Click image to open full size in new tab

Article Text

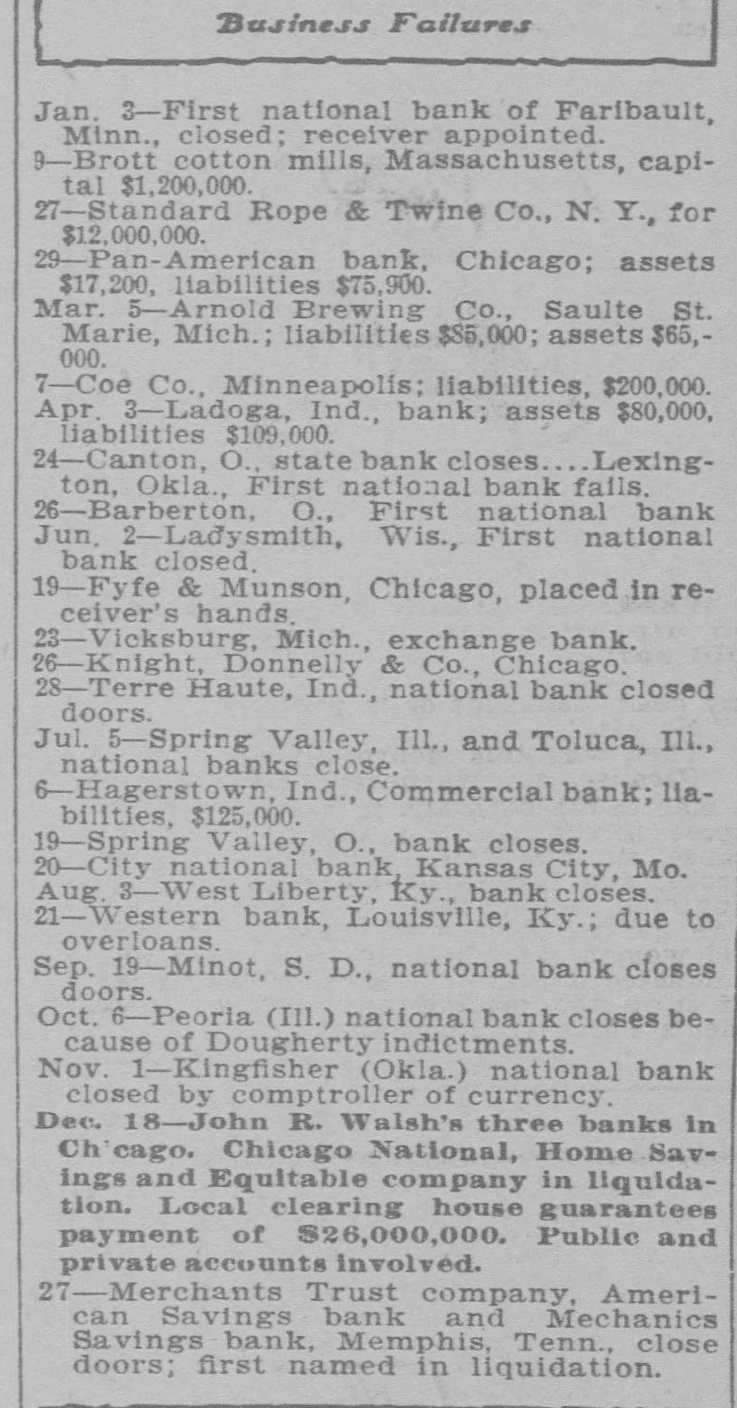

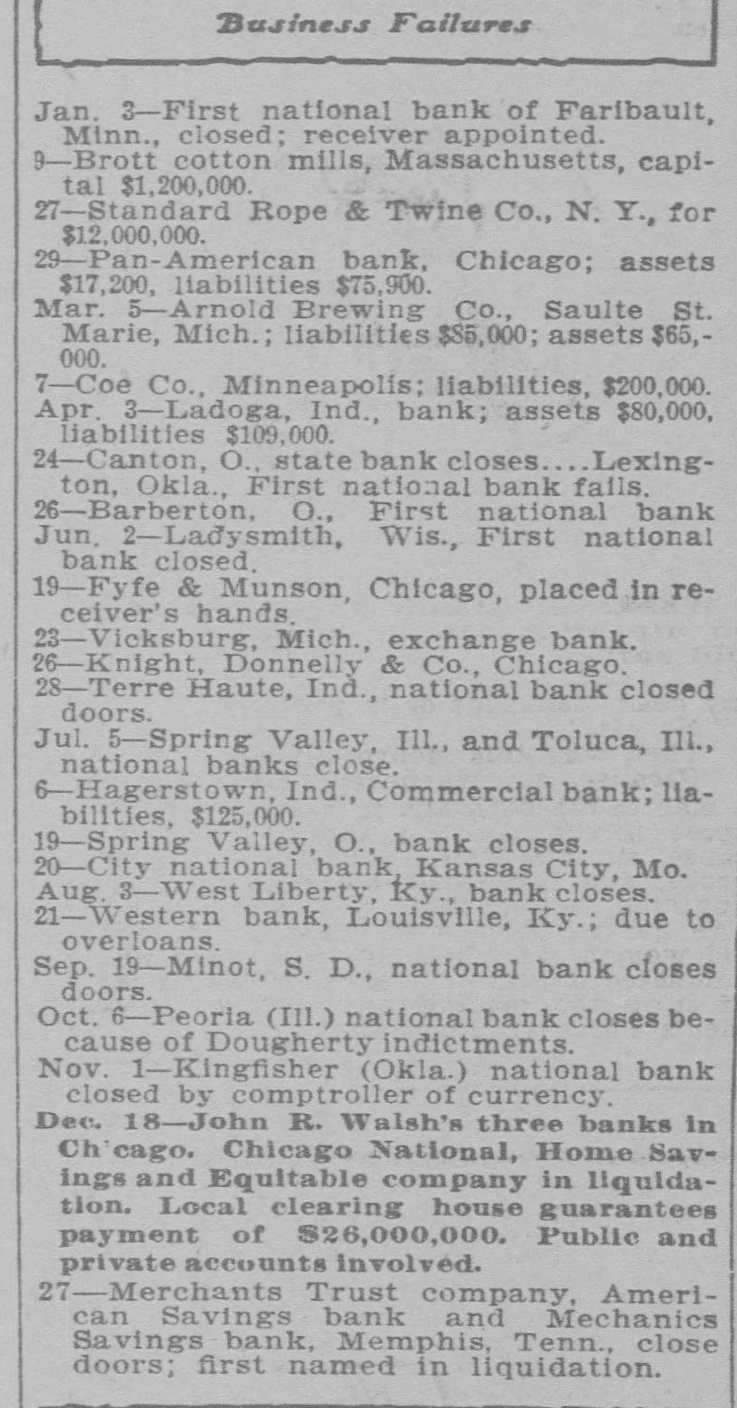

Business Failures Jan. 3-First national bank of Faribault, Minn., closed; receiver appointed. 9-Brott cotton mills, Massachusetts, capital $1,200,000. 27-Standard Rope & Twine Co., N. Y., for $12,000,000. 29-Pan-American bank, Chicago; assets $17,200, liabilities $75,900. Mar. 5-Arnold Brewing Co., Saulte St. Marie, Mich.; liabilities $85,000; assets $65,000. 7-Coe Co., Minneapolis; liabilities, $200,000. Apr. 3-Ladoga, Ind., bank; assets $80,000, liabilities $109,000. 24-Canton, O., state bank closes Lexington, Okla., First national bank falls. 26-Barberton, O., First national bank Jun. 2-Ladysmith, Wis., First national bank closed. 19-Fyfe & Munson, Chicago, placed in receiver's hands. 23-Vicksburg, Mich., exchange bank. 26-Knight, Donnelly & Co., Chicago. 28-Terre Haute, Ind., national bank closed doors. Jul. 5-Spring Valley, Ill., and Toluca, III., national banks close. 6-Hagerstown, Ind., Commercial bank; liabilities, $125,000. 19-Spring Valley, O., bank closes. 20-City national bank, Kansas City, Mo. Aug. 3-West Liberty, Ky., bank closes. 21-Western bank, Louisville, Ky.; due to overloans. Sep. 19-Minot, S. D., national bank closes doors. Oct. 6-Peoria (I11.) national bank closes because of Dougherty indictments. Nov. 1-Kingfisher (Okla.) national bank closed by comptroller of currency. Dec. 18-John R. Walsh's three banks in Ch'cago. Chicago National, Home Savingsand Equitable company in liquidation. Local clearing house guarantees payment of $26,000,000. Public and private accounts involved. 27-Merchants Trust company, American Savings bank and Mechanics Savings bank, Memphis, Tenn., close doors; first named in liquidation.