Article Text

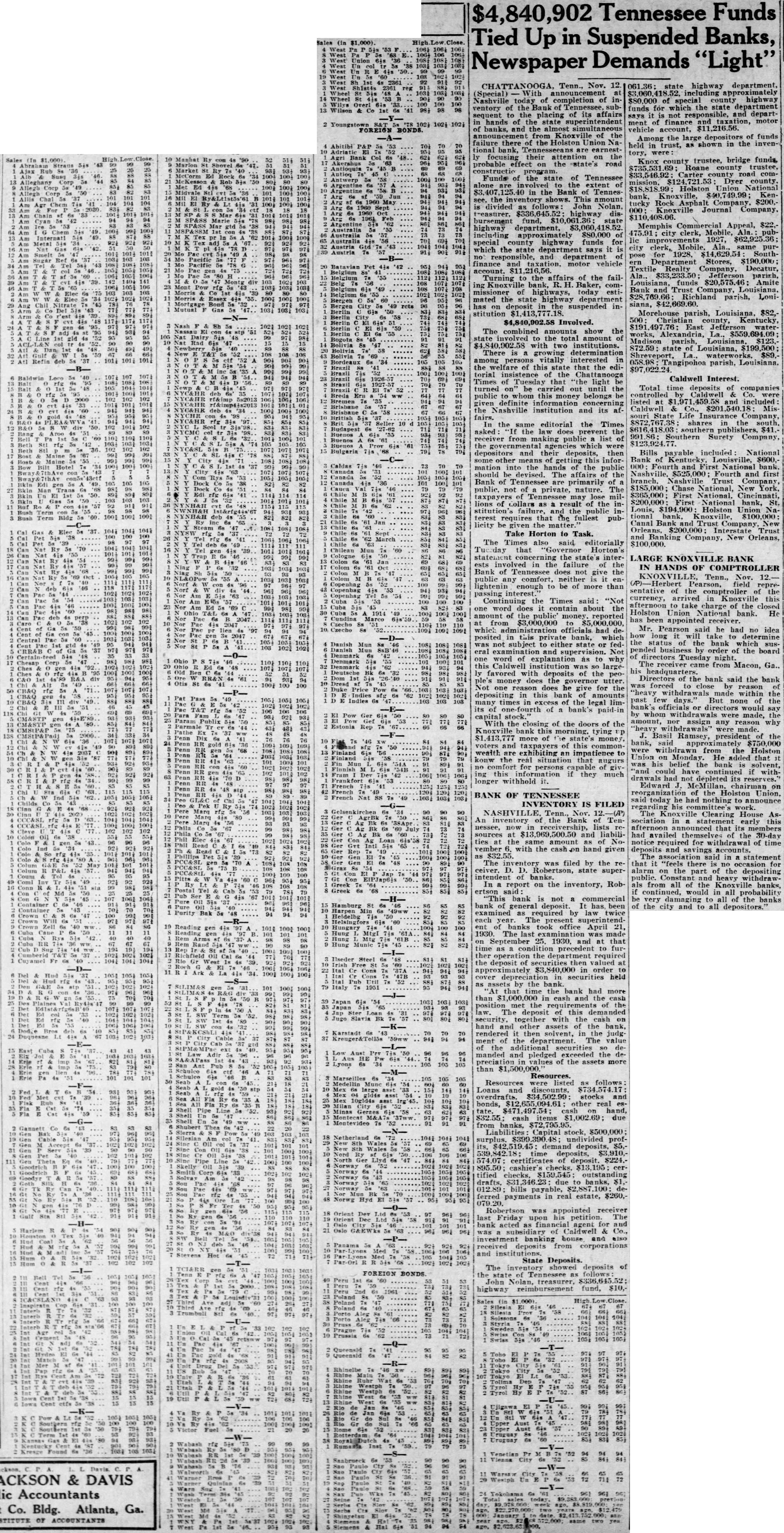

$4,840,902 Tennessee Funds Tied Up in Suspended Banks, Newspaper Demands "Light" ly focusing their attention on the probable effect on the state's road Funds of the state of Tennessee the extent of in the Bank of Tennesthe This amount divided as follows John Nolan, treasurer. $336,645. highway dis bursement fund, $10,061.36: state including approximately $80,000 of special county highway funds for which the state department says it is of finance motor vehicle Turning to the affairs of the fail ing Knoxville bank, R. H. Baker, commissioner of highways, today estimated the state highway department on in the suspended in$4,840,902.58 Involved The combined show the involved the total amount of $4,840,002.58 with two institutions. There is growing determination among vitally interested in the welfare of this state that the editorial insistence the Chattanooga Times of Tuesday that "the light on be out until the public to this money belongs be definite information concerning Nashville institution and its afIn the same editorial the Times asked the law does the from making public list of which were depositors and their deposits, then other of getting this information into the hands of the public should be devised. The affairs of the Bank of Tennessee are primarily of public, not of private, nature. The taxpayers of may Jose milof Collars as a result of the inand the public terest that the fullest publicity be given the Take Horton to Task. The Times also said editorially that Horton's statement the state's interinvolved in the failure of the of Tennessee does not give the public any comfort, is en enough to be of more than passing Continuing the Times said "Not word does contain about the amount of the public' reported from $3,000,000 to $5,000,000, which administration officials had deposited in this private bank, which Danish Mun not subject to either state or fedand Not word of explanation às to why Caldwell institution was so largefavored with deposits of the peomoney does governor utter. one does he give for the depositing in this bank of amounts times in the legal limits of a bank's paid stock With closing of the doors of the Knoxville bank this morning. tying $1,413,777 more of the state's money, voters and taxpayers of this commonwealth are exhibiting an impatience to konw the real situation that augurs for persons of ing this if they much withhold it. BANK OF TENNESSEE INVENTORY IS FILED inventory of the Bank of Tennessee, now lists resources at $13,969,500.50 and liabilities the amount as of No6. with the cash on hand given The inventory was filed by the receiver. D. Robertson, state super intendent of banks. report on the inventory, Robertson said: This bank is not a commercial bank of general deposit. It has examined as required by each year superintendent of banks took office April 21, 1930. The last examination was made on September 1930, and at that as a condition precedent to furoperat the required deposit of then valued at approximately $3,840,000 in order to cover depreciation in securities held as assets by the bank. At that time the bank had more than $1,000,000 in cash the cash the of the The deposit of this security, together with the cash on hand and other assets of the bank, rendered it then solvent, in the judgment of the department. The value the additional securities demanded and pledged exceeded the devalues of the assets more $1,500,000. Resources. Resources listed as follows Loans discounts, $734,574.17 overdrafts. stocks and bonds, $12,655,094.61 other real es $471,497.54 cash hand, $32.55 items $1,002.69; due banks, Liabilities Capital stock, $500,000; surplus. 48: undivided prof$42,519.45 demand deposits, $5, time deposits, $3,910.certificates of $224. cashier's $13,195 cerchecks, $159.545 outstanding drafts, 23 due to banks, $1, 012.89; bills payable, deferred payments in real estate, $260,Robertson was appointed receiver last Friday upon his petition. The bank acted as agent for and subsidiary of Caldwell & Co., investment banking house and deposits from corporations institutions. State Deposits. The showed deposits of FOREIGN the state of Tennessee as follows: John treasurer. $336,645 highway fund, $10,(in High CHATTANOOGA, Tenn., Nov. 12 (Special) Nashville today of completion of inventory of the Bank subsequent to the placing of its affairs hands of the state superintendent banks, and the almost simultaneous announcement Knoxville of the failure there of the Holston Union Na tional bank, are 061.36: state highway department, $3,060,418 including approximately $80,000 of special county highway funds for which the state department says it not responsible, and department finance taxation, motor vehicle account, $11,216.56. Among the large depositors of funds held in trust, as shown in the inventory, Knox county trustee, bridge funds, Roane $33,546.92 Carter mission $124,721.53 Dyer county. 99 Holston Union National bank, Knoxville, $40,749.99; Kentucky Rock Asphalt Company, $200.Knoxville Journal Company, Memphis Commercial Appeal, $22,475.91 clerk, Mobile, public 1927, $62,925.36 city clerk, Mobile. same purfor 1928, $14,629.54 SouthDepartment Stores, $190,000; Textile Realty Company, Decatur, $33,233.50 Jefferson parish, Louisiana, funds $20,575.46; Amite Bank Trust siana, $42,669.60. Morehouse parish, Louisiana, $82, 500: Christian county, Kentucky, $191 497 East waterworks, Alexandria, La., $559,694. Madison parish, Louisiana 872.59; state of Louisiana, $199,500; $89. 058.98 Tangipohoa parish, Louisiana, $97,022.24 Caldwell Interest Total time deposits companies controlled Caldwell & listed at and included Caldwell Co., $201,540.18 Missouri State Life Insurance Company, $872,767.38 shares the south. $616,418.03 southern publishers, $41.991.86: Surety Company, $123,924. Bills payable included: National Bank Kentucky, Louisville, $600,000: Fourth National bank. Nashville, $525,000; Fourth and first branch. Nashville Trust Company, $185,000; Chase National, New York, $365,000 First National, Cincinnati, $200,000; First National bank, St. Louis, $194,900 Holston Union NaCanal Bank and Trust Company, New Orleans, $200,000; Interstate Trust and Company, New Orleans, $100,000. LARGE KNOXVILLE BANK IN HANDS OF COMPTROLLER KNOXVILLE, Tenn., Nov. 12.Herbert field representative of the comptroller of the currency, arrived in Knoxville this afternoon to take charge of the closed Holston Union National bank. He has appointed receiver. Mr. Pearson said he had no idea how long it take to determine the status of the bank which susby order of the board of directors Tuesday night The came from Macon, Ga. his headquarters. Directors of the bank said the bank was forced to close by reason "heavy made within the past few days. But of the bank's or would say by made, the amount, assign any reason why "heavy withdrawals' were made. J. Basil Ramsey, president of the bank, said approximately $750,000 were withdrawn from the Holston Union on Monday. He added that it was his belief the bank solvent, "and could have continued if withdrawals had not depleted its Edward J. McMillan. chairman on reorganizatio of the Holston Union. said today he had nothing to announce his The Clearing House Association in statement early this afternoon announced that its had availed themselves of the 30-day notice required for withdrawal of time deposits and accounts. The said in a statement that "feels there is no occasion for alarm on the part of the depositing public. Constant and heavy withdrawals from all of the Knoxville banks, if continued, would in all probability very damaging to the banks of the city and to all depositors.' (in Youngstown FOREIGN BONDS. Abitibi