Article Text

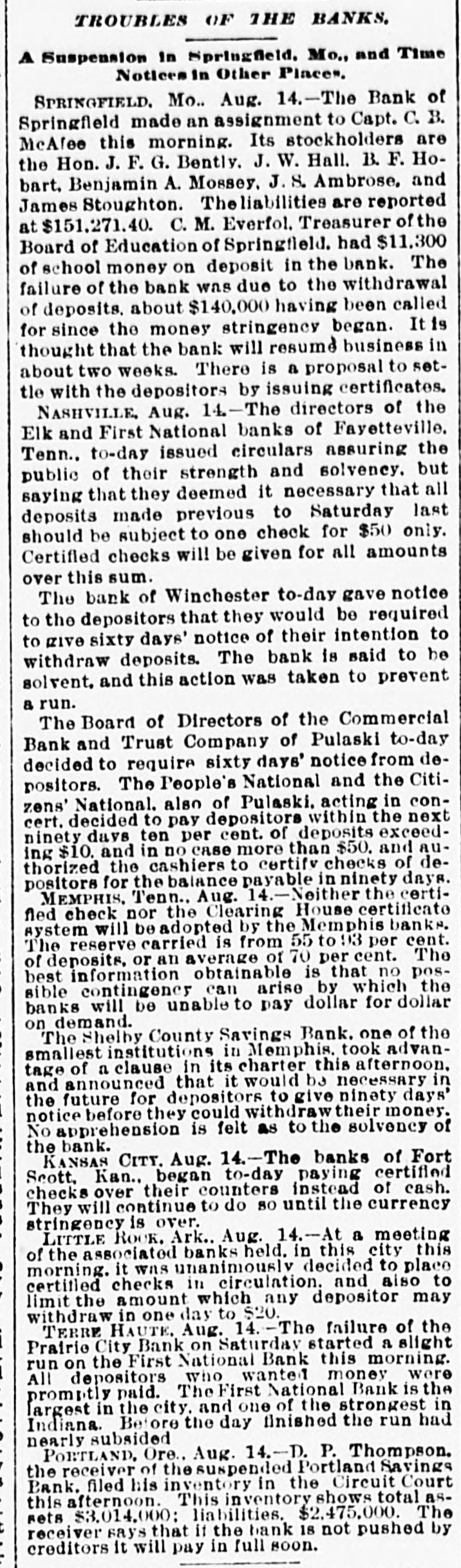

TROUBLES OF THE BANKS. A Suspension in Springfield, Mo., and Time Notices in Other Places. SPRINGFIELD. Mo.. Aug. 14.-The Bank of Springfield made an assignment to Capt. C. B. McAfee this morning. Its stockholders are the Hon. J. F. G. Bently. J. W. Hall. B. F. Hobart. Benjamin A. Mossey. J. S. Ambrose. and James Stoughton. The liabilities are reported at $151,271.40. C. M. Everfol. Treasurer of the Board of Education of Springfield. had $11,300 of school money on deposit in the bank. The failure of the bank was due to the withdrawal of deposits. about $140,000 having been called for since the money stringency began. It is thought that the bank will resume business in about two weeks. There is a proposal to settle with the depositors by issuing certificates. NASHVILLE, Aug. 14.-The directors of the Elk and First National banks of Fayetteville. Tenn., to-day issued circulars assuring the public of their strength and solvency. but saying that they deemed it necessary that all deposits made previous to Saturday last should be subject to one check for $50 only. Certified checks will be given for all amounts over this sum. The bank of Winchester to-day gave notice to the depositors that they would be required to give sixty days' notice of their intention to withdraw deposits. The bank is said to be solvent. and this action was taken to prevent a run. The Board of Directors of the Commercial Bank and Trust Company of Pulaski to-day decided to require sixty days' notice from depositors. The People's National and the Citizens' National. also of Pulaski. acting in concert. decided to pay depositors within the next ninety days ten per cent. of deposits exceeding $10. and in no case more than $50. and authorized the cashiers to certify checks of depositors for the balance payable in ninety days. MEMPHIS, Tenn.. Aug. 14.-Neither the certifled check nor the Clearing House certificate system will be adopted by the Memphis banks. The reserve carried is from 55 to 93 per cent. of deposits. or an average of 70 per cent. The best information obtainable is that no possible contingency can arise by which the banks will be unable to pay dollar for dollar on demand. The Shelby County Savings Bank. one of the smallest institutions in Memphis. took advantage of a clause in its charter this afternoon. and announced that it would be necessary in the future for depositors to give ninety days' notice before they could withdrawtheir money. No apprehension is felt as to the solvency of the bank. KANSAS CITY. Aug. 14.-The banks of Fort Scott. Kan., began to-day paying certified checks over their counters instead of cash. They will continue to do so until the currency stringency is over. LITTLE ROCK. Ark.. Aug. 14.-At a meeting of the associated banks held. in this city this morning. it was unanimously decided to place certified checks in circulation. and also to limit the amount which any depositor may withdraw in one day to $20. TERRE HAUTE. Aug. 14.-The failure of the Prairie City Bank on Saturday started a slight run on the First National Bank this morning. All depositors who wanted money were promptly paid. The First National Bank is the largest in the city. and one of the strongest in Indiana. Before the day finished the run had nearly subsided PORTLAND. Ore.. Aug. 14.-D. P. Thompson. the receiver of the suspended Portland Savings Bank. filed his inventory in the Circuit Court this afternoon. This inventory shows total assets $3,014,000: liabilities. $2,475,000. The receiver says that if the bank 18 not pushed by creditors it will pay in full soon.