Article Text

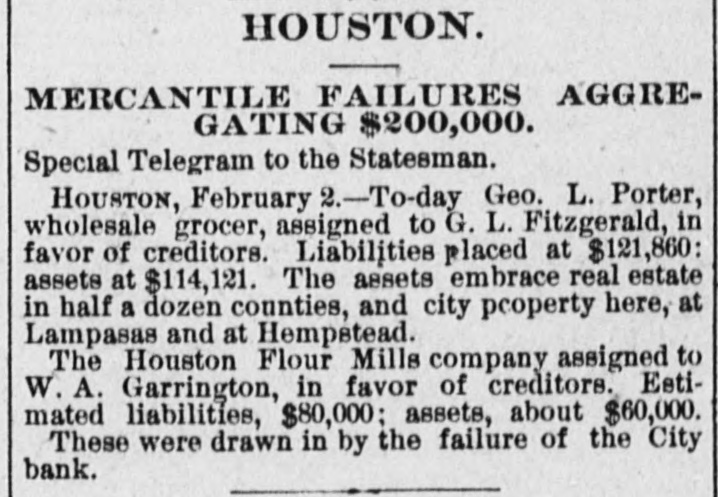

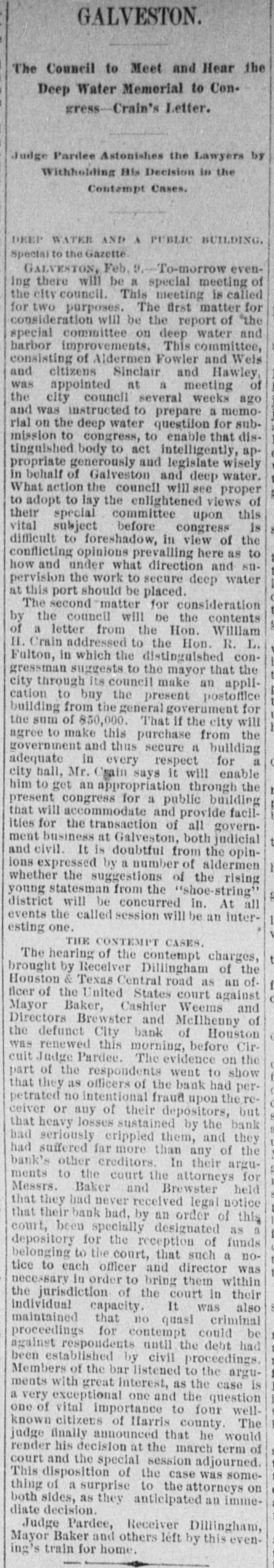

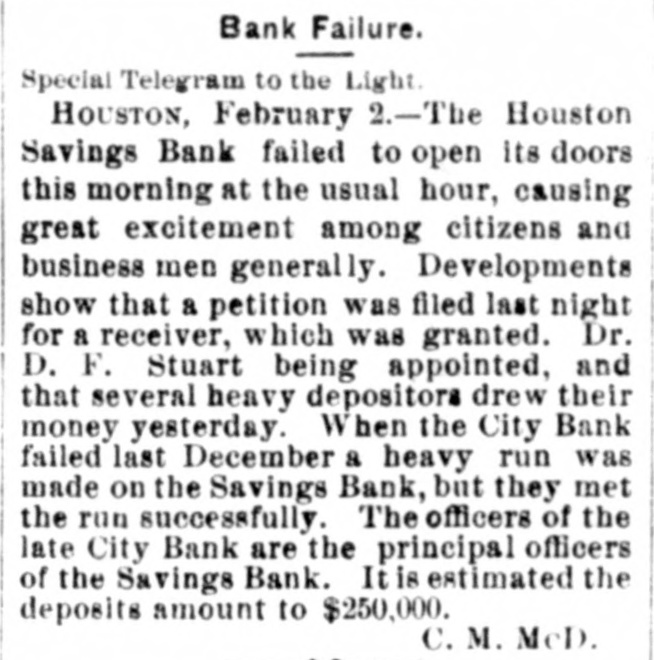

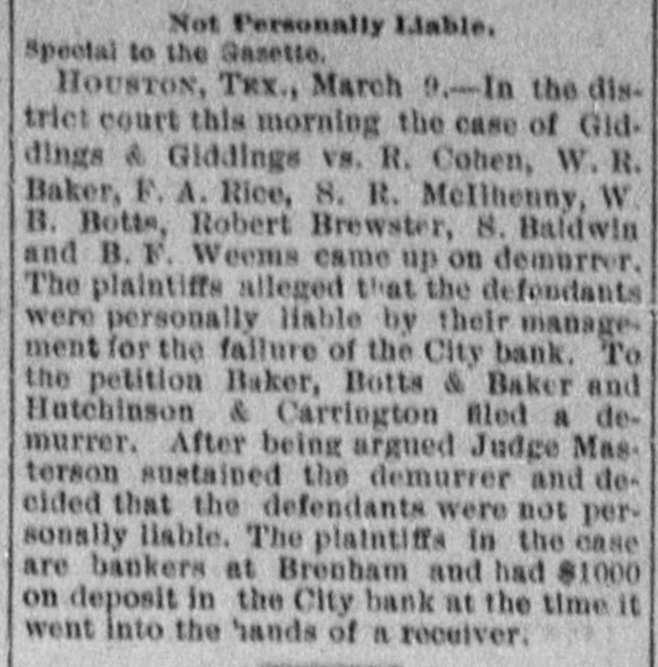

NEWS OF THE WORLD. A Bank Fails at Houston Texas, A MILLION DOLLARS. FOR The Troubles of a Bavarian Who Proved too Attractive to the Fair Sex. Special to the Herald by the Associated Press. HOUSTON, Tex., December 19.-Con siderable excitement was occasioned here this afternoon by the failure of the City Bank of Houston, one of the oldest financial institutions in the city and having a pa.d up capital of $500,000. The doors were closed at 1 o'clock, a notice being posted thereon that the bank had suspended payment pending an application for the appointment of a receiver. At 2:30 P. M. Judge Materson, of the District Court, on a petition filed by the bank's attorney, granted an order appointing Benj. F. Weems, receiver, and that gentleman immediately qualified in bonds of $300,000. Hon. Wm. R. Baker, present Mayor of the city, is President of the bank and Benj. F. Weems, Cashier. While the failure caused some consternation throughout the city, and a large crowd gathered about the bank clamoring for their money, yet the sus. was no surprise to the Total liabilities the a million dollars. other generally. pension including banks capital and An stock, exact business of will statement the exceed bank, men, of the bank's affairs at the time of the suspension is not obtainable to-night, but the last statement made, August 7 1885, gave the assets and liabilities as follows: Loans and discounts, $614,939; stocks and bonds, $343,662; bank building and furniture, $74,566; cash on hand, $145,445; exchange, $62,558; total, $1,241,230. Liabilities-Capital stock, $500,000; demand deposits, $417,841; time deposits, $255,589; due other banks, $65,047; profits, $2753; total, $1,241,230. The above statement is believed to represent nearly the condition of the bank's finances at the time of the suspension. The bank has been losing money for years. Since the time of the failure of William J. Hutchins who was indebted to the bank in $350,000. As security they held liens upon Hutchius' hotel property, the Eureka mills and several va. cant lots. This property constantly depressed in value on the bank's hands, and finally became a source of expense instead of revenue. Owing to the fact that several members of the directory of the Houston Savings Bank are also officers in the suspended bank, e run was immediately inaugurated on the savings bank, but all claims were promptly met. The bank, however, closed its doors at 3 o'clock, the usual closing hour, with a long line of anxious depositors waiting to reach the paying teller's window. If the run is continued on Monday it is believed that the savings bank will be prepared to meet the exigency. The deposits of the broken bank will reach over $500,000. Many poor people were among the depositors.