Article Text

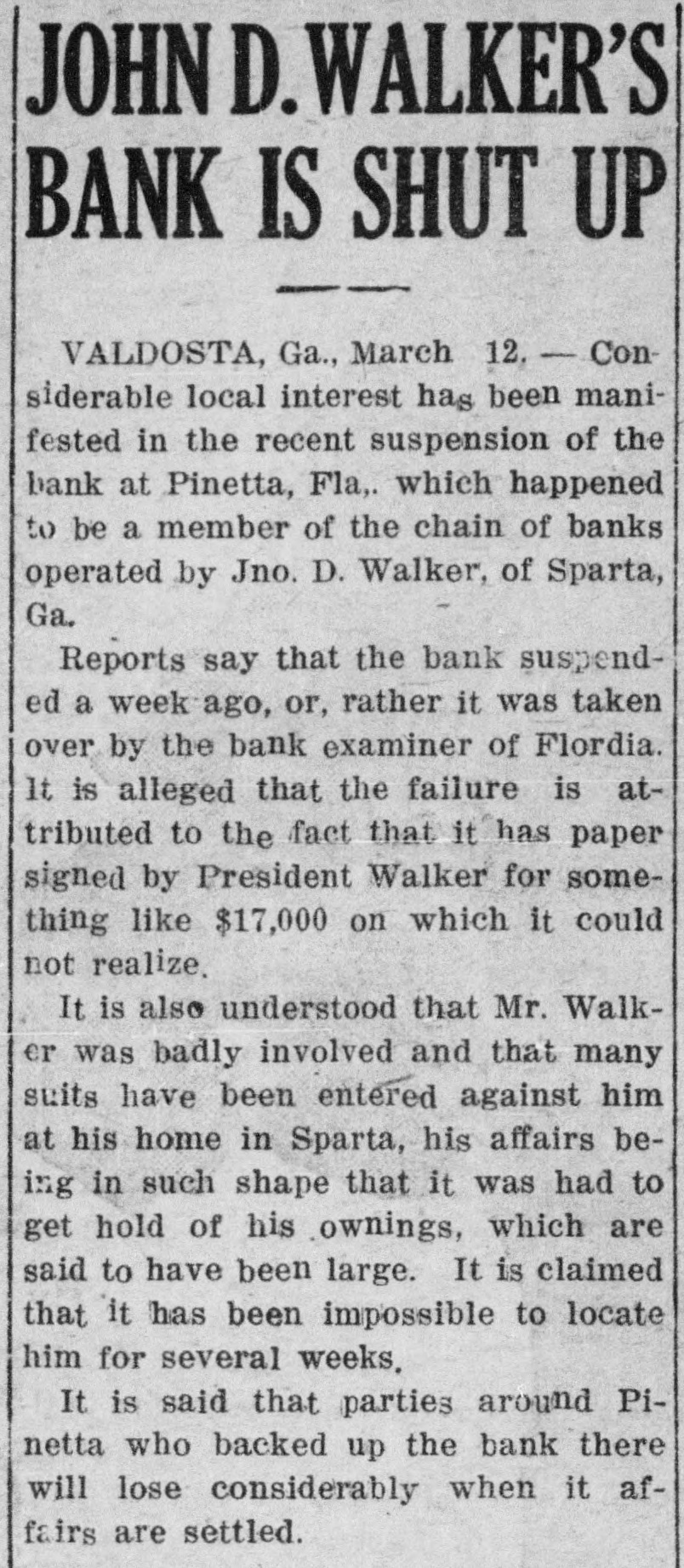

JOHN D.WALKER'S BANK IS SHUT UP VALDOSTA, Ga., March 12. - Considerable local interest has been manifested in the recent suspension of the bank at Pinetta, Fla,. which happened to be a member of the chain of banks operated by Jno. D. Walker, of Sparta, Ga. Reports say that the bank suspended a week ago, or, rather it was taken over by the bank examiner of Flordia. It is alleged that the failure is attributed to the fact that it has paper signed by President Walker for something like $17,000 on which it could not realize. It is also understood that Mr. Walker was badly involved and that many suits have been entered against him at his home in Sparta, his affairs being in such shape that it was had to get hold of his ownings, which are said to have been large. It is claimed that it has been impossible to locate him for several weeks. It is said that parties around Pinetta who backed up the bank there will lose considerably when it affairs are settled.