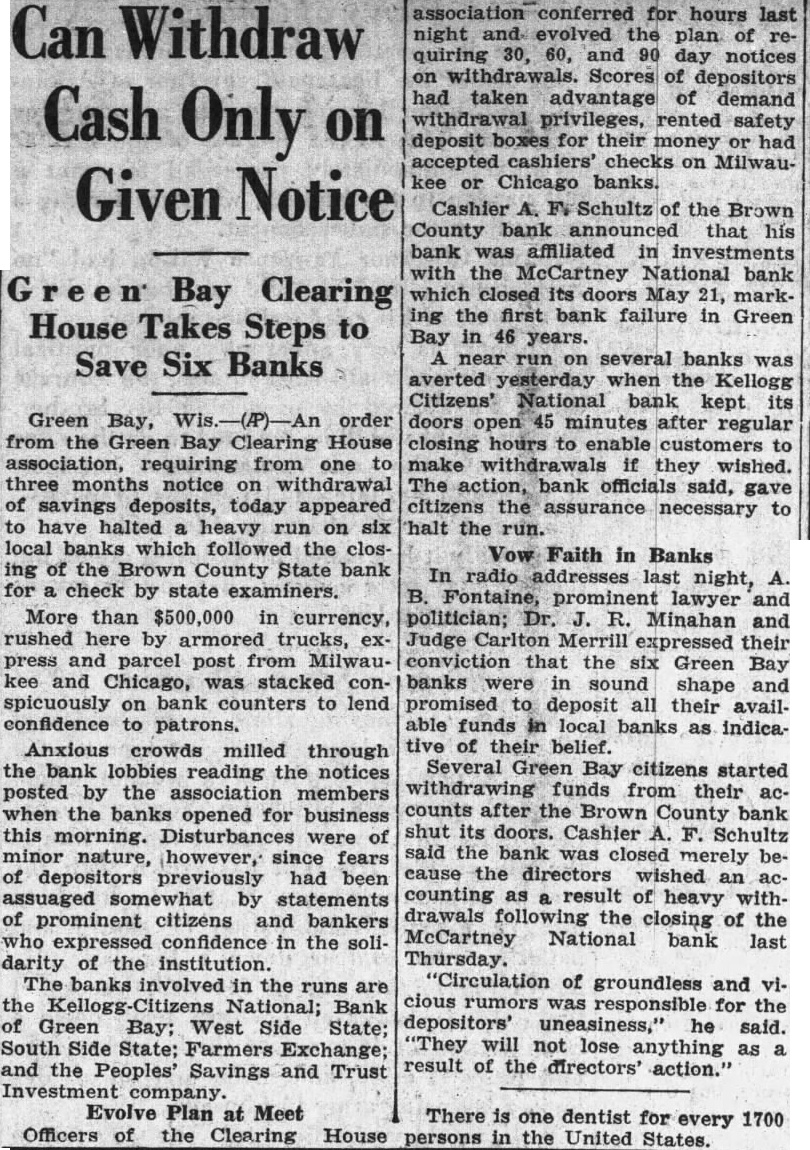

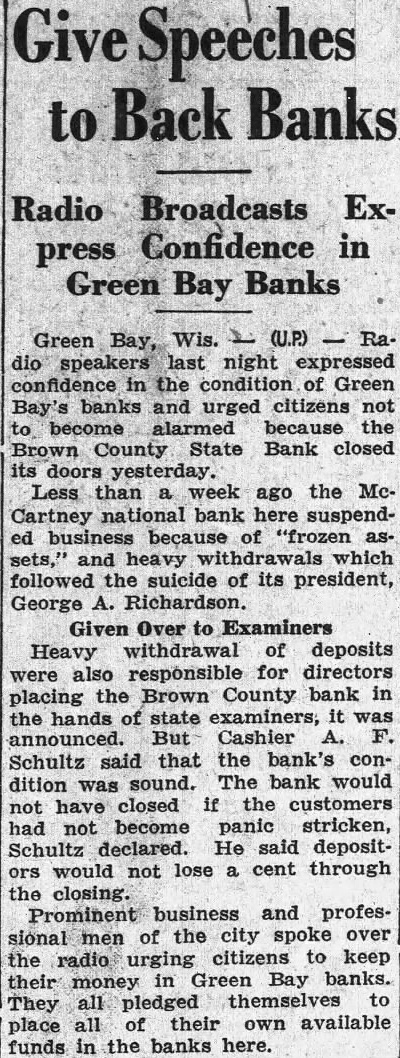

Give Speeches to Back Banks

Radio Broadcasts Express Confidence in Green Bay Banks

Green Bay, Wis. 1 (U.P.) Radio speakers last night expressed confidence in the condition of Green Bay's banks and urged citizens not to become alarmed because the Brown County State Bank closed its doors yesterday. Less than week ago the McCartney national bank here suspended business because of "frozen assets," and heavy withdrawals which followed the suicide of its president, George A. Richardson.

Given Over to Examiners Heavy withdrawal of deposits were also responsible for directors placing the Brown County bank in the hands of state examiners, it was announced. But Cashier A. F. Schultz said that the bank's condition was sound. The bank would not have closed if the customers had not become panic stricken, Schultz declared. He said depositors would not lose a cent through the closing. Prominent business and professional men of the city spoke over the radio urging citizens to keep their money in Green Bay banks. They all pledged to place all of their own available funds in the banks here.

7.

November 10, 1931

Green Bay Press-Gazette

Green Bay, WI

Click image to open full size in new tab

Article Text

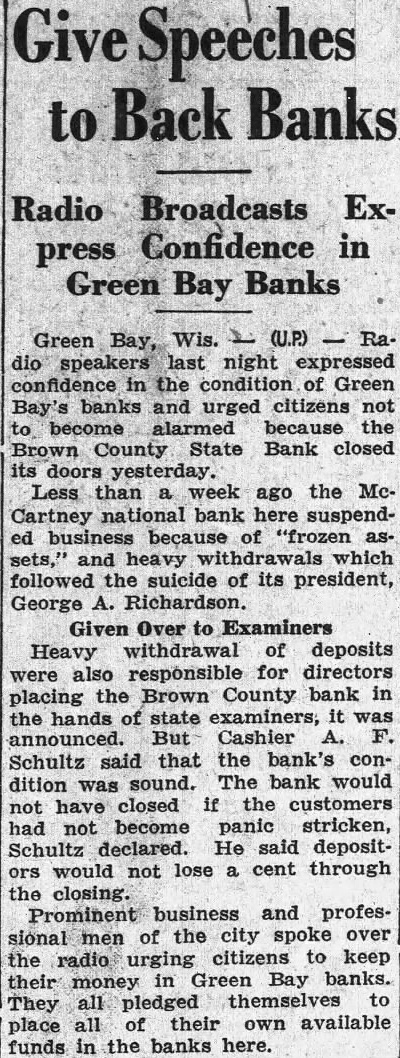

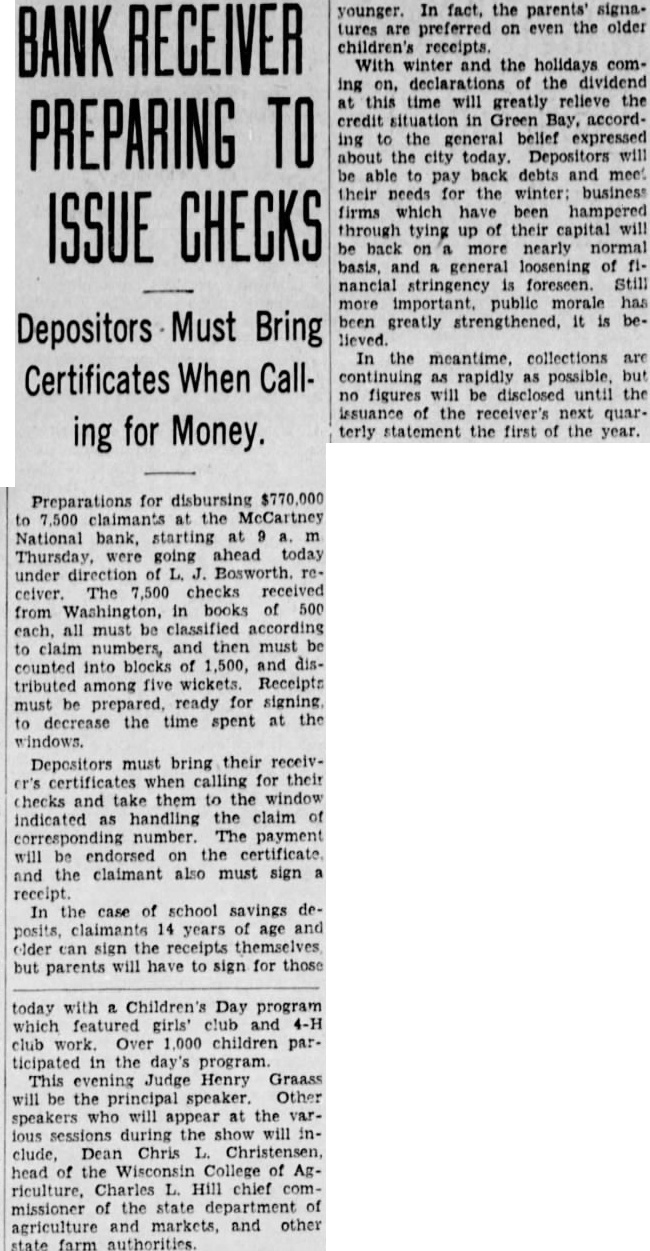

BANK RECEIVER PREPARING TO ISSUE CHECKS

Depositors Must Bring Certificates When Calling for Money.

Preparations for disbursing $770,000 to 7,500 claimants the McCartney National bank, starting at Thursday, were going ahead today under direction of Bosworth. receiver. The 7,500 checks received from Washington, in books of 500 each, all must be classified according to claim numbers, and then must be counted into blocks of 1,500, and distributed among five wickets. Receipts must be prepared, ready for signing to decrease the time spent at the windows. Depositors must bring their receivcr's certificates when calling for their checks and take them to the window indicated as handling the claim of corresponding number. The payment will be endorsed on the certificate and the claimant also must sign receipt. In the case of school savings deposits, claimants 14 years of age and older can sign the receipts themselves but parents will have to sign for those today with a Children's Day program which featured girls' club and 4-H club work. Over 1.000 children participated in the day's program. This evening Judge Henry Grasss will be the principal speaker. Other speakers who will appear at the various sessions during the show will include, Dean Chris L. Christensen, head of the College of Agriculture, Charles L. Hill chief commissioner of the state department of agriculture and markets, and other state farm authorities. younger. In fact, the parents' signatures are preferred on even the older children's receipts. With winter and the holidays coming on, declarations of the dividend at this time will greatly relieve the credit situation in Green Bay, according to the general belief expressed about the city today. Depositors will be able to pay back debts and meet their needs for the winter: business firms which have been hampered through tying up of their capital will be back on more nearly normal basis, and general loosening of fl. nancial stringency is foreseen. Still more important. public morale has been greatly strengthened, it is believed. In the meantime. collections are continuing as rapidly as possible, but no figures will be disclosed until the issuance of the receiver's next quarterly statement the first of the year.

8.

November 13, 1931

Green Bay Press-Gazette

Green Bay, WI

Click image to open full size in new tab

Article Text

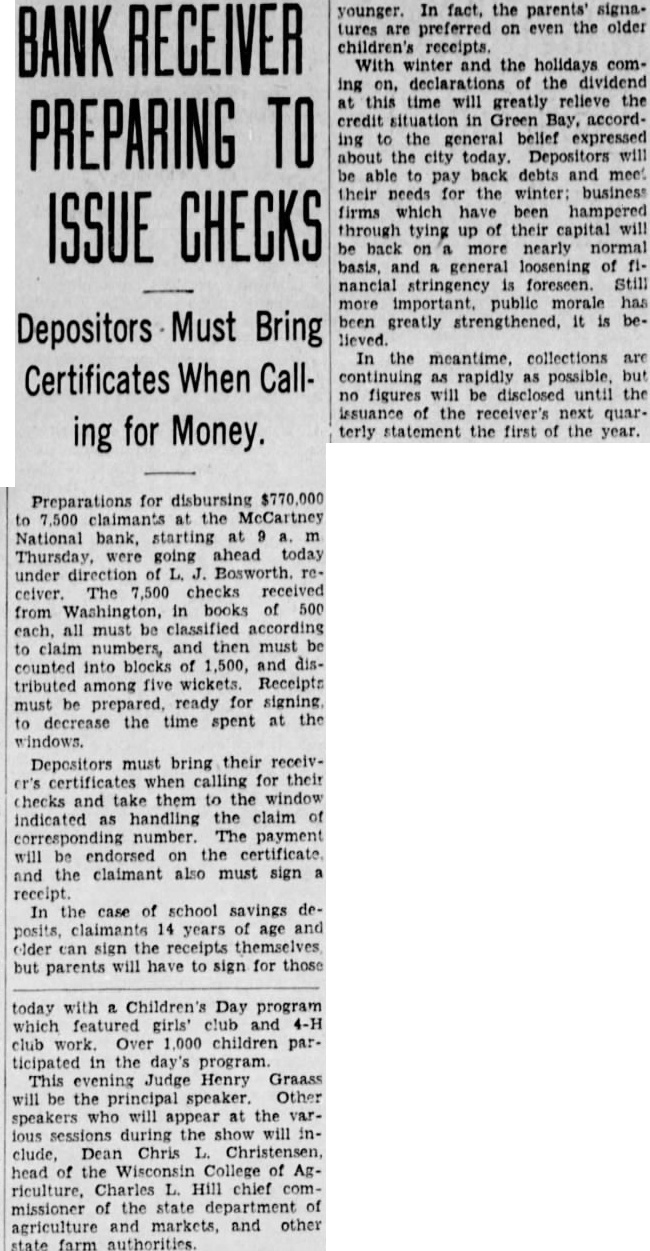

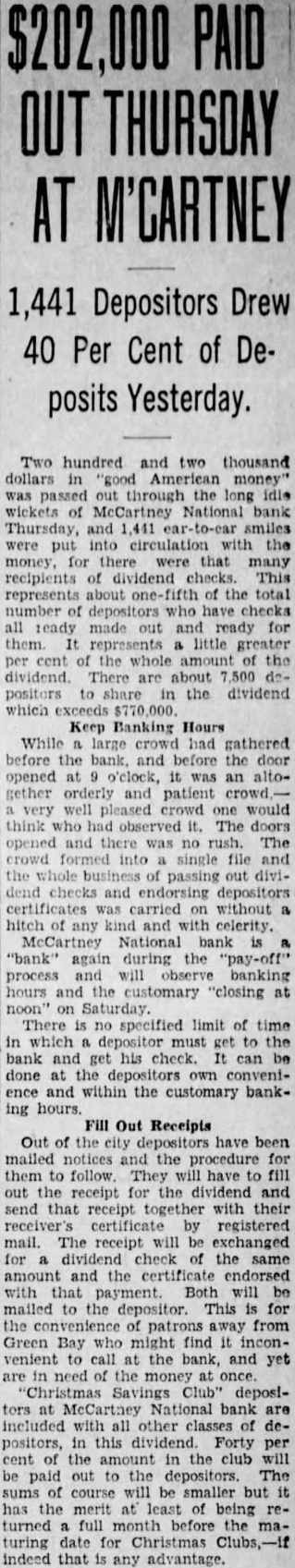

M'CARTNEY

1,441 Depositors Drew 40 Per Cent of Deposits Yesterday.

Two hundred and two thousand dollars "good American the idle National bank Thursday, smiles put the money, recipients dividend This represents of the number checks ready and ready for them. little greater per cent whole amount dividend. There are about share the dividend which Keep Banking Hours While large gathered before the the opened altogether orderly well would think opened and was The crowd single file and the passing checks and depositors certificates carried without with celerity. McCartney National bank "bank" again during the process banking hours customary "closing There limit of time the his can and within the customary banking hours.

Out Receipts Out have been notices and the procedure for them follow. They will the receipt for the dividend and send receipt together their receiver's certificate registered mail. The receipt will exchanged for dividend check same amount and the with payment. Both will the This for the from Green Bay might find inconvenient call the bank and yet McCartney are included with other classes depositors, in this dividend Forty cent the amount the paid out the depositors The will smaller but has merit least of being turned full before turing Christmas indeed that any advantage.

9.

November 13, 1931

Kenosha News

Kenosha, WI

Click image to open full size in new tab

Article Text

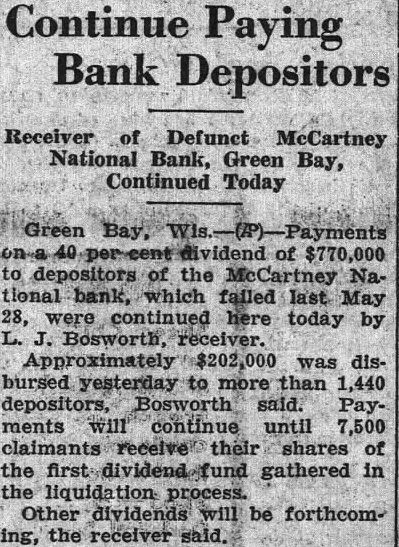

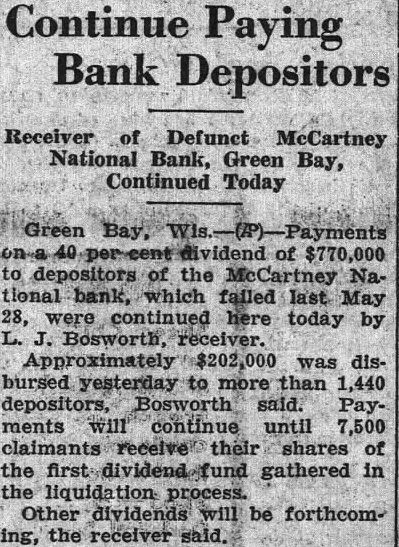

Continue Paying Bank Depositors

Receiver of Defunct McCartney National Bank, Green Bay, Continued Today

Green Bay, of $770,000 to depositors of the McCartney National bank, which failed last May 28, were continued here today by J. Bosworth, receiver. Approximately $202,000 was disbursed yesterday to more than 1,440 depositors, Bosworth said. Payments will continue until 7,500 claimants receive their shares of the gathered in the liquidation process. Other dividends will be forthcoming, the receiver said.

10.

November 14, 1931

Green Bay Press-Gazette

Green Bay, WI

Click image to open full size in new tab

Article Text

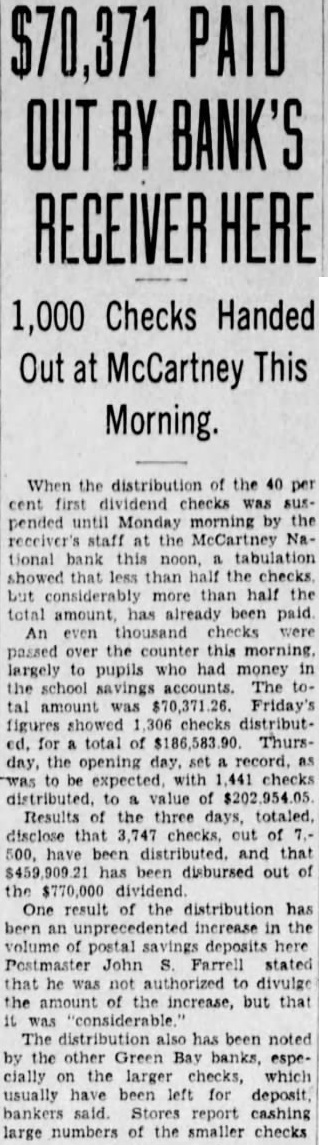

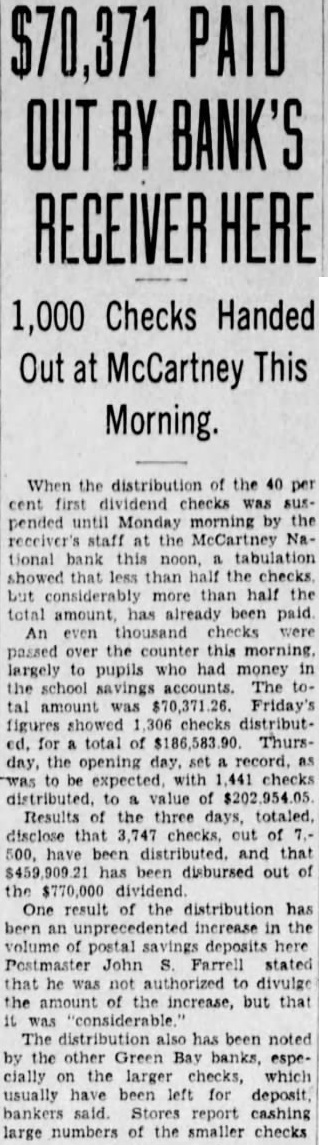

PAID

1,000 Checks Handed Out at McCartney This Morning.

When the the 40 per cent dividend checks was suspended until Monday morning by the receiver's staff McCartney tional bank this tabulation showed than half the checks but than half the already An passed the this morning. largely pupils had money the school The tal amount Friday's figures total Thursday, the set checks Results the three disclose that checks out 500, and that disbursed out the $770,000 One result distribution has increase the volume postal savings deposits here Postmaster John stated that not to divulge the amount the increase, but that The distribution been noted by the other Green banks, especially the larger checks, which usually left bankers Stores report cashing large numbers of the smaller checks

11.

November 19, 1931

The La Crosse Tribune

La Crosse, WI

Click image to open full size in new tab

Article Text

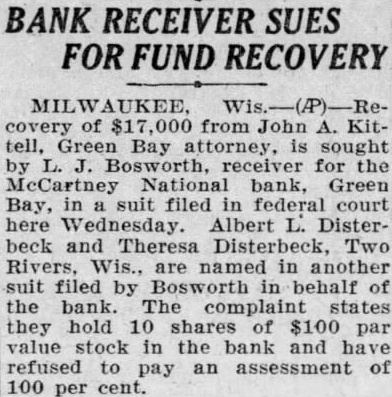

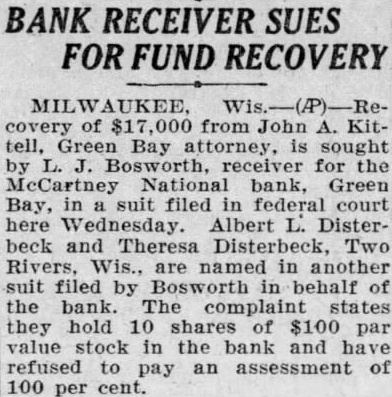

BANK SUES FOR FUND RECOVERY from John A. Kittell, Green Bay attorney, is sought Bosworth, receiver for the McCartney National bank, Green Bay, in suit filed in federal court Wednesday. Albert L. Disterbeck and Disterbeck, Two another suit filed by Bosworth in behalf of the bank. hold 10 of par value stock in the and to pay an assessment of cent.

12.

December 30, 1931

Green Bay Press-Gazette

Green Bay, WI

Click image to open full size in new tab

Article Text

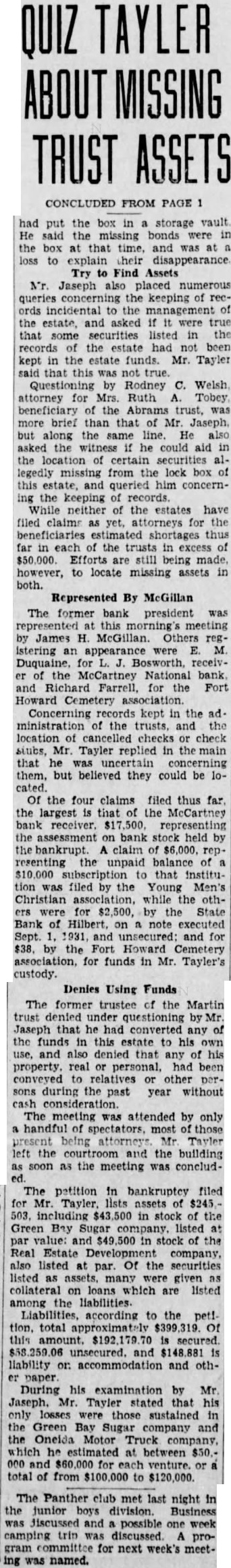

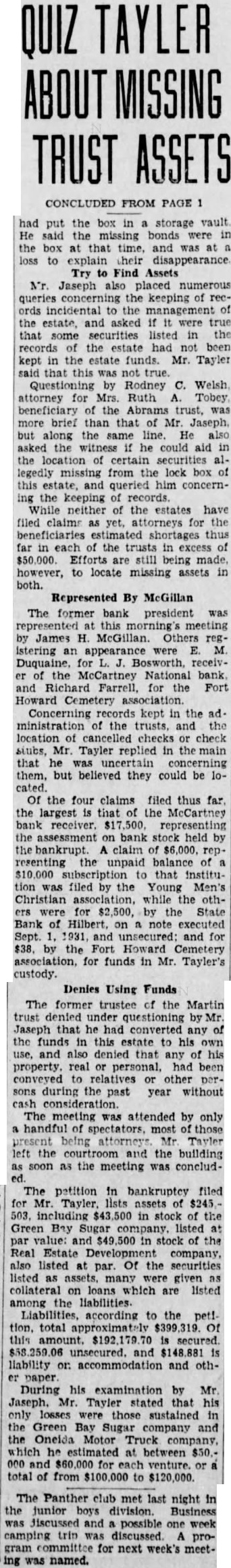

TRUST ASSETS had put the storage vault He said the missing the box at that Try Find Assets Mr. Jaseph placed the keeping of recthe the estate, and asked that some the records the estate had been kept the Mr. Tayler that this was true. Questioning by Rodney C. Welsh attorney for Mrs. Ruth Tobey beneficiary trust, brief that of Mr. Jaseph, along the He he could aid the legedly from lock this estate, queried him concernkeeping records While neither of the estates have filed claims attorneys for beneficiaries estimated shortages thus far each of the trusts excess $50,000. Efforts are still being however, to locate missing assets both.

Represented By McGillan

The former president was meeting James McGillan. Others appearance receivof McCartney National Richard Farrell, the Howard Cemetery association. Concerning kept in the ministration trusts, and location cancelled checks check stubs, Mr. Tayler replied that uncertain concerning them, but believed they could be cated. the four claims filed thus far the largest the McCartney bank receiver. representing the assessment bank held by bankrupt. claim resenting unpaid that institution filed by the Young Men's Christian while the othfor the State of unsecured: and for by the Fort Howard Cemetery for funds in Mr. Tayler's custody.

Denies Using Funds The former trustee the Martin trust denied under questioning Jaseph had converted any the funds estate to his denied property. personal, relatives other during past year without consideration. meeting attended by only handful Tayler left the and the building soon as the meeting was conclud-

The petition bankruptcy filed Mr. Tayler assets of in stock value: in stock Real Estate company, listed Of the securities listed many given collateral loans which are listed among the Liabilities, according to the petitotal Of and liability or. and othDuring his examination Mr. Jaseph. Mr. Tayler stated that losses were those sustained the Green Sugar company and the Oneida Motor Truck company. which estimated between 000 venture. total from $100,000 to

The Panther club met last night in junior boys possible one next meet-

13.

March 31, 1932

Wausau Daily Herald

Wausau, WI

Click image to open full size in new tab

Article Text

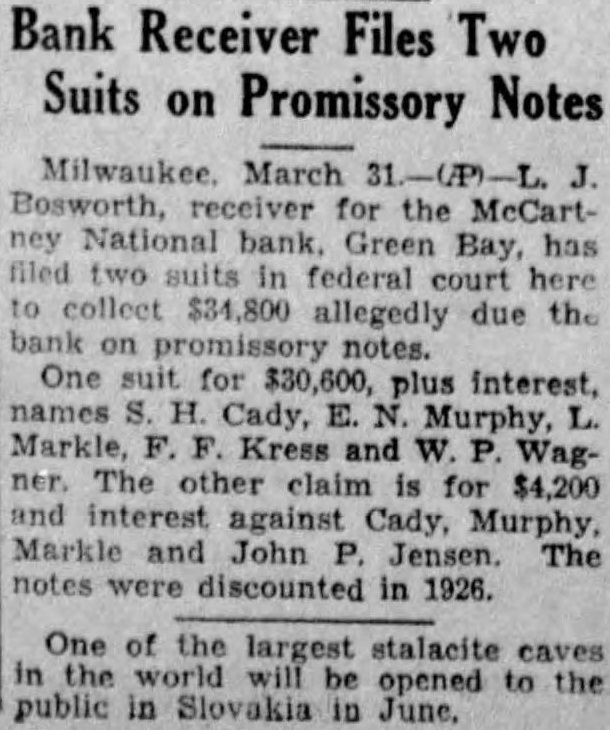

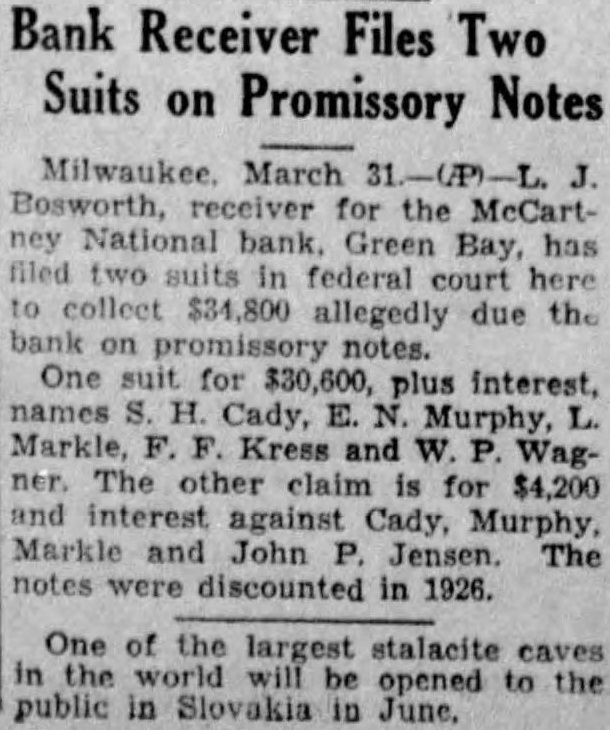

Bank Receiver Files Two Suits on Promissory Notes

Milwaukee. March J. Bosworth, receiver for the McCartney National bank. Green Bay, has two suits in federal court collect $34,800 allegedly due the on promissory notes. One suit for $30,600, plus interest, names Cady, Murphy, Markle, Kress and Wagner. The other claim for $4,200 interest against Cady, Murphy, Markle and John Jensen. notes were discounted in 1926.

One of the largest stalacite caves in world be opened to the public in Slovakia in June.

14.

May 24, 1932

Green Bay Press-Gazette

Green Bay, WI

Click image to open full size in new tab

Article Text

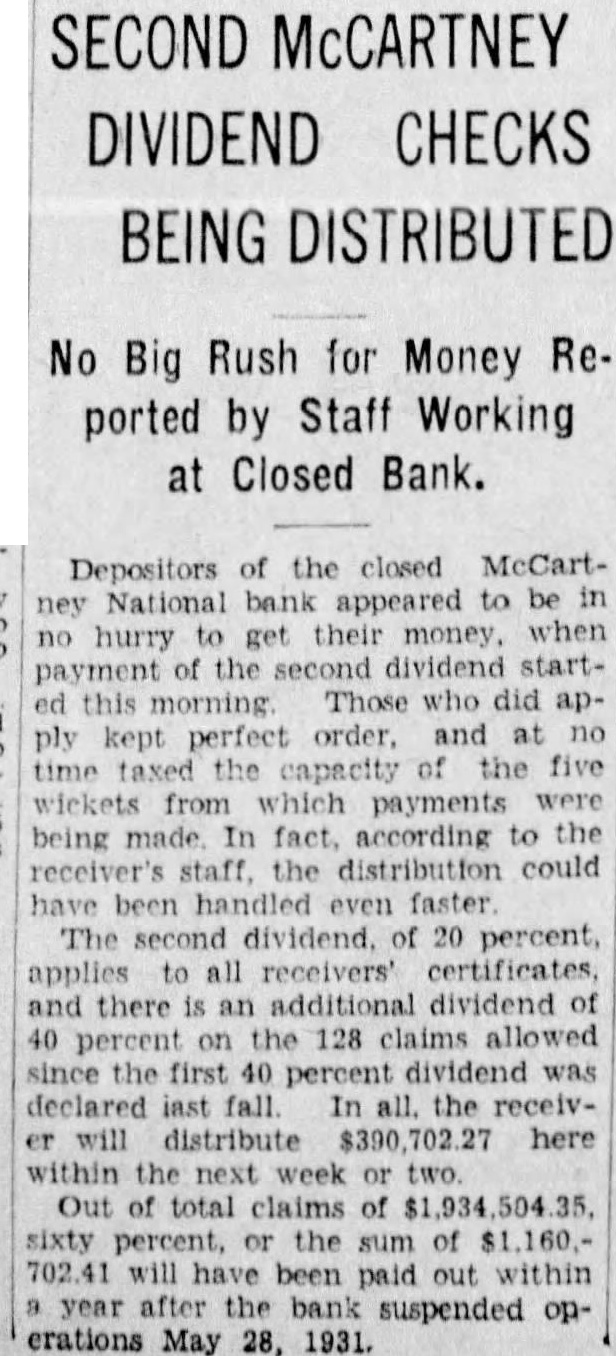

SECOND McCARTNEY DIVIDEND CHECKS BEING DISTRIBUTED

No Big Rush for Money Reported by Staff Working at Closed Bank.

Depositors of the closed McCart. ney National appeared no hurry money. when payment the startthis morning Those did apply kept order. and the the five which were being In according the the distribution The dividend. 20 percent, and there dividend of 40 percent on the 128 claims allowed since first percent dividend was declared fall the receivwill distribute here within the week two. Out claims of percent, or the sum of will been paid out within year suspended operations May 28, 1931.

15.

December 10, 1932

The Daily Tribune

Wisconsin Rapids, WI

Click image to open full size in new tab

Article Text

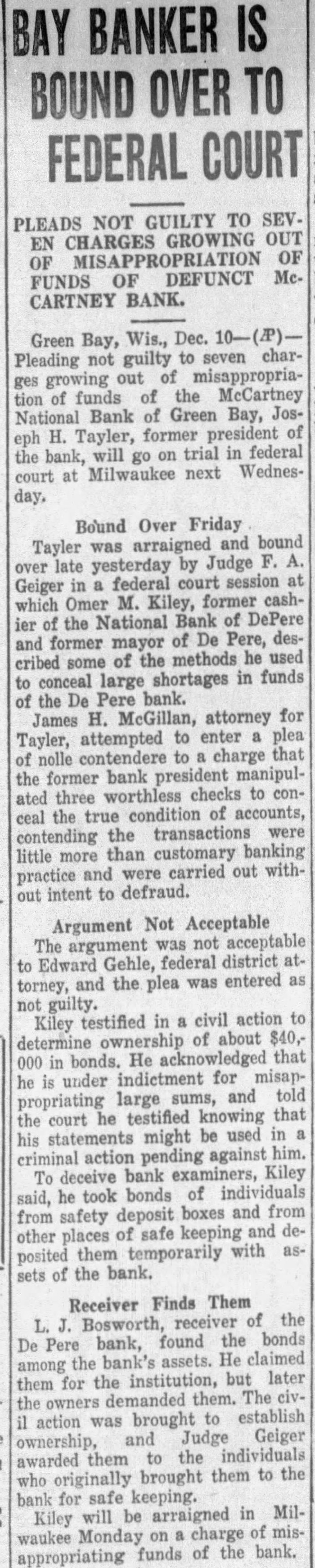

BAY BANKER IS BOUND OVER TO FEDERAL COURT

PLEADS NOT GUILTY TO SEVEN CHARGES GROWING OUT OF MISAPPROPRIATION OF FUNDS OF DEFUNCT McCARTNEY BANK.

Green Bay, Wis., Dec. 10-(P)Pleading not guilty to seven charges growing out of misappropriation of funds of the McCartney National Bank of Green Bay, Joseph H. Tayler, former president of the bank, will go on trial in federal court at Milwaukee next Wednesday.

Bound Over Friday Tayler was arraigned and bound over late yesterday by Judge F. A. Geiger in a federal court session at which Omer M. Kiley, former cashier of the National Bank of DePere and former mayor of De Pere, described some of the methods he used to conceal large shortages in funds of the De Pere bank. James H. McGillan, attorney for Tayler, attempted to enter plea of nolle to a charge that the former bank president manipulated three worthless checks to conceal the true condition of accounts, contending the transactions were little more than customary banking practice and were carried out without intent to defraud.

Argument Not Acceptable The argument was not acceptable to Edward Gehle, federal district attorney, and the plea was entered as not guilty. Kiley testified in a civil action to determine ownership of about $40,000 in bonds. He acknowledged that he is under indictment for misappropriating large sums, and told the court he testified knowing that his statements might be used in criminal action pending against him. To deceive bank examiners, Kiley said, he took bonds of individuals from safety deposit boxes and from other places of safe keeping and deposited them temporarily with assets of the bank.

Receiver Finds Them L. J. Bosworth, receiver of the De Pere bank, found the bonds among the bank's assets. He claimed them for the institution, but later the owners demanded them. The civil action was brought to establish ownership, and Judge Geiger awarded them to the individuals who originally brought them to the bank for safe keeping. Kiley will be arraigned in Milwaukee Monday on a charge of misappropriating funds of the bank.