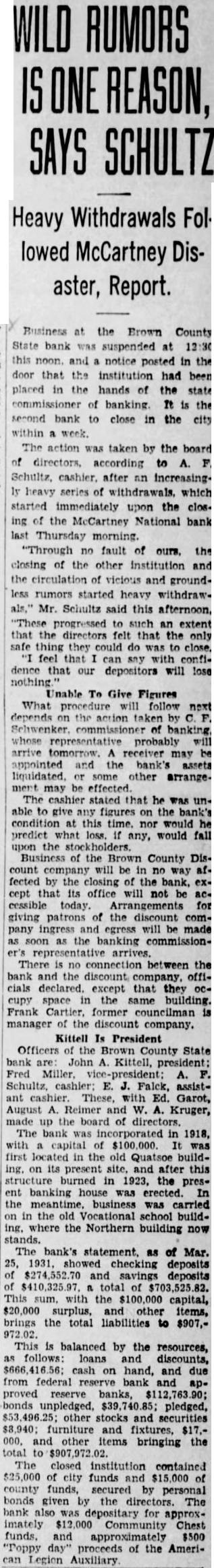

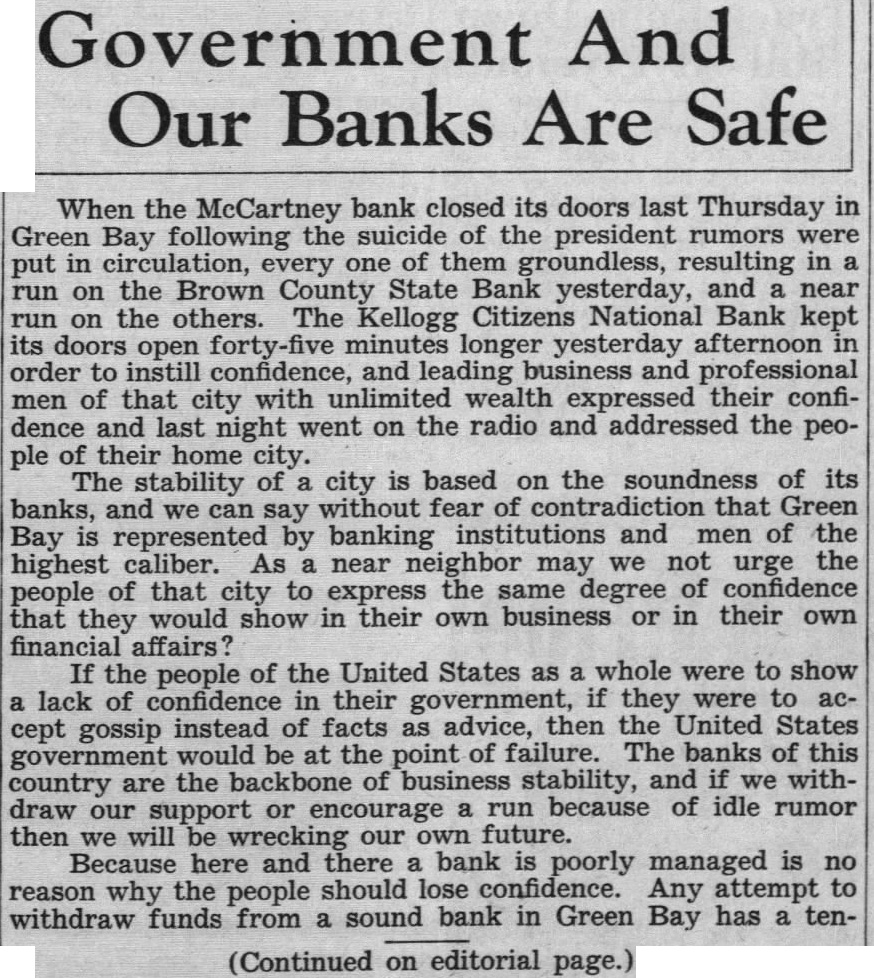

Article Text

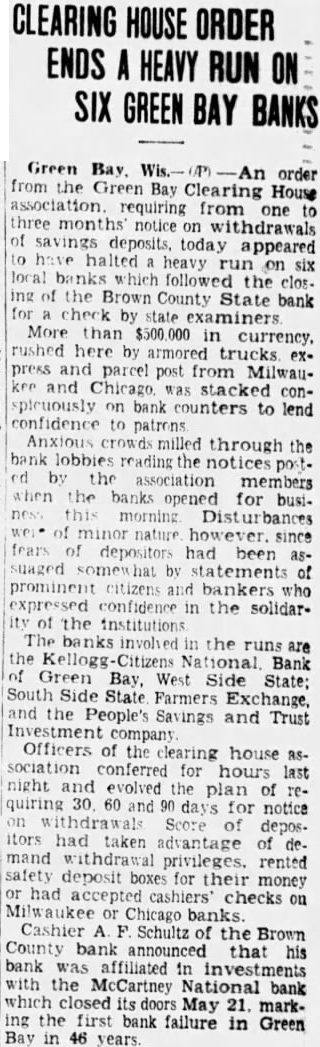

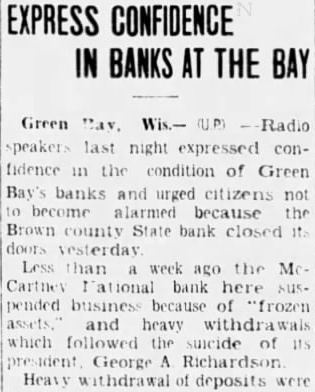

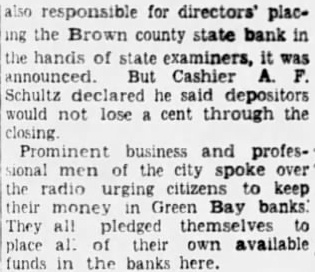

WILD RUMORS REASON, SAYS SCHULTZ Heavy Withdrawals Followed McCartney Disaster, Report. Business at the Brown County State bank suspended at this noon and notice posted in the door that the institution had been placed in the hands the state commissioner of is the second bank close in the city within The action taken by the board according to ly heavy series of withdrawals. which started immediately upon the ing the McCartney National bank last Thursday morning. "Through no fault of ours. the closing of the other institution and the circulation of vicious and groundless rumors started heavy withdrawals." Schultz said this afternoon, such an extent that the felt that the safe they could was any with dence that our depositors will lose nothing Unable To Give Figures What follow next depends the action whose representative probably arrive tomorrow. receiver may appointed the bank's liquidated. some other arrangeeffected. The cashier stated that he was able give any the bank's condition this time. would predict what any, would fall the the County count will be way affected by the closing bank, cept that its office not be today. Arrangements giving patrons of the discount company ingress and egress will be soon the banking commissionrepresentative arrives. There no connection between the the discount company, declared. except that they space the same building. Frank former councilman manager the company. Kittell Is President Officers the Brown County State John Kittell, president: Fred Falck, assistant with Ed. Garot, and Kruger, up the in 1918, first the old Quatsoe buildon present after this burned in 1923, the presbanking erected. the business carried the old Vocational school building. where the Northern building now stands. bank's statement. as of Mar. 1931, showed checking deposits $274,552.70 and savings deposits This sum. with the capital, $20,000 surplus, other items, brings the total liabilities to $907,972.02. This is balanced by the resources, follows: loans discounts, hand, and due from federal and proved reserve banks, $112,763.90; bonds unpledged. pledged, other stocks and securities $8,940: furniture and fixtures. and other items bringing the total to The closed institution contained $25,000 city funds county funds, secured personal bonds given by the directors. The bank also was for approximately $12,000 Community Chest funds. and approximately $500 "Poppy proceeds of the American Legion Auxiliary