Click image to open full size in new tab

Article Text

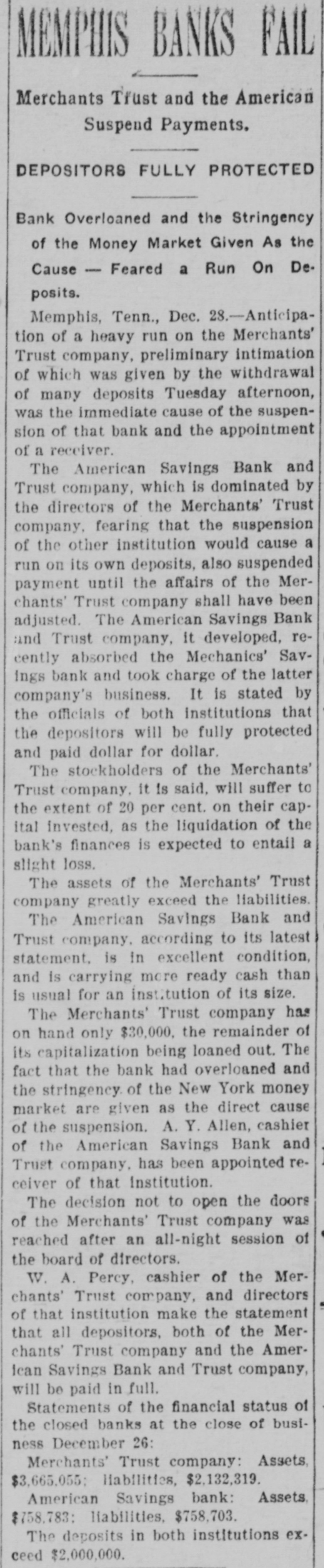

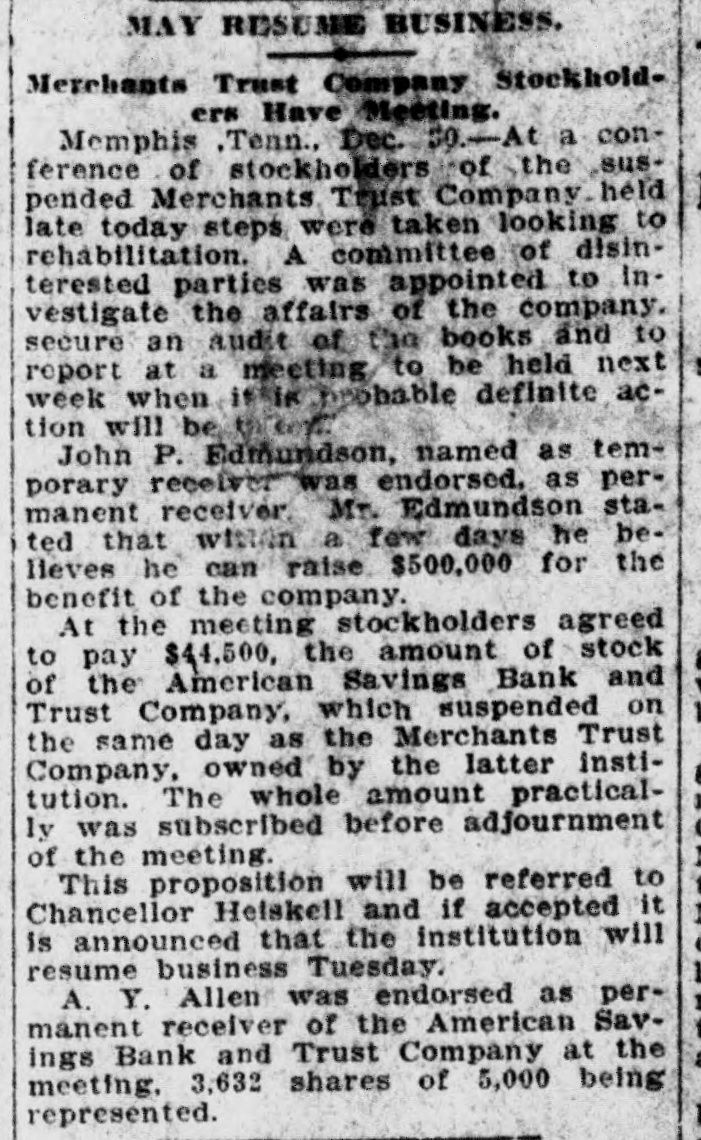

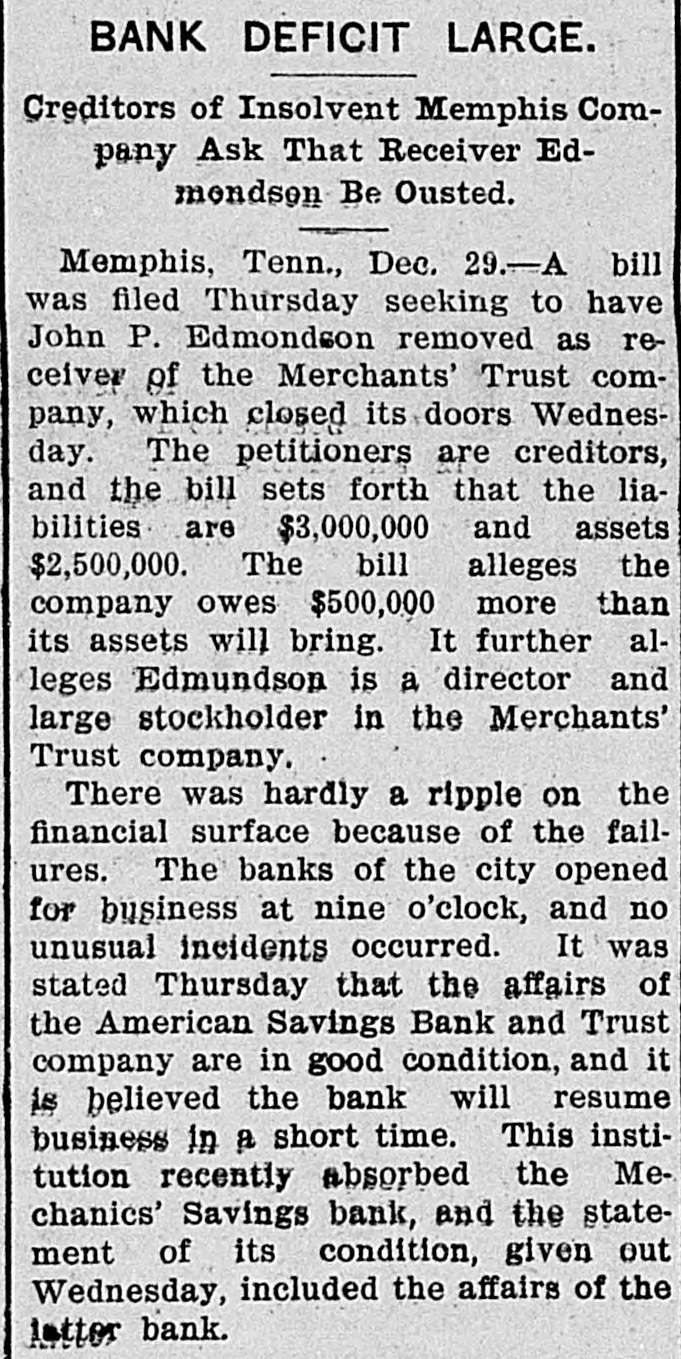

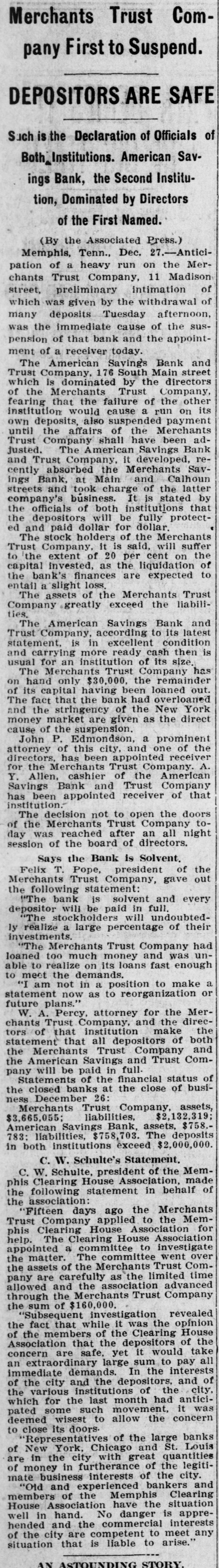

Merchants Trust Company First to Suspend. DEPOSITORS ARE SAFE of Such is the Declaration of Officials Both, Institutions. American Savings Bank, the Second Institution, Dominated by Directors of the First Named. (By the Associated Press.) Memphis, Tenn., Dec. 27.-Anticipation of a heavy run on the Merchants Trust Company, 11 Madison of street, preliminary intimation which was given by the withdrawal of many deposits Tuesday afternoon, was the immediate cause of the suspension of that bank and the appointment of a receiver today. The American Savings Bank and Trust Company. 176 South Main street is dominated by the Merchants of which the Trust Company, the directors other fearing that the failure of institution would cause a run on its own deposits, also suspended payment until the affairs of the Merchants Trust Company shall have been adjusted. The American Savings Bank and Trust Company, it developed, recently absorbed the Merchants Savings Bank, at Main and Calhoun streets and took charge of the latter company's búsiness. It is stated by the officials of both institutions that the depositors will be fully protected and paid dollar for dollar. The stock holders of the Merchants Trust Company, it is said, will suffer to the extent of 20 per cent on the capital invested, as the liquidation of to the bank's finances are expected entail a slight loss. The assets of the Merchants Trust Company greatly exceed the liabilities. The American Savings Bank and Trust Company, according to its latest statement, is in excellent condition is and carrying more ready cash then usual for an institution of its size. The Merchants Trust Company has on hand only $30,000. the remainder of its capital having been loaned out. The fact that the bank had overloaned and the stringency of the New York money market are given as the direct cause of the suspension. John P. Edmondson, a prominent attorney of this city, and one of the directors, has been appointed receiver A. for the Merchants Trust Company. Y. Allen, cashier of the American Savings Bank and Trust Company has been appointed receiver of that institution. The decision not to open the doors of the Merchants Trust Company today was reached after an all night session of the board of directors. Says the Bank is Solvent, Felix T. Pope, president of the Merchants Trust Company, gave out the following statement: "The bank is solvent and every depositor will be paid in full. "The stockholders will undoubtedly realize a large percentage of their investments. "The Merchants Trust Company had loaned too much money and was unable to realize on its loans fast enough to meet the demands. "I am not in a position to make a statement now as to reorganization or future plans.' W. A. Percy, attorney for the Merchants Trust Company, and the direc- the tors of that institution make that all depositors of both Trust statement the Merchants Company Trust Com- and the American Savings and pany will be paid in full. Statements of the financial status of the closed banks at the close of business December 26: Merchants Trust Company, assets, $2,132,319; liabilities, $3,665,055; American Savings Bank, assets, $758.783: liabilities, $758,703. The deposits in both institutions exceed $2,000,000. C. W. Schulte's Statement. C. W. Schulte, president of the Memphis Clearing House Association, made of the following statement in behalf the association: 'Fifteen days ago the Merchants Trust Company applied to the Memphis Clearing House Association for help. The Clearing House Association appointed a committee to investigate the matter. The committee went over the assets of the Merchants Trust Company are carefulty as the limited time allowed and the association advanced through the Merchants Trust Company the sum of $160,000. "Subsequent investigation revealed the fact that while it was the opinion of the members of the Clearing House Association that the depositors of the concern are safe. yet it would take an extraordinary large sum to pay all immediate demands. In the interests of the city and the depositors, and of the various institutions of the city, which for the last month had anticipated some such movement, it was deemed wisest to allow the concern to close its doorsRepresentatives of the large banks New York, Chicago and St. Louis are of in the city with great quantities of money in furtherance of the legitimate business interests of the city. "Old and experienced bankers and members of the Memphis situation Clearing House Association have the well in hand. No danger is appreand the commercial interests are competent any hended of the city to arise." meet situation that is liable to AN ASTOUNDING STORY.