Article Text

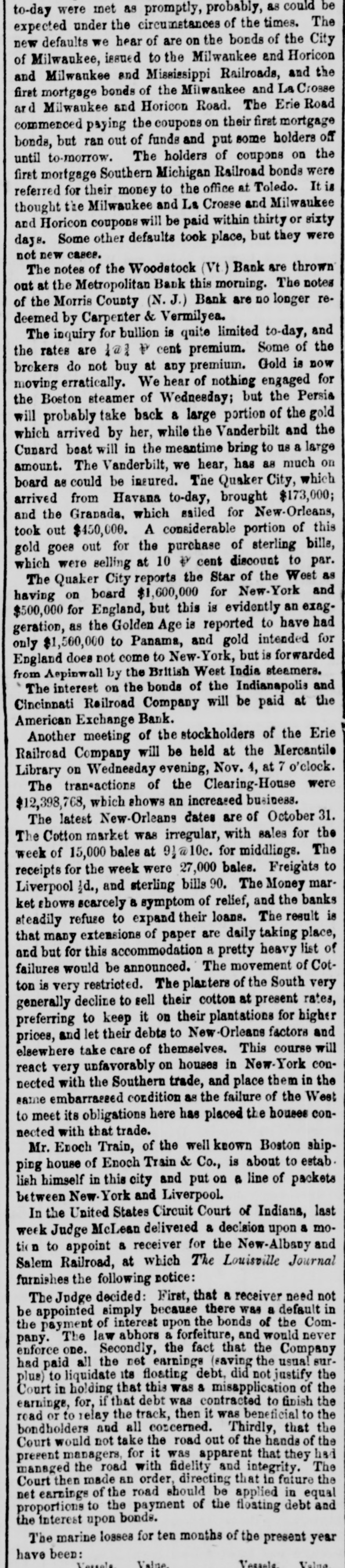

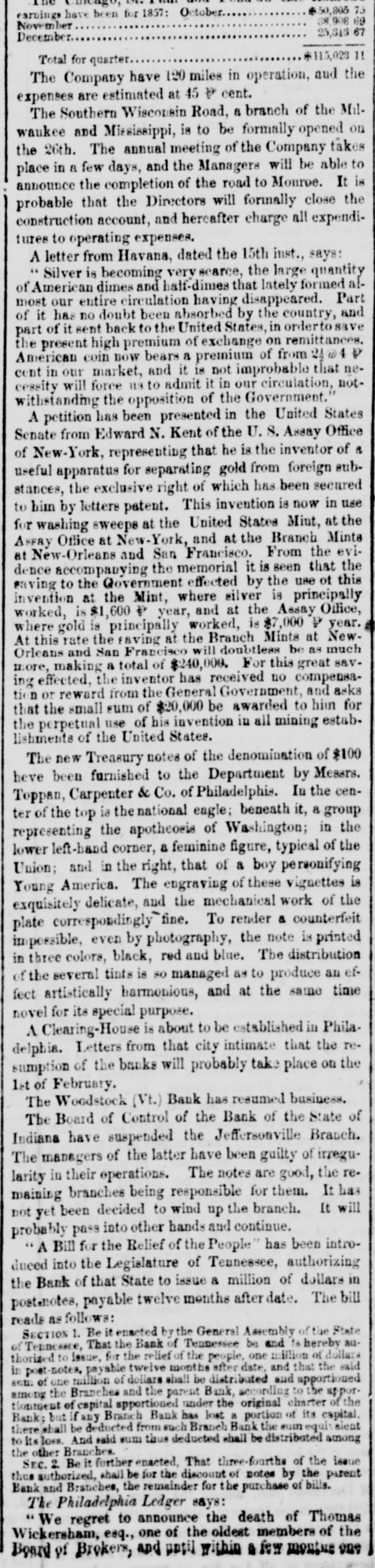

to-day were met as promptly, probably, as could be expected under the circumstances of the times. The new defaults we hear of are on the bonds of the City of Milwaukee, issued to the Milwankee and Horicon and Milwankee and Mississippi Railroads, and the first mortgage bonds of the Milwaukee and La Crosse ard Milwaukee and Horicon Road. The Erie Road commenced paying the coupons on their first mortgage bonds, but ran out of funds and put some holders off until to-morrow. The holders of coupons on the first mortgage Southern Michigan Railroad bonds were referred for their money to the office at Toledo. It is thought the Milwaukee and La Crosse and Milwaukee and Horicon coupons will be paid within thirty or sixty days. Some other defaults took place, but they were not new cases. The notes of the Woodstock (Vt.) Bank are thrown out at the Metropolitan Bank this morning. The notes of the Morris County (N. J.) Bank are no longer redeemed by Carpenter & Vermilyea. The inquiry for bullion is quite limited to-day, and the rates are h@q P cent premium. Some of the brokers do not buy at any premium. Gold is now moving erratically. We hear of nothing engaged for the Boston steamer of Wednesday; but the Persia will probably take back a large portion of the gold which arrived by her, while the Vanderbilt and the Cunard beat will in the meantime bring to us a large amount. The Vanderbilt, we hear, has 88 much on board as could be insured. The Quaker City, which arrived from Havana to-day, brought $173,000; and the Granada, which sailed for New-Orleans, took out $450,000. A considerable portion of this gold goes out for the purchase of sterling bills, which were selling at 10 P cent discount to par. The Quaker City reports the Star of the West as having on board $1,600,000 for New-York and $500,000 for England, but this is evidently an exaggeration, as the Golden Age is reported to have had only $1,500,000 to Panama, and gold intended for England does not come to New-York, but is forwarded from Aspinwall by the British West India steamers. The interest on the bonds of the Indianapolis and Cincinnati Reilroad Company will be paid at the American Exchange Bank. Another meeting of the stockholders of the Erie Railroad Company will be held at the Mercantile Library on Wednesday evening, Nov. 4, at 7 o'clock. The transactions of the Clearing-House were $12,398,768, which shows an increased business. The latest New-Orleans dates are of October 31. The Cotton market was irregular, with sales for the week of 15,000 bales at 9}@10c. for middlings. The receipts for the week were 27,000 bales. Freights to Liverpool 1d., and sterling bills 90. The Money market shows scarcely a symptom of relief, and the banks steadily refuse to expand their loans. The result is that many extensions of paper are daily taking place, and but for this accommodation a pretty heavy list of failures would be announced. The movement of Cotton is very restricted. The planters of the South very generally decline to sell their cotton at present rates, preferring to keep it on their plantations for higher prices, and let their debts to New-Orleans factors and elsewhere take care of themselves. This course will react very unfavorably on houses in New-York connected with the Southern trade, and place them in the same embarrassed condition as the failure of the West to meet its obligations here has placed the houses connected with that trade. Mr. Enoch Train, of the well known Boston shipping house of Enoch Train & Co., is about to estab. lish himself in this city and put on a line of packets between New.York and Liverpool. In the United States Circuit Court of Indiana, last week Judge McLean delivered & decision upon a motic n to appoint a receiver for the New-Albany and Salem Railroad, at which The Louisville Journal furnishes the following notice: The Judge decided: First, that a receiver need not be appointed simply because there was a default in the payment of interest upon the bonds of the Company. The law abhors a forfeiture, and would never enforce one. Secondly, the fact that the Company had paid all the net earnings (saving the usual surplus) to liquidate its floating debt, did not justify the Court in holding that this was a misapplication of the earnings, for, if that debt was contracted to finish the road or to relay the track, then it was beneficial to the bondholders and all concerned. Thirdly, that the Court would not take the road out of the hands of the present managers, for it was apparent that they had managed the road with fidelity and integrity. The Court then made an order, directing that in future the net earnings of the road should be applied in equal proportions to the payment of the floating debt and the interest upon bonds. The marine losses for ten months of the present year have been: Vessels. Value. Value, Vessele,