Click image to open full size in new tab

Article Text

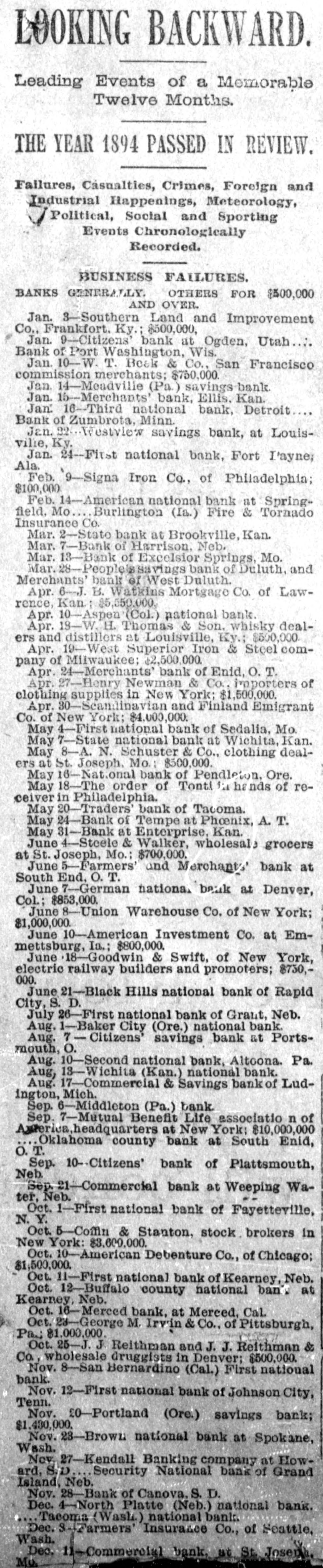

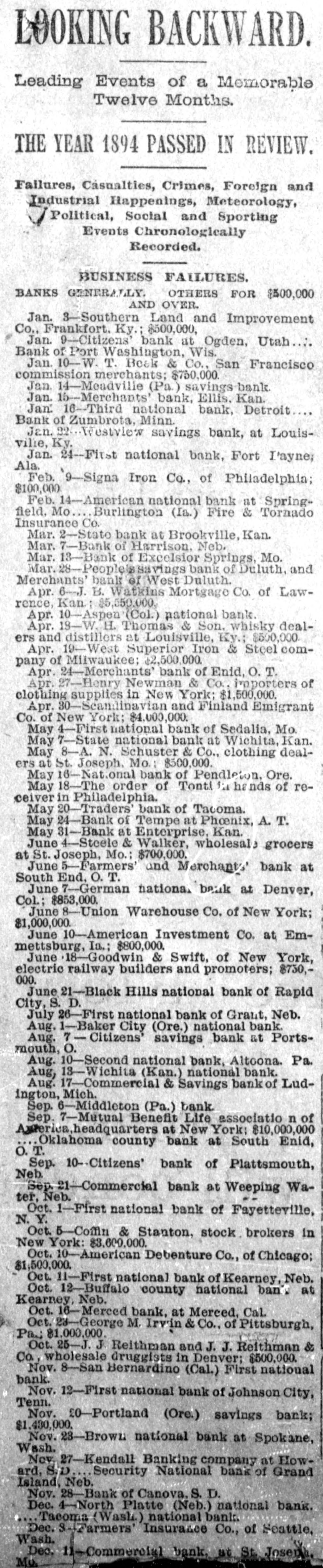

LOOKING BACKWARD. Leading Events of a Memorable Twelve Months. THE YEAR 1894 PASSED IN REVIEW. Failures, Casualties, Crimes, Foreign and Industrial Happenings, Meteorology, Political, Social and Sporting Events Chronologically Recorded. BUSINESS FAILURES. BANKS GENERALLY. OTHERS FOR $500,000 AND OVER. Jan. 3-Southern Land and Improvement Co., Frankfort. Ky.; $500,000, Jan. 9-Citizens' bank at Ogden, Utah Bank of Port Washington, Wis. Jan. 10-W. T. Beek & Co., San Francisco commission merchants; $750,000. Jan. 14-Mendville (Pa.) savings bank Jan. 16-Merchants' bank, Ellis. Kan. Jan. 16-Third national bank, Detroit Bank of Zumbrota, Minn. Jan. 324 Westview savings bank, at Louisvilie, Ky. Jan. 24-First national bank, Fort Payne; Ala. Feb. 9-Signa Iron Co., of Philadelphia; $100,000 Feb. 14-American national bank at Springfield, Mo Burlington (Ia.) Fire & Tornado Insurance Co. Mar. 2-State bank at Brookville, Kan. Mar. 7-Bank of Harrison, Neb. Mar. 13-Bank of Excelsior Springs, Mo. Mar.28--Peoplelssavings bank of Duluth, and Merchants' bank of West Duluth. Apr. 6--J. B. Watkins Mortgage Co. of Lawrence, Kan: $5,550,000, Apr. 10-Aspen (Col.) national bank. Apr. 18-W. Thomas & Son. whisky dealers and distillers at Louisville, Ky.; $500,000. Apr. 19-West Superior Iron & Steel company of Milwaukee: $2,500,000. Apr. 24-Merchants bank of Enid, O. T. Apr. 27-Henry Newman & Co., importers of clothing supplies in New York: $1,500,000. Apr. 30-Scandinavian and Finland Emigrant Co. of New York; $4,000,000. May 4-First national bank of Sedalia, Mo. May 7-State national bank at Wichita, Kan. May 8-A. N. Schuster & Co., clothing dealers at St. Joseph, Mo.: $500,000. May 16-National bank of Pendleton, Ore. May 18-The order of Tonti to ha nds of receiver in Philadelphia. May 20-Traders' bank of Tacoma. May 24-Bank of Tempe at Phoenix, A. T. May 31-Bank at Enterprise, Kan. June 4-Steele & Walker, wholesale grocers at St. Joseph, Mo.: $700,000. June -Farmers' and Merchants' bank at South End. O. T. June German national bank at Denver, Col: $853,000. June 8-Union Warehouse Co. of New York; $1,000,000. June 10-American Investment Co. at Emmettsburg, In.: $800,000. June 18-Goodwin & Swift, of New York, electric railway builders and promoters; $750,000. June 21-Black Hills national bank of Rapid City, S. D. July 26-First national bank of Grant, Neb. Aug. 1-Baker City (Ore.) national bank. Aug. 7 Citizens' savings bank at Portsmouth, O. Aug. 10-Second national bank, Altoona. Pa. Aug, 18-Wichita (Kan.) national bank. Aug. 17-Commercial & Savings bankof Ludington, Mich. Sep. 6-Middleton (Pa.) bank. Sep. 7-Mutual Benefit Life associatio n of America ,headquarters at New York: $10,000,000 Oklahoma county bank at South Enid, O.T. Sep. 10-Citizens' bank of Plattsmouth, Neb. Sep. 21-Commercial bank at Weeping Water, Neb. Oct. 1-First national bank of Fayetteville, N.Y. Oct. 5-Coffin & Stanton, stock. brokers in New York: $3,600,000. Oct. 10-American Debenture Co., of Chicago; $1,500,000. Oct. 11-First national bank of Kearney, Neb. Oct. 12-Buffalo county national bank at Kearney, Neb. Oct. 16-Merced bank, at Merced, Cal. Oct. 23-George M. Irvin & Co., of Pittsburgh, Pai $1,000,000. Oct. 25-J. J Reithman and J. J. Reithman & Co. wholesale druggists in Denver; $500,000. Nov. 8-San Bernardino (Cal.) First national bank. Nov. 12-First national bank of Johnson City, Tenn. Nov. 10-Portland (Ore.) savings bank; $1,430,000. Nov. 23-Brown national bank at Spokane, Wash. Nov. 27-Kendall Banking company at Howard, S.D. Security National bank of Grand Island, Neb. Nov. 28-Bank of Canova, S. D. Dec. 4-North Platte (Neb.) national bank. Tacoma (Wash.) national bank. Dec. S-Farmers' Insurance Co., of Seattle, Wash. Dec. 11-Commercial bank, at St. Joseph, Mo.