Click image to open full size in new tab

Article Text

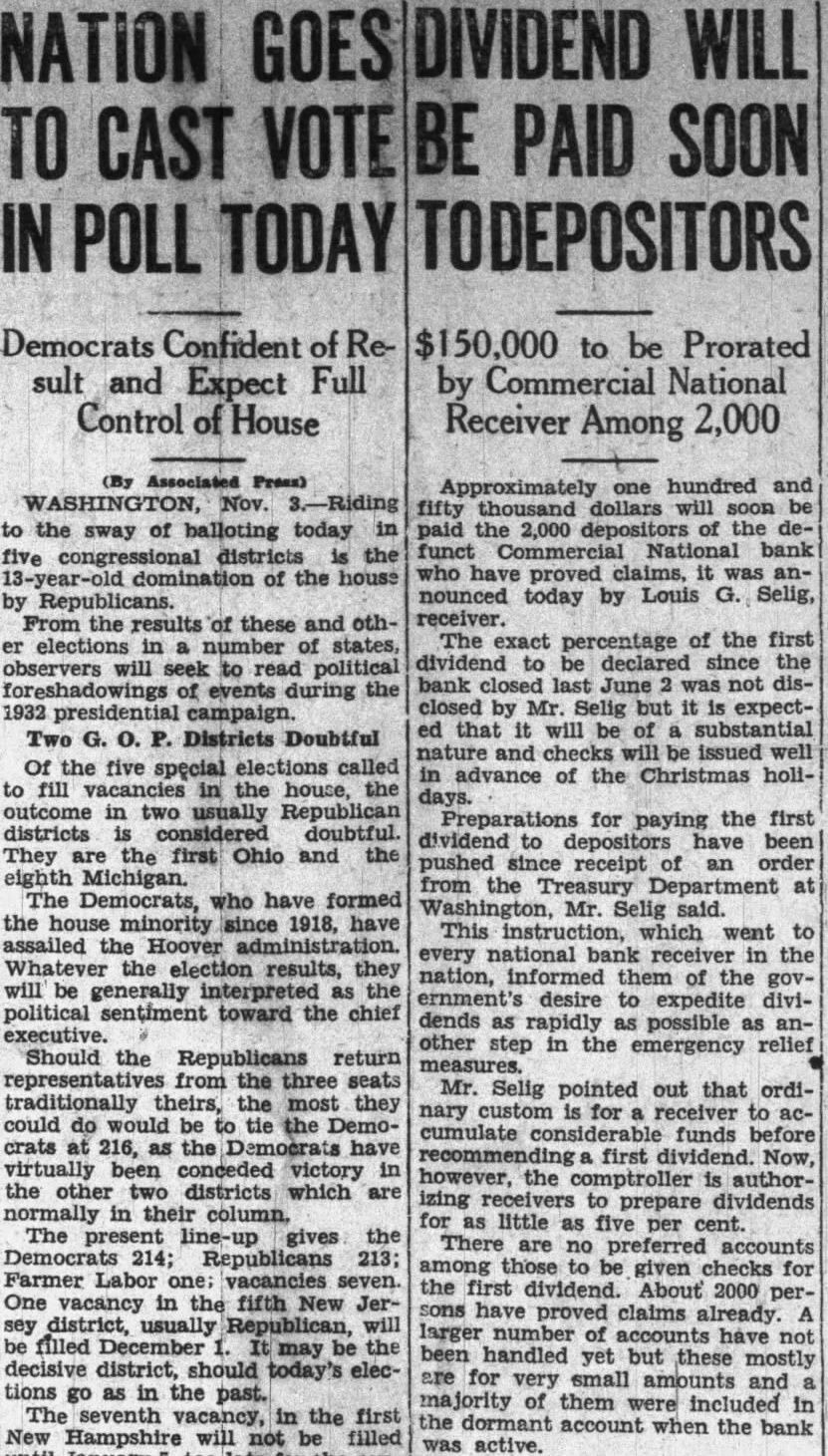

SELIG MAKES BANK SURVEY

Condition of Commercial National as of Sept. 30, Is Outlined

With only a short time remaining for the filing of claims against the Commercial National bank, which closed on June 2. this year, Louis G. Selig, receiver, today issued a statement of condition of the defunct institution as of September 30. All claims must be filed with the receiver within three months from July 21, the date on which claim notices were first published. Regarding the probable time of payment of the first dividend to creditors and the amount likely to be made available, the receiver is prohibited by the Treasury department from speculating Practically all major claims have been filed with the receiver, though it is estimated that approximately 3,000 smaller claims, some of them ranging from a few cents to a few dollars, will not be filed. This is the case in every bank failure, according to Mr. Selig, many depositors with inactive accounts neglecting to

0.00

0.00 file claims. Mr. Selig's statement of condition of the bank follows: Assets Bills Receivable $529,146.73 Cash on hand 4,000.36 Assets other than Bills receivable and cash on hand 373,028.90 Additional Assets acquired 716.16 Stock Assessment 100,000.00 Total of all Assets coming into the hands of the Receiver $1,006,892.15 Remaining Assets Uncollected Bills Receiv448,200.72 able Assets other Bills Receivable 116,891.57 Additional Assets ac70.59 quired Stock Assess91,958.15 ment Total Assets uncollected Liabilities Total claims proven on unsecured liabilities. 304,480.94 Total unproven unsecured claims. 76,043.03 Total secured liabilities outstanding unpaid 200,002.42 Total Rediscounts unpaid Total Bills Payable unpaid Total additional Liabilities 378.85 proven Total of all Liabilities Dividends paid during last quar0.00 ter Dividends paid prior 0.00 thereto Total Dividends paid to date Cash on hand

Pat Greene, said to be of Pearl River county, was in Forrest county jail today awaiting arrival here of Pearl River county officers. He was arrested Saturday by Deputy Shert iffs H. K. McLemore and Frank Williams. He is held on a liquor possession charge. Postal Telegraph Office Equipment Much Improved Completion of extensive improvements in equipment of the local Postal Telegraph company office in Hotel Hattiesburg, was announced this morning by C. A. Cox. manager. For more than a week plant and equipment engineers were engaged in making new installations in the office and increasing volume capacity to accommodate recent increases in business recorded locally, Mr. Cox said. These improvements afford the local office ample facilities for 657,121.03 handling an increased volume of business, and caring for a number of special simplex sending-receiving stations installed in large business offices in the city. Besides its main office the Postal is operating a branch in the lobby of Forrest hotel. CROSLEY RADIOS SALES and SERVICE Tubes, Batteries, Aerials, etc. Polk Hardware & 580,905.24 Implement Co. You Don't Have to 0.00 119,236.19 Buy Tires