Click image to open full size in new tab

Article Text

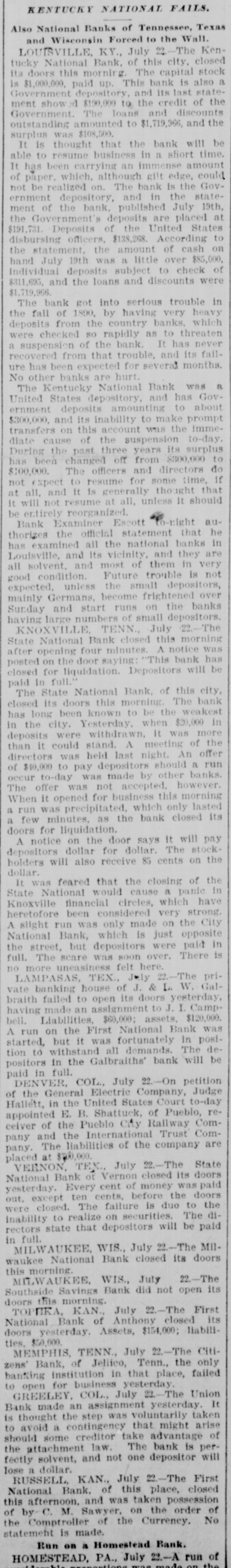

Also National Banks of Tennessee, Texas and Wisconsin Forced to the Wall. LOUISVILLE, KY., July 22.-The Kentucky National Bank, of this city, closed its doors this morning. The capital stock is $1,000,000. paid up. This bank is also a Government depository, and its last statement show $190,000 to the credit of the Government The loans and discounts outstanding amounted to $1,719,366, and the surplus was $108,500. It is thought that the bank will be able to resume business in a short time. It has been carrying an immense amount of paper, which, although gilt edge, could not be realized on. The bank is the Government depository, and in the statement of the bank. published July 19th, the Government's deposits are placed at $191,731. Deposits of the United States disbursing officers, $138,268. According to the statement, the amount of cash on hand July 19th was a little over $85,000, Individual deposits subject to check of $311,693. and the loans and discounts were $1,719,966. The bank got into serious trouble in the fall of 1890, by having very heavy deposits from the country banks. which were checked so rapidly as to threaten a suspension of the bank. It has never recovered from that trouble, and its failure has been expected for several months. No other banks are hurt. The Kentucky National Bank was a United States depository, and has Government deposits amounting to about $300,000, and its inability to make prompt transfers on this account was the immediate cause of the suspension to-day. During the past three years its surplus has been changed off from $300,000 to $100,000. The officers and directors do not expect to resume for some time, if at all, and it is generally thought that it will not resume at all, unless it should be entirely reorganized. ⑉ Bank Examiner Escott b-right authorizes the official statement that he has examined all the national banks in Louisville, and its vicinity, and they are all solvent. and most of them in very good condition. Future trouble is not expected, unless the small depositors, mainly Germans, become frightened over Sunday and start runs on the banks having large numbers of small depositors. KNOXVILLE, TENN July 22.-The State National Bank closed this morning after opening four minutes. notice was posted on the door saying: "This bank has closed for liquidation. Depositors will be paid in full. The State National Bank, of this city, closed its doors this morning. The bank has long been known to be the weakest in the city. Yesterday, when $20,000 in deposits were withdrawn. it was more than it could stand. A meeting of the directors was held last night. An offer of $40,000 to pay depositors should a run occur to-day was made by other banks. The offer was not accepted, however. When it opened for business this morning a run was precipitated, which only lasted a few minutes, as the bank closed its doors for liquidation. A notice on the door says it will pay depositors dollar for dollar. The stock holders will also receive 85 cents on the dollar. It was feared that the closing of the State National would cause a panic in Knoxville financial circles, which have heretofore been considered very strong. A slight run was only made on the City National Bank, which is just opposite the street, but depositors were paid in full. The scare was soon over. There is no more uneasiness felt here. LAMPASAS, TEX., July 22. The private banking house of J. & L W. Galbraith failed to open its doors yesterday, having made an assignment to Camp bell. Liabilities, $60,000; assets, $120,000. A run on the First National Bank was started, but it was fortunately in position to withstand all demands. The depositors in the Galbraiths' bank will be paid in full. DENVER, COL., July 22.-On petition of the General Electric Company, Judge Hallett, in the United States Court to-day appointed E. B. Shattuck, of Pueblo, receiver of the Pueblo City Railway Company and the International Trust Company. The liabilities of the company are placed at $700,000. VERNON, TEX. July 22.-The State National Bank or Vernon closed its doors yesterday. Every cent of money was paid out. except ten cents, before the doors were closed. The failure is due to the inability to realize on securities. The directors state that depositors will be paid in full. MILWAUKEE, WIS. July -The Milwaukee National Bank closed its doors this morning. MILWAUKEE, WIS., July 22.-The Southside Savings Bank did not open its doors this morning. TOPUKA, KAN., July -The First National Bank of Anthony closed its doors yesterday. Assets, $154,000; liabilities, $50,000. MEMPHIS, TENN., July 22.-The Citizens' Bank, of Jellico, Tenn., the only banking institution in that place, failed to open for business yesterday. GREELEY, COL. July 22. The Union Bank made an assignment yesterday. It is thought the step was voluntarily taken to avoid a contingency that might arise should some creditor take advantage of the attachment law. The bank is perfeetly solvent, and not one depositor will lose a dollar. RUSSELL KAN., July 22 The First National Bank, of this place, closed this afternoon, and was taken possession of by C. M. Sawyer, on the order of the Comptroller of the Currency. No statement is made. Run on a Homestead Bank. HOMESTEAD, PA., July 22.-A run of mada on the