Click image to open full size in new tab

Article Text

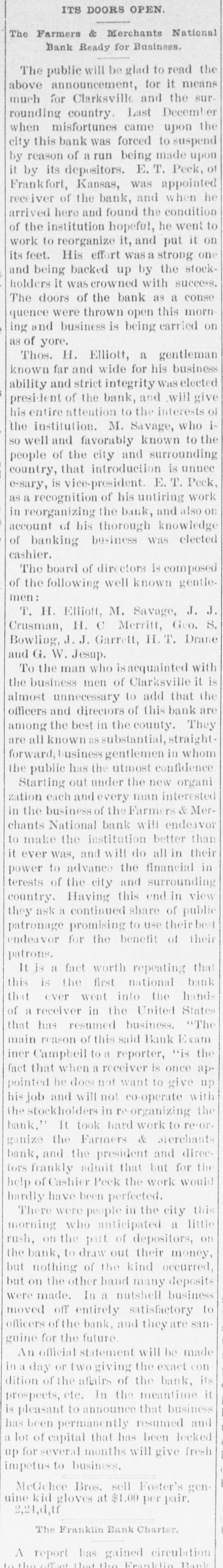

FINANCIAL AFFAIRS. Failures Reported in New York and other Parts of the Country. The New York clearing-house issued $500,000 additional certificates. The total now outstanding is $15,025,000. There has been some discussion of the wisdom of banks buying bills of exchange at the low rates now prevailing and importing gold against them. It is announced that the directors of the Bank of Commerce authorized the purchase of a large amount of sterling ex. change and to take out clearing-house certificates for this purchase. Advices from London says: "Bullion to he amount of £350,000 was withdrawn from the Bank of England for shipment to America." Charles H. Hamilton and William F. Bishop comprising the firm of Hamilton & Bishop, stock brokers and bankers of 96 Broadway, made an assignment to Harman Aaran. Assignee Aaron says the liabilities of the suspended firm would amount to about $75,000 Their assets are not as yet known. Tarlow & Hutshing, manufacturers of knit goods at 34 Walker ssreet, have been closed by thesheriff. Richard D. Young, perfumer at 100 William street, made an as ignment. CLARKSVILLE, TENN.-Tne Franklin Bank of this city, has suspended payment. The failure was caused by the recent failure of Henry Seafert, of New York, a large tobacconist, with whom the Franklin had been doing H large credit business. The Franklin Bank is a private bank, its capital stock is $50,000. The assets and liabilities of the bank are not known as yet. Kendrick, Pettus & Co., a large tobacco firm, made an assignment. The suspension of the bank, in which the firm had large deposits, and the stringency of the money market made it impossible for the firm to meet their obligations, and in order to protect all their creditors alike they assigned. The liabilities are $41,000. A statement of the assets has not been made. The liabilities of the Franklin Bank amount to over $200,000, and assets exceed the liabilities by about $50,000. The liabilities of Kendrick, Pettus & Co., areover $400,000; nominal e-sets exceed this amount. A run' on the Farmers and Mechants' National Bank followed, and the doors were closed. This was caused by the other failures, but that institution will probably resume business in a day or two. Great excitement exists in business circles. MEMPHIS, TENN.-N. L. Avery and Raphael Simmes, conducting business under the firm name of N. L. Avery & Co., at Osceola, Ark.; Avery & Simmes, at Blytheville, Ark.,. and N. L Avery, at Frenchman's Bayou, Ark., made an assignment at Osceola, Ark. They were the principal merchants of that town. Liabilities $60,000, due principally to Memphis and St. Louis creditors. Assets nominally $60,000. The failure is attributed to poor crops and inability to make collections. ARKANSAS CITY, KAN.-The information is given out that the American Bank, will not resume bu iness. A bank inspector and United States marshal will take charge of the bank and close up itsbusiness. There is about $190,000 due depositors. DENVER, CoL-The grocery and importing house of John H. Carleton was closed on attachments of $20,000. The liabilities are $24,000; assets unknown.