Article Text

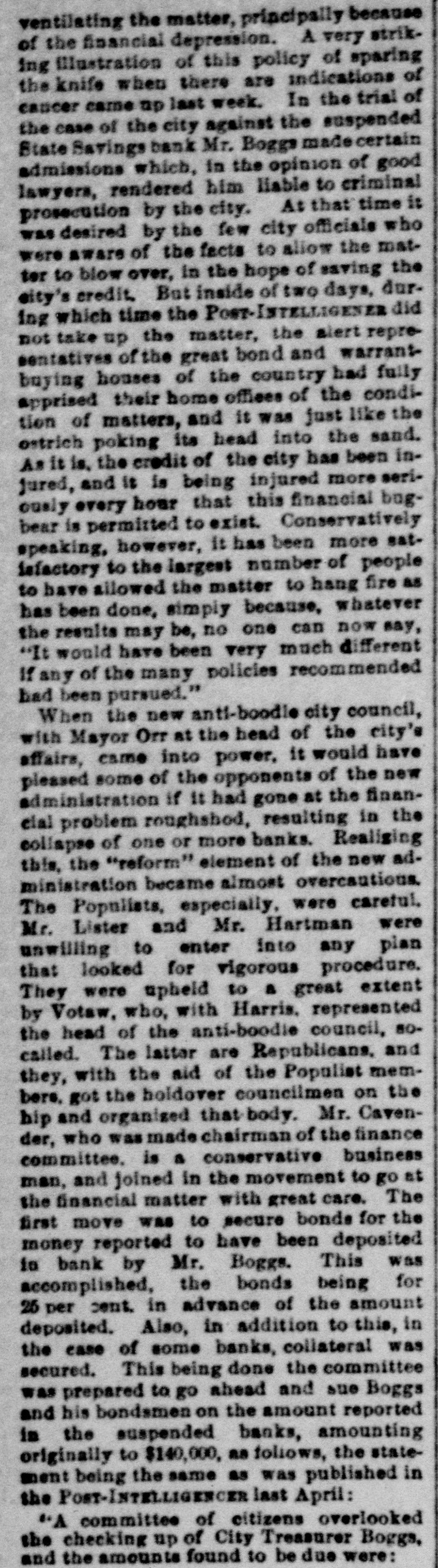

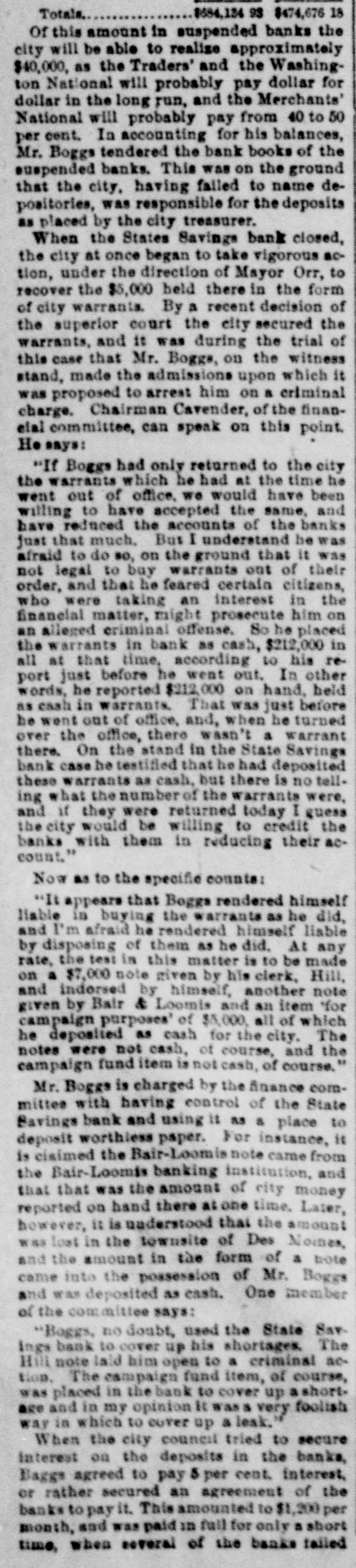

# VENTILATING THE MATTER At that time it ventilating the matter, principally because of the financial depression. A very striking illustration of this policy of sparing the knife when there are indications of cancer came up last week. In the trial of the case of the city against the suspended State Savings bank Mr. Boggs made certain admissions which, in the opinion of good lawyers, rendered him liable to criminal prosecution by the city. was desired by the few city officials who were aware of the facts to allow the matter to blow over, in the hope of saving the city's credit. But inside of two days, during which time the Post-INTELLIGENCER did not take up the matter, the alert representatives of the great bond and warrant-buying houses of the country had fully apprised their home offices of the condition of matters, and it was just like the ostrich poking its head into the sand. As it is, the credit of the city has been injured, and it is being injured more seriously every hour that this financial bugbear is permitted to exist. Conservatively speaking, however, it has been more satisfactory to the largest number of people to have allowed the matter to hang fire as has been done, simply because, whatever the results may be, no one can now say, "It would have been very much different If any of the many policies recommended had been pursued." When the new anti-boodle city council, with Mayor Orr at the head of the city's affairs, came into power, it would have pleased some of the opponents of the new administration if it had gone at the financial problem roughshod, resulting in the collapse of one or more banks. Realizing this, the "reform" element of the new administration became almost overcautious. The Populists, especially, were careful. Mr. Lister and Mr. Hartman were unwilling to enter into any plan that looked for vigorous procedure. They were upheld to a great extent by Votaw, who, with Harris, represented the head of the anti-boodle council, so-called. The latter are Republicans, and they, with the aid of the Populist members, got the holdover councilmen on the hip and organized that body. Mr. Cavender, who was made chairman of the finance committee, is a conservative business man, and joined in the movement to go at the financial matter with great care. The first move was to secure bonds for the money reported to have been deposited in bank by Mr. Boggs. This was accomplished, the bonds being for 25 per cent. in advance of the amount deposited. Also, in addition to this, in the case of some banks, collateral was secured. This being done the committee was prepared to go ahead and sue Boggs and his bondsmen on the amount reported in the suspended banks, amounting originally to $140,000, as follows, the statement being the same as was published in the POST-INTELLIGENCER last April: "A committee of citizens overlooked the checking up of City Treasurer Boggs, and the amounts found to be due were: