Click image to open full size in new tab

Article Text

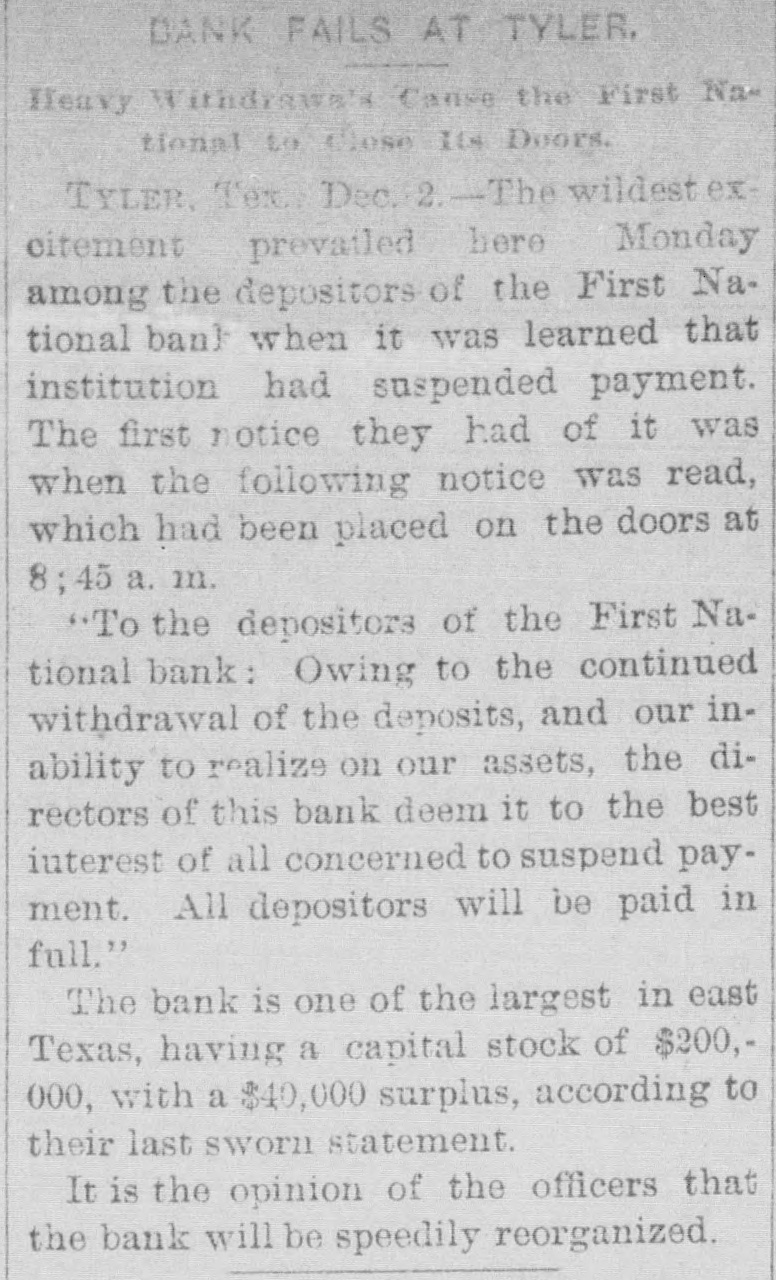

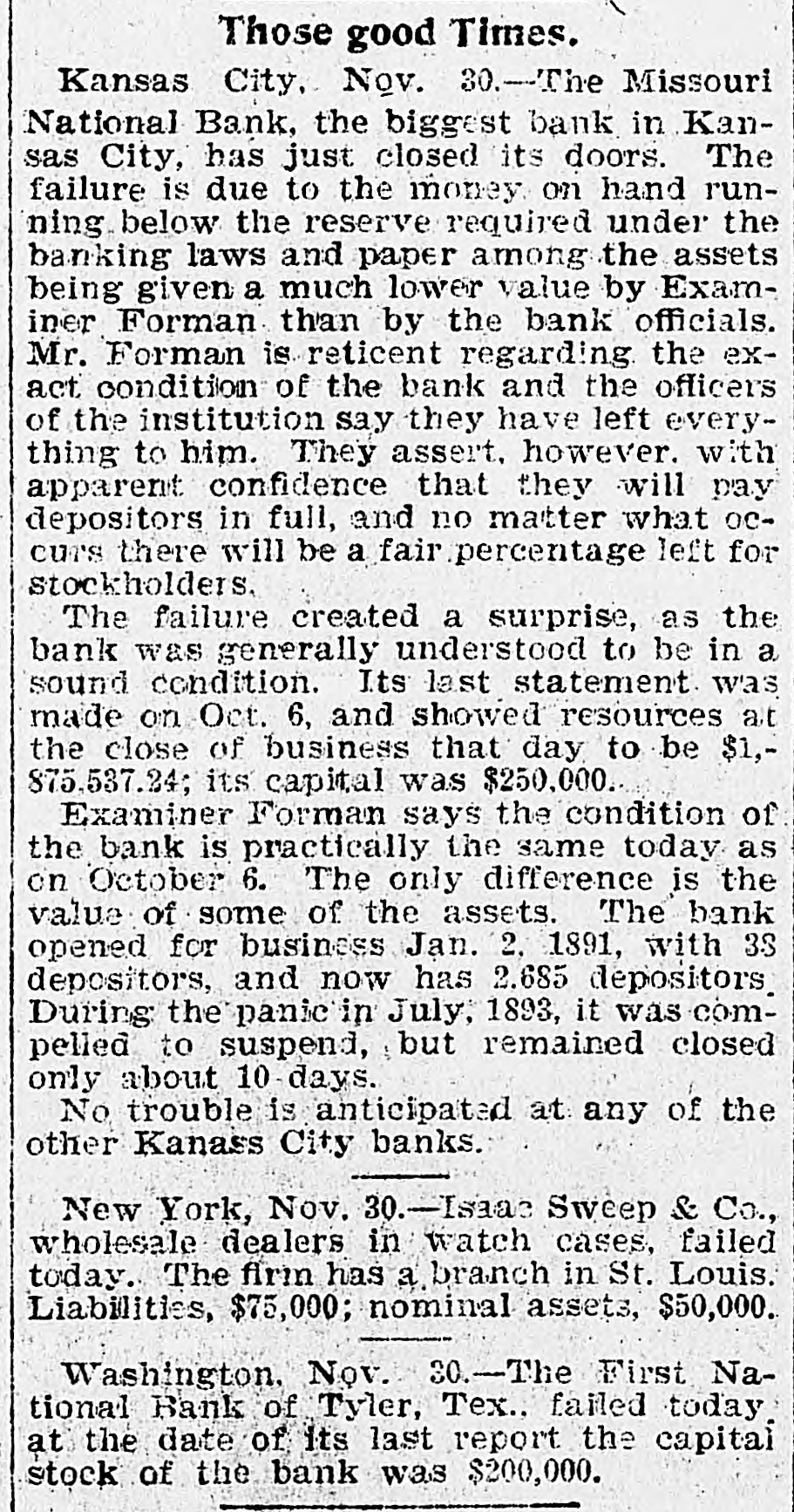

to mas am JOI Consionan R Su 46, or $17,601,977 less than during the preceding year. The public debt cutisuieDu SUM 1,676, 120,983 on June 30, 1895. Henry Powers, aged 33 years, a farmer iving near Marion, O., killed his wife nd then took his OWL life while temorarily insane. The Citizens' bank of Midlothian, Tex., has suspended business. W. E. Coe, county treasurer, was fataly shot by burglars in his office at Dalas. Tex. and robbed of $6,000. The passenger steamer City of Kalmazoo was burned at South Haven. Mich., and Robert Van Ostrand. Joseph Lang and Miss Rosa Germs perished in he flames. An immense ice gorge 30 feet high formed across the Chippewa river beow Chippewa Falls, Wis., and farms nd farm buildings along six miles of the Chippewa valley were under water. Zenas Varney's carriage factory in St. Louis was damaged by fire to the exent of $100,000. C. M. Blaine. aged 52. chaplain of the army post at Fort Ringgold, Tex., and is 11-year-old daughter were burned o death in their home. Mr. Blaine was 1 cousin of the late James G. Blaine. The next annual encampment of the G. A. R. will be held in Buffalo, N. Y., beginning August 23. The First national bank of Tyler. Tex., closed its doors with deposits of '000'183' The house of Sam Henderson (colored). near Conway, Ark., was burned nd five of his children perished in the lames. The desertions of sailors from the havy have left some of the ships with hardly sufficient men to man the vessels. George Edwin Dean. aged 12 years, nd John Selcer, aged nine, were Irowned at Des Moines, la., while skatng. The Missouri national bank of Kanas City closed its doors with deposits '000'121'1$ IC The richest and most extensive discovery of rock phosphate in the history f the world has been made in Tennesee in the counties of Davidson. Williamson. Rutherford and Maury. As the result of political unimosity )boothers white 'a "I pun 'A '1 cilled at Bethany, S. C., by L. J. Wiliams. a prominent politician. The report of Mr. Kimball. the general superintendent of the life-saving ervice, for the year ending June 30. hows that the crews saved and assisted o save 472 vessels, valued. with their argoes, at $4,853,110. The cost of mainlaining the service for the year was $1.United States Register Tillman, of the reasury, in his annual report states hat during the year there were issued 43,476 bonds of the value of $258,595. 50. and during the same period there vere cancelled 64,579 bonds of the value " Morello, the once three-year-old king of the turf, died near San Francisco. In his best days he was valued at $100,000. The two 16-year-old twin daughters of Riley Taft. of Orange, Mich., were nstantly killed at a railway crossing. A bill has been introduced in the Georgia legislature prohibiting the playing of football in the state; also prohibiting the sale of cigarettes or cigarette paper. The public debt statement issued on the 1st showed that the debt increased $8,270,203 during the month of November. The cash balance in the treasury was $835,961,529. The total debt, less the cash balance in the treasury, amounts to $1,221,126,257. The German-Ameriean bank at Portage. Wis., made an assignment for the