Click image to open full size in new tab

Article Text

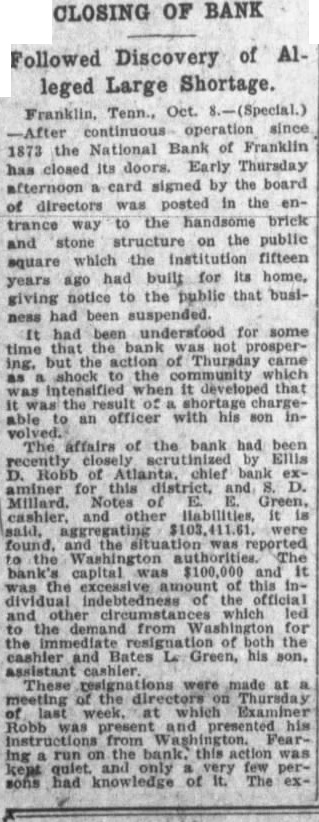

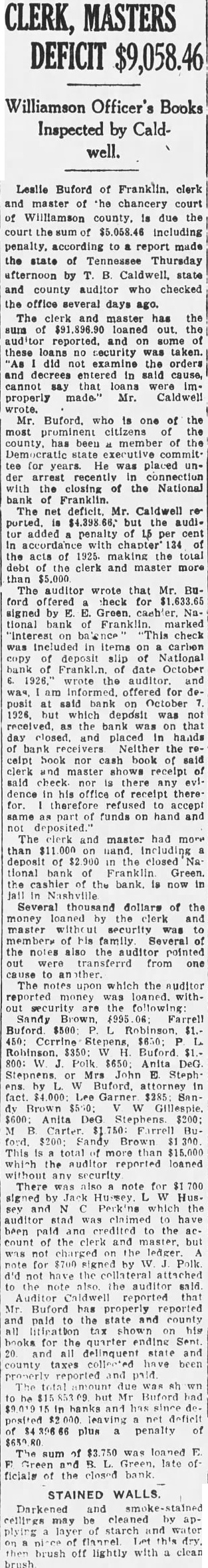

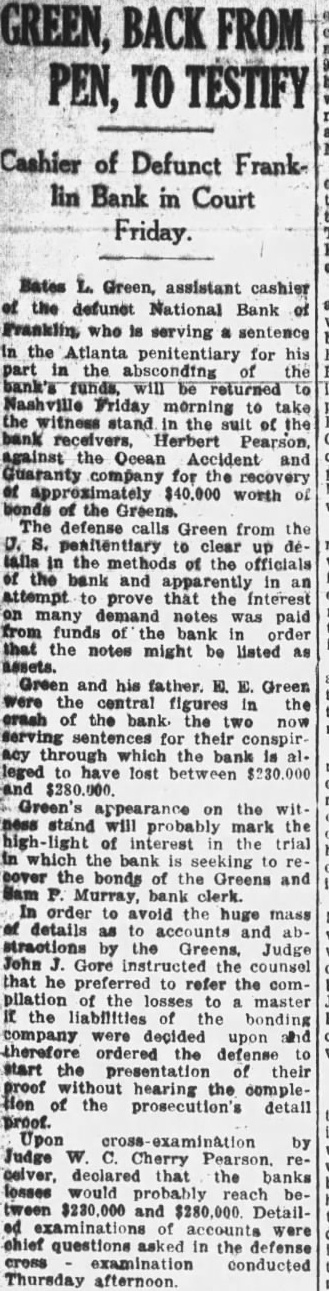

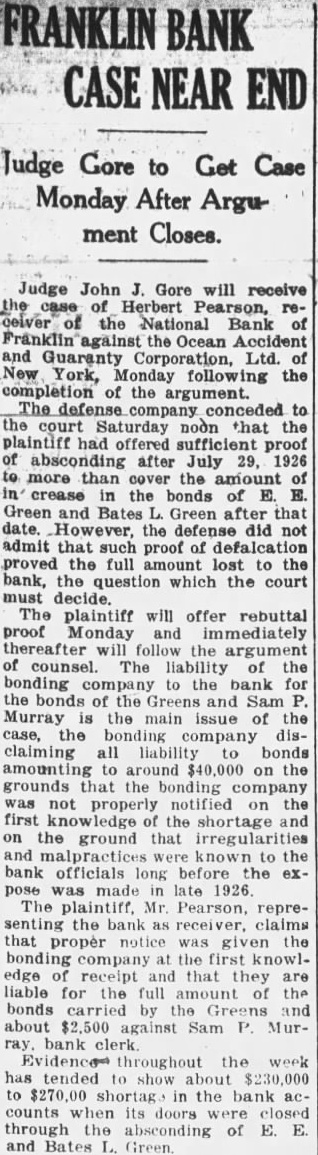

FRAKLIN BANK RECEIVER SUES

68 Stockholders Named In Move to Recover $50,654

Seeking the recovery from 68 @tockholders of the National Bank of Franklin of $50,654, alleged to have been wrongfully paid to them as dividends of the bank at a time when the institution is said to have been insolvent, bill of equity was filed by Herbert Pearson, receiver for the defunct bank, with the clerk of the United States district court Thursday. The bill sets out the history of the failure of the National Bank of Franklin which resulted in the indictment and later the imprisonment of E E. Green, cashier of the bank. and his son, Bates Green. It sets out that Herbert Pearson was appointed receiver for the bank October 19, 1926, by the comptroller of currency at Washington, following the discovery that the bank was insolvent and the closing of its doors week prior to that time. At the time that the shortage was found the elder Green entered plea of guilty in federal court and received long term in the Atlanta prison. His son likewise pleaded guilty to violation of the national banking laws and was sent to prison. The shortage, which was first reported as being about half milllion dollars. was later placed at about $150,000. In his bill the receiver, Mr. Pearson, prays recovery of the amount dividends which had been paid to the 68 stockholders since 1921 when the bank is said to have become insolvent. These amounts with interest accrued since May 4, 1927 amount to $50,564. At the time that these amounts were paid, the bill sets forth, the bank had no earnings although these sums were alleged to have come out of surplus profits and Both sections 5199 and 5204 of the revised statutes of the United States were violated according to the bill drawn up for the receiver Bass, Berry and Sims, his attornoys Section 5199 provides: "The directors of any association may, declare divIdend of 80 much of the net profits of the association as they shall judge expedient, but each association shall, before the declaration of dididend, carry one tenth part of its net profits of the preceding half year to its surplus fund until the same shall amount to 20 per centum of its capital stock. Section 5204 states: "No association, or any member thereof, shall, during the time it shall continue its banking operations. withdraw, or permit to be withdrawn, either in the form of dividends otherwise any portion of its capital. If losses have at any time been sustained by any such association, equal to or exceeding its undivided profts, then on hand, no dividend shall be made; and no dividend shall ever be made by any association, while continues its banking operations, to an amount greater than its net profits then on hand, deducting therefrom its losses and bad debta. within two weeks. They are now roughly 1,300, mostly in these sufficiently well forward for us to counties, will be planted so late as to be doubtful in result. There make rough estimate and we have to set aside the necessary funds likely to be an array of difficulties cover the cost of the rehabitation. In some of these counties even beThe remaining 20 counties are yond winter food, such as inability most difficult problem- They to meet levee and other taxes and still largely under water and to its depth and the second flood, ELECTRICIAN KILLED these counties will not be clear water until it is too late for safe (By Associated Press) Memphis, Tenn., June planting of normal crops. Lammons, 35, was electrocuted to"This means that harvest results day while fixing wire on an elecwill be most uncertain. We have set trfe drill at the plant of the Christie aside funds which will cover the Cut Stone company. He died while necessities of these 20 counties unon the way to hospital til the end of October next, when the result of the harvest will be PATOU FROCK known. It will then be necessary A Patou frock is sailor dress of entirely review the situation. TakIng the valley as a whole, approxi- heavy white crepe marocain. The mately 3,500,000 acres of crops were jumper is straight and short-sleeved these, and the skirt has cluster pleats. originally flooded out.