Click image to open full size in new tab

Article Text

IT TAKES TIME

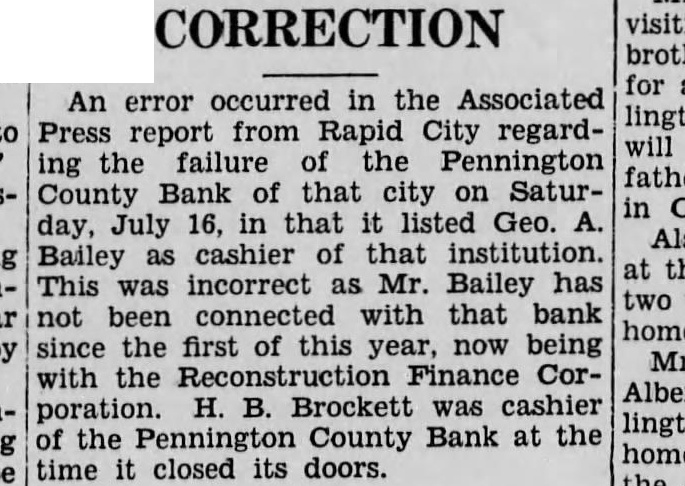

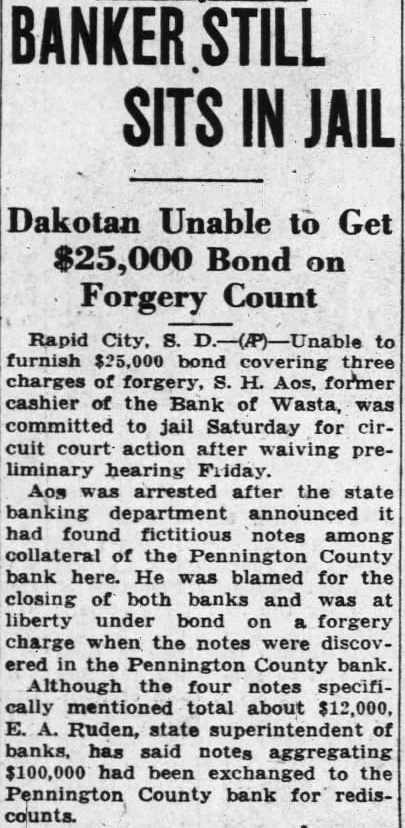

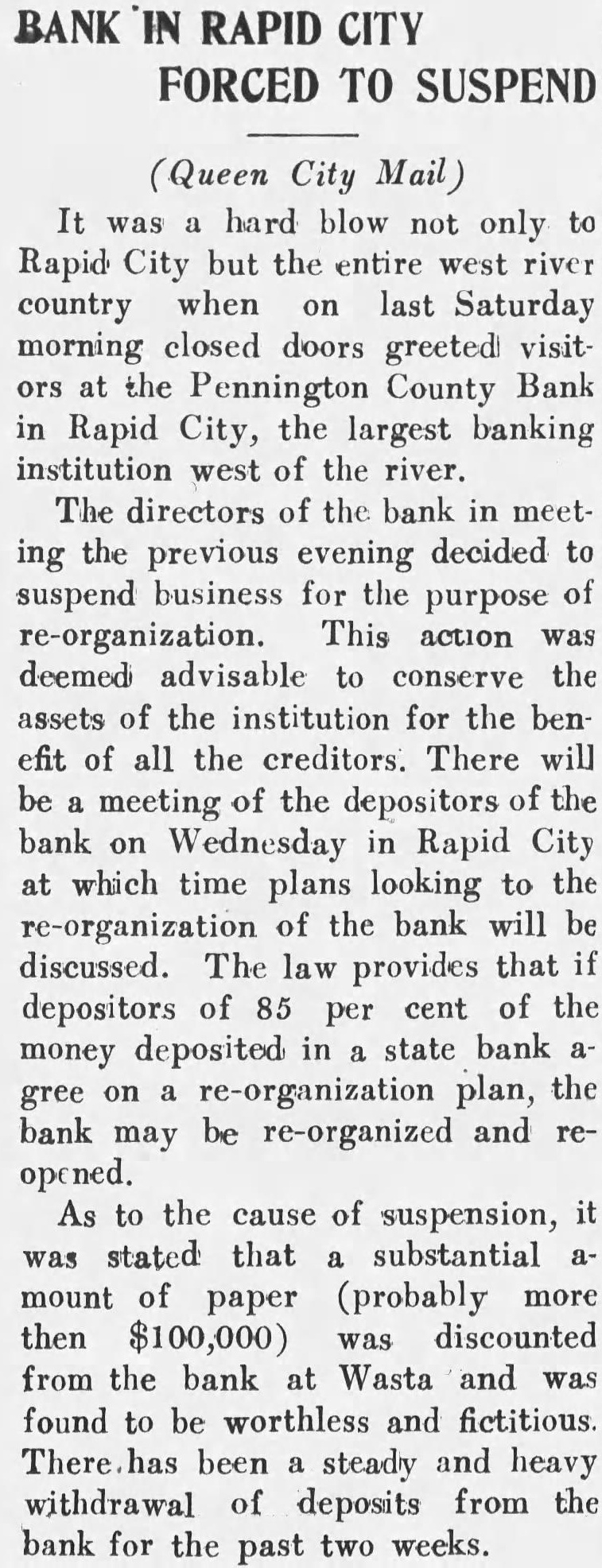

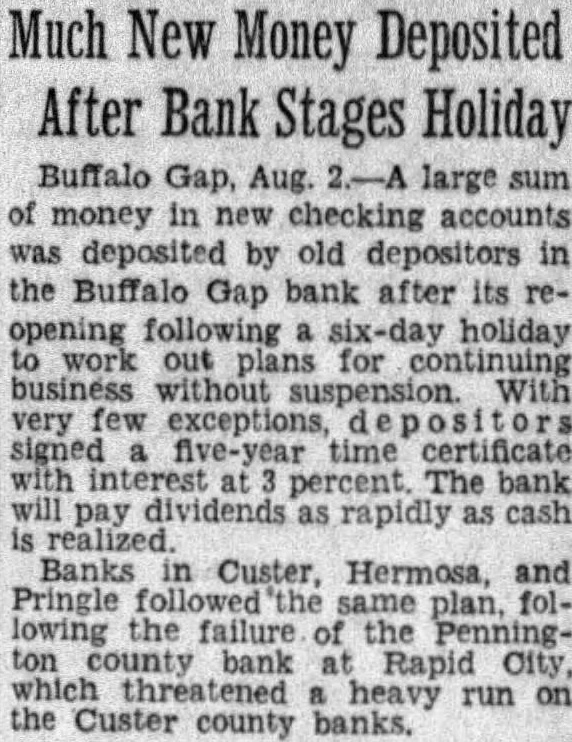

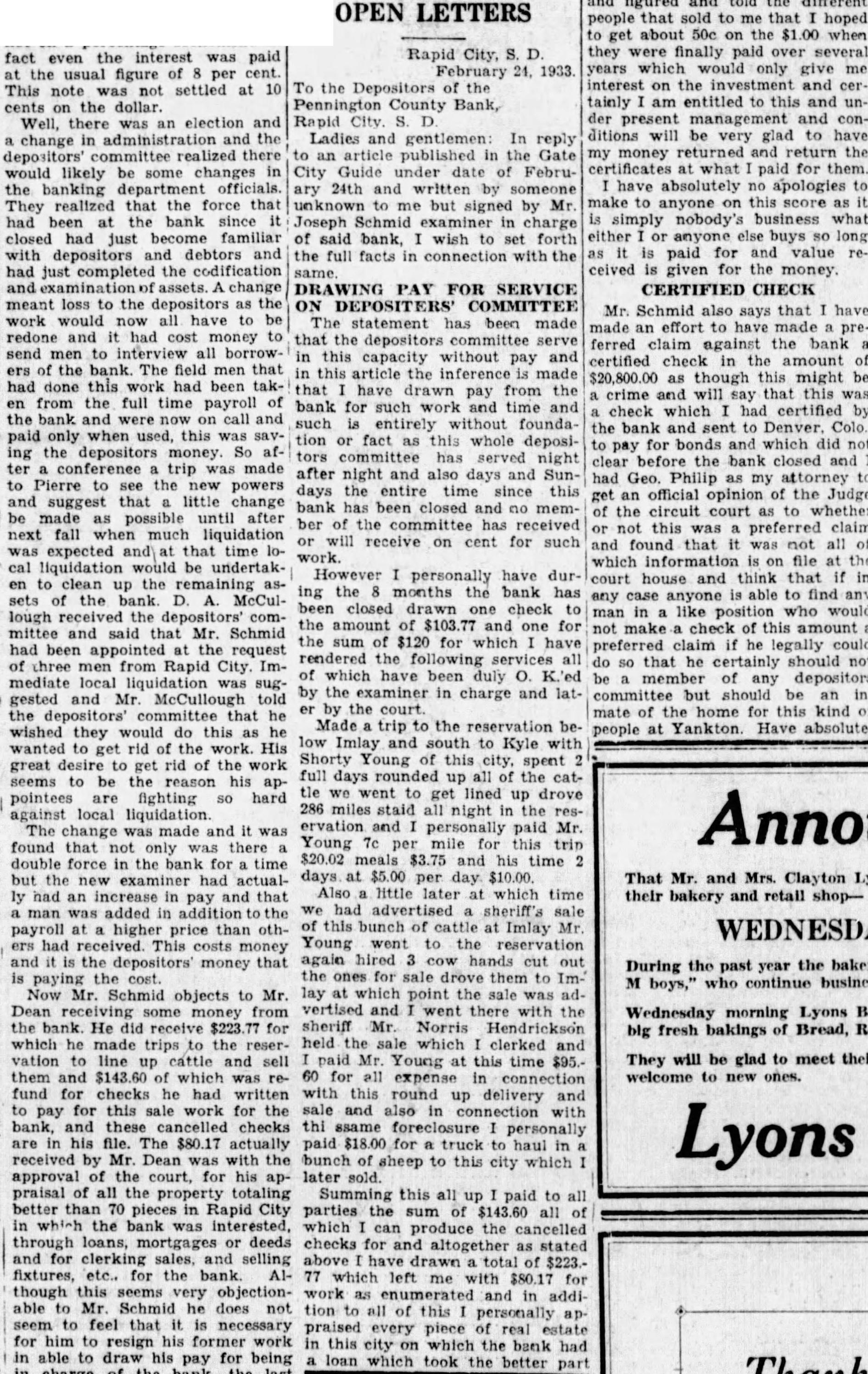

The announcement Saturday by E. Dahl, examiner in charge of the closed Pen nington County bank, that depositors could expect to have before them for their decision a plan for reorganization of the closed institution within the next 30 days will be good news to the many persons who have their money tied up in this closed bank. now nearly a month since the Penning ton County bank suspended business and if the reorganization plan is ready for depositors action another 30 days the in stitution will have an opportunity to reopen possibly within 90 days of the date it closed. is long time to depositors who have all their funds and savings tied up in the closed bank but 90 days is a short time to go over, catalogue and value all the notes in a bank the size of the Pennington County bank and undoubtedly reorganization with in the 90 day period would be a prompt ord. It took about four and a half to reopen a Sioux City, Iowa, bank.

When the report of a reorganization plan is ready for depositors the work of reorganizing the bank is not complete, for, according to state law 80 per cent of the total deposits of a closed bank must agree to the reorganization plan in writing prior to the opening of the new institution. As the perthe plan will call for in the new bank is unknown as yet and there are no definite plans made as to curtailment of deposits or any of the usual contained in a reorganization agreement it is had to say how pleased the depositors will be with the plan but no matter how satisfactory a plan is evolved for the depositors it is a job and will take considerable time to see all the depositors of the Pennington County bank and get them to sign the new agreement. This is easily shown in the case of this bank in that although deposit statements were ready for depositors the first week after the close of the bank there are many of these statements still uncalled for at the bank and it may be as difficult again to get in touch with all of the bank's creditors.

However, almost regardless of the amount that the state banking department approves as the percentage of loans and deposits than can go into the new institution, reorganization is the best plan for depositors to approve 80 as to get the maximum from their deposits in the now closed bank. A closed institution, no matter who liquidates it, will never attract the borrower to any inconvenience to clear up his obligation to dead institution that will never again be able to serve him either as creditor or debtor. Such an attitude is only normal and it is also normal that borrowers will make efforts to keep their credit good with a going concern such as a reorganized bank would be. Then, too. the time required to liquidate and pay depositors in a closed bank is long and the only way to reduce this time of liquidation is through reopening the bank. Thus both from the standpoint of time and amount of payment it is to the ad vantage of depositors of the Pennington County bank that this bank be reorganized as rapidly and on as good and firm a basis as possible. The state banking department and Gov ernor Green are cooperating thoroughly in the work looking toward reorganization of the Pennington County bank A letter from Governor Green, sent to members of the depositors committee recently offers his cooperation in the following words want to take this opportunity of as suring you and the other members of the De positors Committee of the Pennington County Bank of Rapid City that this administration, through the banking department. will cooperate with you to the fullest extent in every way possible to bring about a reor ganization of your institution. "Please feel free to call on the banking department or me personally for any assist ance that you may desire." Sincerely yours, WARREN GREEN, Governor this American cooperation in the settlement of the world's post-war ills is the big issue of the campaign. But he refuses to support the candidate whose most closely coincide with his own. Of course President Hoover's methods differ from those of Senator Borah Whereas the senator would dump eleven billion dollars in on one big conference table, with an agreement to tear them up. in whole or in part. in the event of certain pledges forthcoming from the debtors, the president would exact payment in facts accomplished, rather than in mere promises Mr. Hoover prefers first, an conference next conference, and finally cosideratio of the debts. Mr Borah seemingly would adjust the debts without waiting, and then take chance on Europe's good faith. The country we believe prefers Mr. Hoover's method. It has had, in the last thirteen years, not altogether happy experience with European good faith.

If Americans are going to trade eleven billions in which they will have to pay themselves if Europe does not pay bag labeled "prosperity, they wish to look inside the bag before completing the swap.

Hayti Looking at the matter from strictly selfish point of view, South Dakota would be foolish to go democratic this fall as few of the exuberant democratic leaders claim South Dakota will. Our Senator Norbeck holds position of influence in Washington, when he returns for his third term that influence will be augmented still further- provided the republicans continue in power. Should the democrats gain control of congress, Senator Norbeck would become only minority leader and as such in no position to render effective service similar to that which he rendered during the lief crisis last spring and which he is in position to render now. And because of the rule of seniority which prevails in congress, Senator Bulow is away down the list and consequently would wield no influe ence worthwhile to South Dakota even if his party did control congress. Senator Norbeck today stauds in an influential position with President Hoover Should democrats be successful in displacing President Hoover, Senator Norbeck's opportunity to be helpful to South Dakota in this quarter would likewise vanish A change in political domination at Washington cannot but work to the disadvantage of South Dakota. President Hoover has not been perfect, but through him alone Senator Norbeck of fers us here in South Dakota our only hope for any consideration at all. This is something for the serious minded voter to think over.