Click image to open full size in new tab

Article Text

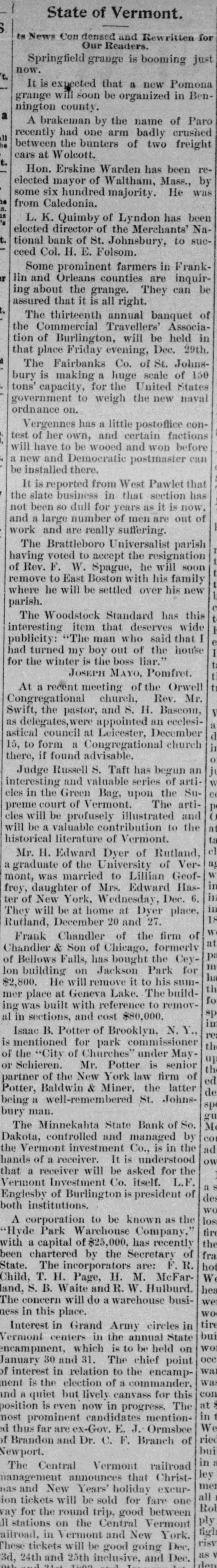

State of Vermont. ts News Con densed and Rewritten for Our Readers. Springfield grange is booming just now. t. It is expected that a new Pomona grange will soon be organized in Bennington county. a A brakeman by the name of Paro recently had one arm badly crushed 11 between the bunters of two freight cars at Wolcott. 3. Hon. Erskine Warden has been reelected mayor of Waltham, Mass., by some six hundred majority. He was from Caledonia. L. K. Quimby of Lyndon has been elected director of the Merchants' National bank of St. Johnsbury, to succeed Col. H. E. Folsom. Some prominent farmers in FrankIf lin and Orleans counties are inquiring about the grange. They can be assured that it is all right. The thirteenth annual banquet of the Commercial Travellers' Association of Burlington, will be held in that place Friday evening, Dec. 29th. The Fairbanks Co. of St. Johnsbury is making a huge scale of 150 tons' capacity, for the United States government to weigh the new naval ordnance on. Vergennes has a little postoffice contest of her own, and certain factions will have to be wooed and won before a new and Democratic postmaster can be installed there. It is reported from West Pawlet that the slate business in that section has not been so dull for years as it is now, and a large number of men are out of work and are really suffering. The Brattleboro Universalist parish having voted to accept the resignation of Rev. F. W. Spague, he will soon remove to East Boston with his family where he will be settled over his new parish. The Woodstock Standard has this interesting item that deserves wide publicity: "The man who said that I had turned my boy out of the house for the winter is the boss liar." JOSEPH MAYO, Pomfret. At a recent meeting of the Orwell Congregational church, Rev. Mr. Swift, the pastor, and S. H. Bascom, as delegates, were appointed an ecclesiastical council at Leicester, December 15, to form a Congregational church there, if found advisable. Judge Russell S. Taft has begun an interesting and valuable series of articles in the Green Bag, upon the Supreme court of Vermont. The articles will be profusely illustrated and will be a valuable contribution to the 1 historical literature of Vermont. Mr. H. Edward Dyer of Rutland, a graduate of the University of Ver! mont, was married to Lillian Geoffrey, daughter of Mrs. Edward Haster of New York, Wednesday, Dec. 6. i They will be at home at Dyer place, 1 Rutland, December 20 and 27. \ Frank Chandler of the firm of a Chandler & Son of Chicago, formerly of Bellows Falls, has bought the Cey1 lon building on Jackson Park for I $2,800. He will remove it to his sum1 mer place at Geneva Lake. The buildI ing was built with reference to removal in sections, and cost $80,000. i Isaac B. Potter of Brooklyn, N.Y., l' is mentioned for park commissioner 1 of the "City of Churches" under Mayu or Schieren. Mr. Potter is senior 1 e partner of the New York law firm of d Potter, Baldwin & Miner, the latter 8 being a well-remembered St. Johnsbury man. g y The Minnekahta State Bank of So. e Dakota, controlled and managed by a the Vermont investment Co., is in the o hands of a receiver. It is understood that a receiver will be asked for the Vermont Investment Co. itself. L.F. a Englesby of Burlington is president of d both. institutions. "