Click image to open full size in new tab

Article Text

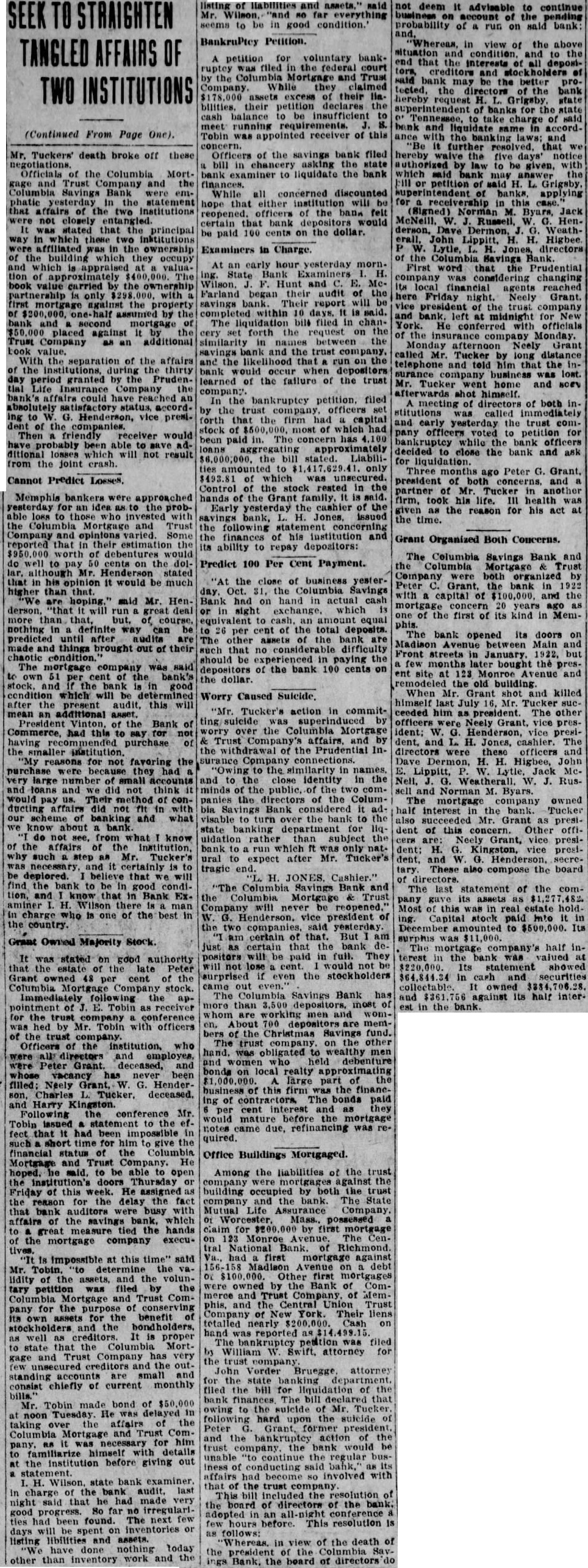

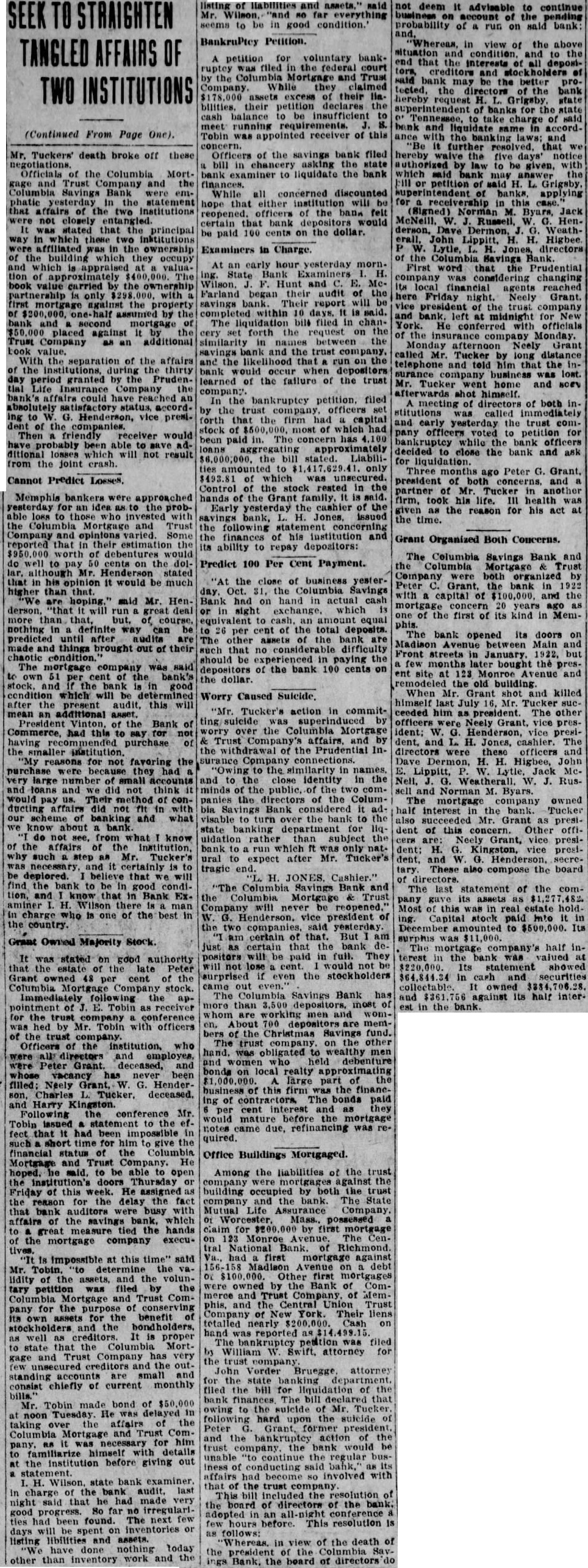

TO STRAIGHTEN TANGLED AFFAIRS OF TWO INSTITUTIONS

(Continued From Page One).

Mr. Tuckers' death broke off these Officials the Columbia Mort. gage and Trust Company and the Savings Bank were emphatic yesterday the statement that affairs of the two Institutions not closely entangled. It was stated that the principal way in these two institutions affiliated was the ownership the which they occupy appraised valuation of approximately The book value carried by the ownership partnership only with first mortgage against the property of assumed by the mortgage placed against It Trust Company as an additional With the separation of the affairs of the the thirty day granted by the PrudenLife Insurance the bank's could have reached absolutely accord. to G. Henderson, vice of the Then friendly would been able additional losses which will not result from the joint crash. Cannot Predict Losses,

Memphis bankers were approached for idea as to the prob. able loss to who invested with the Mortgage and Trust Company varied. Some reported that in their estimation the of debentures do well to pay 50 cents on the although Mr. Henderson stated that in his opinion it would be much higher than derson, "that run more course, in definite way can predicted until after audits are made and things brought out of their chaotic condition. The mortgage was said to own per cent of the bank's stock, the good condition which will be after the present audit, this will mean an additional asset. President Vinton, of the Bank of Commerce, had this to say for having purchase the institution "My reasons for not favoring the purchase were because they had very large number of small accounts and toans and did not think would of conducting affairs did not fit in our banking and what we know about bank not from what know of the affairs of the institution, such step as Mr. Tucker's necessary. certainly is to be deplored that we will find the bank be in condi and in Bank Ex. aminer H. Wilson man in charge who is one of the best in the country. Grant Owned Majority Stock.

It was stated on good authority that the estate the late Peter Grant 48 per cent of the Columbia Mortgage Company stock. following the pointment of Tobin as receiver for the conference hed by Mr. Tobin with officers of the trust Officers of the institution, who were directors and employes, Grant. deceased, and has never been filled; Neely Grant, G. Henderson, Charles Tucker. deceased. and Harry Following the Mr. Tobin issued statement to the fect that had been impossible in short time for him give the financial of the Columbia Mortgage and Trust Company. He hoped. said, to be able to open the doors Thursday Friday of this week. He assigned the reason for the delay the fact that bank auditors were busy with affairs the savings bank, which great the hands of the mortgage company executives. is impossible at this time" said Mr. Tobin. determine the lidity of assets, and the voluntary petition filed by the Columbia Mortgage and Trust Company for the purpose of conserving its assets for the benefit of the bondholders, as well as It proper to state the Columbia Mortgage and Trust Company has very creditors the outstanding accounts small consist chiefly of current monthly bills." Mr. Tobin bond of $50,000 at noon He was in the affairs of the taking Columbia Mortgage and Trust for Com- him it was necessary familiarize himself details at the institution before giving out statement. state bank examiner. last in charge night said that he had made progress. So far irregularities had been found. The next few days will be spent on inventories or listing libilities and assets. have done nothing today other than inventory work and the listing of liabilities and assets." said Mr. "and far everything seems to be in good condition. BankruPtcy Petition. petition voluntary bankruptey was filed in the federal court the Columbia Mortgage and Trust Company While they claimed assets excess their lia. bilities. their petition declares cash balance to be insufficient meet running Tobin was appointed receiver of this Officers of the savings bank filed bill in chancery asking the state bank examiner to liquidate the bank finances. While all concerned discounted hope that either will officers of the felt certain bank would be paid 100 cents on the dollar. Examiners in Charge. At an early hour yesterday morn. State Bank Examiners Wilson, Hunt and McFarland began their audit of the savings Their report will within The liquidation bill filed in cery forth the request on the set similarity in names between the savings bank and the trust company, and the likelihood that run on the occur when learned of the failure of the trust company bankruptcy filed by the trust forth that firm had capital of most of which been paid in. The concern has approximately $6,000,000. the stated. Liabilities only $493.81 Control the rested in the hands of the Grant family, It is Early yesterday the cashier of the savings bank, H. issued the following statement concerning the finances of his institution and its ability to repay depositors: Predict 100 Per Cent Payment. the close of business yesterday. Oct. 31, the Columbia Savings Bank had on in actual cash sight which cash, an 26 per cent of the total deposits. The other assets of the bank such that no considerable difficulty should be experienced in paying the depositors the bank 100 cents on the dollar.

Worry Caused Suicide,

"Mr. Tucker's action in committing by the Columbia Mortgage affairs. and the of the Prudential Insurance Company connections. "Owing the similarity in names, and to close identity in the minds of public, of the two companies the directors of the Columbia Bank the bank the state department Hquidation rather than subject bank to run which was ural to expect after Mr. Tucker's tragic H. JONES. The Columbia Savings Bank and the Columbia Trust will G. Henderson. vice president of the two companies, said yesterday am certain of that. But am just as certain that the bank positors will be paid in full. They not would not be surprised if even the stockholders came out The Columbia Savings Bank has more than depositors, most whom men and womAbout 700 depositors are memof the Christmas Savings fund. trust on the to wealthy held debenture on local realty approximating large part of the business of this firm was the financIng of contractors, The bonds cent and as they would the notes came due, refinancing was required. Office Buildings Mortgaged.

Among the liabilities of the trust the building occupied by both the trust company and the The State Mutual Life Assurance possessed for 000 by first on 123 Monroe The tral National Bank Richmond had first mortgage against 156-158 Madison Avenue debt or $100 Other first mortgages were owned by the Bank of Comand Trust Company, of Memphis, and the Trust Company of York Their liens totalled nearly $200,000. Cash on hand was reported The bankruptcy petition was filed William W. attorney for the trust company Vorder Bruegge attorney for the state filed the bill for Hquidation of the bank finances The bill that owing to the suicide of Mr. Tucker following hard upon the suicide Peter Grant, and the action of the trust the bank unable continue the regular busIness of conducting said bank," as Its affairs had become NO involved with that of the trust company This bill included the of the board of directors of the bank. adopted conference few hours before. This resolution Is as follows: 'Whereas. in view of the death of the president of the Columbia Bank, the heard of directors do not deem It advisable to continue account of the pending probability of a run on said bank: and

'Whereas, in view of the above situation and condition. and to the end that the all deposicreditors and said bank the better protected, the directors bank hereby request state superintendent of banks for the state Tennessee, to take charge of said bank and liquidate accordwith the and it further that hereby the days' notice authorized by law to be which said bank may the or petition of said H. L. for receivership this (Signed) Norman Jack McNeill. W. Russell, G. Henderson, Dave Dermon, WeathJohn Lippitt, H. H. Higbee Lytle, Jones, directors of the Columbia Bank. First word that the Prudential company considering changing its local financial agents reached here Friday night. Neely Grant. vice president of the trust company and at midnight for New York. He conferred with officials of the Monday. afternoon Neely Grant called Mr Tucker by long distance telephone and told him that the insurance company business was lost. Mr. Tucker went home and scev afterwards shot himself. meeting of directors of both inwas called and early the trust company voted to petition for while the bank officers decided to close the bank and ask for Three ago Peter G. Grant, president of both concerns. and partner of Mr in another firm, took his III health was given as the reason for his act at the time.

Grant Organized Both Concerns.

The Columbia Savings Bank and the Columbia Mortgage Trust Company were both organized by Peter Grant, the bank in with capital of $100,000. and the mortgage concern 20 years ago one of the first of its kind in Memphis. The bank opened its doors on Madison Main and Front streets in January. 1922, but few months bought the pres. ent site at 123 and remodeled the old building. When Mr. Grant shot and killed himself last July Mr. Tucker succeeded him president. The other officers Neely Grant, vice president; W. Henderson, vice president, and L H. Jones, cashier. The were these officers and Dave Dermon, H. H Higbee, John Lippitt, Lytle, Jack Mc Nell, Weatherall W. J. Russell and Norman M. Byars. The mortgage company owned half interest in the bank. Tucker succeeded Mr. Grant as dent of this Other offiGrant, vice presiH. Kingston, vice presiand secretary These also compose the board of directors. The last statement of the company its assets as Most of this real estate hold. ing. stock Into it in to $500,000. Its surplus was The mortgage company's half interest in the bank valued at $220,000. Its statement showed in cash and securities It and against Its half interest in the bank.