Article Text

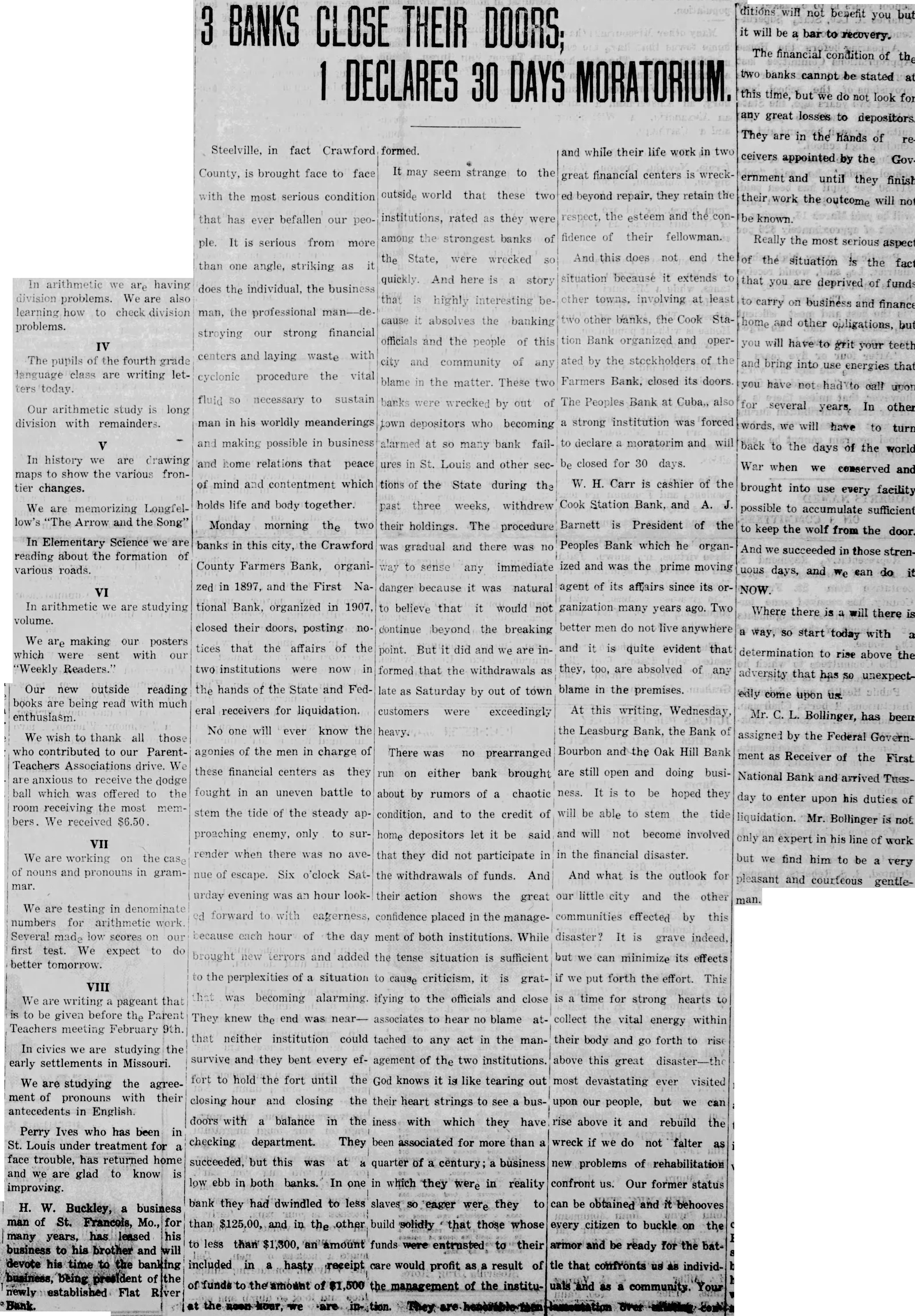

3 BANKS CLOSE THEIR DOORS; 1 DECLARES 3O DAYS MORATORIUM. Steelville, in fact Crawford formed. County, is brought face to face with the most serious condition It may seem strange to the and while their life work in two that has ever befallen our peo- outside world that these two great financial centers is wreck- ple. It is serious from more institutions, rated as they were ed beyond repair, they retain the In arithmetic we are having division problems. We are also learning how to check division problems. than one angle, striking as it among the strongest banks of respect, the esteem and the con- does the individual, the business the State, were wrecked SO fidence of their fellowman. quickly. And here is a story And this does not end the man, the professional man-de- that is highly interesting be- situation because it extends to IV The pupils of the fourth grade language class are writing letters today. stroying our strong financial cause it absolves the banking other towns, involving at least centers and laying waste with officials and the people of this two other banks, the Cook Sta- cyclonic procedure the vital city and community of any tion Bank organized and oper- ated by the stockholders of the Our arithmetic study is long division with remainders. fluid SO necessary to sustain blame in the matter. These two Farmers Bank, closed its doors. banks were wrecked by out of The Peoples Bank at Cuba,, also V In history we are drawing maps to show the various frontier changes. man in his worldly meanderings town depositors who becoming a strong institution was forced and making possible in business and home relations that peace alarmed at SO many bank fail- ures in St. Louis and other sec- to declare a moratorim and will We are memorizing Longfellow's "The Arrow and the Song" In Elementary Science we are reading about the formation of various roads. of mind and contentment which tions of the State during the bₑ closed for 30 days. W. H. Carr is cashier of the VI In arithmetic we are studying volume. We are making our posters which were sent with our "Weekly Readers." past three weeks, withdrew Cook Station Bank, and A. J. holds life and body together. Barnett is President of the their holdings. The procedure Monday morning the two banks in this city, the Crawford was gradual and there was no Peoples Bank which he organCounty Farmers Bank, organi- way to sense any immediate ized and was the prime moving zed in 1897, and the First Na- danger because it was natural agent of its affairs since its ortional Bank, organized in 1907, to believe that it would not ganization many years ago. Two closed their doors, posting no- continue beyond the breaking better men do not live anywhere Our new outside reading books are being read with much enthusiasm. tices that the affairs of the point. But it did and we are in- two institutions were now in formed that the withdrawals as and it is quite evident that they, too, are absolved of any the hands of the State and Fed- blame in the premises. late as Saturday by out of town We wish to thank all those who contributed to our ParentTeachers Associations drive. We are anxious to receive the dodge ball which was offered to the room receiving the most members. We received $6.50. eral receivers for liquidation. customers were exceedingly There was no prearranged No one will ever know the heavy. At this writing, Wednesday the Leasburg Bank, the Bank of Bourbon and the Oak Hill Bank VII We are working on the case of nouns and pronouns in grammar. We are testing in denominate numbers for arithmetic work. Several made low scores on our first test. We expect to do better tomorrow. agonies of the men in charge of run on either bank brought are still open and doing busi- these financial centers as they fought in an uneven battle to about by rumors of a chaotic ness. It is to be hoped they stem the tide of the steady ap- condition, and to the credit of will be able to stem the tide proaching enemy, only to sur- home depositors let it be said and will not become involved render when there was no ave- in the financial disaster. that they did not participate in nue of escape. Six o'clock Sat- the withdrawals of funds. And And what is the outlook for urday evening was an hour look- their action shows the great our little city and the other VIII We are writing a pageant that is to be given before the Parent Teachers meeting February 9th. In civics we are studying the early settlements in Missouri. We are studying the agreement of pronouns with their antecedents in English. Perry Ives who has been in a is improving. H. W. Buckley, a business man of St. Francois, Mo., for many years, has leased his business to his brother and will devote his time to the banking business, being president of the newly established Flat ver Bank. ed forward to with eagerness, confidence placed in the manage- communities effected by this because each hour of the day ment of both institutions. While disaster? It is grave indeed, brought new terrors and added the tense situation is sufficient but we can minimize its effects to the perplexities of a situation to cause criticism, it is grat- if we put forth the effort. This that was becoming alarming. ifying to the officials and close is a time for strong hearts to They knew the end was near- associates to hear no blame at- collect the vital energy within that neither institution could tached to any act in the man- survive and they bent every ef- agement of the two institutions. fort to hold the fort until the God knows it is like tearing out closing hour and closing the their heart strings to see a bus- doors with a balance in the iness with which they have checking department. They been associated for more than a their body and go forth to rise above this great disaster-th most devastating ever visited upon our people, but we can rise above it and rebuild the wreck if we do not falter as new problems of rehabilitation succeeded, but this was at a quarter of a century a business confront us. Our former status low ebb in both banks. In one in which they were in reality bank they had dwindled to less slaves so eager were they to can be obtained and it behooves than $125.00, and in the other build solidly that those whose every citizen to buckle on the to less than $1,300, an amount funds were entrusted to their armor and be ready for the batincluded in a hasty receipt care would profit as a result of tle that confronts us as individof funds to the amount of $1,500 the management of the institu- uals and as a community. Your at the hour, tion. They are ditions will not benefit you but it will be a bar to recovery. The financial condition of the two banks cannot be stated at this time, but we do not look for any great losses to depositors. They are in the hands of re- ceivers appointed by the Gov- ernment and until they finish their work the outcome will not be known. Really the most serious aspect of the situation is the fact that you are deprived of funds to carry on business and finance home and other opligations, but you will to grit your teeth and bring into use energies that you have not had to call upon for several years, In other words, we will have to turn back to the days of the world War when we conserved and brought into use every facility possible to accumulate sufficient to keep the wolf from the door. And we succeeded in those stren- uous days, and We can do it NOW. Where there is a will there is a way, SO start today with a determination to rise above the adversity that has so unexpect- edly come upon us. Mr. C. L. Bollinger, has been assigned by the Federal Govern- ment as Receiver of the First National Bank and arrived Tues- day to enter upon his duties of liquidation. Mr. Bollinger is not only an expert in his line of work but we find him to be a very pleasant and courteous gentle- man.