Article Text

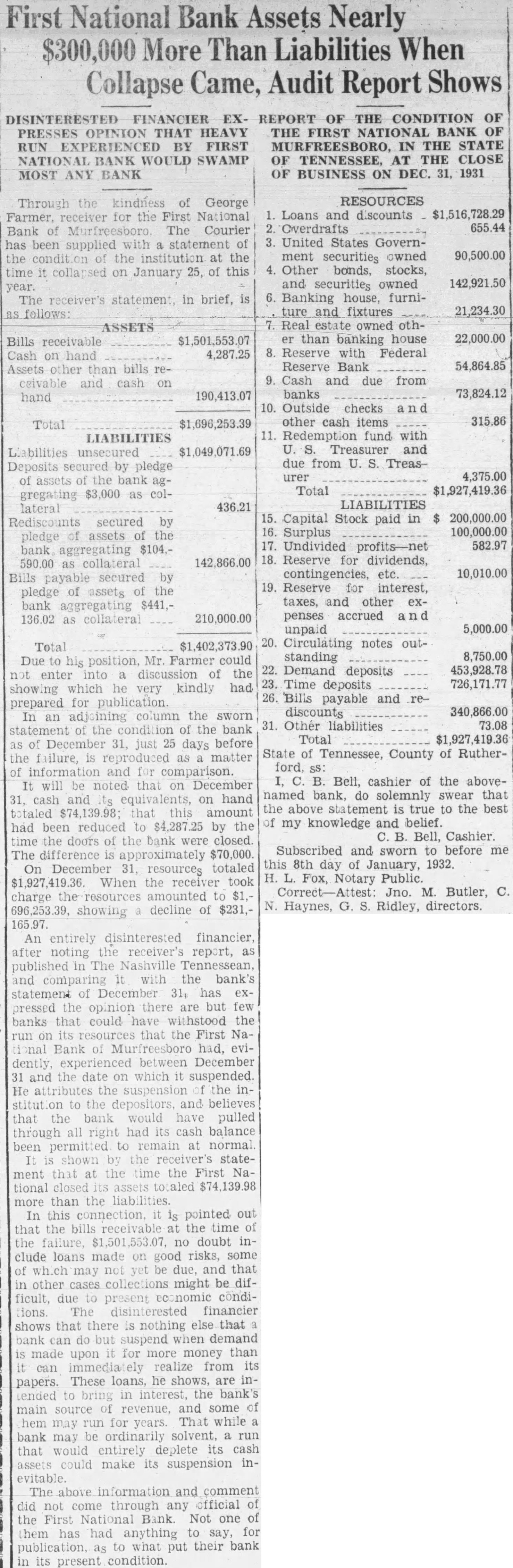

WORLD BULLETINS Wet Salesmen Visit Finns. 25.-(P)-A small army agents of foreign wine houses has invaded Helsingfors as consequence of the recent vote against continuation of prohibition. Many Return to Work. ALBANY N. Jan. 25. (AP) Seventeen hundred men returned to work in the west A1bany locomotive shops the New York Central railroad today. Jobs For 400 More. BUFFALO, N. Y., Jan. 25. (AP) The Consolidated Aircraft corporation announced today it would on additional employes within the next few months as result orders which assured full production during 1932. Run Closes Bank. MURFREESBORO, T n n., Jan. 25. The First National Bank of Murfreesboro, $200,000 capital, surplus closed today after brief run by depositors Edith Gould Gets Divorce. RENO, Nev., Jan. 25. The former Edith C. Gould was Carroll Livingston New York artist, on grounds of mental cruelty. She given enstody of three minor children. Sixty Chickens Martyred. CLARKSBURG. Tenn., Jan. 25 (UP)-Sixty chickens were martyred here when Mrs. Ray Ford lost her $125 diamond ring. Someone suggested chicken might have swallowed it and every of the flock was killed without result. The fowls were dressed and peddled from door to door. Night Club Gamblers Robbed. MIAMI, Fla., Jan. Hidden behind women's brown silk stockings tied around the lower part of their faces four armed men held up gamblers Hialeah night club early today and escaped with $600. Goat Swallows $10. CLARKSBURG, Tenn., Jan. 25 -(UP)-Henry Mathis' goat swallowed ten dollar bill he dropped. The bill was recovered in mortem performed immediately and was exchanged at bank Sheriff Must Answer. ALBANY. N. Y., Jan. 25 (UP)-Governor Roosevelt tonight announced he has called upon Sheriff Thomas M. Farley New York county to answer charges filed by Judge Samuel Seabury. council to the Hofstadter investigating committee. Flaming River Dammed. HARRODSBU RG, Ky. Jan. 25 Flaming oil that flowed down creck through Harrodsburg late today was dammed be. fore it reached the Standard Oil plant with 40,000 gallons of gasoline. Several oil tanks were stroyed and number of small houses. More Than 1,000 Killed. NEW YORK. Jan. The New York Sun said today unconfirmed private dispatches received from Salvador told of the killing over the of 1,000 more persons in the uprising laid to Roosevelt to See Smith. Franklin D Roosevelt and former Governor Alfred E. Smith are to have friendly meeting here February 12, was revealed tonight. The meeting was regarded the gesture of friendliness the Georgian Shares Estate. NEW YORK Jan. 25.-(P)Louis Bercksman of Augusta Ga., $25,000 from the es. tate of Samuel D. McGorkey, who died September 30. 1930 transfer tax appraisal filed today showed. Bay State Budget Cut. Governor Joseph B. Ely submitted his 1932 budget to the legislature and in it for per salary cut for all state employes $2.000 more annually. He estimated saving of $570,000 would result. May Reduce Reward. OKLAHOMA CITY Jan. Oklahoma may to reduce the 000 reward offered for the arrest of Charles Arthur (Pretty Boy) Floyd to $500 cause the state's extraordinary protection fund almost hausted Gov. illiam Murray indicated Floyd is charged with numerous bank robberies and killings. Smith Heads Marine Body. Berrish Smith, president of the national council of American shipbuilder, today was elected chairman of the executive board of the American marine standards committee. Board members for 1932 include Homer L. Ferguson. Newport News, Va Ilsley Estate $200,000. An estate valued at more than $200.000 listed in the will Mrs. Agnes Boeing Ilsley ho with her maid January 13 on her estate at Middleburg Va. The document was admited to probate today. Levee Threatened. Jan. -Danger of break of the imminent today as flood waters pounded the old levee where it was tied in the new levee R. and land said the situation