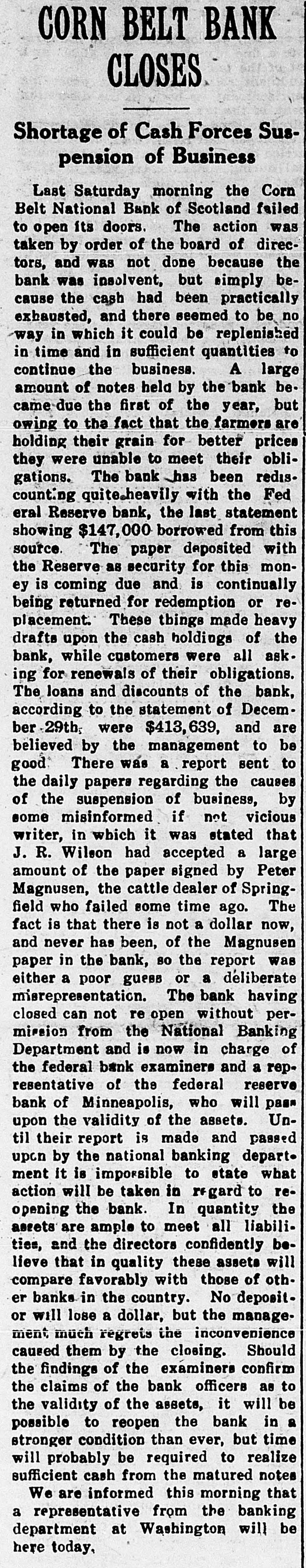

Article Text

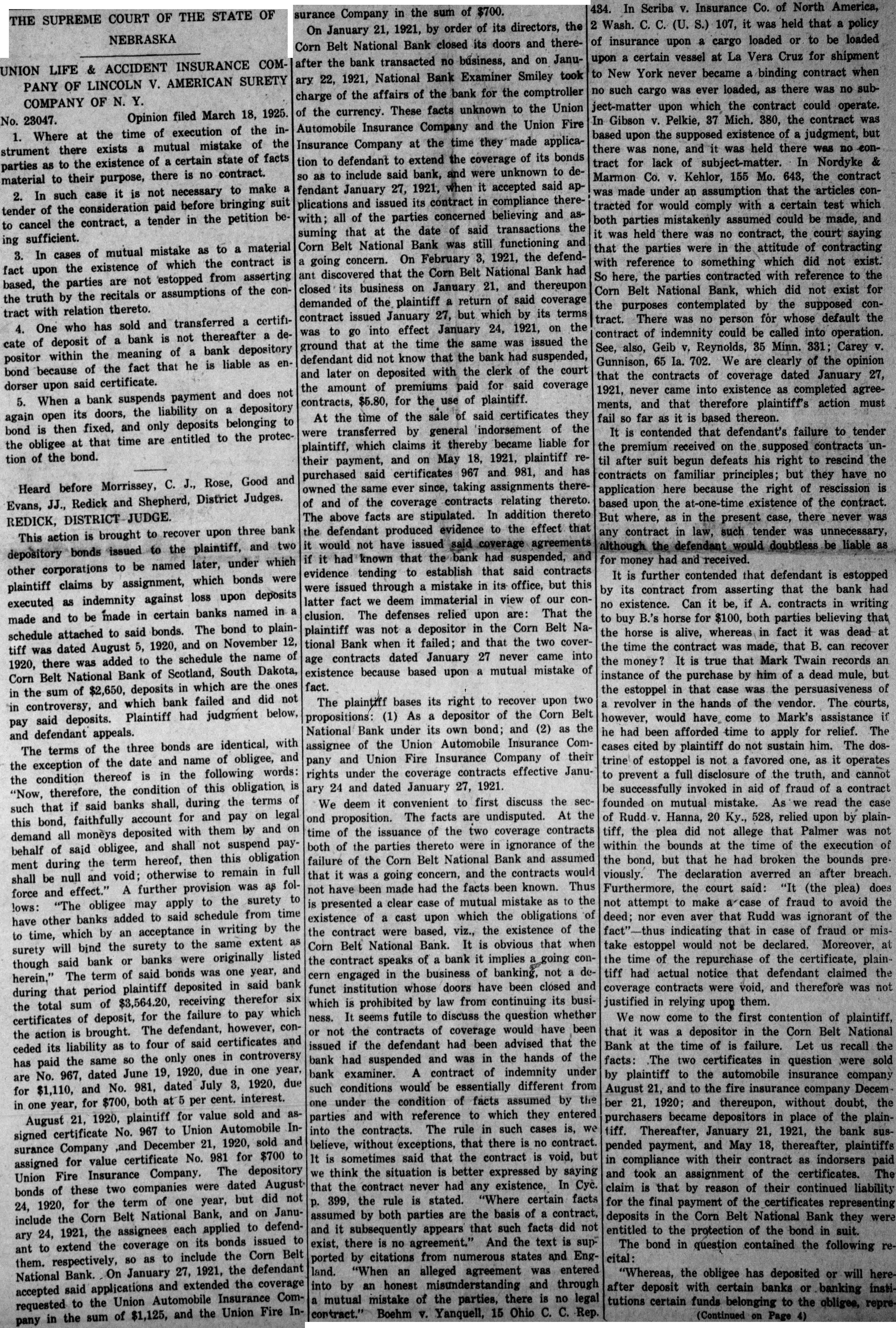

THE SUPREME COURT OF THE STATE OF

NEBRASKA

UNION LIFE & ACCIDENT INSURANCE COMPANY OF LINCOLN V. AMERICAN SURETY

COMPANY OF N. Y.

No. 23047.

Opinion filed March 18, 1925. 1. Where at the time of execution of the instrument there exists a mutual mistake of the parties as to the existence of a certain state of facts material to their purpose, there is no contract. 2. In such case it is not necessary to make a tender of the consideration paid before bringing suit to cancel the contract, a tender in the petition being sufficient. 3. In cases of mutual mistake as to a material fact upon the existence of which the contract is based, the parties are not estopped from asserting the truth by the recitals or assumptions of the contract with relation thereto. 4. One who has sold and transferred a certificate of deposit of a bank is not thereafter a depositor within the meaning of a bank depository bond because of the fact that he is liable as endorser upon said certificate. 5. When a bank suspends payment and does not again open its doors, the liability on a depository bond is then fixed, and only deposits belonging to the obligee at that time are entitled to the protection of the bond.

Heard before Morrissey, C. J., Rose, Good and Evans, JJ., Redick and Shepherd, District Judges. REDICK, DISTRICT JUDGE. This action is brought to recover upon three bank depository bonds issued to the plaintiff, and two other corporations to be named later, under which plaintiff claims by assignment, which bonds were executed as indemnity against loss upon deposits made and to be made in certain banks named in a schedule attached to said bonds. The bond to plaintiff was dated August 5, 1920, and on November 12, 1920, there was added to the schedule the name of Corn Belt National Bank of Scotland, South Dakota, in the sum of $2,650, deposits in which are the ones in controversy, and which bank failed and did not pay said deposits. Plaintiff had judgment below, and defendant appeals. The terms of the three bonds are identical, with the exception of the date and name of obligee, and the condition thereof is in the following words: "Now, therefore, the condition of this obligation is such that if said banks shall, during the terms of this bond, faithfully account for and pay on legal demand all monèys deposited with them by and on behalf of said obligee, and shall not suspend payment during the term hereof, then this obligation shall be null and void; otherwise to remain in full force and effect." A further provision was as follows: "The obligee may apply to the surety to have other banks added to said schedule from time to time, which by an acceptance in writing by the surety will bind the surety to the same extent as though said bank or banks were originally listed herein." The term of said bonds was one year, and during that period plaintiff deposited in said bank the total sum of $3,564.20, receiving therefor six certificates of deposit, for the failure to pay which the action is brought. The defendant, however, conceded its liability as to four of said certificates and has paid the same so the only ones in controversy are No. 967, dated June 19, 1920, due in one year, for $1,110, and No. 981, dated July 3, 1920, due in one year, for $700, both at 5 per cent. interest. August 21, 1920, plaintiff for value sold and assigned certificate No. 967 to Union Automobile Insurance Company ,and December 21, 1920, sold and assigned for value certificate No. 981 for $700 to Union Fire Insurance Company. The depository bonds of these two companies were dated August 24, 1920, for the term of one year, but did not include the Corn Belt National Bank, and on January 24, 1921, the assignees each applied to defendant to extend the coverage on its bonds issued to them. respectively, so as to include the Corn Belt National Bank. On January 27, 1921, the defendant accepted said applications and extended the coverage requested to the Union Automobile Insurance Company in the sum of $1,125, and the Union Fire In- surance Company in the sum of $700. On January 21, 1921, by order of its directors, the Corn Belt National Bank closed its doors and thereafter the bank transacted no business, and on January 22, 1921, National Bank Examiner Smiley took charge of the affairs of the bank for the comptroller of the currency. These facts unknown to the Union Automobile Insurance Company and the Union Fire Insurance Company at the time they made application to defendant to extend the coverage of its bonds so as to include said bank, and were unknown to defendant January 27, 1921, when it accepted said applications and issued its contract in compliance therewith; all of the parties concerned believing and assuming that at the date of said transactions the Corn Belt National Bank was still functioning and a going concern. On February 3, 1921, the defendant discovered that the Corn Belt National Bank had closed its business on January 21, and thereupon demanded of the plaintiff a return of said coverage contract issued January 27, but which by its terms was to go into effect January 24, 1921, on the ground that at the time the same was issued the defendant did not know that the bank had suspended, and later on deposited with the clerk of the court the amount of premiums paid for said coverage contracts, $5.80, for the use of plaintiff. At the time of the sale of said certificates they were transferred by general indorsement of the plaintiff, which claims it thereby became liable for their payment, and on May 18, 1921, plaintiff repurchased said certificates 967 and 981, and has owned the same ever since, taking assignments thereof and of the coverage contracts relating thereto. The above facts are stipulated. In addition thereto the defendant produced evidence to the effect that it would not have issued said coverage agreements if it had known that the bank had suspended, and evidence tending to establish that said contracts were issued through a mistake in its office, but this latter fact we deem immaterial in view of our conclusion. The defenses relied upon are: That the plaintiff was not a depositor in the Corn Belt National Bank when it failed; and that the two coverage contracts dated January 27 never came into existence because based upon a mutual mistake of fact.

The plaintiff bases its right to recover upon two propositions: (1) As a depositor of the Corn Belt National Bank under its own bond; and (2) as the assignee of the Union Automobile Insurance Company and Union Fire Insurance Company of their rights under the coverage contracts effective January 24 and dated January 27, 1921. We deem it convenient to first discuss the second proposition. The facts are undisputed. At the time of the issuance of the two coverage contracts both of the parties thereto were in ignorance of the failure of the Corn Belt National Bank and assumed that it was a going concern, and the contracts would not have been made had the facts been known. Thus is presented a clear case of mutual mistake as to the existence of a cast upon which the obligations of the contract were based, viz., the existence of the Corn Belt National Bank. It is obvious that when the contract speaks of a bank it implies a going concern engaged in the business of banking, not a defunct institution whose doors have been closed and which is prohibited by law from continuing its business. It seems futile to discuss the question whether or not the contracts of coverage would have been issued if the defendant had been advised that the bank had suspended and was in the hands of the bank examiner. A contract of indemnity under such conditions would be essentially different from one under the condition of facts assumed by the parties and with reference to which they entered into the contracts. The rule in such cases is, we believe, without exceptions, that there is no contract. It is sometimes said that the contract is void, but we think the situation is better expressed by saying that the contract never had any existence, In Cyc. p. 399, the rule is stated. "Where certain facts assumed by both parties are the basis of a contract, and it subsequently appears that such facts did not exist, there is no agreement." And the text is supported by citations from numerous states and England. "When an alleged agreement was entered into by an honest misunderstanding and through a mutual mistake of the parties, there is no legal contract." Boehm V. Yanquell, 15 Ohio C. C. Rep.

434. In Scriba V. Insurance Co. of North America, 2 Wash. C. C. (U. S.) 107, it was held that a policy of insurance upon a cargo loaded or to be loaded upon a certain vessel at La Vera Cruz for shipment to New York never became a binding contract when no such cargo was ever loaded, as there was no subject-matter upon which the contract could operate. In Gibson V. Pelkie, 37 Mich. 380, the contract was based upon the supposed existence of a judgment, but there was none, and it was held there was no -eontract for lack of subject-matter. In Nordyke & Marmon Co. V. Kehlor, 155 Mo. 643, the contract was made under an assumption that the articles contracted for would comply with a certain test which both parties mistakenly assumed could be made, and it was held there was no contract, the court saying that the parties were in the attitude of contracting with reference to something which did not exist. So here, the parties contracted with reference to the Corn Belt National Bank, which did not exist for the purposes contemplated by the supposed contract. There was no person for whose default the contract of indemnity could be called into operation. See, also, Geib V, Reynolds, 35 Minn. 331; Carey V. Gunnison, 65 Ia. 702. We are clearly of the opinion that the contracts of coverage dated January 27, 1921, never came into existence as completed agreements, and that therefore plaintiff's action must fail so far as it is based thereon. It is contended that defendant's failure to tender the premium received on the supposed contracts until after suit begun defeats his right to rescind the contracts on familiar principles; but they have no application here because the right of rescission is based upon the at-one-time existence of the contract. But where, as in the present case, there never was any contract in law, such tender was unnecessary, although the defendant would doubtless be liable as for money had and received. It is further contended that defendant is estopped by its contract from asserting that the bank had no existence. Can it be, if A. contracts in writing to buy B.'s horse for $100, both parties believing that the horse is alive, whereas in fact it was dead at the time the contract was made, that B. can recover the money? It is true that Mark Twain records an instance of the purchase by him of a dead mule, but the estoppel in that case was the persuasiveness of a revolver in the hands of the vendor. The courts, however, would have come to Mark's assistance if he had been afforded time to apply for relief. The cases cited by plaintiff do not sustain him. The dostrine of estoppel is not a favored one, as it operates to prevent a full disclosure of the truth, and cannot be successfully invoked in aid of fraud of a contract founded on mutual mistake. As we read the case of Rudd V. Hanna, 20 Ky., 528, relied upon by plaintiff, the plea did not allege that Palmer was not within the bounds at the time of the execution of the bond, but that he had broken the bounds previously. The declaration averred an after breach. Furthermore, the court said: "It (the plea) does not attempt to make a'case of fraud to avoid the deed; nor even aver that Rudd was ignorant of the fact"-thus indicating that in case of fraud or mistake estoppel would not be declared. Moreover, at the time of the repurchase of the certificate, plaintiff had actual notice that defendant claimed the coverage contracts were void, and therefore was not justified in relying upon them. We now come to the first contention of plaintiff, that it was a depositor in the Corn Belt National Bank at the time of is failure. Let us recall the facts: The two certificates in question were sold by plaintiff to the automobile insurance company August 21, and to the fire insurance company Decem ber 21, 1920; and thereupon, without doubt, the purchasers became depositors in place of the plaintiff. Thereafter, January 21, 1921, the bank suspended payment, and May 18, thereafter, plaintiffs in compliance with their contract as indorsers paid and took an assignment of the certificates. The claim is that by reason of their continued liability for the final payment of the certificates representing deposits in the Corn Belt National Bank they were entitled to the protection of the bond in suit. The bond in question contained the following recital: "Whereas, the obligee has deposited or will hereafter deposit with certain banks or banking institutions certain funds belonging to the obligee, repre(Continued on Page 4)