Article Text

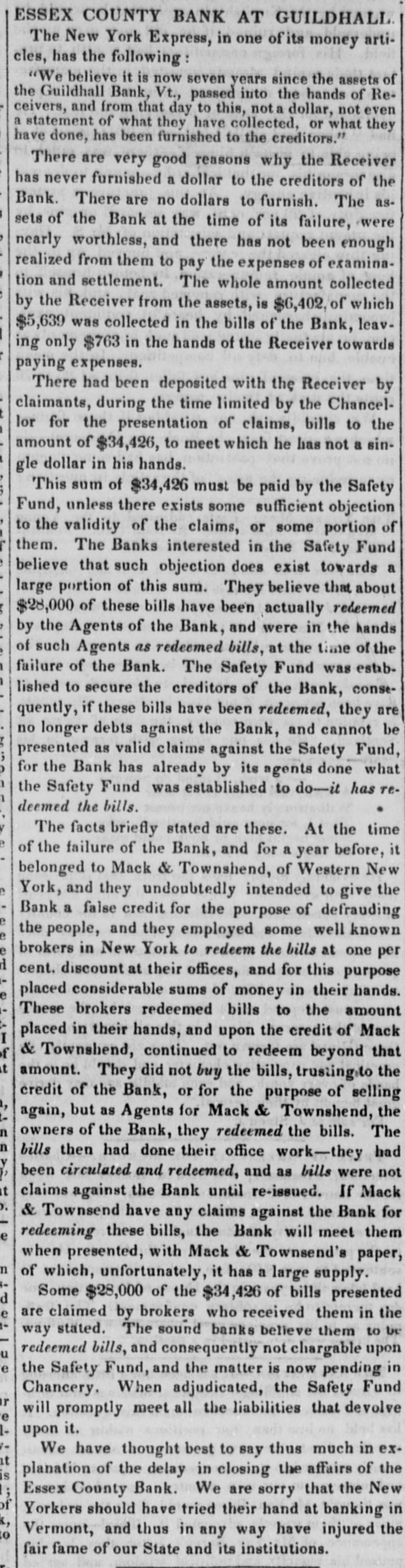

ESSEX COUNTY BANK AT GUILDHALL The New York Express, in one of its money articles, has the following "We believe it is now seven years since the assets of the Guildhall Bank, Vt., passed into the hands of Receivers, and from that day to this, not a dollar, not even a statement of what they have collected, or what they have done, has been furnished to the creditors." There are very good reasons why the Receiver has never furnished a dollar to the creditors of the Bank. There are no dollars to furnish. The assets of the Bank at the time of its failure, were nearly worthless, and there has not been enough realized from them to pay the expenses of examination and settlement. The whole amount collected by the Receiver from the assets, is $6,402, of which $5,639 was collected in the bills of the Bank, leaving only $763 in the hands of the Receiver towards paying expenses. There had been deposited with the Receiver by claimants, during the time limited by the Chancellor for the presentation of claims, bills to the amount of $34,426, to meet which he has not a single dollar in his hands. This sum of $34,426 must be paid by the Safety Fund, unless there exists some sufficient objection to the validity of the claims, or some portion of them. The Banks interested in the Safety Fund a believe that such objection does exist towards large portion of this sum. They believe that about $28,000 of these bills have been actually redeemed by the Agents of the Bank, and were in the hands of such Agents as redeemed bills, at the time of the failure of the Bank. The Safety Fund was estab lished to secure the creditors of the Bank, consequently, if these bills have been redeemed, they are no longer debts against the Bank, and cannot be presented as valid claims against the Safety Fund, for the Bank has already by its agents done what the Safety Fund was established to do-it has redeemed the bills. The facts briefly stated are these. At the time of the failure of the Bank, and for a year before, it belonged to Mack & Townshend, of Western New e York, and they undoubtedly intended to give the Bank a false credit for the purpose of defrauding the people, and they employed some well known brokers in New York to redeem the bills at one per d cent. discount at their offices, and for this purpose placed considerable sums of money in their hands. e These brokers redeemed bills to the amount placed in their hands, and upon the credit of Mack I of & Townshend, continued to redeem beyond that t amount. They did not buy the bills, trustingito the credit of the Bank, or for the purpose of selling again, but as Agents for Mack & Townshend, the owners of the Bank, they redeemed the bills. The bills then had done their office work-they had been circulated and redeemed, and as bills were not t claims against the Bank until re-issued. If Mack . & Townsend have any claims against the Bank for redeeming these bills, the Bank will meet them e when presented, with Mack & Townsend's paper, n of which, unfortunately, it has a large supply. Some $28,000 of the $34,426 of bills presented d e are claimed by brokers who received them in the way stated. The sound banks believe them to be redeemed bills, and consequently not chargable upon u e the Safety Fund, and the matter is now pending in Chancery. When adjudicated, the Safety Fund r will promptly meet all the liabilities that devolve e upon it. We have thought best to say thus much in exit planation of the delay in closing the affairs of the is ; Essex County Bank. We are sorry that the New of Yorkers should have tried their hand at banking in k, Vermont, and thus in any way have injured the to fair fame of our State and its institutions.