Article Text

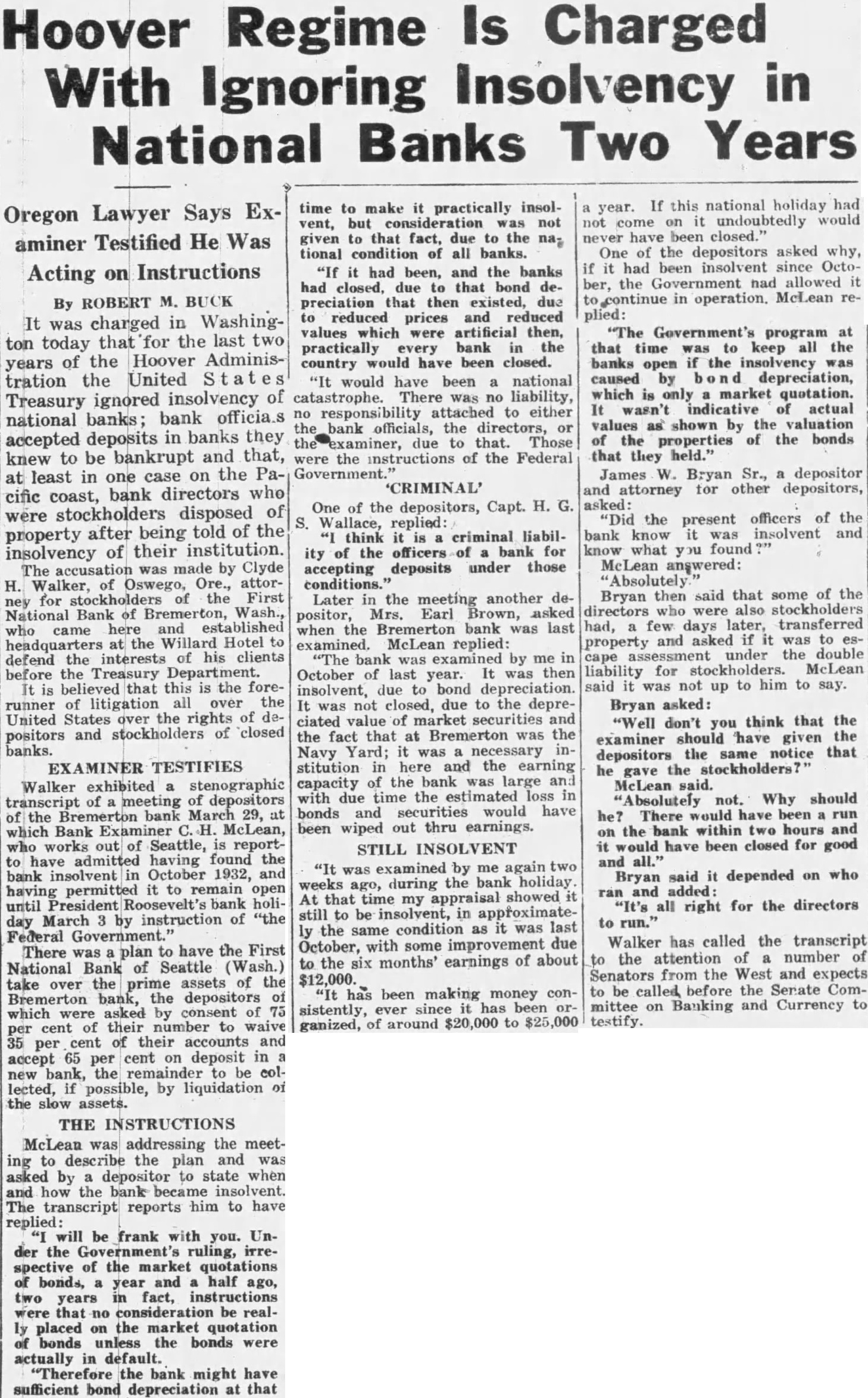

Hoover Regime Is Charged With Ignoring Insolvency in National Banks Two Years Oregon Lawyer Says Examiner Testified He Was Acting on Instructions By ROBERT M. BUCK It was charged in Washington today that for the last two years of the Hoover Administration the United States Treasury ignored insolvency of national banks; bank officia.s accepted deposits in banks they knew to be bankrupt and that, at least in one case on the Pacific coast, bank directors who were stockholders disposed of property after being told of the insolvency of their institution. The accusation was made by Clyde H. Walker, of Oswego, Ore., attorney for stockholders of the First National Bank of Bremerton, Wash., who came here and established headquarters at the Willard Hotel to defend the interests of his clients before the Treasury Department. It is believed that this is the forerunner of litigation all over the United States over the rights of depositors and stockholders of closed banks. EXAMINER TESTIFIES Walker exhibited a stenographic transcript of a meeting of depositors of the Bremerton bank March 29, at which Bank Examiner C. H. McLean, who works out of Seattle, is reportto have admitted having found the bank insolvent in October 1932, and having permitted it to remain open until President Roosevelt's bank holiday March 3 by instruction of "the Federal Government." There was a plan to have the First National Bank of Seattle (Wash.) take over the prime assets of the Bremerton bank, the depositors of which were asked by consent of 75 per cent of their number to waive 35 per cent of their accounts and accept 65 per cent on deposit in a new bank, the remainder to be collected, if possible, by liquidation of the slow assets. THE INSTRUCTIONS McLean was addressing the meeting to describe the plan and was asked by a depositor to state when and how the bank became insolvent. The transcript reports him to have replied: "I will be frank with you. Under the Government's ruling, irrespective of the market quotations of bonds, a year and a half ago, two years in fact, instructions were that no consideration be really placed on the market quotation of bonds unless the bonds were actually in default. "Therefore the bank might have sufficient bond depreciation at that time to make it practically insolvent, but consideration was not given to that fact, due to the national condition of all banks. "If it had been, and the banks had closed, due to that bond depreciation that then existed, due to reduced prices and reduced values which were artificial then, practically every bank in the country would have been closed. "It would have been a national catastrophe. There was no liability, no responsibility attached to either the bank officials, the directors, or the examiner, due to that. Those were the instructions of the Federal Government.' 'CRIMINAL' One of the depositors, Capt. H. G. S. Wallace, replied: "I think it is a criminal liability of the officers of a bank for accepting deposits under those conditions." Later in the meeting another depositor, Mrs. Earl Brown, asked when the Bremerton bank was last examined. McLean replied: "The bank was examined by me in October of last year. It was then insolvent, due to bond depreciation. It was not closed, due to the depreciated value of market securities and the fact that at Bremerton was the Navy Yard; it was a necessary institution in here and the earning capacity of the bank was large and with due time the estimated loss in bonds and securities would have been wiped out thru earnings. STILL INSOLVENT "It was examined by me again two weeks ago, during the bank holiday. At that time my appraisal showed it still to be insolvent, in approximately the same condition as it was last October, with some improvement due to the six months' earnings of about $12,000. "It has been making money consistently, ever since it has been organized, of around $20,000 to $25,000 a year. If this national holiday had not come on it undoubtedly would never have been closed." One of the depositors asked why, if it had been insolvent since October, the Government had allowed it to continue in operation. McLean replied: "The Government's program at that time was to keep all the banks open if the insolvency was caused by bond depreciation, which is only a market quotation. It wasn't indicative of actual values as shown by the valuation of the properties of the bonds that they held." James W. Bryan Sr., a depositor and attorney for other depositors, asked: "Did the present officers of the bank know it was insolvent and know what you found McLean answered: "Absolutely." Bryan then said that some of the directors who were also stockholders had, a few days later, transferred property and asked if it was to escape assessment under the double liability for stockholders. McLean said it was not up to him to say. Bryan asked: "Well don't you think that the examiner should have given the depositors the same notice that he gave the stockholders?' McLean said. "Absolutely not. Why should he? There would have been a run on the bank within two hours and it would have been closed for good and all." Bryan said it depended on who ran and added: "It's all right for the directors to run." Walker has called the transcript to the attention of a number of Senators from the West and expects to be called before the Senate Committee on Banking and Currency to testify.